Valid Investment Letter of Intent Form

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | An Investment Letter of Intent (LOI) outlines the preliminary terms and conditions for an investment agreement between parties. |

| Purpose | It serves to express the intent of the parties to enter into a formal agreement, facilitating negotiations and due diligence. |

| Non-Binding Nature | Typically, an LOI is non-binding, meaning that it does not legally obligate the parties to finalize the investment. |

| Key Components | Common elements include investment amount, valuation, timelines, and conditions for closing the deal. |

| State-Specific Forms | Some states may have specific forms or requirements for LOIs, governed by local securities laws. |

| Governing Laws | In California, for instance, the California Corporations Code applies to investment agreements, including LOIs. |

| Confidentiality Provisions | Many LOIs include clauses that protect the confidentiality of the information exchanged during negotiations. |

| Termination Clause | LOIs often contain terms under which either party can terminate the agreement before a formal contract is executed. |

Dos and Don'ts

When filling out the Investment Letter of Intent form, it is important to follow certain guidelines to ensure clarity and accuracy. Below is a list of things you should and shouldn't do.

- Do read the entire form carefully before starting.

- Do provide accurate and up-to-date information.

- Do double-check your contact information for correctness.

- Do use clear and concise language throughout the form.

- Do sign and date the form where required.

- Don't leave any required fields blank.

- Don't use jargon or overly complex language.

- Don't submit the form without reviewing it for errors.

- Don't forget to keep a copy of the completed form for your records.

- Don't rush through the process; take your time to ensure accuracy.

Create Popular Types of Investment Letter of Intent Documents

Letter of Intent Purchase Business - This document can include statements from professional advisers guiding the transaction.

Letter of Intent to Buy - It can serve as a basis for future negotiations and agreements.

Intent to Sue Letter Template - Make sure to address the letter to the proper party to avoid confusion.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required personal and financial details. Missing information can delay the investment process.

-

Incorrect Contact Information: Providing outdated or incorrect contact details can hinder communication. Ensure that phone numbers and email addresses are current.

-

Failure to Specify Investment Amount: Omitting the intended investment amount can lead to confusion. Clearly state the amount you wish to invest.

-

Ignoring Terms and Conditions: Some individuals overlook the terms outlined in the letter. It is crucial to read and understand these conditions before signing.

-

Not Including Signatures: A common mistake is submitting the form without required signatures. Ensure all necessary parties have signed before submission.

-

Inconsistent Information: Providing conflicting details, such as different names or addresses, can raise red flags. Consistency is key.

-

Neglecting to Review the Form: Rushing through the form can lead to errors. Take the time to review all entries carefully before finalizing.

-

Missing Supporting Documents: Some forms require additional documentation. Failing to attach these can result in delays or rejection.

-

Not Following Submission Guidelines: Each investment opportunity may have specific submission requirements. Adhering to these guidelines is essential for acceptance.

Documents used along the form

The Investment Letter of Intent form is a crucial document in the investment process, outlining the preliminary agreement between parties. Several other forms and documents often accompany it to ensure clarity and mutual understanding. Below is a list of these documents, each serving a specific purpose in the investment journey.

- Confidentiality Agreement: This document protects sensitive information shared between parties. It ensures that proprietary details remain confidential throughout the negotiation process.

- Term Sheet: A term sheet summarizes the key terms and conditions of the investment. It acts as a blueprint for the final agreement, detailing aspects like valuation, investment amount, and ownership structure.

- Due Diligence Checklist: This checklist outlines the necessary information and documentation required to assess the investment opportunity. It helps ensure that all relevant factors are considered before proceeding.

- Investment Agreement: This formal contract finalizes the terms of the investment. It includes detailed provisions regarding the rights and obligations of each party, ensuring that all aspects of the deal are legally binding.

- Shareholder Agreement: This document governs the relationship among shareholders. It outlines rights, responsibilities, and procedures for decision-making, ensuring smooth operations and conflict resolution within the company.

Each of these documents plays an essential role in facilitating a successful investment process. They work together to provide a comprehensive framework that supports transparency and trust between the parties involved.

Misconceptions

The Investment Letter of Intent (LOI) is a crucial document in the investment process, yet many people harbor misconceptions about its purpose and functionality. Here are seven common misunderstandings:

-

The LOI is a legally binding contract.

Many believe that signing an LOI means they are entering into a legally binding agreement. In reality, most LOIs are intended to outline preliminary terms and conditions and are not legally enforceable.

-

The LOI guarantees funding.

Some investors think that once they submit an LOI, the funding is guaranteed. However, an LOI is more of an expression of interest and does not ensure that the investment will proceed.

-

All LOIs are the same.

Not all Investment Letters of Intent follow a standard format. Each LOI can vary significantly based on the specifics of the deal, the parties involved, and the industry.

-

The LOI is only for investors.

This document is often thought to be exclusively for investors. In fact, both parties—investors and companies seeking investment—can benefit from using an LOI to clarify intentions.

-

Once signed, the terms in the LOI cannot be changed.

Some assume that the terms outlined in an LOI are set in stone. In truth, negotiations can continue even after an LOI is signed, allowing for adjustments as discussions evolve.

-

The LOI is unnecessary if there’s a verbal agreement.

While verbal agreements can be made, they often lack the clarity and detail that a written LOI provides. Having a formal document helps avoid misunderstandings later on.

-

LOIs are only for large investments.

Some people believe that LOIs are only relevant for large-scale investments. However, they can be useful in transactions of any size, as they help set the stage for further discussions.

Understanding these misconceptions can help both investors and companies navigate the investment landscape more effectively. A well-crafted LOI can serve as a valuable tool in establishing a clear framework for future negotiations.

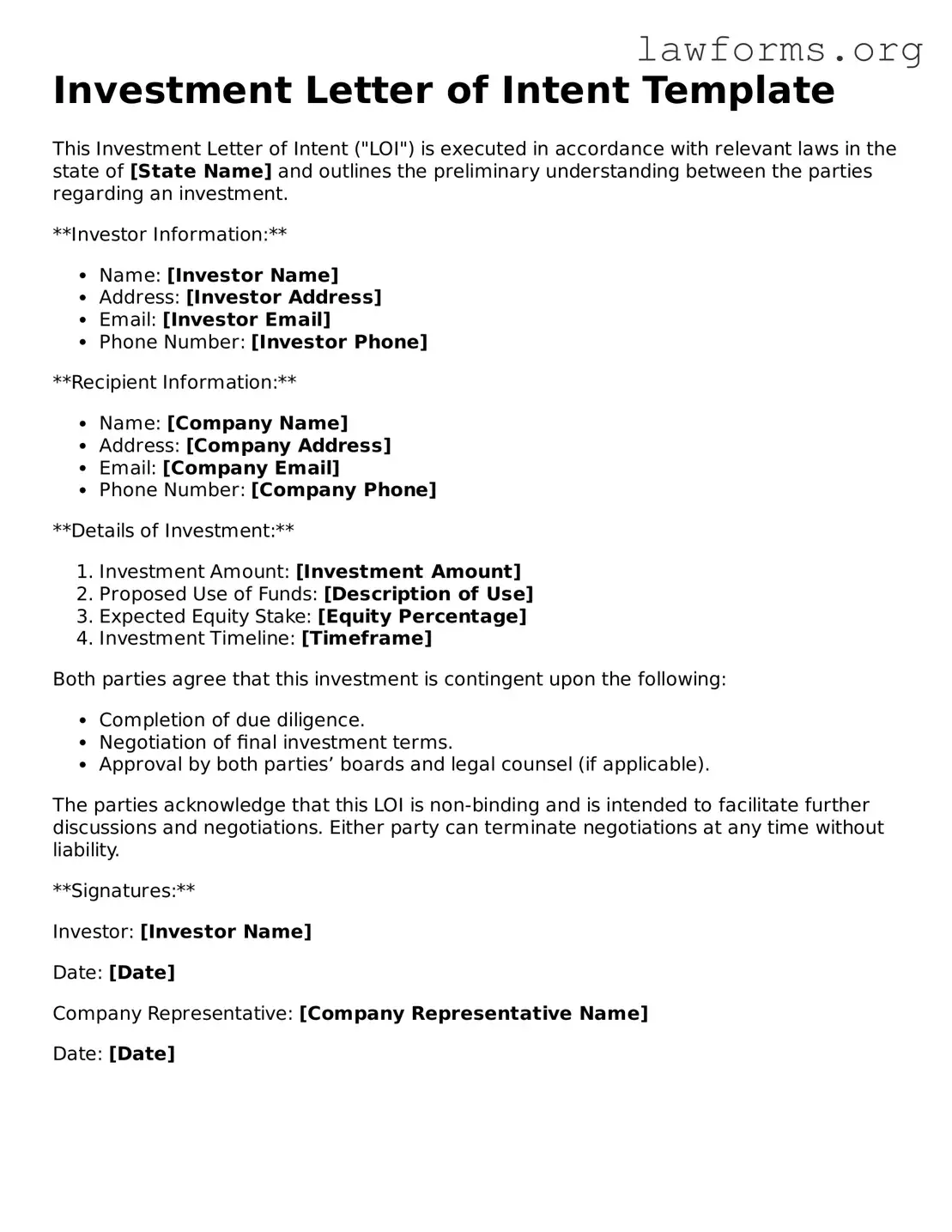

Preview - Investment Letter of Intent Form

Investment Letter of Intent Template

This Investment Letter of Intent ("LOI") is executed in accordance with relevant laws in the state of [State Name] and outlines the preliminary understanding between the parties regarding an investment.

**Investor Information:**

- Name: [Investor Name]

- Address: [Investor Address]

- Email: [Investor Email]

- Phone Number: [Investor Phone]

**Recipient Information:**

- Name: [Company Name]

- Address: [Company Address]

- Email: [Company Email]

- Phone Number: [Company Phone]

**Details of Investment:**

- Investment Amount: [Investment Amount]

- Proposed Use of Funds: [Description of Use]

- Expected Equity Stake: [Equity Percentage]

- Investment Timeline: [Timeframe]

Both parties agree that this investment is contingent upon the following:

- Completion of due diligence.

- Negotiation of final investment terms.

- Approval by both parties’ boards and legal counsel (if applicable).

The parties acknowledge that this LOI is non-binding and is intended to facilitate further discussions and negotiations. Either party can terminate negotiations at any time without liability.

**Signatures:**

Investor: [Investor Name]

Date: [Date]

Company Representative: [Company Representative Name]

Date: [Date]

Key takeaways

Filling out an Investment Letter of Intent (LOI) form is an important step in the investment process. Here are key takeaways to consider:

- Purpose: The LOI outlines the preliminary terms of an investment agreement between parties.

- Clarity: Clearly state your intentions and expectations to avoid misunderstandings.

- Details Matter: Include specific details such as investment amount, timeline, and conditions.

- Non-Binding Nature: Understand that an LOI is typically non-binding, meaning it does not create a legal obligation.

- Confidentiality: Consider including a confidentiality clause to protect sensitive information.

- Negotiation Tool: Use the LOI as a starting point for negotiations, allowing for adjustments as needed.

- Review Process: Review the document thoroughly before signing to ensure accuracy and completeness.

- Legal Advice: Seek legal counsel if you have questions or concerns about the terms outlined in the LOI.

- Signatures: Ensure all parties involved sign the document to acknowledge agreement on the terms.

- Follow-Up: After submitting the LOI, maintain communication to discuss the next steps in the investment process.

Similar forms

- Memorandum of Understanding (MOU): Similar to an Investment Letter of Intent, an MOU outlines the intentions of parties involved in a potential agreement. It serves as a preliminary document, establishing a mutual understanding without creating binding obligations.

- Term Sheet: A term sheet summarizes the key terms and conditions of a proposed investment. Like the Investment Letter of Intent, it provides a framework for negotiations and outlines the main points before a formal agreement is drafted.

- Letter of Intent (LOI): An LOI is a document that expresses a party's intention to enter into a formal agreement. It shares similarities with the Investment Letter of Intent by detailing the preliminary terms and conditions of a potential deal.

- Confidentiality Agreement: This document ensures that sensitive information shared during negotiations remains protected. While the Investment Letter of Intent may not include confidentiality clauses, both documents often deal with sensitive information and the need for trust between parties.

- Joint Venture Agreement: A joint venture agreement outlines the terms of a partnership between two or more parties for a specific project. It is similar to the Investment Letter of Intent in that it establishes a framework for collaboration and investment.

- Investment Agreement: This formal document details the terms of an investment, including obligations and rights of the parties involved. It follows the preliminary discussions often initiated by an Investment Letter of Intent.

- Purchase Agreement: A purchase agreement outlines the terms under which one party agrees to buy an asset from another. It is similar in purpose to the Investment Letter of Intent, as both documents set the stage for a transaction.

- Shareholder Agreement: This document governs the relationship between shareholders in a company. It shares a common goal with the Investment Letter of Intent by establishing the framework for investment and governance in a business context.