Fill Out a Valid Gift Letter Template

Form Specs

| Fact Name | Description |

|---|---|

| Definition | A gift letter is a document that states a monetary gift has been given, typically for a home purchase. |

| Purpose | It helps verify that the funds are a gift and not a loan, which is crucial for mortgage approval. |

| Requirements | The letter should include the donor's name, address, relationship to the recipient, and the amount of the gift. |

| Signature | Both the donor and the recipient should sign the letter to confirm the gift's authenticity. |

| State-Specific Forms | Some states may have specific requirements for gift letters; check local laws for details. |

| Tax Implications | Gifts over a certain amount may require the donor to file a gift tax return. |

| Validity | A gift letter is generally valid as long as it clearly states the terms and is properly signed. |

| Usage in Mortgages | Lenders often request a gift letter to ensure compliance with their lending guidelines. |

| Governing Laws | Gift laws vary by state; consult local regulations for specific requirements related to gift letters. |

Dos and Don'ts

When filling out the Gift Letter form, it is important to ensure accuracy and clarity. Here are five things you should and shouldn't do:

- Do provide clear and complete information about the donor and recipient.

- Do specify the amount of the gift in writing.

- Do include a statement confirming that the gift is not a loan.

- Don't leave any sections of the form blank; this may lead to delays.

- Don't use vague language; be specific about the nature of the gift.

Following these guidelines will help ensure that the Gift Letter form is processed smoothly and efficiently.

Other PDF Documents

Free Printable Puppy Health Guarantee - Once the puppy is in the buyer's care, the breeder's additional guarantees end.

By utilizing the Illinois Non-disclosure Agreement form, individuals and businesses can effectively protect their sensitive information from unauthorized disclosure, making it essential for anyone serious about confidentiality. For further details and to access the required documentation, visit formsillinois.com/, and take the necessary steps to secure your intellectual assets today.

6 Team Consolation Bracket - Includes slots for noting 3rd and 7th place outcomes.

Common mistakes

-

Failing to include the donor's full name. It is essential to provide the complete name to avoid any confusion regarding the source of the gift.

-

Not specifying the relationship between the donor and the recipient. This information helps establish the context of the gift and is often required by financial institutions.

-

Omitting the date of the gift. Including the date is crucial as it documents when the transfer of funds occurred.

-

Providing an incorrect amount. Double-checking the gift amount ensures accuracy and prevents potential disputes later.

-

Neglecting to sign the letter. A signature from the donor is necessary to validate the authenticity of the gift.

-

Using vague language. Clear and concise wording is important to avoid misunderstandings about the nature of the gift.

-

Not including the recipient's full name. Just as with the donor, the recipient's complete name is required for proper identification.

-

Failing to provide contact information for the donor. Including a phone number or email address can facilitate communication if further verification is needed.

Documents used along the form

When it comes to financial transactions, particularly in real estate, a Gift Letter form often plays a crucial role. This document is typically used to declare that a monetary gift is being provided, especially in the context of home purchases. However, several other forms and documents may accompany the Gift Letter to ensure clarity and compliance. Here are some commonly used documents that you might encounter alongside the Gift Letter:

- Loan Application Form: This is the primary document that potential borrowers fill out when seeking a mortgage. It collects essential information about the applicant's financial status, employment history, and creditworthiness.

- Bank Statements: These documents provide a snapshot of the donor's financial situation. They help verify the source of the gift and confirm that the funds are available for transfer.

- Proof of Identity: A copy of a government-issued ID, such as a driver’s license or passport, is often required to confirm the identity of both the donor and the recipient.

- Gift Tax Return (Form 709): If the gift exceeds a certain amount, the donor may need to file this form with the IRS. It reports the gift and ensures compliance with tax regulations.

- Purchase Agreement: This contract outlines the terms of the property sale, including the purchase price and any contingencies. It is essential for both the buyer and seller to agree on these terms.

- Title Insurance Policy: This document protects the buyer and lender against any claims or disputes over the property title. It ensures that the buyer has clear ownership of the property.

- Motorcycle Bill of Sale: This form, required in Washington for motorcycle sales, details the transaction specifics. For templates, refer to Forms Washington.

- Closing Disclosure: This form is provided to the buyer three days before closing. It details the final loan terms, monthly payments, and all closing costs associated with the transaction.

Understanding these documents can streamline the process of securing a mortgage and completing a property purchase. Each form serves a specific purpose, contributing to a transparent and efficient transaction. Being well-prepared with these documents can make the journey to homeownership smoother and less stressful.

Misconceptions

Many people have misunderstandings about the Gift Letter form. Here are some common misconceptions explained:

- Gift Letters are only for first-time homebuyers. This is not true. Anyone receiving a financial gift for a home purchase can use a Gift Letter, regardless of their buying history.

- Gift Letters must be notarized. Notarization is not a requirement. Most lenders accept a simple signed letter from the donor.

- Only family members can give gifts. Friends and other individuals can also provide gifts. However, lenders may have specific requirements regarding the relationship.

- Gift Letters are not necessary for small amounts. Even small gifts may require a Gift Letter. Lenders often want documentation for any funds used in the home purchase.

- A Gift Letter guarantees loan approval. While a Gift Letter can help, it does not guarantee that the loan will be approved. Lenders consider various factors in their decision.

- Gift Letters need to be submitted before closing. Some lenders may allow submission at closing, but it’s best to provide the letter as early as possible.

- All lenders accept the same Gift Letter format. Each lender may have their own requirements. Always check with the lender for their preferred format.

- Gift Letters are only for down payments. Gifts can also be used for closing costs or other expenses related to the home purchase.

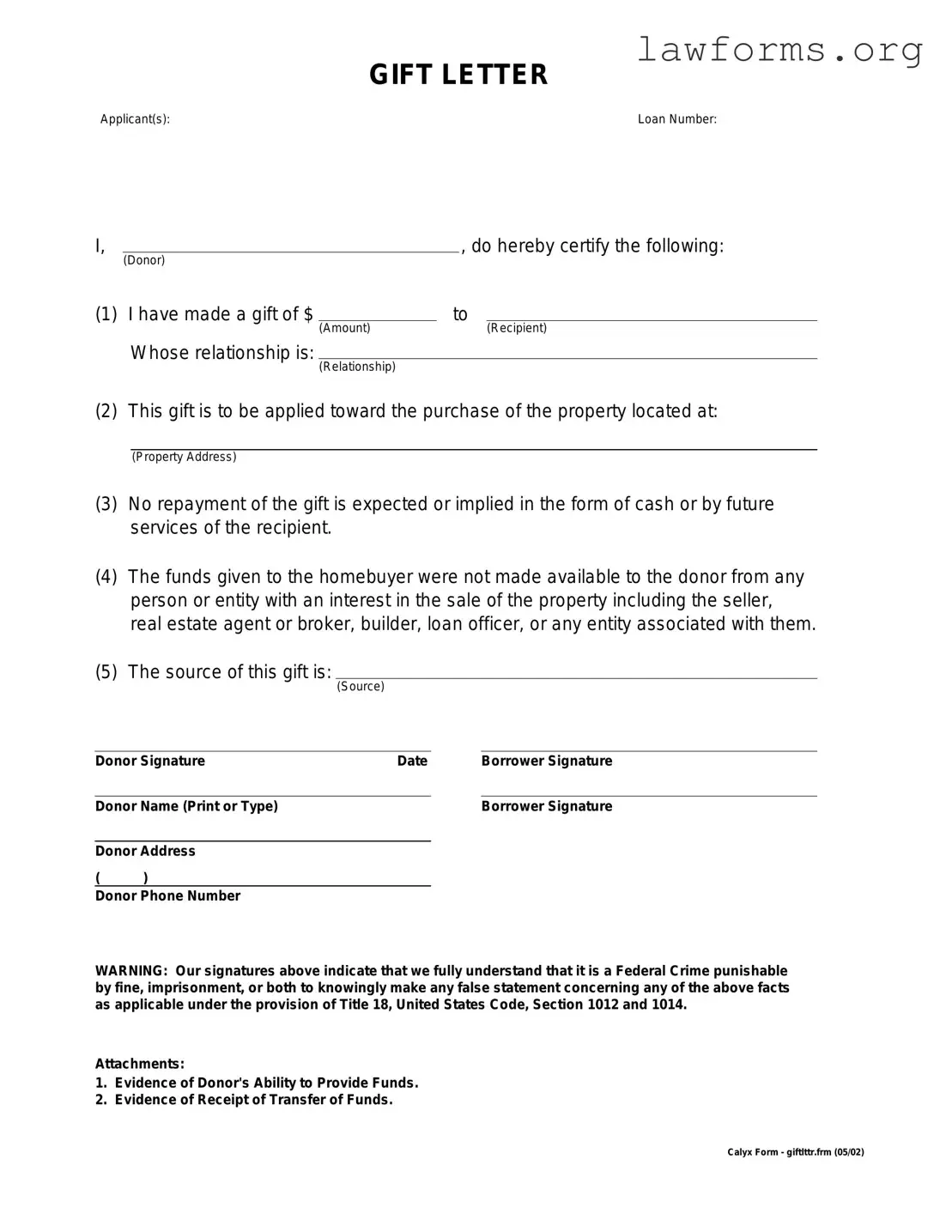

Preview - Gift Letter Form

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Key takeaways

When filling out and using the Gift Letter form, there are several important points to keep in mind. Here are key takeaways to ensure the process goes smoothly:

- Understand the purpose: A Gift Letter is used to document financial gifts given to help with a purchase, typically in real estate transactions.

- Clearly state the donor's intent: The letter should specify that the money is a gift and not a loan, which is crucial for lenders.

- Include all necessary information: The form must have details such as the donor's name, address, and relationship to the recipient.

- Document the amount: Clearly state the exact amount being gifted to avoid any confusion later on.

- Signatures are essential: Both the donor and recipient should sign the letter to validate the gift.

- Keep it simple: Use straightforward language to ensure clarity and avoid misunderstandings.

- Provide proof if necessary: Sometimes, lenders may request additional documentation, like bank statements, to verify the gift.

- Check for lender requirements: Different lenders may have specific requirements for Gift Letters, so it's essential to review those beforehand.

- Store a copy: Always keep a copy of the signed Gift Letter for your records and future reference.

Following these guidelines will help make the process of using a Gift Letter more effective and less stressful.

Similar forms

- Affidavit of Support: This document is used to demonstrate financial support for someone applying for a visa or immigration. Like a gift letter, it shows that funds are available for the recipient's use.

- Loan Agreement: A loan agreement outlines the terms of a loan between parties. Similar to a gift letter, it specifies the amount of money involved, but it requires repayment, unlike a gift.

- Employment Verification Form: This form can be crucial when verifying an individual's employment status, often needed in conjunction with other financial documents. For more details, visit californiadocsonline.com/employment-verification-form.

- Promissory Note: This is a written promise to pay a specific amount of money to a designated person. It shares similarities with a gift letter in that it involves financial transactions, but it imposes a legal obligation to repay.

- Bank Statement: A bank statement provides a summary of an account's activity. It can support a gift letter by showing the donor's financial capacity to make a gift.

- Financial Statement: A financial statement details an individual's financial position, including assets and liabilities. Like a gift letter, it can help verify the donor's ability to provide funds.

- Gift Tax Return: This document is filed with the IRS to report gifts over a certain amount. It is related to a gift letter, as both address the transfer of funds without expecting repayment.

- Declaration of Trust: This document establishes a trust and outlines how assets are managed. It can be similar to a gift letter when funds are transferred into a trust for the benefit of another party.

- Real Estate Transfer Document: This document is used to transfer ownership of property. It can be similar to a gift letter when property is gifted, showing the intent to transfer ownership without compensation.