Fill Out a Valid Goodwill donation receipt Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose of the Receipt | The Goodwill donation receipt serves as proof of a donation made to Goodwill Industries, which can be used for tax purposes. |

| Tax Deduction | Donors may be eligible for a tax deduction based on the fair market value of the donated items, as allowed by the IRS. |

| Item Description | The receipt typically includes a description of the items donated, which helps in determining their value. |

| Donation Date | The date of the donation is recorded on the receipt, which is important for tax records and compliance. |

| State-Specific Forms | Some states may have specific requirements for donation receipts. For example, California requires a written acknowledgment for donations over $250. |

| Fair Market Value | Donors are responsible for determining the fair market value of their donations, which is the price that items would sell for in the open market. |

| Record Keeping | It is advisable for donors to keep the receipt for their records in case of an audit by the IRS. |

| Non-Cash Donations | The receipt is particularly important for non-cash donations, such as clothing or household items, as these are often subject to specific valuation rules. |

| Goodwill's Role | Goodwill Industries provides the receipt upon donation, ensuring that donors have the necessary documentation for their contributions. |

Dos and Don'ts

When filling out the Goodwill donation receipt form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are seven things to consider:

- Do provide a detailed description of the items donated.

- Do include your name and contact information for record-keeping.

- Do estimate the fair market value of the donated items.

- Do keep a copy of the receipt for your tax records.

- Don't leave the receipt blank or incomplete.

- Don't overestimate the value of items to avoid potential issues with tax deductions.

- Don't forget to sign and date the receipt.

Following these guidelines can help ensure that your donation process is smooth and that you have the necessary documentation for your records.

Other PDF Documents

How to Make a Coat of Arms - A dynamic design that celebrates both past and future.

When preparing for a transaction, utilizing a Washington Bill of Sale is crucial to ensure clarity and legality; for those who need assistance in drafting this document, resources such as Forms Washington can provide helpful templates to ensure all necessary information is included.

Texas Temporary Tag - Temporary tags are not transferable between vehicles.

Common mistakes

-

Incomplete Information: Many people forget to fill out all the required fields. Missing names, addresses, or dates can lead to confusion later.

-

Incorrect Item Descriptions: Describing items inaccurately can create issues. It's essential to provide clear and specific descriptions of donated items.

-

Overestimating Value: Some donors may overvalue their items. It's crucial to assign a fair market value based on condition and comparables.

-

Not Keeping a Copy: Forgetting to keep a copy of the receipt can cause problems. Donors should always retain a copy for their records.

-

Ignoring Donation Guidelines: Not following Goodwill’s guidelines for acceptable items can lead to confusion. Familiarizing oneself with these guidelines is helpful.

-

Submitting the Form Late: Some individuals may delay submitting their forms. Timely submission ensures that donations are properly recorded.

-

Not Signing the Receipt: Failing to sign the receipt is a common oversight. A signature validates the donation and is often required for tax purposes.

-

Neglecting to Date the Form: Omitting the date can lead to complications. Always include the date of donation for accurate record-keeping.

-

Forgetting to Check for Restrictions: Some donors overlook restrictions on certain items. It's important to verify that all donated items comply with Goodwill’s policies.

Documents used along the form

When making a donation to Goodwill or similar organizations, several other forms and documents may be relevant. These documents help ensure that both the donor and the organization have clear records of the transaction. Below is a list of commonly used forms associated with the Goodwill donation receipt.

- Donation Inventory List: This list details the items donated, including descriptions and estimated values. It serves as a personal record for the donor.

- Tax Deduction Worksheet: This worksheet helps donors calculate the potential tax deductions based on the value of their donations. It is useful for tax preparation.

- Charitable Contribution Statement: This statement provides a summary of all charitable contributions made during the year. It is often used for tax filing purposes.

- Donor Acknowledgment Letter: This letter is sent by the organization to thank the donor and confirm the receipt of the donation. It may include details about the donation.

- Divorce Settlement Agreement Form: To ensure a fair division of assets and obligations, utilize the essential Divorce Settlement Agreement resources for a smoother divorce process.

- Appraisal Form: If the donated items are of significant value, an appraisal form may be required. This document provides an official valuation of the items.

- IRS Form 8283: This form is used to report non-cash charitable contributions over a certain value. It must be filled out and submitted with tax returns.

- Goodwill Donation Guidelines: These guidelines outline what items can be donated and any restrictions. They help donors understand the donation process better.

Having these documents on hand can facilitate a smoother donation experience and assist with tax-related matters. It is advisable for donors to keep their records organized for future reference.

Misconceptions

-

Misconception 1: The receipt is only useful for tax deductions.

Many people believe that the Goodwill donation receipt is solely for tax purposes. While it is true that you can use it to claim a deduction, the receipt also serves as proof of your charitable contribution. This can be important for personal record-keeping and for showing your commitment to supporting your community.

-

Misconception 2: The value of donated items is predetermined by Goodwill.

Some think that Goodwill assigns a fixed value to donated items. In reality, donors are responsible for determining the fair market value of their contributions. The receipt provides a space for you to list your items, but it does not dictate their worth. It’s important to research and assess the value of your donations accurately.

-

Misconception 3: You need to itemize every single item on the receipt.

People often feel overwhelmed by the idea of listing every item they donate. While it’s helpful to provide a detailed list, it is not mandatory. You can simply write a general description of the items and their estimated value. This flexibility can make the process easier and less stressful.

-

Misconception 4: The receipt is not valid if you lose it.

Some individuals worry that losing the receipt renders their donation invalid. However, Goodwill can often provide a replacement receipt if you lose the original. Keeping a copy of your donation details, such as photos or a list of items, can also help in case you need to verify your contribution later.

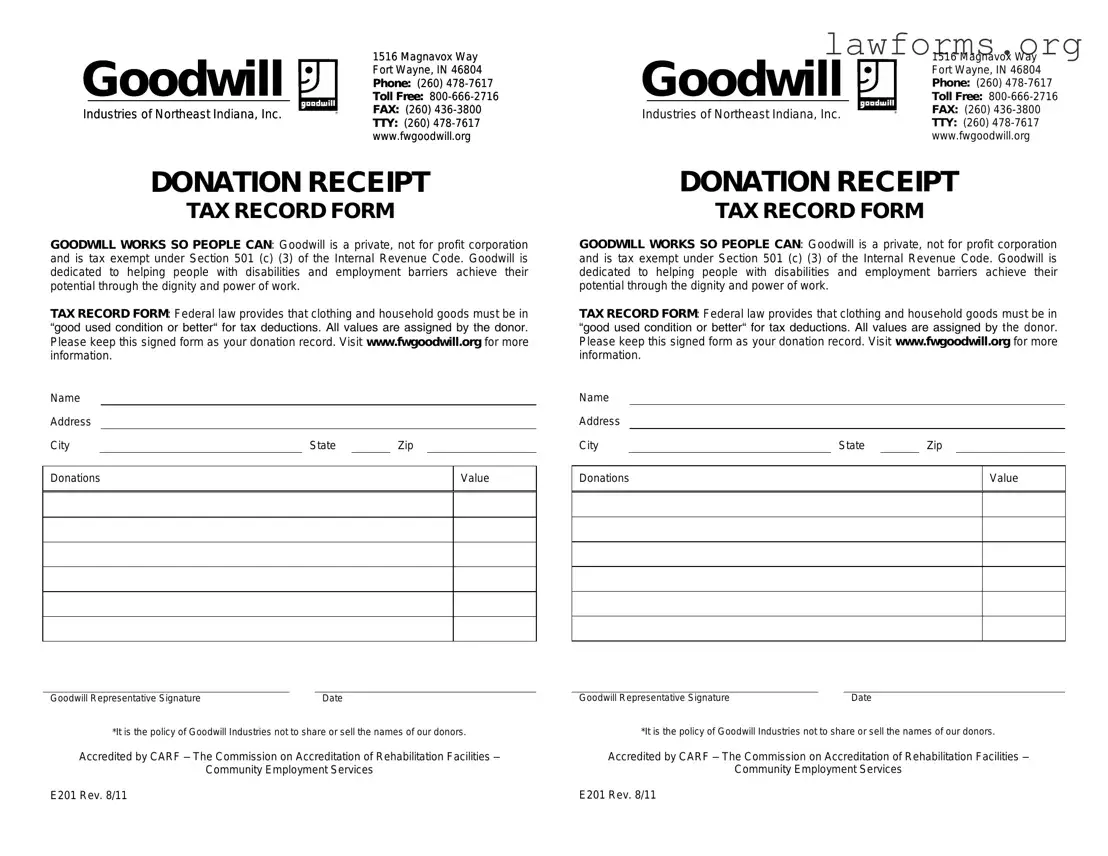

Preview - Goodwill donation receipt Form

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Key takeaways

When filling out and using the Goodwill donation receipt form, keep the following key takeaways in mind:

- Accurate Information: Ensure all donor details, including name and address, are filled out correctly.

- Item Description: Clearly list the items donated. Include details such as quantity and condition.

- Value Estimation: Estimate the fair market value of each item. This will help during tax filing.

- Signature: Sign and date the receipt to validate your donation.

- Keep a Copy: Retain a copy of the receipt for your records. This is essential for tax purposes.

- Tax Deduction: Donations to Goodwill may be tax-deductible. Consult a tax professional for guidance.

- Submission: Do not submit the receipt to the IRS. Keep it for your records only.

- Follow-Up: If you have questions about your donation or the receipt, contact Goodwill for assistance.

Similar forms

The Goodwill donation receipt form serves as a vital document for individuals who wish to claim tax deductions for their charitable contributions. However, it shares similarities with several other important documents. Here are five documents that resemble the Goodwill donation receipt form:

- Charitable Contribution Receipt: Like the Goodwill receipt, this document provides proof of a donation made to a qualified charity. It details the items donated and their estimated value, helping donors substantiate their tax deductions.

- California LLC-1 Form: Similar to the Goodwill donation receipt, this document is essential for establishing a Limited Liability Company in California. It provides necessary information about the business structure and management. For more details, visit https://californiadocsonline.com/california-llc-1-form.

- Donation Acknowledgment Letter: This letter, often sent by the charity, acknowledges the receipt of a donation. It includes the donor's name, the date of the donation, and a description of the items donated, similar to what you find in a Goodwill receipt.

- IRS Form 8283: For non-cash contributions exceeding a certain value, this form is required by the IRS. It provides a detailed account of the donated items, much like the Goodwill receipt, but is used specifically for tax reporting purposes.

- Sales Receipt for Donated Items: When you donate items to a thrift store or similar organization, you may receive a sales receipt. This document, while not a formal donation receipt, can serve a similar purpose by providing proof of the items donated and their estimated worth.

- Gift Tax Return (IRS Form 709): If a donation exceeds the annual gift tax exclusion, this form must be filed. It captures details about the gift, akin to how a Goodwill receipt records the donation, but focuses on larger gifts that may affect tax liability.