Valid Lady Bird Deed Form

State-specific Lady Bird Deed Documents

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed allows a property owner to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. |

| Governing States | This deed is recognized in several states, including Florida, Texas, Michigan, and others. |

| Benefits | It helps avoid probate, allowing for a smoother transfer of property upon the owner's death. |

| Retained Rights | The property owner retains the right to sell, mortgage, or change the beneficiaries at any time. |

| Tax Implications | Property transferred via a Lady Bird Deed may qualify for a step-up in basis for tax purposes, potentially reducing capital gains taxes for beneficiaries. |

| Legal Requirements | The deed must be executed and recorded in accordance with state laws, which may vary by jurisdiction. |

| Limitations | Not all states allow Lady Bird Deeds, and some may have specific requirements that must be met for the deed to be valid. |

Dos and Don'ts

When filling out a Lady Bird Deed form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are six things to consider:

- Do: Clearly identify the property being transferred. Include the full legal description to avoid any confusion.

- Do: List all grantors and grantees accurately. Ensure that names match official documents to prevent issues later.

- Do: Include any specific terms or conditions of the transfer. This clarity helps all parties understand their rights and responsibilities.

- Do: Sign and date the document in the presence of a notary. Notarization is crucial for the deed to be legally binding.

- Don't: Leave any sections blank. Incomplete forms can lead to delays or rejection by the county clerk.

- Don't: Use ambiguous language. Be precise to ensure that the intent of the deed is clear and enforceable.

By adhering to these guidelines, individuals can facilitate a smoother process when completing a Lady Bird Deed form.

Create Popular Types of Lady Bird Deed Documents

California Corrective Deed - This deed plays a key role in streamlining real estate transactions.

To successfully establish an LLC in California, it is essential to complete the California LLC-1 form, which serves as a submission cover sheet for the Articles of Organization. This process not only facilitates communication with the Secretary of State's office but also ensures that your submissions are processed efficiently. For a detailed guide on completing this important form, you can refer to californiadocsonline.com/california-llc-1-form.

Deed in Lieu of Foreclosure Meaning - A Deed in Lieu of Foreclosure can help a borrower avoid court involvement in their property dispute.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to accurately describe the property being transferred. It's essential to include the correct legal description, which can often be found on the property deed. Simply stating the address may not be sufficient.

-

Omitting Necessary Signatures: All required parties must sign the deed. If a spouse or co-owner is involved, their signature is typically needed. Forgetting to obtain these signatures can lead to complications later on.

-

Not Notarizing the Document: A Lady Bird Deed must be notarized to be legally valid. Failing to have the deed notarized can result in it being deemed unenforceable. Always ensure that a notary is present during the signing process.

-

Filing the Deed Incorrectly: After completing the form, it must be filed with the appropriate county office. Some people mistakenly believe that mailing it is sufficient. It’s important to deliver the deed in person or follow the specific filing procedures outlined by the local office.

Documents used along the form

The Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. When preparing a Lady Bird Deed, several other forms and documents may be necessary to ensure a comprehensive estate plan. Here is a list of commonly used documents that complement the Lady Bird Deed.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. It can include provisions for guardianship of minor children and the appointment of an executor.

- Durable Power of Attorney: This form allows an individual to designate someone else to manage their financial affairs if they become incapacitated. It is crucial for ensuring decisions can be made on behalf of the person who is unable to act.

- Healthcare Power of Attorney: Similar to the durable power of attorney, this document designates someone to make medical decisions on behalf of an individual if they are unable to do so themselves.

- Living Will: A living will specifies an individual’s wishes regarding medical treatment and end-of-life care. It provides guidance to healthcare providers and family members about the person's preferences.

- Transfer on Death Deed (TOD): This deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. It is similar to the Lady Bird Deed but does not allow for retained control during the owner's lifetime.

- Beneficiary Designation Forms: These forms are used for financial accounts and insurance policies to specify who will receive the assets upon the account holder's death. They help avoid probate and ensure a smooth transfer of assets.

- Bill of Sale: This legal document acts as proof of the transfer of ownership of personal property and is essential for protecting both parties in a transaction. Utilizing a template from Forms Washington can simplify the process of creating a Bill of Sale.

- Trust Documents: If a trust is established, these documents outline the terms of the trust, the trustee's powers, and the beneficiaries. Trusts can help manage assets and provide for beneficiaries in specific ways.

- Property Deeds: Existing property deeds should be reviewed to ensure that the Lady Bird Deed is properly executed and that the property is correctly titled. This includes checking for any liens or encumbrances on the property.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person without going through probate. It can be helpful in clarifying ownership of property after someone passes away.

Incorporating these documents into an estate plan can provide clarity and security for both the property owner and their beneficiaries. Each document plays a vital role in ensuring that an individual's wishes are honored and that their assets are managed appropriately.

Misconceptions

The Lady Bird Deed, also known as an enhanced life estate deed, is a powerful tool in estate planning. However, several misconceptions surround its use. Understanding these misconceptions is crucial for anyone considering this option.

- Misconception 1: A Lady Bird Deed is only for married couples.

- Misconception 2: The property must be paid off to use a Lady Bird Deed.

- Misconception 3: A Lady Bird Deed avoids all taxes.

- Misconception 4: A Lady Bird Deed cannot be revoked.

- Misconception 5: Only real estate can be transferred using a Lady Bird Deed.

- Misconception 6: A Lady Bird Deed guarantees that the property will go to the intended beneficiary.

- Misconception 7: A Lady Bird Deed is the same as a traditional life estate deed.

- Misconception 8: You do not need legal assistance to create a Lady Bird Deed.

This is not true. While many married couples use Lady Bird Deeds, they can also be beneficial for single individuals, siblings, or other family members who wish to transfer property while retaining certain rights.

In reality, you can use a Lady Bird Deed on property that has a mortgage. However, the mortgage will remain attached to the property, and the lender may still have rights to the property if payments are not made.

While a Lady Bird Deed can help avoid probate, it does not eliminate property taxes or capital gains taxes. The property may still be subject to these taxes upon transfer or sale.

This is incorrect. One of the advantages of a Lady Bird Deed is that the grantor retains the right to revoke or change the deed at any time during their lifetime.

While the Lady Bird Deed is primarily used for real estate, it is not the only option for transferring other types of assets. Different legal tools may be more appropriate for other asset types.

Although a Lady Bird Deed designates beneficiaries, it does not guarantee that the property will not be challenged in court. Heirs or creditors may still contest the transfer.

There are key differences. Unlike a traditional life estate deed, a Lady Bird Deed allows the grantor to sell or mortgage the property without the consent of the remainderman.

While it is possible to create one without legal help, it is highly advisable to consult with an attorney. Legal expertise can ensure that the deed is properly executed and that all implications are understood.

Preview - Lady Bird Deed Form

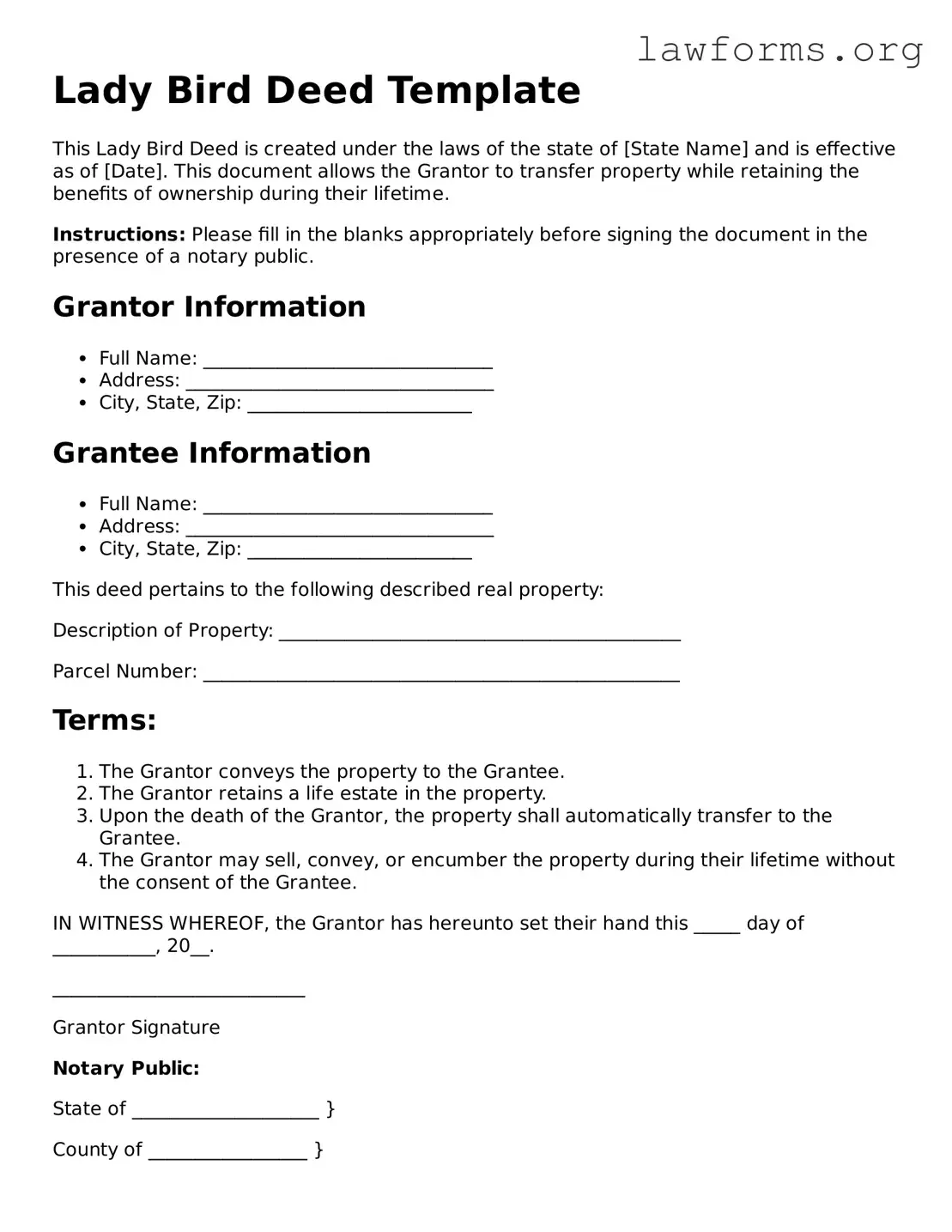

Lady Bird Deed Template

This Lady Bird Deed is created under the laws of the state of [State Name] and is effective as of [Date]. This document allows the Grantor to transfer property while retaining the benefits of ownership during their lifetime.

Instructions: Please fill in the blanks appropriately before signing the document in the presence of a notary public.

Grantor Information

- Full Name: _______________________________

- Address: _________________________________

- City, State, Zip: ________________________

Grantee Information

- Full Name: _______________________________

- Address: _________________________________

- City, State, Zip: ________________________

This deed pertains to the following described real property:

Description of Property: ___________________________________________

Parcel Number: ___________________________________________________

Terms:

- The Grantor conveys the property to the Grantee.

- The Grantor retains a life estate in the property.

- Upon the death of the Grantor, the property shall automatically transfer to the Grantee.

- The Grantor may sell, convey, or encumber the property during their lifetime without the consent of the Grantee.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand this _____ day of ___________, 20__.

___________________________

Grantor Signature

Notary Public:

State of ____________________ }

County of _________________ }

Subscribed and sworn to before me this _____ day of ___________, 20__.

___________________________

Notary Public Signature

My commission expires: ____________________

Key takeaways

The Lady Bird Deed is a useful legal tool for property owners. It allows for the transfer of real estate while retaining certain rights. Here are key takeaways regarding its use and completion:

- Retained Control: The property owner retains the right to live in and use the property during their lifetime.

- Automatic Transfer: Upon the owner's death, the property automatically transfers to the designated beneficiaries without going through probate.

- Revocable: The deed can be revoked or altered at any time before the owner's death, providing flexibility.

- Tax Benefits: The property may not be considered a gift for tax purposes until the owner's death, potentially reducing tax liabilities.

- Simple Process: Filling out the Lady Bird Deed form is generally straightforward, requiring basic property and owner information.

- State Specifics: The availability and specific requirements of the Lady Bird Deed can vary by state, so it is important to understand local laws.

- Beneficiary Designation: Clearly naming beneficiaries is crucial to ensure the property is transferred as intended.

- Legal Assistance: While the form can be completed without an attorney, seeking legal guidance may help avoid mistakes.

- Impact on Medicaid: The Lady Bird Deed may have implications for Medicaid eligibility, so consulting with a professional is advisable.

Understanding these key points can help individuals make informed decisions about their property and estate planning.

Similar forms

- Quitclaim Deed: A quitclaim deed transfers ownership of property without any warranties. Like a Lady Bird Deed, it allows for a straightforward transfer of interest, but it does not provide the same level of control over the property during the owner's lifetime.

- Pennsylvania Motor Vehicle Bill of Sale: This legal document records the sale of a vehicle and includes essential details such as the price and date. To ensure a proper transaction, interested parties should print and complete the form.

- Life Estate Deed: This document creates a life estate, allowing the owner to retain use of the property during their lifetime. Similar to a Lady Bird Deed, it ensures that the property passes to a designated beneficiary upon the owner’s death.

- Transfer on Death Deed (TOD): A TOD deed allows property to pass directly to a beneficiary upon the owner's death. It shares similarities with the Lady Bird Deed in that it avoids probate, but it does not provide the same retained rights during the owner’s lifetime.

- General Warranty Deed: This deed offers a guarantee that the grantor holds clear title to the property. While it provides more protection than a Lady Bird Deed, both documents facilitate the transfer of property ownership.

- Special Warranty Deed: A special warranty deed conveys property with limited warranties. It is similar to a Lady Bird Deed in that it can transfer ownership while protecting the interests of the grantor, but it does not offer the same lifetime rights.

- Revocable Living Trust: This legal arrangement allows individuals to manage their assets during their lifetime and specify how they should be distributed after death. Like a Lady Bird Deed, it helps avoid probate and provides flexibility in asset management.