Fill Out a Valid IRS Schedule C 1040 Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | Schedule C (Form 1040) is used by sole proprietors to report income and expenses from their business activities. |

| Filing Requirement | If you earn $400 or more in net earnings from self-employment, you must file Schedule C with your tax return. |

| Business Structure | This form is specifically for sole proprietorships. Other business structures, like partnerships or corporations, require different forms. |

| Income Reporting | All income received from your business must be reported, including cash, checks, and credit card payments. |

| Expense Deductions | Business expenses, such as supplies, rent, and utilities, can be deducted to reduce taxable income. |

| Net Profit or Loss | The bottom line of Schedule C shows your net profit or loss, which is transferred to your Form 1040. |

| Record Keeping | It’s essential to keep accurate records of income and expenses to support the figures reported on Schedule C. |

| Self-Employment Tax | Net earnings reported on Schedule C may be subject to self-employment tax, which funds Social Security and Medicare. |

| State-Specific Forms | Some states require additional forms for reporting business income. Check your state’s Department of Revenue for specific requirements. |

| Due Date | Schedule C is typically due on April 15, coinciding with the due date for individual tax returns, unless an extension is filed. |

Dos and Don'ts

When filling out the IRS Schedule C 1040 form, it is important to be thorough and accurate. Here are some guidelines to follow:

- Do provide accurate and complete information about your business income.

- Do keep detailed records of all business expenses to support your claims.

- Don't underestimate your income; report all earnings to avoid issues later.

- Don't leave any sections blank; incomplete forms may delay processing.

Other PDF Documents

Free Printable Direction to Pay Form - The authorization ensures that your repair shop is the direct payment recipient.

The New York Mobile Home Bill of Sale form is essential for documenting the sale and transfer of ownership of a mobile home in the state of New York. This form acts as proof of purchase and includes important details about the buyer, seller, and the mobile home. To ensure a smooth transaction, you can easily complete the necessary paperwork for the form.

Netspend All-access Phone Number - Liability for unauthorized transactions may apply before reporting your card as lost.

Common mistakes

-

Incorrect Business Name or Structure: Many individuals fail to accurately provide their business name or the correct business structure. This can lead to confusion and potential issues with the IRS.

-

Neglecting to Report All Income: Some people mistakenly omit certain income sources. Every dollar earned should be reported to avoid penalties.

-

Improper Deduction Claims: Claiming deductions that do not apply to the business can lead to audits. It is crucial to ensure that all claimed expenses are legitimate and properly categorized.

-

Failure to Keep Accurate Records: Inadequate record-keeping can result in errors. Maintaining organized and detailed records of income and expenses is essential for accuracy.

-

Missing Signature: Forgetting to sign the form is a common oversight. A missing signature can delay processing and lead to complications.

-

Incorrect Calculation of Expenses: Miscalculating expenses can affect the bottom line. Double-checking calculations helps ensure that figures are accurate and complete.

-

Ignoring State Requirements: Some individuals overlook the need to comply with state-specific regulations. Each state may have additional forms or requirements that must be met.

Documents used along the form

When filing your taxes as a self-employed individual, the IRS Schedule C (Form 1040) is a critical document. However, it is often accompanied by several other forms and documents that help provide a complete picture of your business finances. Below is a list of common forms and documents you may need to submit alongside your Schedule C.

- Form 1040: This is the standard individual income tax return form used by all taxpayers. It summarizes your income, deductions, and tax liability.

- Schedule SE: This form is used to calculate self-employment tax. If you have net earnings of $400 or more from self-employment, you need to file this form.

- Form 4562: This form is necessary for reporting depreciation and amortization of business assets. It helps you claim deductions for equipment and property used in your business.

- Room Rental Agreement: For those renting out space, having a solid rental contract is important. The Lease Agreement for a Room provides the necessary legal framework to protect both the landlord's and tenant's interests.

- Form 8829: If you use part of your home for business, this form allows you to calculate and claim the home office deduction.

- Form 1099-NEC: If you paid independent contractors $600 or more during the year, you must issue this form to report those payments to the IRS.

- Receipts and Invoices: Keep detailed records of all business expenses and income. These documents support the figures reported on your Schedule C.

- Bank Statements: Personal and business bank statements can help substantiate your income and expenses, providing a clear financial picture for the IRS.

By preparing these forms and documents in advance, you can ensure a smoother tax filing process. Being organized not only helps you comply with IRS requirements but also maximizes your potential deductions.

Misconceptions

When it comes to filing taxes as a sole proprietor, the IRS Schedule C (Form 1040) can be a bit confusing. Here are six common misconceptions that people often have about this important form:

-

Only businesses with high income need to file Schedule C.

This is not true. Any sole proprietor, regardless of income level, must file Schedule C if they have net earnings from self-employment. Even if your earnings are modest, reporting them is essential.

-

All expenses can be deducted without documentation.

While many expenses can be deducted, it's crucial to keep records. The IRS requires documentation for all business expenses, so save your receipts and maintain accurate records to support your claims.

-

Schedule C is only for full-time businesses.

This form can be used by anyone earning income from self-employment, whether it's full-time, part-time, or even side gigs. If you’re earning money through a business activity, you need to file.

-

Filing Schedule C guarantees a tax refund.

Filing this form does not automatically mean you will receive a refund. Your tax situation depends on various factors, including your total income, deductions, and credits.

-

Once filed, there’s no need to keep records.

It’s essential to keep your records even after filing. The IRS may request documentation if they have questions about your return, and having your records on hand can make the process smoother.

-

Only one Schedule C can be filed per tax return.

This is a misconception. If you operate multiple businesses, you can file a separate Schedule C for each one. Just ensure that each business is reported accurately.

Understanding these misconceptions can help you navigate the tax filing process more effectively. Always consider consulting a tax professional if you have specific questions or concerns about your situation.

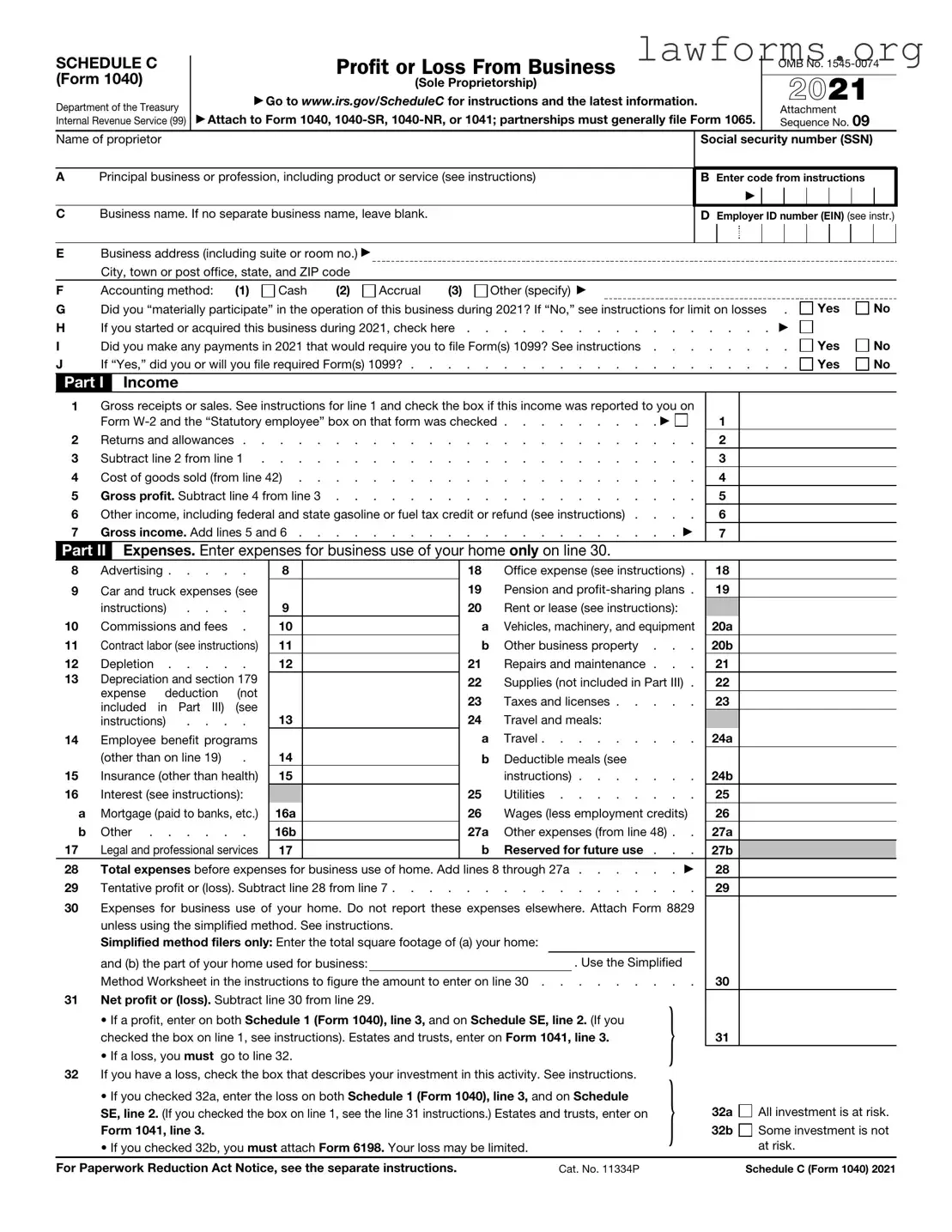

Preview - IRS Schedule C 1040 Form

SCHEDULE C (Form 1040)

Department of the Treasury Internal Revenue Service (99)

Profit or Loss From Business

(Sole Proprietorship)

▶Go to www.irs.gov/ScheduleC for instructions and the latest information.

▶Attach to Form 1040,

OMB No.

2021

Attachment Sequence No. 09

Name of proprietor

APrincipal business or profession, including product or service (see instructions)

CBusiness name. If no separate business name, leave blank.

Social security number (SSN)

BEnter code from instructions

▶

DEmployer ID number (EIN) (see instr.)

EBusiness address (including suite or room no.) ▶

City, town or post office, state, and ZIP code

F |

Accounting method: |

(1) |

Cash |

(2) |

|

Accrual |

(3) |

Other (specify) ▶ |

|

|

|

|

|

|

|

||||||

G |

Did you “materially participate” in the operation of this business during 2021? If “No,” see instructions for limit on losses |

. |

Yes |

No |

|||||||||||||||||

H |

If you started or acquired this business during 2021, check here |

. . |

. . |

▶ |

|

|

|||||||||||||||

I |

Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions . . . |

. . |

. . |

. |

Yes |

No |

|||||||||||||||

J |

If “Yes,” did you or will you file required Form(s) 1099? |

. . |

. . |

. |

Yes |

No |

|||||||||||||||

Part I |

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on |

|

|

|

|

|

|||||||||||||||

|

Form |

. . . . . . . . . ▶ |

1 |

|

|

|

|

||||||||||||||

2 |

Returns and allowances |

2 |

|

|

|

|

|||||||||||||||

3 |

Subtract line 2 from line 1 |

3 |

|

|

|

|

|||||||||||||||

4 |

Cost of goods sold (from line 42) |

4 |

|

|

|

|

|||||||||||||||

5 |

Gross profit. Subtract line 4 from line 3 |

5 |

|

|

|

|

|||||||||||||||

6 |

Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . . . |

6 |

|

|

|

|

|||||||||||||||

7 |

Gross income. Add lines 5 and 6 |

. . . . . . . . . |

. ▶ |

7 |

|

|

|

|

|||||||||||||

Part II |

Expenses. Enter expenses for business use of your home only on line 30. |

|

|

|

|

|

|

|

|||||||||||||

8 |

Advertising |

8 |

|

|

|

|

|

|

18 |

Office expense (see instructions) . |

18 |

|

|

|

|

||||||

9 |

Car and truck expenses (see |

|

|

|

|

|

|

|

19 |

Pension and |

19 |

|

|

|

|

||||||

|

instructions) . . . . |

9 |

|

|

|

|

|

|

20 |

Rent or lease (see instructions): |

|

|

|

|

|

||||||

10 |

Commissions and fees . |

10 |

|

|

|

|

|

|

a |

Vehicles, machinery, and equipment |

20a |

|

|

|

|

||||||

11 |

Contract labor (see instructions) |

11 |

|

|

|

|

|

|

b |

Other business property . . . |

20b |

|

|

|

|

||||||

12 |

Depletion |

12 |

|

|

|

|

|

|

21 |

Repairs and maintenance . . . |

21 |

|

|

|

|

||||||

13 |

Depreciation and section 179 |

|

|

|

|

|

|

|

22 |

Supplies (not included in Part III) . |

22 |

|

|

|

|

||||||

|

expense deduction |

(not |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

23 |

Taxes and licenses |

23 |

|

|

|

|

|||||||

|

included in Part III) (see |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

instructions) . . . . |

13 |

|

|

|

|

|

|

24 |

Travel and meals: |

|

|

|

|

|

|

|

||||

14 |

Employee benefit programs |

|

|

|

|

|

|

|

a |

Travel |

24a |

|

|

|

|

||||||

|

(other than on line 19) |

. |

14 |

|

|

|

|

|

|

b |

Deductible meals (see |

|

|

|

|

|

|

|

|||

15 |

Insurance (other than health) |

15 |

|

|

|

|

|

|

|

instructions) |

24b |

|

|

|

|

||||||

16 |

Interest (see instructions): |

|

|

|

|

|

|

|

25 |

Utilities |

25 |

|

|

|

|

||||||

a |

Mortgage (paid to banks, etc.) |

16a |

|

|

|

|

|

|

26 |

Wages (less employment credits) |

26 |

|

|

|

|

||||||

b |

Other |

16b |

|

|

|

|

|

|

27a |

Other expenses (from line 48) . . |

27a |

|

|

|

|

||||||

17 |

Legal and professional services |

17 |

|

|

|

|

|

|

b |

Reserved for future use . . . |

27b |

|

|

|

|

||||||

28 |

Total expenses before expenses for business use of home. Add lines 8 through 27a |

. ▶ |

28 |

|

|

|

|

||||||||||||||

29 |

Tentative profit or (loss). Subtract line 28 from line 7 |

29 |

|

|

|

|

|||||||||||||||

30 |

Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 |

|

|

|

|

|

|||||||||||||||

|

unless using the simplified method. See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Simplified method filers only: Enter the total square footage of (a) your home: |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

and (b) the part of your home used for business: |

|

|

|

|

|

|

|

. Use the Simplified |

|

|

|

|

|

|||||||

|

Method Worksheet in the instructions to figure the amount to enter on line 30 |

30 |

|

|

|

|

|||||||||||||||

31 |

Net profit or (loss). Subtract line 30 from line 29. |

|

|

|

|

|

|

|

} |

|

|

|

|

|

|

||||||

|

• If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you |

|

|

|

|

|

|

||||||||||||||

|

checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. |

|

31 |

|

|

|

|

||||||||||||||

|

• If a loss, you must go to line 32. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

32 |

If you have a loss, check the box that describes your investment in this activity. See instructions. |

} |

|

|

|

|

|

|

|||||||||||||

|

• If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule |

|

|

|

|

|

|

||||||||||||||

|

SE, line 2. (If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on |

|

32a |

All investment is at risk. |

|||||||||||||||||

|

Form 1041, line 3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

32b |

Some investment is not |

|||||

|

• If you checked 32b, you must attach Form 6198. Your loss may be limited. |

|

|

|

at risk. |

|

|

||||||||||||||

For Paperwork Reduction Act Notice, see the separate instructions. |

|

|

Cat. No. 11334P |

|

|

|

Schedule C (Form 1040) 2021 |

||||||||||||||

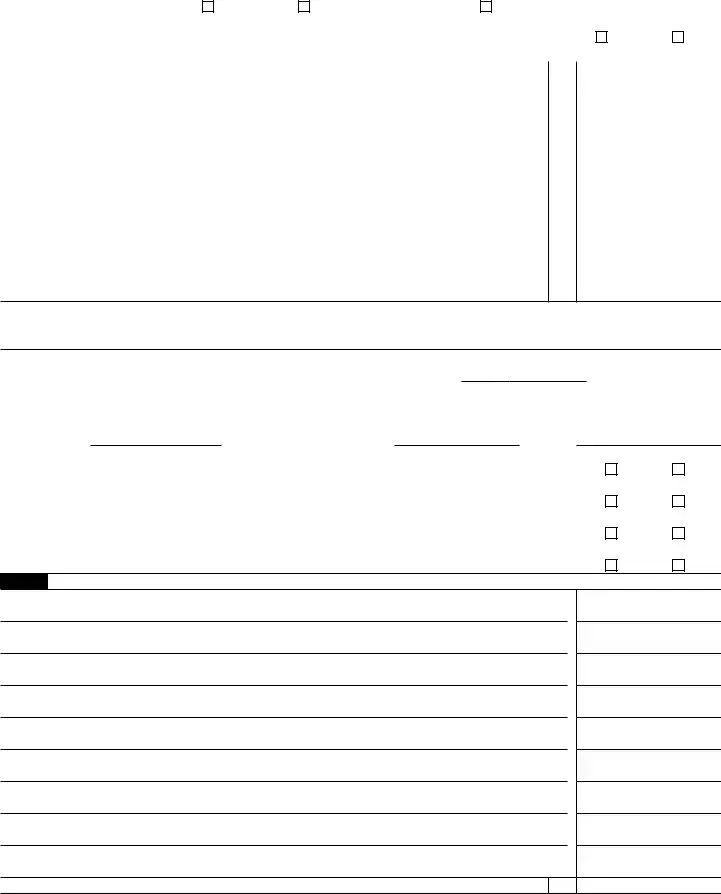

Schedule C (Form 1040) 2021 |

Page 2 |

|

Part III |

Cost of Goods Sold (see instructions) |

|

33 |

Method(s) used to |

|

|

|

|

|

|

|

value closing inventory: |

a |

Cost |

b |

Lower of cost or market |

c |

Other (attach explanation) |

34Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

If “Yes,” attach explanation |

Yes |

No

35 |

Inventory at beginning of year. If different from last year’s closing inventory, attach explanation . . . |

35 |

36 |

Purchases less cost of items withdrawn for personal use |

36 |

37 |

Cost of labor. Do not include any amounts paid to yourself |

37 |

38 |

Materials and supplies |

38 |

39 |

Other costs |

39 |

40 |

Add lines 35 through 39 |

40 |

41 |

Inventory at end of year |

41 |

42 |

Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 |

42 |

Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562.

43 |

When did you place your vehicle in service for business purposes? (month/day/year) |

▶ |

/ |

/ |

44Of the total number of miles you drove your vehicle during 2021, enter the number of miles you used your vehicle for:

a |

Business |

b Commuting (see instructions) |

c Other |

45 |

Was your vehicle available for personal use during |

||

46 |

Do you (or your spouse) have another vehicle available for personal use? |

||

47a |

Do you have evidence to support your deduction? |

||

b |

If “Yes,” is the evidence written? |

||

Yes

Yes

Yes

Yes

No

No

No

No

Part V Other Expenses. List below business expenses not included on lines

48 |

Total other expenses. Enter here and on line 27a |

48

Schedule C (Form 1040) 2021

Key takeaways

When filling out and using the IRS Schedule C (Form 1040), it is essential to understand its purpose and the information required. Here are some key takeaways:

- Purpose of Schedule C: This form is used by sole proprietors to report income or loss from a business they operated or a profession they practiced.

- Accurate Record-Keeping: Maintain detailed records of all business income and expenses throughout the year. This will make completing the form easier and ensure accuracy.

- Deductible Expenses: Familiarize yourself with the types of expenses you can deduct, such as supplies, utilities, and business travel. Proper deductions can significantly reduce your taxable income.

- Net Profit or Loss: The bottom line of Schedule C shows your net profit or loss. This figure is crucial as it affects your overall tax liability.

- Self-Employment Tax: If you report a profit, you may also be subject to self-employment tax. This is in addition to your regular income tax and should be calculated carefully.

- Filing Deadlines: Be aware of the filing deadlines for your tax return. Schedule C is typically due on April 15, along with your Form 1040, unless you apply for an extension.

Similar forms

The IRS Schedule C (Form 1040) is used by sole proprietors to report income and expenses from their business. Several other forms and documents serve similar purposes in different contexts. Here are eight documents that share similarities with Schedule C:

- Schedule E (Form 1040): This form is used to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. Like Schedule C, it requires detailing income and expenses but focuses on passive income sources.

- Schedule F (Form 1040): This form is for reporting profit or loss from farming. Similar to Schedule C, it allows farmers to report their income and expenses, providing a comprehensive view of their agricultural business finances.

- Form 1065: Partnerships use this form to report income, deductions, gains, and losses. While Schedule C is for individual sole proprietors, Form 1065 serves partnerships, requiring similar financial disclosures.

- Ohio Unclaimed Funds Reporting Form (OUF-1): Similar to the forms used for income reporting, this form is essential for companies disclosing unclaimed funds to the state. For more information, you can visit Ohio PDF Forms.

- Form 1120: Corporations file this form to report their income, gains, losses, deductions, and credits. Like Schedule C, it outlines business financial activity but is specifically for corporate entities.

- Form 1120S: This is used by S corporations to report income, deductions, and other tax-related information. It shares similarities with Schedule C in that it provides a means for reporting business income and expenses.

- Form 1040-ES: This form is used for estimating quarterly tax payments for self-employed individuals. While not a reporting form, it is essential for managing taxes similar to how Schedule C helps in reporting income and expenses.

- Form 1040: The main individual income tax return form includes various schedules, including Schedule C. It serves as the primary document for reporting overall income, deductions, and credits.

- Schedule SE (Form 1040): This form is used to calculate self-employment tax. Individuals who report income on Schedule C must also file Schedule SE, making it closely related in the context of self-employment.