Valid Last Will and Testament Form

State-specific Last Will and Testament Documents

Last Will and Testament Document Categories

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. |

| Testamentary Capacity | To create a valid will, the individual must be of sound mind and at least 18 years old in most states. |

| Witness Requirements | Most states require that a will be signed in the presence of at least two witnesses who are not beneficiaries. |

| State-Specific Laws | Each state has its own laws governing wills, including requirements for execution and revocation. For example, California's Probate Code governs these matters. |

| Revocation | A will can be revoked by creating a new will or by destroying the original document, depending on state law. |

| Probate Process | After death, a will typically goes through probate, a legal process to validate the will and distribute assets according to its terms. |

Dos and Don'ts

When filling out a Last Will and Testament form, it is important to follow certain guidelines to ensure that your wishes are clearly expressed and legally valid. Below is a list of things you should and shouldn't do during this process.

- Do: Clearly state your full name and address at the beginning of the document.

- Do: Identify your beneficiaries by their full names and relationship to you.

- Do: Specify how you want your assets to be distributed among your beneficiaries.

- Do: Sign the document in the presence of witnesses, as required by your state laws.

- Do: Keep the original document in a safe place and inform your executor of its location.

- Don't: Use vague language that could lead to confusion about your intentions.

- Don't: Forget to date the will; this helps establish when it was created.

- Don't: Attempt to make changes to the will without following proper legal procedures.

- Don't: Leave out important details, such as the names of alternate beneficiaries.

Popular Templates:

How to Write a Letter of Recommendation for Citizenship - Can provide important context to the couple's relationship.

Llc Membership Certificate Template - Support effective management of membership-related records.

Promissory Note Sample for Loan - It defines the responsibilities of both the borrower and lender.

Common mistakes

-

Neglecting to Update the Will

Many individuals create a Last Will and Testament and then forget about it. Life events such as marriage, divorce, the birth of children, or the death of beneficiaries can significantly alter one’s wishes. Failing to update the will to reflect these changes can lead to unintended consequences, such as assets being distributed in a way that does not align with current intentions.

-

Not Clearly Identifying Beneficiaries

Another common mistake is the vague identification of beneficiaries. Using general terms like "my children" without specifying names can create confusion, especially if the family structure changes over time. Clearly naming each beneficiary ensures that there is no ambiguity about who is entitled to receive what.

-

Overlooking Witness Requirements

Most states require that a will be signed in the presence of witnesses. Some people either forget to have witnesses or fail to meet the legal requirements for those witnesses. This oversight can render a will invalid, leading to complications during probate.

-

Failing to Consider Tax Implications

Individuals often overlook the potential tax consequences of their estate. Not accounting for estate taxes or failing to understand how assets will be taxed upon transfer can lead to unexpected financial burdens for heirs. Consulting with a tax professional can provide valuable insights into minimizing tax liabilities.

Documents used along the form

When preparing a Last Will and Testament, several other documents may be necessary to ensure that your wishes are carried out effectively. Each of these documents serves a specific purpose and can help clarify your intentions regarding your estate and loved ones.

- Durable Power of Attorney: This document allows you to designate someone to manage your financial affairs if you become incapacitated. It ensures that your bills are paid and your assets are managed according to your wishes.

- Healthcare Proxy: A healthcare proxy appoints someone to make medical decisions on your behalf if you are unable to do so. This document is crucial for ensuring that your healthcare preferences are respected.

- Living Will: A living will outlines your preferences regarding medical treatment in situations where you cannot communicate your wishes. This document helps guide your healthcare proxy and medical professionals in critical situations.

- Revocable Living Trust: This trust allows you to place your assets into a trust during your lifetime, which can help avoid probate upon your death. It also provides flexibility in managing your assets while you are alive.

- Employee Handbook: This essential resource outlines company policies and expectations, helping employees understand their rights and responsibilities. For templates, visit Top Document Templates.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, allow you to name beneficiaries directly. Keeping these designations updated ensures that your assets are distributed according to your wishes, regardless of what your will states.

- Letter of Intent: While not a legal document, a letter of intent can accompany your will. It provides guidance to your executor about your wishes, funeral arrangements, and other personal matters that may not be detailed in your will.

Having these documents in place alongside your Last Will and Testament can provide clarity and peace of mind for both you and your loved ones. It’s always wise to consult with a legal professional to ensure that all documents are properly prepared and executed.

Misconceptions

When it comes to creating a Last Will and Testament, many people hold misconceptions that can lead to confusion or even complications down the line. Here are eight common misunderstandings:

- Only wealthy individuals need a will. Many believe that a will is only necessary for those with significant assets. In reality, anyone with personal belongings, children, or specific wishes should consider having a will to ensure their desires are honored.

- A will can be verbal. Some think that simply stating their wishes verbally is enough. However, a will must be documented in writing to be legally binding, ensuring that your wishes are clear and enforceable.

- Once a will is made, it cannot be changed. Many assume that a will is set in stone once created. In fact, you can update or revoke your will as your circumstances change, such as after a marriage, divorce, or the birth of a child.

- All debts are automatically forgiven upon death. Some believe that when a person passes away, their debts disappear. However, debts typically need to be settled from the estate before any assets can be distributed to heirs.

- Having a will avoids probate. There is a misconception that a will can bypass the probate process entirely. While a will does direct how your assets should be distributed, it still must go through probate to be validated.

- Wills are only for distributing assets. Many think a will is solely for asset distribution. In reality, it can also address guardianship for minor children, funeral arrangements, and other personal wishes.

- Anyone can write a will without assistance. While it’s true that you can write your own will, having legal guidance can help ensure that it meets all legal requirements and accurately reflects your wishes.

- A handwritten will is always valid. Some people believe that as long as a will is handwritten, it is automatically valid. However, certain legal standards must be met, and not all handwritten wills are recognized in every state.

Understanding these misconceptions can help you make informed decisions about your estate planning. Taking the time to create a clear and legally sound will can provide peace of mind for you and your loved ones.

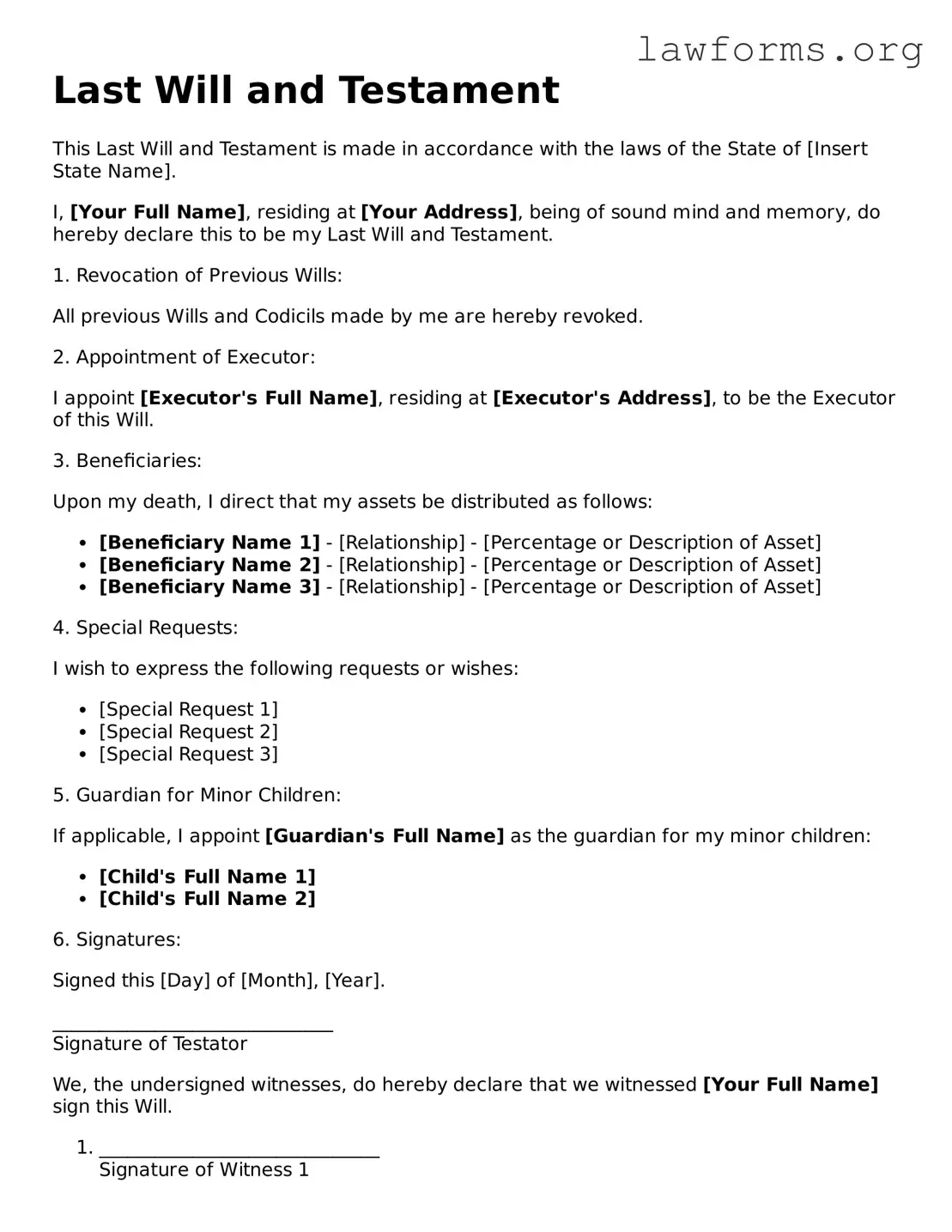

Preview - Last Will and Testament Form

Last Will and Testament

This Last Will and Testament is made in accordance with the laws of the State of [Insert State Name].

I, [Your Full Name], residing at [Your Address], being of sound mind and memory, do hereby declare this to be my Last Will and Testament.

1. Revocation of Previous Wills:

All previous Wills and Codicils made by me are hereby revoked.

2. Appointment of Executor:

I appoint [Executor's Full Name], residing at [Executor's Address], to be the Executor of this Will.

3. Beneficiaries:

Upon my death, I direct that my assets be distributed as follows:

- [Beneficiary Name 1] - [Relationship] - [Percentage or Description of Asset]

- [Beneficiary Name 2] - [Relationship] - [Percentage or Description of Asset]

- [Beneficiary Name 3] - [Relationship] - [Percentage or Description of Asset]

4. Special Requests:

I wish to express the following requests or wishes:

- [Special Request 1]

- [Special Request 2]

- [Special Request 3]

5. Guardian for Minor Children:

If applicable, I appoint [Guardian's Full Name] as the guardian for my minor children:

- [Child's Full Name 1]

- [Child's Full Name 2]

6. Signatures:

Signed this [Day] of [Month], [Year].

______________________________

Signature of Testator

We, the undersigned witnesses, do hereby declare that we witnessed [Your Full Name] sign this Will.

- ______________________________

Signature of Witness 1

[Witness 1 Full Name] - [Address] - ______________________________

Signature of Witness 2

[Witness 2 Full Name] - [Address]

In witness whereof, I have hereunto set my hand this [Day] of [Month], [Year].

Key takeaways

Filling out a Last Will and Testament form is an important step in ensuring that your wishes are honored after your passing. Here are some key takeaways to consider:

- Understand the Purpose: A Last Will and Testament outlines how your assets will be distributed and who will manage your estate.

- Be Clear and Specific: Clearly state your wishes regarding asset distribution to avoid confusion or disputes among your beneficiaries.

- Choose an Executor: Appoint a trustworthy person as your executor to ensure your wishes are carried out effectively.

- Sign and Date: Always sign and date your will in the presence of witnesses, as required by state law, to make it valid.

- Review Regularly: Life changes such as marriage, divorce, or the birth of a child may require updates to your will.

- Store Safely: Keep your will in a safe place and inform your executor and close family members where it can be found.

Taking these steps can help provide peace of mind, knowing that your wishes will be respected and your loved ones will be taken care of.

Similar forms

- Living Will: A living will outlines a person's wishes regarding medical treatment in situations where they are unable to communicate their preferences. Like a Last Will and Testament, it is a legal document that provides guidance on how an individual's desires should be honored.

- Durable Power of Attorney: This document allows an individual to designate someone to make financial or medical decisions on their behalf if they become incapacitated. Similar to a will, it ensures that a person's wishes are followed even when they cannot express them.

- Health Care Proxy: A health care proxy appoints someone to make medical decisions for an individual if they are unable to do so. This document complements a Last Will and Testament by addressing health care preferences during life.

- Trust Agreement: A trust agreement establishes a fiduciary relationship where one party holds assets for the benefit of another. Like a will, it dictates how assets should be managed and distributed, but it can take effect during the grantor's lifetime.

- Codicil: A codicil is an amendment to an existing will. It allows for changes or additions without the need to create an entirely new document, thus maintaining the original will's validity while updating specific provisions.

- Letter of Instruction: This informal document provides guidance to loved ones about personal wishes, such as funeral arrangements or the distribution of personal items. While not legally binding, it serves as a companion to a will, clarifying intentions.

- Prenuptial Agreement: A prenuptial agreement outlines the distribution of assets in the event of divorce or separation. Similar to a will, it addresses how property should be handled, ensuring clarity and reducing potential disputes.

- Estate Plan: An estate plan encompasses a variety of documents, including wills and trusts, to manage an individual’s assets during life and after death. It provides a comprehensive approach to asset distribution, similar to the focused intent of a Last Will and Testament.