Fill Out a Valid IRS 1120 Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1120 is used by corporations to report their income, gains, losses, deductions, and credits to the federal government. |

| Filing Requirement | All domestic corporations must file Form 1120 annually, regardless of whether they have taxable income. |

| Due Date | The form is typically due on the 15th day of the 4th month after the end of the corporation's tax year. |

| Estimated Taxes | Corporations may need to make estimated tax payments throughout the year, which can be calculated using Form 1120-W. |

| State-Specific Forms | Many states have their own versions of the corporate tax return, such as California's Form 100, governed by the California Revenue and Taxation Code. |

| Tax Rates | The federal corporate tax rate is a flat 21%, established by the Tax Cuts and Jobs Act of 2017. |

| Filing Methods | Form 1120 can be filed electronically or by mail, depending on the corporation's size and preference. |

Dos and Don'ts

When filling out the IRS 1120 form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are five things to do and five things to avoid:

- Do: Gather all necessary financial documents before starting the form.

- Do: Double-check all calculations for accuracy.

- Do: Use the most current version of the form available on the IRS website.

- Do: Sign and date the form before submission.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank.

- Don't: Use incorrect tax rates or deductions.

- Don't: Submit the form without reviewing it thoroughly.

- Don't: Forget to check for any changes in tax laws that may affect your filing.

- Don't: Ignore deadlines for submission to avoid penalties.

Other PDF Documents

Basketball Evaluation Form Pdf - Review the player's effectiveness in performing bounce passes.

The California Boat Bill of Sale form is indispensable for anyone looking to buy or sell a boat, as it provides a clear record of the ownership transfer. By filling out the form accurately, both buyers and sellers can safeguard their interests and ensure the transaction proceeds without complications. For more information on how to complete this essential document, you can refer to https://californiadocsonline.com/boat-bill-of-sale-form/.

Free Printable Puppy Health Guarantee - Any return of the puppy must coincide with notified defects and veterinary advice.

What Is a 1098 Form - The interest rate is noted, along with its valid period until a specific date.

Common mistakes

-

Failing to include all necessary information. Many businesses overlook critical details, such as the correct name of the corporation or the Employer Identification Number (EIN).

-

Incorrectly calculating income. Errors in reporting revenue can lead to significant discrepancies, affecting tax liability.

-

Neglecting to report all deductions. Some taxpayers miss out on valid deductions, which can reduce the overall tax burden.

-

Using outdated forms. Always ensure that you are using the most current version of the IRS 1120 form, as outdated forms may not be accepted.

-

Not signing the form. A common oversight is failing to sign the form, which can result in delays or rejections.

-

Submitting the form to the wrong address. It is crucial to verify the correct mailing address for the IRS to avoid processing issues.

-

Ignoring deadlines. Timely submission is essential. Late filings can incur penalties and interest.

-

Not keeping copies of submitted forms. Retaining copies for your records is vital for future reference and potential audits.

-

Overlooking state tax requirements. While the IRS form addresses federal taxes, state-specific obligations must also be fulfilled.

Documents used along the form

The IRS Form 1120 is the U.S. Corporation Income Tax Return, which corporations use to report their income, gains, losses, deductions, and credits. Along with this form, several other documents may be required to provide a comprehensive overview of the corporation's financial status. Below is a list of commonly used forms and documents that often accompany the IRS 1120 form.

- Schedule C: This schedule is used to report the corporation's dividends, interest income, and other income types. It provides a detailed breakdown of income sources, which is essential for accurate tax reporting.

- Schedule J: This schedule outlines the corporation's tax computation and payments. It includes information on the tax rates applied and any estimated tax payments made throughout the year.

- Form 4562: This form is utilized to claim depreciation and amortization. Corporations use it to report the cost of assets over time, which can significantly impact taxable income.

- Form 941: This is the Employer's Quarterly Federal Tax Return. It reports income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks and the corporation's portion of Social Security and Medicare taxes.

- Texas Boat Bill of Sale Form: To ensure smooth transactions, refer to our trusted Texas boat bill of sale options which provide essential documentation for ownership transfer.

- Form 1099: This form is used to report various types of income received by the corporation, such as payments to independent contractors. It ensures that all income is accurately accounted for during tax reporting.

- Form 1125-E: This form is for reporting compensation of officers. It provides transparency regarding the salaries paid to corporate officers, which is necessary for determining reasonable compensation deductions.

These forms and documents are integral to the accurate completion of the IRS 1120 form. They help ensure that all financial aspects of the corporation are reported correctly, facilitating compliance with tax regulations.

Misconceptions

The IRS Form 1120 is a crucial document for corporations in the United States, yet several misconceptions surround its purpose and requirements. Understanding these misconceptions can help business owners navigate their tax obligations more effectively.

- Misconception 1: Only large corporations need to file Form 1120.

- Misconception 2: Form 1120 is only for profit-making corporations.

- Misconception 3: Filing Form 1120 is optional.

- Misconception 4: The IRS does not check Form 1120 for accuracy.

- Misconception 5: Filing Form 1120 is the same as filing personal taxes.

Many people believe that only large corporations are required to file this form. In reality, any corporation, regardless of size, must file Form 1120 if it is recognized as a corporation for tax purposes. This includes small businesses and startups.

Some assume that Form 1120 is only applicable to corporations that make a profit. However, even corporations that incur losses must file this form. Filing can help carry forward losses to offset future taxable income.

There is a common belief that filing Form 1120 is optional for corporations. This is incorrect. Corporations are legally required to file this form annually, regardless of whether they owe taxes.

Some corporations mistakenly think that the IRS does not scrutinize Form 1120 submissions. In fact, the IRS employs various methods to ensure compliance and accuracy. Inaccuracies can lead to audits or penalties.

Individuals often confuse corporate tax filings with personal tax filings. While both involve reporting income and expenses, the rules and forms differ significantly. Corporations must adhere to specific regulations and guidelines that do not apply to individual taxpayers.

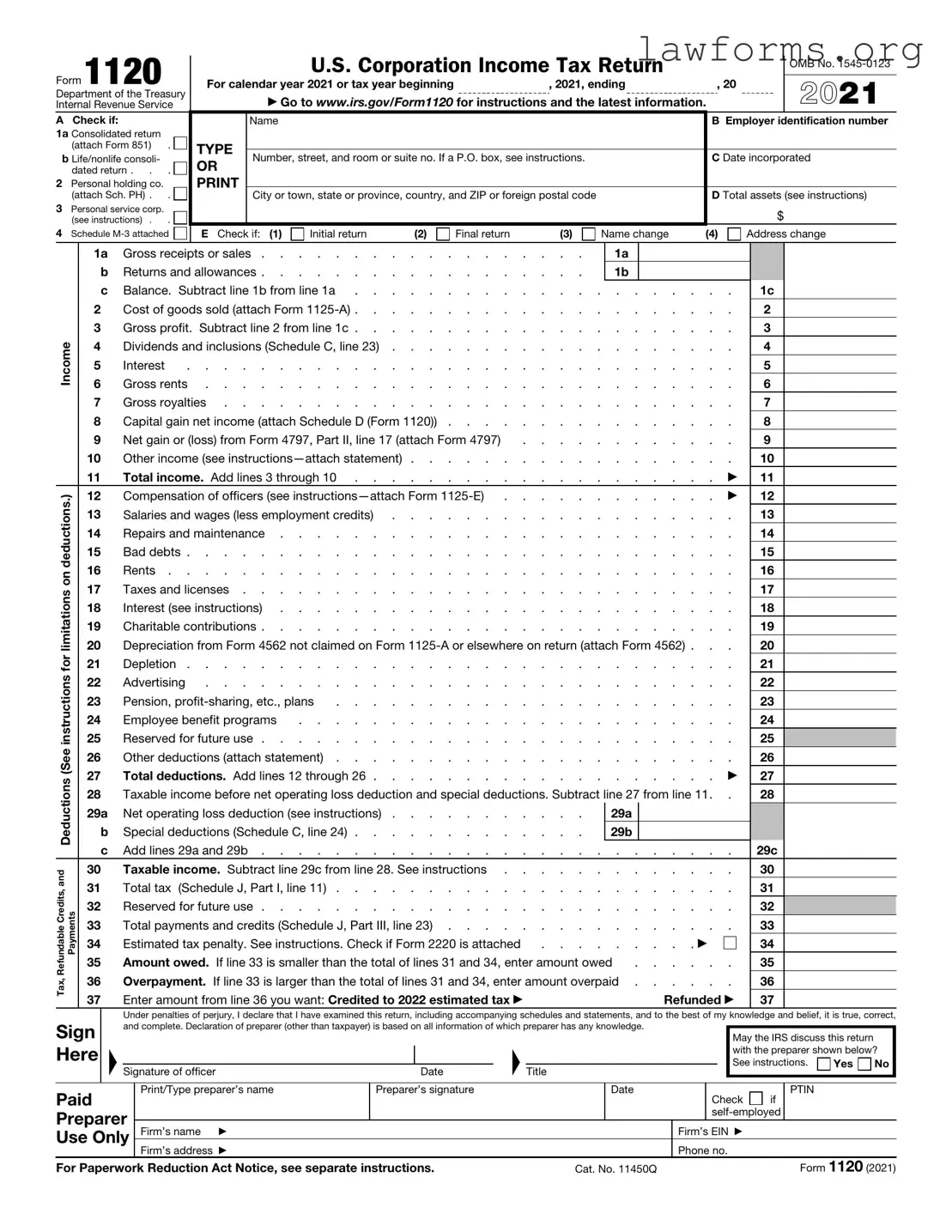

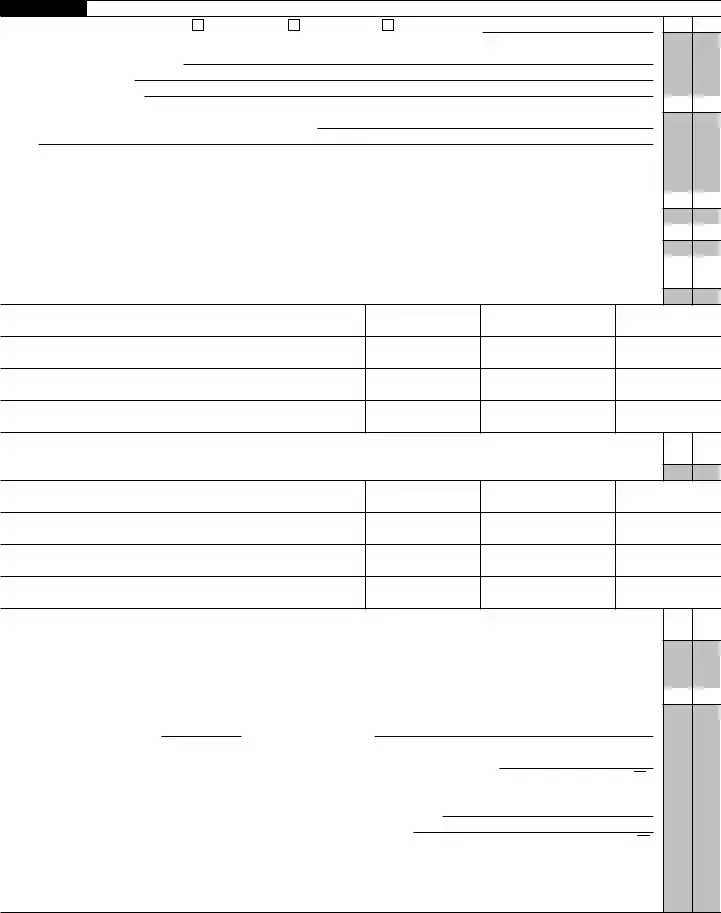

Preview - IRS 1120 Form

Form 1120

Department of the Treasury

Internal Revenue Service

A Check if:

1a Consolidated return (attach Form 851) .

b Life/nonlife consoli- dated return . . .

2Personal holding co. (attach Sch. PH) . .

3Personal service corp. (see instructions) . .

4 Schedule

|

|

U.S. Corporation Income Tax Return |

|

|

OMB No. |

||||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

For calendar year 2021 or tax year beginning |

|

, 2021, ending |

, 20 |

|

2021 |

||||

|

▶ Go to www.irs.gov/Form1120 for instructions and the latest information. |

|

|||||||

|

Name |

|

|

|

|

|

B Employer identification number |

||

TYPE |

|

|

|

|

|

|

|

|

|

Number, street, and room or suite no. If a P.O. box, see instructions. |

|

C Date incorporated |

|||||||

OR |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

D Total assets (see instructions) |

|||||||

|

|

||||||||

|

|

|

|

|

|

|

|

$ |

|

E Check if: (1) |

Initial return |

(2) |

Final return |

(3) |

Name change |

(4) |

Address change |

||

|

1a |

|

Gross receipts or sales |

|

. . . |

. |

|

1a |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

b |

|

Returns and allowances |

|

. . . |

. |

|

1b |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

c |

|

Balance. Subtract line 1b from line 1a |

|

. . . . . . . . . . . . |

1c |

|

|

||||||||||||||||||||

|

2 |

|

|

Cost of goods sold (attach Form |

|

. . . . . . . . . . . . |

2 |

|

|

|

|||||||||||||||||||

|

3 |

|

|

Gross profit. Subtract line 2 from line 1c |

|

. . . . . . . . . . . . |

3 |

|

|

|

|||||||||||||||||||

Income |

4 |

|

|

Dividends and inclusions (Schedule C, line 23) |

|

. . . . . . . . . . . . |

4 |

|

|

|

|||||||||||||||||||

5 |

|

|

Interest |

. . . . . . . . . . . . . . . . . . |

|

. . . . . . . . . . . . |

5 |

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

6 |

|

|

Gross rents |

|

. . . . . . . . . . . . |

6 |

|

|

|

|||||||||||||||||||

|

7 |

|

|

Gross royalties |

|

. . . . . . . . . . . . |

7 |

|

|

|

|||||||||||||||||||

|

8 |

|

|

Capital gain net income (attach Schedule D (Form 1120)) . . . . |

|

. . . . . . . . . . . . |

8 |

|

|

|

|||||||||||||||||||

|

9 |

|

|

Net gain or (loss) from Form 4797, Part II, line 17 (attach Form 4797) |

|

. . . . . . . . . . . . |

9 |

|

|

|

|||||||||||||||||||

|

10 |

|

|

Other income (see |

|

. . . . . . . . . . . . |

10 |

|

|

|

|||||||||||||||||||

|

11 |

|

|

Total income. Add lines 3 through 10 |

|

. . . |

. |

. . |

. . |

. |

. |

. |

|

▶ |

11 |

|

|

|

|||||||||||

deductions.) |

12 |

|

|

Compensation of officers (see |

|

. . . |

. |

. . |

. . |

. |

. |

. |

|

▶ |

12 |

|

|

|

|||||||||||

13 |

|

|

Salaries and wages (less employment credits) |

|

. . . . . . . . . . . . |

13 |

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

14 |

|

|

Repairs and maintenance |

|

. . . . . . . . . . . . |

14 |

|

|

|

|||||||||||||||||||

|

15 |

|

|

Bad debts |

|

. . . . . . . . . . . . |

15 |

|

|

|

|||||||||||||||||||

on |

16 |

|

|

Rents |

|

. . . . . . . . . . . . |

16 |

|

|

|

|||||||||||||||||||

17 |

|

|

Taxes and licenses |

|

. . . . . . . . . . . . |

17 |

|

|

|

||||||||||||||||||||

limitations |

|

|

|

|

|

|

|||||||||||||||||||||||

20 |

|

|

Depreciation from Form 4562 not claimed on Form |

20 |

|

|

|

||||||||||||||||||||||

|

18 |

|

|

Interest (see instructions) |

|

. . . . . . . . . . . . |

18 |

|

|

|

|||||||||||||||||||

|

19 |

|

|

Charitable contributions |

|

. . . . . . . . . . . . |

19 |

|

|

|

|||||||||||||||||||

for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

21 |

|

|

Depletion |

|

. . . . . . . . . . . . |

21 |

|

|

|

||||||||||||||||||||

instructions |

25 |

|

|

Reserved for future use |

|

. . . . . . . . . . . . |

25 |

|

|

|

|||||||||||||||||||

|

22 |

|

|

Advertising |

|

. . . . . . . . . . . . |

22 |

|

|

|

|||||||||||||||||||

|

23 |

|

|

Pension, |

. . . . . . . . . . |

|

. . . . . . . . . . . . |

23 |

|

|

|

||||||||||||||||||

|

24 |

|

|

Employee benefit programs |

. . . . . . . . . . . . |

|

. . . . . . . . . . . . |

24 |

|

|

|

||||||||||||||||||

(See |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

Other deductions (attach statement) |

|

. . . . . . . . . . . . |

26 |

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

Deductions |

27 |

|

|

Total deductions. Add lines 12 through 26 |

|

. . . |

. |

. . |

. . |

. |

. |

. |

|

▶ |

27 |

|

|

|

|||||||||||

28 |

|

|

Taxable income before net operating loss deduction and special deductions. Subtract line 27 from line 11. . |

28 |

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||

|

29a |

|

Net operating loss deduction (see instructions) |

|

. . . |

. |

|

29a |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

b |

|

Special deductions (Schedule C, line 24) |

|

. . . |

. |

|

29b |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

c |

|

Add lines 29a and 29b |

|

. . . . . . . . . . . . |

29c |

|

|

||||||||||||||||||||

and |

30 |

|

|

Taxable income. Subtract line 29c from line 28. See instructions . |

|

. . . . . . . . . . . . |

30 |

|

|

|

|||||||||||||||||||

31 |

|

|

Total tax |

(Schedule J, Part I, line 11) |

|

. . . . . . . . . . . . |

31 |

|

|

|

|||||||||||||||||||

Credits,Refundable Payments |

|

|

|

|

|

|

|||||||||||||||||||||||

32 |

|

|

Reserved for future use |

|

. . . . . . . . . . . . |

32 |

|

|

|

||||||||||||||||||||

|

33 |

|

|

Total payments and credits (Schedule J, Part III, line 23) . . . . |

|

. . . . . . . . . . . . |

33 |

|

|

|

|||||||||||||||||||

|

34 |

|

|

Estimated tax penalty. See instructions. Check if Form 2220 is attached |

. . |

. |

. . |

. . |

. |

. ▶ |

|

|

|

34 |

|

|

|

||||||||||||

|

35 |

|

|

Amount owed. If line 33 is smaller than the total of lines 31 and 34, enter amount owed |

. . . . . . |

35 |

|

|

|

||||||||||||||||||||

Tax, |

36 |

|

|

Overpayment. If line 33 is larger than the total of lines 31 and 34, enter amount overpaid |

36 |

|

|

|

|||||||||||||||||||||

37 |

|

|

Enter amount from line 36 you want: Credited to 2022 estimated tax ▶ |

|

|

|

|

|

|

|

Refunded ▶ |

37 |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Sign |

|

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, |

||||||||||||||||||||||||||

|

|

and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

|

|

|

|

|

May the IRS discuss this return |

|

||||||||||||||||||||

Here |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

with the preparer shown below? |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See instructions. |

Yes |

No |

||

|

|

|

▲Signature of officer |

|

|

|

Date |

▲ |

|

Title |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

|

|

Print/Type preparer’s name |

|

|

Preparer’s signature |

|

|

|

|

|

Date |

|

|

|

|

|

Check |

if |

PTIN |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Firm’s name ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s EIN ▶ |

|

|

|

|

|||||||||

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Firm’s address ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone no. |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

For Paperwork Reduction Act Notice, see separate instructions. |

|

|

|

Cat. No. 11450Q |

|

|

|

|

|

|

|

Form 1120 (2021) |

|||||||||||||||||

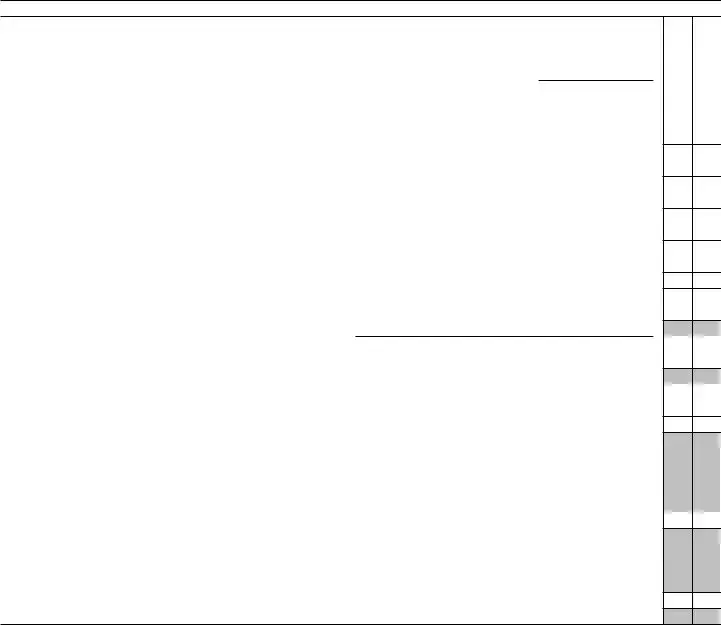

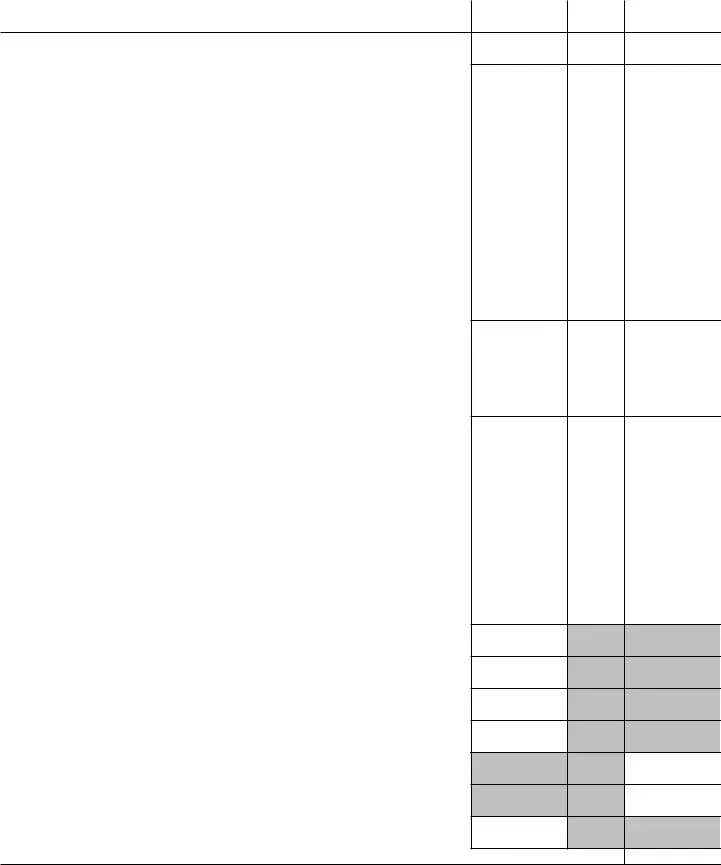

Form 1120 (2021) |

|

|

Page 2 |

|

Schedule C |

Dividends, Inclusions, and Special Deductions (see |

(a) Dividends and |

(b) % |

(c) Special deductions |

|

instructions) |

inclusions |

(a) × (b) |

|

|

|

|||

1Dividends from

stock) |

50 |

2Dividends from

|

stock) |

65 |

|

|

See |

3 |

Dividends on certain |

instructions |

4 |

Dividends on certain preferred stock of |

23.3 |

5 |

Dividends on certain preferred stock of |

26.7 |

6 |

Dividends from |

50 |

7 |

Dividends from |

65 |

8 |

Dividends from wholly owned foreign subsidiaries |

100 |

|

|

See |

9 |

Subtotal. Add lines 1 through 8. See instructions for limitations |

instructions |

10Dividends from domestic corporations received by a small business investment

|

company operating under the Small Business Investment Act of 1958 |

100 |

11 |

Dividends from affiliated group members |

100 |

12 |

Dividends from certain FSCs |

100 |

13

|

corporation (excluding hybrid dividends) (see instructions) |

|

100 |

|

|

14 |

Dividends from foreign corporations not included on line 3, 6, 7, 8, 11, 12, or 13 |

|

|

||

|

(including any hybrid dividends) |

|

|

|

|

15 |

Reserved for future use |

|

|

|

|

16a |

Subpart F inclusions derived from the sale by a controlled foreign corporation (CFC) of |

|

|

||

|

the stock of a |

100 |

|

||

|

(see instructions) |

|

|

||

b |

Subpart F inclusions derived from hybrid dividends of tiered corporations (attach Form(s) |

|

|

||

|

5471) (see instructions) |

|

|

|

|

c |

Other inclusions from CFCs under subpart F not included on line 16a, 16b, or 17 (attach |

|

|

||

|

Form(s) 5471) (see instructions) |

|

|

||

17 |

Global Intangible |

18 |

|

19 |

|

20 |

Other dividends |

21 |

Deduction for dividends paid on certain preferred stock of public utilities . . . . |

22 |

Section 250 deduction (attach Form 8993) |

23Total dividends and inclusions. Add column (a), lines 9 through 20. Enter here and on page 1, line 4 . . . . . . . . . . . . . . . . . . . . . .

24 |

Total special deductions. Add column (c), lines 9 through 22. Enter here and on page 1, line 29b |

Form 1120 (2021)

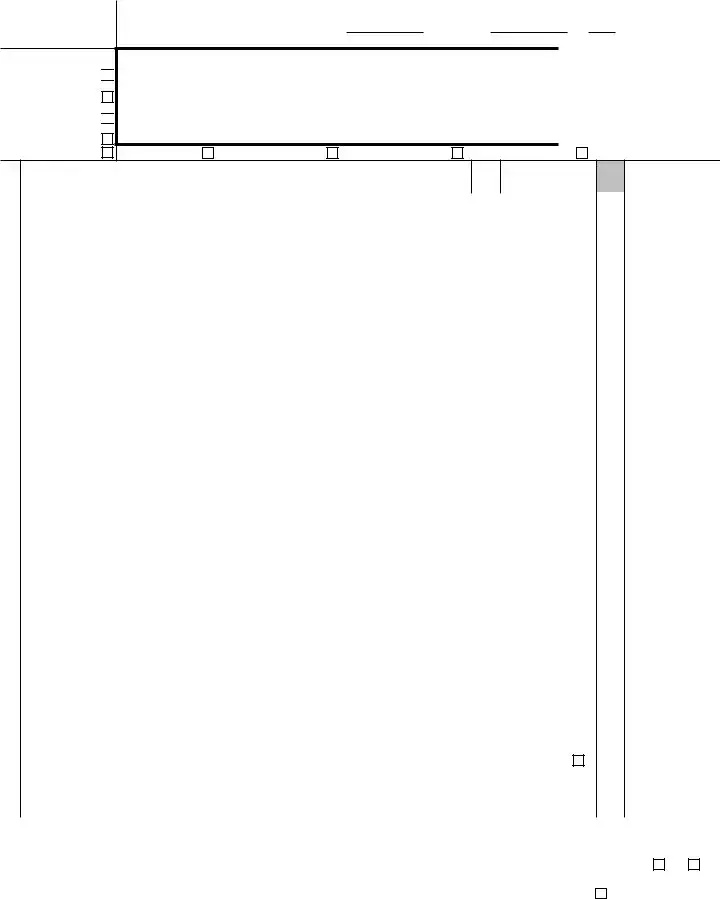

Form 1120 (2021) |

|

|

|

|

|

Page 3 |

|

Schedule J |

Tax Computation and Payment (see instructions) |

|

|

|

|

|

|

Part |

|

|

|

|

|

||

1 |

Check if the corporation is a member of a controlled group (attach Schedule O (Form 1120)). See instructions |

▶ |

|

|

|||

2 |

Income tax. See instructions |

. . . . |

. . . |

2 |

|

||

3 |

Base erosion minimum tax amount (attach Form 8991) |

. . . . |

. . . |

3 |

|

||

4 |

Add lines 2 and 3 |

. . . . |

. . . |

4 |

|

||

5a |

Foreign tax credit (attach Form 1118) |

5a |

|

|

|

|

|

b |

Credit from Form 8834 (see instructions) |

5b |

|

|

|

|

|

c |

General business credit (attach Form 3800) |

5c |

|

|

|

|

|

d |

Credit for prior year minimum tax (attach Form 8827) |

5d |

|

|

|

|

|

e |

Bond credits from Form 8912 |

5e |

|

|

|

|

|

6 |

Total credits. Add lines 5a through 5e |

. . . . |

. . . |

6 |

|

||

7 |

Subtract line 6 from line 4 |

. . . . |

. . . |

7 |

|

||

8 |

Personal holding company tax (attach Schedule PH (Form 1120)) |

. . . . |

. . . |

8 |

|

||

9a |

Recapture of investment credit (attach Form 4255) |

9a |

|

|

|

|

|

b |

Recapture of |

9b |

|

|

|

|

|

c |

Interest due under the |

|

|

|

|

|

|

|

Form 8697) |

9c |

|

|

|

|

|

d |

Interest due under the |

9d |

|

|

|

|

|

e |

Alternative tax on qualifying shipping activities (attach Form 8902) |

9e |

|

|

|

|

|

f |

Interest/tax due under section 453A(c) and/or section 453(l) |

9f |

|

|

|

|

|

g |

Other (see |

9g |

|

|

|

|

|

10 |

Total. Add lines 9a through 9g |

. . . . |

. . . |

10 |

|

||

11 |

Total tax. Add lines 7, 8, and 10. Enter here and on page 1, line 31 |

. . . . |

. . . |

11 |

|

||

Part

12 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

Part

13 |

2020 overpayment credited to 2021 |

. . . . . . . . |

13 |

|

|

||

14 |

2021 estimated tax payments |

. . . . . . . . |

14 |

|

|

||

15 |

2021 refund applied for on Form 4466 |

. . . . . . . . |

15 |

( |

) |

||

16 |

Combine lines 13, 14, and 15 |

. . . . . . . . |

16 |

|

|

||

17 |

Tax deposited with Form 7004 |

. . . . . . . . |

17 |

|

|

||

18 |

Withholding (see instructions) |

. . . . . . . . |

18 |

|

|

||

19 |

Total payments. Add lines 16, 17, and 18 |

. . . . . . . . |

19 |

|

|

||

20 |

Refundable credits from: |

|

|

|

|

|

|

a |

Form 2439 |

|

20a |

|

|

|

|

b |

Form 4136 |

|

20b |

|

|

|

|

c |

Reserved for future use |

|

20c |

|

|

|

|

d |

Other (attach |

|

20d |

|

|

|

|

21 |

Total credits. Add lines 20a through 20d |

. . . . . . . . |

21 |

|

|

||

22 |

Reserved for future use |

. . . . . . . . |

22 |

|

|

||

23 |

Total payments and credits. Add lines 19 and 21. Enter here and on page 1, line 33 . |

. . . . . . . . |

23 |

|

|

||

|

|

|

|

|

|

|

Form 1120 (2021) |

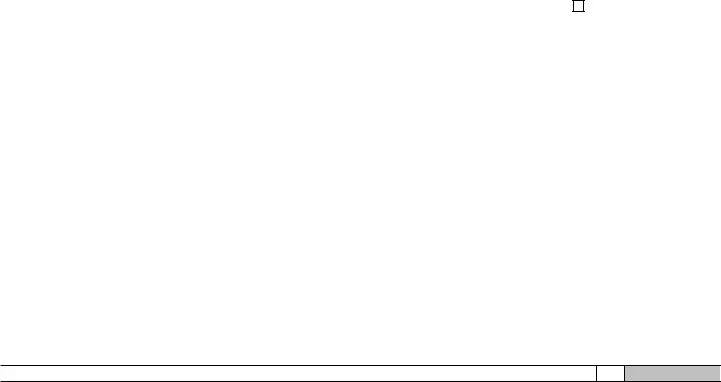

Form 1120 (2021) |

Page 4 |

Schedule K Other Information (see instructions)

1 |

Check accounting method: a |

Cash |

b |

Accrual |

c |

Other (specify) ▶ |

2See the instructions and enter the: a Business activity code no. ▶

b Business activity ▶ c Product or service ▶

3 Is the corporation a subsidiary in an affiliated group or a

If “Yes,” enter name and EIN of the parent corporation ▶

4At the end of the tax year:

aDid any foreign or domestic corporation, partnership (including any entity treated as a partnership), trust, or

corporation’s stock entitled to vote? If “Yes,” complete Part I of Schedule G (Form 1120) (attach Schedule G) . . . . . .

bDid any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all

classes of the corporation’s stock entitled to vote? If “Yes,” complete Part II of Schedule G (Form 1120) (attach Schedule G) .

5At the end of the tax year, did the corporation:

aOwn directly 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of stock entitled to vote of any foreign or domestic corporation not included on Form 851, Affiliations Schedule? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (iv) below.

Yes No

(i)Name of Corporation

(ii)Employer

Identification Number

(if any)

(iii)Country of Incorporation

(iv)Percentage Owned in Voting

Stock

bOwn directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (iv) below.

(i)Name of Entity

(ii)Employer

Identification Number

(if any)

(iii)Country of Organization

(iv)Maximum

Percentage Owned in Profit, Loss, or Capital

6During this tax year, did the corporation pay dividends (other than stock dividends and distributions in exchange for stock) in

excess of the corporation’s current and accumulated earnings and profits? See sections 301 and 316 . . . . . . . .

If “Yes,” file Form 5452, Corporate Report of Nondividend Distributions. See the instructions for Form 5452. If this is a consolidated return, answer here for the parent corporation and on Form 851 for each subsidiary.

7At any time during the tax year, did one foreign person own, directly or indirectly, at least 25% of the total voting power of all classes of the corporation’s stock entitled to vote or at least 25% of the total value of all classes of the corporation’s stock? .

For rules of attribution, see section 318. If “Yes,” enter:

(a) Percentage owned ▶ |

and (b) Owner’s country ▶ |

(c)The corporation may have to file Form 5472, Information Return of a 25%

8 Check this box if the corporation issued publicly offered debt instruments with original issue discount . . . . . . ▶

If checked, the corporation may have to file Form 8281, Information Return for Publicly Offered Original Issue Discount Instruments.

If checked, the corporation may have to file Form 8281, Information Return for Publicly Offered Original Issue Discount Instruments.

9Enter the amount of

10Enter the number of shareholders at the end of the tax year (if 100 or fewer) ▶

11If the corporation has an NOL for the tax year and is electing to forego the carryback period, check here (see instructions) ▶

If the corporation is filing a consolidated return, the statement required by Regulations section

12Enter the available NOL carryover from prior tax years (do not reduce it by any deduction reported on

page 1, line 29a.) . . . . . . . . . . . . . . . . . . . . . . . . . ▶ $

Form 1120 (2021)

Form 1120 (2021) |

Page 5 |

Schedule K Other Information (continued from page 4)

13 |

Are the corporation’s total receipts (page 1, line 1a, plus lines 4 through 10) for the tax year and its total assets at the end of the |

Yes No |

|

||

|

tax year less than $250,000? |

|

|

If “Yes,” the corporation is not required to complete Schedules L, |

|

|

distributions and the book value of property distributions (other than cash) made during the tax year ▶ $ |

|

14 |

Is the corporation required to file Schedule UTP (Form 1120), Uncertain Tax Position Statement? See instructions . . . . |

|

|

If “Yes,” complete and attach Schedule UTP. |

|

15a |

Did the corporation make any payments in 2021 that would require it to file Form(s) 1099? |

|

b |

If “Yes,” did or will the corporation file required Form(s) 1099? |

|

16During this tax year, did the corporation have an

own stock? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17During or subsequent to this tax year, but before the filing of this return, did the corporation dispose of more than 65% (by value)

of its assets in a taxable,

18Did the corporation receive assets in a section 351 transfer in which any of the transferred assets had a fair market basis or fair

market value of more than $1 million? . . . . . . . . . . . . . . . . . . . . . . . . . . .

19During the corporation’s tax year, did the corporation make any payments that would require it to file Forms 1042 and

20 Is the corporation operating on a cooperative basis?. . . . . . . . . . . . . . . . . . . . . . .

21During the tax year, did the corporation pay or accrue any interest or royalty for which the deduction is not allowed under section

267A? See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If “Yes,” enter the total amount of the disallowed deductions ▶ $

22Does the corporation have gross receipts of at least $500 million in any of the 3 preceding tax years? (See sections 59A(e)(2)

and (3)) . |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

If “Yes,” complete and attach Form 8991.

23Did the corporation have an election under section 163(j) for any real property trade or business or any farming business in effect

|

during the tax year? See instructions |

24 |

Does the corporation satisfy one or more of the following? See instructions |

aThe corporation owns a

bThe corporation’s aggregate average annual gross receipts (determined under section 448(c)) for the 3 tax years preceding the current tax year are more than $26 million and the corporation has business interest expense.

cThe corporation is a tax shelter and the corporation has business interest expense. If “Yes,” complete and attach Form 8990.

25 |

Is the corporation attaching Form 8996 to certify as a Qualified Opportunity Fund? |

|

If “Yes,” enter amount from Form 8996, line 15 . . . . ▶ $ |

26Since December 22, 2017, did a foreign corporation directly or indirectly acquire substantially all of the properties held directly or indirectly by the corporation, and was the ownership percentage (by vote or value) for purposes of section 7874 greater than 50% (for example, the shareholders held more than 50% of the stock of the foreign corporation)? If “Yes,” list the ownership

percentage by vote and by value. See instructions . . . . . . . . . . . . . . . . . . . . . . .

Percentage: By Vote |

By Value |

Form 1120 (2021)

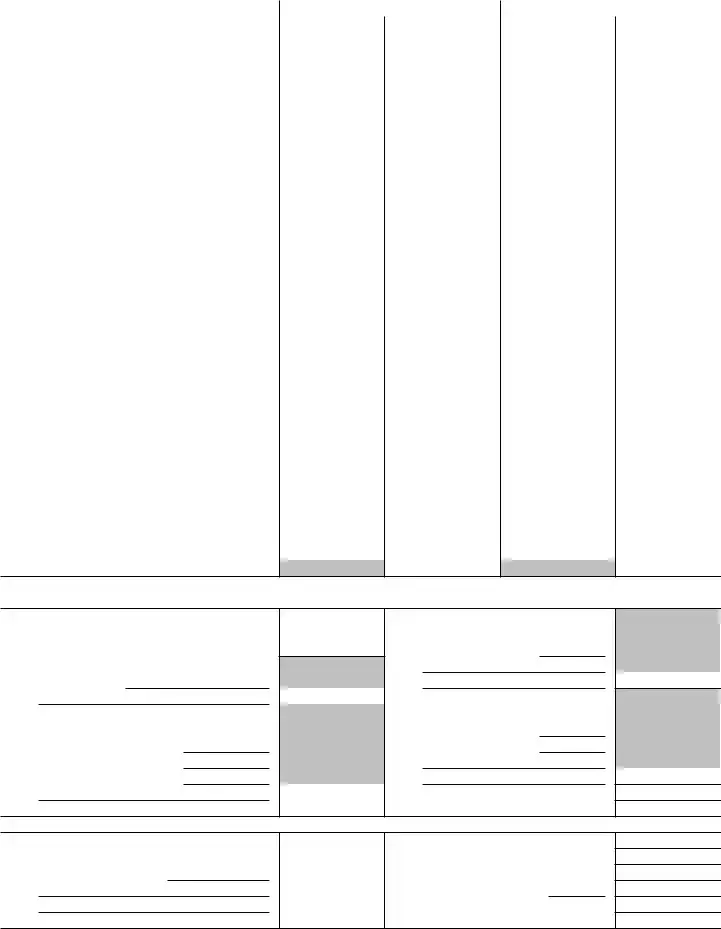

Form 1120 (2021) |

|

|

|

|

|

|

|

|

|

|

|

|

Page 6 |

||

Schedule L |

|

Balance Sheets per Books |

|

|

Beginning of tax year |

|

|

End of tax year |

|

||||||

|

|

|

Assets |

|

|

|

|

(a) |

|

(b) |

|

(c) |

|

|

(d) |

1 |

Cash |

|

|

|

|

|

|

|

|

|

|

||||

2a |

Trade notes and accounts receivable . . . |

|

|

|

|

|

|

|

|

|

|||||

b |

Less allowance for bad debts . . |

. . . |

|

( |

|

) |

|

( |

) |

|

|

||||

3 |

Inventories |

|

|

|

|

|

|

|

|

|

|||||

4 |

U.S. government obligations |

. . . . . |

|

|

|

|

|

|

|

|

|

|

|||

5 |

|

|

|

|

|

|

|

|

|

|

|||||

6 |

Other current assets (attach statement) . . |

|

|

|

|

|

|

|

|

|

|

||||

7 |

Loans to shareholders |

|

|

|

|

|

|

|

|

|

|

||||

8 |

Mortgage and real estate loans |

|

|

|

|

|

|

|

|

|

|

||||

9 |

Other investments (attach statement) . . . |

|

|

|

|

|

|

|

|

|

|

||||

10a |

Buildings and other depreciable assets . . |

|

|

|

|

|

|

|

|

|

|||||

b |

Less accumulated depreciation . . |

. . . |

|

( |

|

) |

|

( |

) |

|

|

||||

11a |

Depletable assets |

|

|

|

|

|

|

|

|

|

|||||

b |

Less accumulated depletion . . . |

. . . |

|

( |

|

) |

|

( |

) |

|

|

||||

12 |

Land (net of any amortization) |

|

|

|

|

|

|

|

|

|

|||||

13a |

Intangible assets (amortizable only) |

. . . |

|

|

|

|

|

|

|

|

|

|

|||

b |

Less accumulated amortization . . |

. . . |

|

( |

|

) |

|

( |

) |

|

|

||||

14 |

Other assets (attach statement) |

|

|

|

|

|

|

|

|

|

|

||||

15 |

Total assets |

|

|

|

|

|

|

|

|

|

|||||

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

|||||

16 |

Accounts payable |

|

|

|

|

|

|

|

|

|

|

||||

17 |

Mortgages, notes, bonds payable in less than 1 year |

|

|

|

|

|

|

|

|

|

|

||||

18 |

Other current liabilities (attach statement) . . |

|

|

|

|

|

|

|

|

|

|

||||

19 |

Loans from shareholders |

|

|

|

|

|

|

|

|

|

|

||||

20 |

Mortgages, notes, bonds payable in 1 year or more |

|

|

|

|

|

|

|

|

|

|

||||

21 |

Other liabilities (attach statement) . . . . |

|

|

|

|

|

|

|

|

|

|

||||

22 |

Capital stock: |

a Preferred stock . . . . |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

b Common stock . . . . |

|

|

|

|

|

|

|

|

|

|

||

23 |

Additional |

|

|

|

|

|

|

|

|

|

|

||||

24 |

Retained |

|

|

|

|

|

|

|

|

|

|

||||

25 |

Retained |

|

|

|

|

|

|

|

|

|

|

||||

26 |

Adjustments to shareholders’ equity (attach statement) |

|

|

|

|

|

|

|

|

|

|

||||

27 |

Less cost of treasury stock |

|

|

|

|

( |

) |

|

|

( |

) |

||||

28 |

Total liabilities and shareholders’ equity . . |

|

|

|

|

|

|

|

|

|

|||||

Schedule

Note: The corporation may be required to file Schedule

1 |

Net income (loss) per books |

7 |

Income recorded on books this year |

|

2 |

Federal income tax per books |

|

|

not included on this return (itemize): |

3 |

Excess of capital losses over capital gains . |

|

|

|

4Income subject to tax not recorded on books this year (itemize):

|

|

|

8 |

|

Deductions on this return not charged |

5 |

Expenses recorded on books this year not |

|

against book income this year (itemize): |

||

|

deducted on this return (itemize): |

a |

Depreciation . . $ |

||

a |

Depreciation . . . . $ |

b |

Charitable contributions $ |

||

bCharitable contributions . $

cTravel and entertainment . $

|

|

|

9 |

Add lines 7 and 8 |

6 |

Add lines 1 through 5 |

10 |

Income (page 1, line |

|

Schedule

1 |

Balance at beginning of year |

5 |

Distributions: a Cash |

||

2 |

Net income (loss) per books |

|

|

|

b Stock . . . . |

3 |

Other increases (itemize): |

|

|

|

c Property . . . . |

|

|

|

6 |

Other decreases (itemize): |

|

|

|

|

7 |

Add lines 5 and 6 |

|

4 |

Add lines 1, 2, and 3 |

8 |

Balance at end of year (line 4 less line 7) |

||

Form 1120 (2021)

Key takeaways

When filling out and using the IRS 1120 form, there are several important points to keep in mind. Here are some key takeaways:

- Ensure that all information is accurate. Mistakes can lead to delays or penalties.

- Be aware of the filing deadline. Typically, the form is due on the 15th day of the fourth month after the end of your corporation's tax year.

- Consider seeking assistance from a tax professional. They can provide guidance and help maximize deductions.

- Keep copies of your completed form and any supporting documents. This will be helpful for future reference or audits.

Similar forms

The IRS Form 1120 is used by corporations to report their income, gains, losses, deductions, and credits. Several other forms serve similar purposes for different types of entities or situations. Here are eight documents that share similarities with Form 1120:

- IRS Form 1065: This form is used by partnerships to report income, deductions, gains, and losses. Like Form 1120, it provides a comprehensive overview of the entity’s financial activity.

- IRS Form 1040: Individual taxpayers use this form to report their personal income. Similar to Form 1120, it requires detailed reporting of income and deductions.

- IRS Form 1120-S: This form is for S corporations. It allows pass-through taxation, much like how partnerships operate, while still requiring a corporate structure for reporting income.

- IRS Form 990: Non-profit organizations use this form to report their financial information. It is similar in that it requires a detailed account of income and expenses, though it serves a different type of entity.

- Ohio Unclaimed Funds Reporting Form: Companies must use this essential document to report unclaimed funds to the state, ensuring compliance and avoiding penalties. For more details, you can refer to Ohio PDF Forms.

- IRS Form 941: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It shares the reporting aspect but focuses on payroll rather than corporate income.

- IRS Form 1120-POL: Political organizations use this form to report their income. Like Form 1120, it requires a detailed account of income and deductions, tailored to the unique nature of political entities.

- IRS Form 1065-B: This is a form for electing large partnerships. It shares similarities with Form 1065 but is specifically designed for larger entities, maintaining the focus on partnership income and deductions.

- IRS Form 1041: This form is used by estates and trusts to report income. It is similar to Form 1120 in that it requires a detailed account of income and deductions, although it applies to different types of entities.