Fill Out a Valid Independent Contractor Pay Stub Template

Form Specs

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines payments made to an independent contractor for services rendered. |

| Purpose | It serves as a record of earnings, taxes withheld (if applicable), and other deductions, providing transparency for both the contractor and the hiring entity. |

| State-Specific Forms | Some states require specific formats or additional information on pay stubs, so it is important to check local regulations. |

| Governing Laws | In California, for example, the California Labor Code Section 226 outlines requirements for pay stubs, including itemized deductions. |

| Information Included | A typical pay stub includes the contractor's name, address, payment period, total earnings, and any deductions. |

| Tax Implications | Independent contractors are generally responsible for paying their own taxes, unlike employees for whom taxes are withheld by the employer. |

| Record Keeping | Contractors should keep copies of their pay stubs for tax purposes and to track their income over time. |

| Payment Frequency | Pay stubs can be issued on various schedules, such as weekly, bi-weekly, or monthly, depending on the agreement between the contractor and the client. |

| Electronic vs. Paper | Pay stubs can be provided in electronic format or as physical documents. Both formats are acceptable, but they must be easily accessible to the contractor. |

| Dispute Resolution | If there are discrepancies in pay stubs, contractors should address these issues promptly with the hiring entity to seek resolution. |

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do double-check all personal information for accuracy.

- Do clearly state the payment period.

- Do include the correct payment amount.

- Do specify the nature of the work performed.

- Do keep a copy of the completed pay stub for your records.

- Don't leave any sections blank unless specified.

- Don't use incorrect or outdated tax information.

- Don't forget to sign and date the form.

- Don't submit the form without reviewing it thoroughly.

Other PDF Documents

Druid Spell Chart - This space can be used for notes on quests, adventures, or important story elements.

Electrical Panel Schedule Template - Simplifies the process of planning new electrical installations.

For business owners seeking to enhance protection through legal means, the creation of a Non-compete Agreement is vital. This document prevents employees from operating in similar fields post-employment, ensuring the safeguarding of proprietary information. To understand how to best utilize this important tool, refer to the guide on crafting a well-structured Non-compete Agreement template for your needs at a comprehensive Non-compete Agreement guide.

Fedex Reprint Label - The Bill of Lading helps ensure legal compliance during transportation.

Common mistakes

-

Incorrect Personal Information: One common mistake is providing inaccurate or incomplete personal information. This includes your name, address, and Social Security number. Ensure that all details match official documents to avoid issues with tax reporting.

-

Miscalculating Hours Worked: Many independent contractors forget to accurately track their hours. If you work on a project basis, clearly document your hours to ensure you receive the correct payment. Double-check your calculations to prevent underpayment or overpayment.

-

Neglecting to Include Deductions: Some contractors overlook necessary deductions. This can include taxes or other withholdings that may apply to your earnings. Familiarize yourself with any applicable deductions to ensure your pay stub reflects the correct amount.

-

Failing to Keep Copies: After completing the pay stub, it's crucial to keep a copy for your records. Many people forget this step, which can lead to problems during tax season or if any disputes arise. Always maintain a personal copy for reference.

Documents used along the form

When working with independent contractors, various forms and documents are often utilized alongside the Independent Contractor Pay Stub form. Each of these documents serves a specific purpose, ensuring that both parties are clear on terms, payments, and responsibilities. Below is a list of common forms that may accompany the pay stub.

- Independent Contractor Agreement: This document outlines the terms of the relationship between the contractor and the client. It typically includes details about the scope of work, payment terms, and confidentiality obligations.

- W-9 Form: Contractors must complete this IRS form to provide their Taxpayer Identification Number (TIN). This information is essential for the client to report payments to the IRS accurately.

- Invoice: An invoice is a request for payment sent by the contractor to the client. It details the services provided, the amount due, and payment terms.

- Time Sheet: A time sheet records the hours worked by the contractor. This document can help in verifying the hours for payment and may be required for billing purposes.

- Employment Verification Form: This form serves as a vital tool for employers to confirm an individual's employment status, particularly useful in contexts such as loan applications and housing requests. More information can be found at https://californiadocsonline.com/employment-verification-form/.

- 1099 Form: At the end of the tax year, clients use this IRS form to report payments made to independent contractors. Contractors receive a copy to help them file their taxes.

- Confidentiality Agreement: Also known as a Non-Disclosure Agreement (NDA), this document protects sensitive information shared between the contractor and the client during the course of their work.

- Scope of Work Document: This outlines the specific tasks and deliverables expected from the contractor. It helps to clarify expectations and avoid misunderstandings.

- Expense Reimbursement Form: If contractors incur expenses while performing their duties, this form allows them to request reimbursement from the client for those costs.

Understanding these documents can streamline the process of working with independent contractors. Each form plays a vital role in establishing clear communication and ensuring compliance with legal and tax obligations. By using these documents together, both clients and contractors can foster a professional and transparent working relationship.

Misconceptions

Understanding the Independent Contractor Pay Stub form can be challenging, especially with the many misconceptions that surround it. Here are nine common misunderstandings, along with clarifications to help you navigate this important document.

- Independent contractors do not need a pay stub. Many believe that since independent contractors are not employees, they do not require a pay stub. However, a pay stub can provide important documentation of earnings for tax purposes and financial records.

- All independent contractors are paid the same way. Payment methods can vary widely among independent contractors. Some may receive hourly wages, while others work on a project basis or receive commission. A pay stub reflects the specific payment arrangement agreed upon.

- A pay stub is only for full-time workers. This is a misconception. Independent contractors, regardless of their work hours, can benefit from having a pay stub to outline their earnings and deductions.

- Independent contractors do not have taxes withheld. While it’s true that independent contractors typically handle their own taxes, some may choose to have taxes withheld voluntarily. A pay stub can show any amounts that have been deducted.

- Pay stubs are only necessary for large projects. Whether the project is big or small, having a pay stub can help independent contractors keep track of their earnings and maintain accurate financial records.

- Independent contractors are not entitled to benefits. While it’s correct that independent contractors generally do not receive employee benefits, some clients may offer benefits or perks. A pay stub can help clarify any additional compensation.

- A pay stub must be issued weekly. There is no universal requirement for how often pay stubs must be issued to independent contractors. The frequency can depend on the agreement between the contractor and the client.

- All pay stubs look the same. Pay stubs can vary in format and content. Different clients may use different systems, so it’s important to understand what information is included on your specific pay stub.

- You don’t need to keep pay stubs. This is a common error. Keeping pay stubs is crucial for tracking income and preparing for tax season. It’s wise to maintain a record of all pay stubs received.

By clearing up these misconceptions, independent contractors can better understand their rights and responsibilities regarding pay stubs, ensuring they have the necessary documentation for their financial health.

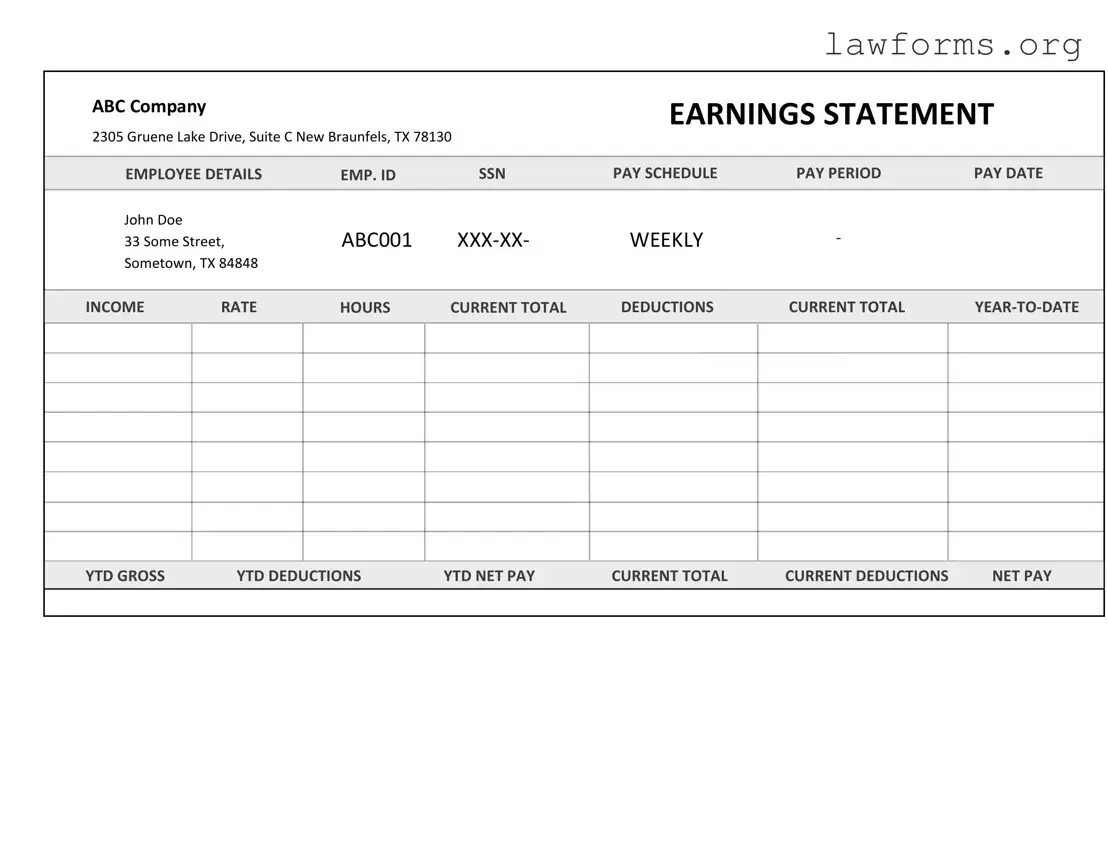

Preview - Independent Contractor Pay Stub Form

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Key takeaways

Here are some important points to remember when filling out and using the Independent Contractor Pay Stub form:

- Accurate Information: Always provide correct details about the contractor and the services rendered. This includes names, addresses, and payment amounts.

- Payment Dates: Clearly indicate the date of payment. This helps both the contractor and the client keep track of financial records.

- Itemized Services: List the services provided in detail. This transparency can prevent misunderstandings about what was paid for.

- Tax Information: Be aware of tax implications. Independent contractors are responsible for their own taxes, so include relevant information if applicable.

- Keep Copies: Always retain a copy of the pay stub for personal records. This can be useful for future reference or tax purposes.

Similar forms

The Independent Contractor Pay Stub form serves a specific purpose in documenting payments made to independent contractors. However, it shares similarities with several other important documents. Below is a list of eight documents that are comparable to the Independent Contractor Pay Stub form, along with explanations of their similarities.

- Employee Pay Stub: Like the Independent Contractor Pay Stub, this document outlines earnings, deductions, and net pay for employees, providing a clear record of compensation.

-

Motorcycle Bill of Sale: The Washington Motorcycle Bill of Sale form is essential for documenting the sale of a motorcycle in Washington, ensuring both buyer and seller are protected. For a comprehensive template, you can refer to Forms Washington.

- Invoice: Both invoices and pay stubs detail the services rendered and the amount due. However, invoices are typically issued by the contractor, while pay stubs are issued by the employer.

- W-2 Form: This tax document summarizes an employee's annual wages and taxes withheld, similar to how a pay stub summarizes earnings for a specific pay period.

- 1099 Form: Issued to independent contractors, the 1099 form reports total earnings for the year, akin to the information found on a pay stub regarding compensation.

- Payroll Summary Report: This report provides an overview of all employee payments, including contractors, similar to how a pay stub breaks down individual earnings.

- Payment Receipt: A payment receipt confirms that a payment has been made, much like a pay stub confirms the payment of services rendered by a contractor.

- Contractor Agreement: This document outlines the terms of the working relationship and payment details, similar to how a pay stub reflects the financial aspect of that agreement.

- Expense Report: While expense reports detail costs incurred during work, both documents serve to provide financial clarity regarding payments and reimbursements.