Fill Out a Valid Intent To Lien Florida Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Intent to Lien form notifies the property owner of an impending lien due to non-payment for services or materials provided. |

| Governing Law | This form is governed by Florida Statutes §713.06, which outlines the procedures for filing a lien in Florida. |

| Notice Period | The notice must be served at least 45 days before a lien is recorded, ensuring the property owner has time to respond. |

| Response Time | Property owners have 30 days to respond to the notice before a lien may be filed against their property. |

| Consequences of Non-Payment | If payment is not made, the property may be subject to foreclosure, and the owner could incur additional costs. |

| Certificate of Service | The form includes a section to certify that the notice was properly served to the property owner. |

| Contact Information | The form requires the sender’s name, title, phone number, and email address for further communication. |

Dos and Don'ts

Things You Should Do:

- Ensure all information is accurate and complete.

- Use the full legal names of property owners and contractors.

- Provide a clear description of the property.

- State the exact amount owed for services rendered.

- Send the notice at least 45 days before recording the lien.

Things You Shouldn't Do:

- Do not use abbreviations or nicknames for names.

- Do not omit any required information.

- Do not send the notice without verifying the mailing address.

- Do not ignore the 30-day response requirement.

- Do not fail to keep a copy of the notice for your records.

Other PDF Documents

Druid Spell Chart - Spells available to the character are listed here, showing magical capabilities.

The Divorce Settlement Agreement form is crucial for ensuring that both parties have a clear understanding of their rights and obligations. For more information on this important legal document, you can explore our resource on the essential steps for completing a Divorce Settlement Agreement efficiently here.

Bdsm List - List any hard limits that should not be crossed during play.

Common mistakes

-

Incomplete Property Owner Information: Failing to provide the full legal name and mailing address of the property owner can lead to delays or invalidation of the lien notice.

-

Missing Date: Not including the date at the top of the form can create confusion regarding the timeline for actions related to the lien.

-

Inaccurate Property Description: Providing an incorrect street address or legal description can complicate the lien process and may render it unenforceable.

-

Omitting the Amount Due: Not stating the specific amount owed for services or materials can weaken your claim and lead to misunderstandings.

-

Failure to Notify the General Contractor: If applicable, neglecting to include the general contractor’s information may violate notification requirements.

-

Not Following the Required Timeline: Sending the notice less than 45 days before filing a lien can invalidate your claim.

-

Ignoring the Certificate of Service: Failing to properly certify that the notice was served can lead to challenges in court.

-

Not Using the Correct Delivery Method: Choosing an inappropriate method for delivering the notice can affect its validity.

-

Neglecting to Keep Records: Failing to keep copies of all correspondence and documentation can hinder your position if disputes arise.

Documents used along the form

When dealing with property liens in Florida, it's essential to understand not just the Intent to Lien form but also the other documents that often accompany it. These documents help ensure that all parties are aware of their rights and obligations. Here’s a brief overview of some key forms you might encounter:

- Claim of Lien: This is the formal document filed with the county clerk to officially assert a lien against the property. It details the amount owed and the nature of the work performed. Once recorded, it serves as a public notice of the creditor's claim.

- Hold Harmless Agreement: To protect against liability during contractual engagements, it is advisable for parties to utilize the formsillinois.com for proper documentation.

- Notice to Owner: This document informs the property owner that a contractor or subcontractor has been hired for work on their property. It helps protect the rights of those providing services or materials, ensuring they can file a lien if necessary.

- Release of Lien: When payment is made, this document is filed to remove the lien from the property records. It confirms that the debt has been settled and protects the property owner from potential foreclosure actions.

- Waiver of Lien: This is a legal document where a contractor or subcontractor agrees to waive their right to file a lien on a property, usually in exchange for payment. It provides assurance to property owners that they will not face a lien for the services rendered.

- Affidavit of Non-Payment: This document can be used to affirm that payment has not been received for work performed. It may be necessary in certain legal proceedings or disputes regarding payments and liens.

Understanding these documents can significantly impact your rights and responsibilities as a property owner or contractor. Being informed helps you navigate the complexities of property liens and ensures you take appropriate actions when necessary. Always consider seeking professional advice when dealing with these matters to protect your interests effectively.

Misconceptions

Understanding the Intent To Lien form in Florida can be challenging, and several misconceptions can lead to confusion. Here are eight common misunderstandings about this important document:

- Misconception 1: The Intent To Lien is the same as a lien.

- Misconception 2: Sending the notice guarantees payment.

- Misconception 3: The notice must be sent immediately after work is completed.

- Misconception 4: You can skip sending the notice if you have a contract.

- Misconception 5: The notice can be sent to anyone involved in the project.

- Misconception 6: You can ignore the notice if you believe it is unjustified.

- Misconception 7: The notice does not need to be documented.

- Misconception 8: You can file a lien without sending the notice.

This is incorrect. The Intent To Lien is a notice that someone plans to file a lien. It does not create a lien itself.

While it serves as a formal reminder, sending this notice does not ensure that payment will be made. It is a step in the process.

Florida law requires that the notice be sent at least 45 days before filing a lien. Timing is crucial.

Even with a contract, sending the Intent To Lien is necessary to protect your rights under Florida law.

It must be sent to the property owner and, if applicable, the general contractor. Proper recipients are essential for validity.

Ignoring the notice can lead to serious consequences, including the recording of a lien and potential foreclosure.

It is crucial to keep a copy of the notice and proof of delivery. This documentation is important for any future legal actions.

Florida law mandates that the Intent To Lien be sent before a lien can be recorded. Skipping this step can jeopardize your claim.

Being informed about these misconceptions can help you navigate the process more effectively. If you have questions or need assistance, addressing them promptly is essential.

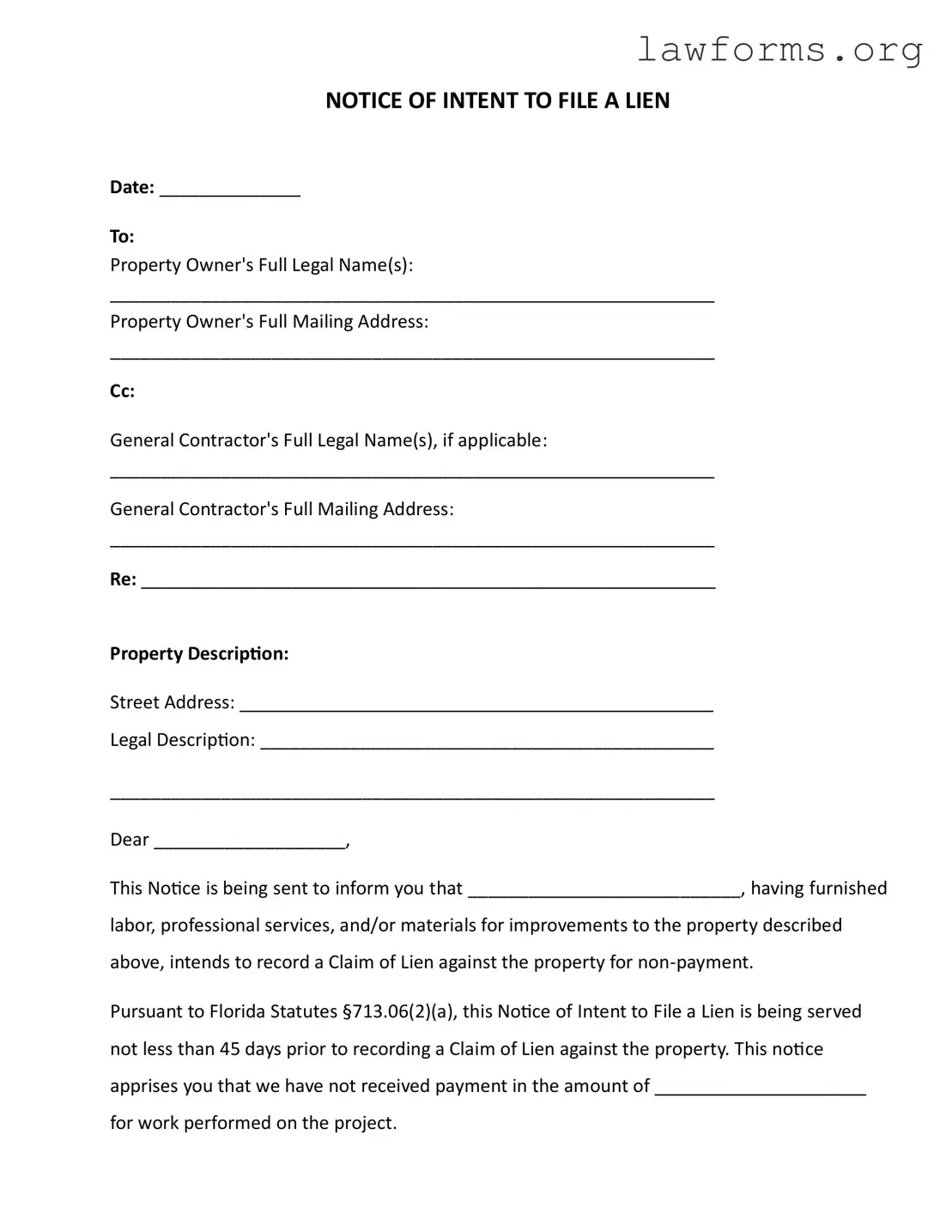

Preview - Intent To Lien Florida Form

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

Key takeaways

When filling out and using the Intent To Lien Florida form, it is essential to keep the following key takeaways in mind:

- Timely Notification: The form must be sent at least 45 days before filing a Claim of Lien. This advance notice is crucial for compliance with Florida law.

- Clear Communication: Include the full legal names and mailing addresses of both the property owner and the general contractor, if applicable. This ensures that all parties are accurately informed.

- Payment Information: Clearly state the amount owed for services rendered. This transparency helps in resolving payment issues and reduces the likelihood of disputes.

- Consequences of Non-Payment: Inform the property owner about the potential repercussions of failing to respond, such as foreclosure proceedings and additional costs. This emphasizes the seriousness of the situation.

Similar forms

The Intent To Lien Florida form shares similarities with several other legal documents related to property and lien processes. Each of these documents serves a specific purpose in notifying parties about claims or intentions regarding property rights. Below is a list of eight documents that are comparable to the Intent To Lien form:

- Notice of Lien: This document formally asserts a claim against a property due to unpaid debts. It serves as a legal warning that a lien has been recorded, similar to the Intent To Lien, which notifies the property owner of an impending lien.

- Claim of Lien: This is the official filing that follows the Intent To Lien. It records the lien against the property and outlines the amount owed, much like the Intent To Lien indicates the intention to file such a claim.

- Notice of Non-Payment: This document informs the property owner that payment has not been received for services rendered. It is a preliminary step, akin to the Intent To Lien, which also addresses non-payment issues.

- Pre-Lien Notice: Similar to the Intent To Lien, this notice is sent before a lien is filed. It serves to alert the property owner and other interested parties of the potential for a lien due to unpaid debts.

- Notice of Default: This document is issued when a borrower fails to meet the terms of a loan agreement. It serves as a warning, paralleling the Intent To Lien's role in notifying property owners of a claim against their property.

- Mechanic's Lien: This is a specific type of lien filed by contractors or suppliers for unpaid work. It directly relates to the Intent To Lien, which is often the precursor to filing a mechanic's lien.

- California LLC-1 Form: This is a submission cover sheet required when filing Articles of Organization for an LLC in California. Completing this form is essential for ensuring that communication with the Secretary of State’s office is effective and that submissions are processed correctly. For more details, visit https://californiadocsonline.com/california-llc-1-form/.

- Demand Letter: A demand letter requests payment and outlines the consequences of non-payment. Like the Intent To Lien, it seeks to prompt action from the property owner before further legal steps are taken.

- Waiver of Lien Rights: This document can be used to relinquish the right to file a lien. It contrasts with the Intent To Lien, which emphasizes the intention to enforce lien rights due to non-payment.