Valid Letter of Intent to Purchase Business Form

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Letter of Intent (LOI) outlines the preliminary agreement between parties before finalizing a purchase of a business. |

| Purpose | The LOI serves to express the interest of the buyer and seller, setting the stage for negotiations and due diligence. |

| Non-Binding Nature | Typically, an LOI is non-binding, meaning it does not create a legal obligation to complete the transaction. |

| State-Specific Considerations | LOIs may be governed by state laws, which can vary. For example, in California, the California Commercial Code may apply. |

| Key Components | An effective LOI includes terms like purchase price, payment structure, and timelines for closing the deal. |

Dos and Don'ts

When filling out the Letter of Intent to Purchase Business form, it’s essential to approach the task with care. Here’s a list of things you should and shouldn’t do:

- Do provide accurate and complete information.

- Do clearly outline the terms of the purchase.

- Do include a timeline for the transaction.

- Do specify any contingencies that must be met.

- Don't use vague language or ambiguous terms.

- Don't omit important details about the business.

- Don't rush the process; take your time to review.

By following these guidelines, you can ensure that your Letter of Intent is clear and effective.

Create Popular Types of Letter of Intent to Purchase Business Documents

Commercial Lease Proposal - This document typically covers aspects such as lease duration, rental rates, and property use.

Understanding the significance of the California Homeschool Letter of Intent can greatly assist parents in navigating the homeschooling process effectively. This document serves as the initial notification to local authorities, ensuring that families are aligned with educational requirements while providing personalized learning experiences for their children.

Grant Loi Template - Showcases the project's alignment with the funder's priorities and mission.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to misunderstandings. Ensure that all sections are filled out thoroughly.

-

Ambiguous Terms: Using vague language can create confusion. Clearly define all terms and conditions to avoid misinterpretation.

-

Ignoring Contingencies: Not addressing contingencies, such as financing or due diligence, can jeopardize the transaction. Include any necessary conditions for the offer.

-

Overlooking Confidentiality: Failing to include confidentiality clauses may expose sensitive information. Protect both parties by specifying confidentiality obligations.

-

Neglecting to Specify Purchase Price: Omitting the proposed purchase price can lead to confusion. Clearly state the amount to facilitate negotiations.

-

Not Including Expiration Date: Leaving out an expiration date for the offer can create uncertainty. Specify how long the offer remains valid.

-

Forgetting to Review Legal Implications: Failing to consider the legal consequences of the letter may result in unintended obligations. Review the document carefully.

-

Inadequate Signatures: Neglecting to include signatures from all parties can invalidate the letter. Ensure that all necessary individuals sign the document.

-

Rushing the Process: Completing the form hastily can lead to errors. Take the time to review and edit the letter before submission.

Documents used along the form

A Letter of Intent to Purchase a Business is an important first step in the acquisition process. However, it is often accompanied by several other key documents that help clarify the terms and intentions of the parties involved. Below is a list of commonly used forms and documents that complement the Letter of Intent.

- Confidentiality Agreement: This document ensures that sensitive information shared during negotiations remains protected. Both parties agree not to disclose proprietary details about the business, fostering an environment of trust.

- Due Diligence Checklist: This checklist outlines the information and documents the buyer needs to review before finalizing the purchase. It typically includes financial statements, legal documents, and operational details that help assess the business's value and risks.

- Purchase Agreement: Once negotiations are complete, this formal contract outlines the final terms of the sale. It includes details such as the purchase price, payment terms, and any contingencies that must be met for the sale to proceed.

- Homeschool Intent Letter: Completing the Homeschool Intent Letter is a vital step for families who choose to educate their children at home, ensuring they meet the necessary legal requirements and communicate their intentions to the local school district.

- Financing Proposal: If the buyer requires financing to complete the purchase, this document outlines the terms and conditions of the loan or investment. It specifies the amount needed, repayment terms, and any collateral offered.

These documents work together to provide clarity and security throughout the business acquisition process. Each plays a vital role in ensuring that both parties understand their rights and obligations, ultimately leading to a smoother transaction.

Misconceptions

Many people have misunderstandings about the Letter of Intent to Purchase Business form. Here are nine common misconceptions:

- It is a legally binding contract. Many believe that a Letter of Intent (LOI) is a formal contract. In reality, it is often a preliminary document that outlines the intentions of the parties involved but does not create binding obligations.

- It guarantees the sale of the business. An LOI does not guarantee that the business will be sold. It simply indicates that the buyer is interested and outlines the terms under which they are willing to proceed.

- All terms are final once the LOI is signed. Some think that signing an LOI means all terms are set in stone. However, negotiations can continue after the LOI is signed, and changes can be made before a final agreement is reached.

- It is unnecessary if you have a purchase agreement. Some believe that an LOI is redundant if a purchase agreement exists. However, an LOI can help clarify intentions and outline key points before drafting a more detailed agreement.

- It should include every detail of the transaction. Many assume that an LOI must cover all aspects of the deal. Instead, it typically highlights the main points and leaves room for further discussion and negotiation.

- Only buyers need to sign the LOI. Some think that only the buyer's signature is required. In fact, both parties may need to sign the LOI to show mutual agreement on the outlined terms.

- It is only for large transactions. A misconception exists that LOIs are only relevant for large business transactions. They can be useful for businesses of any size, providing clarity and direction in negotiations.

- It is a standard form that requires no customization. Many believe an LOI is a one-size-fits-all document. In reality, it should be tailored to fit the specific circumstances and needs of the parties involved.

- Legal counsel is not needed for an LOI. Some think they can draft an LOI without legal assistance. While it is possible, consulting a lawyer can help ensure that the document accurately reflects the parties' intentions and protects their interests.

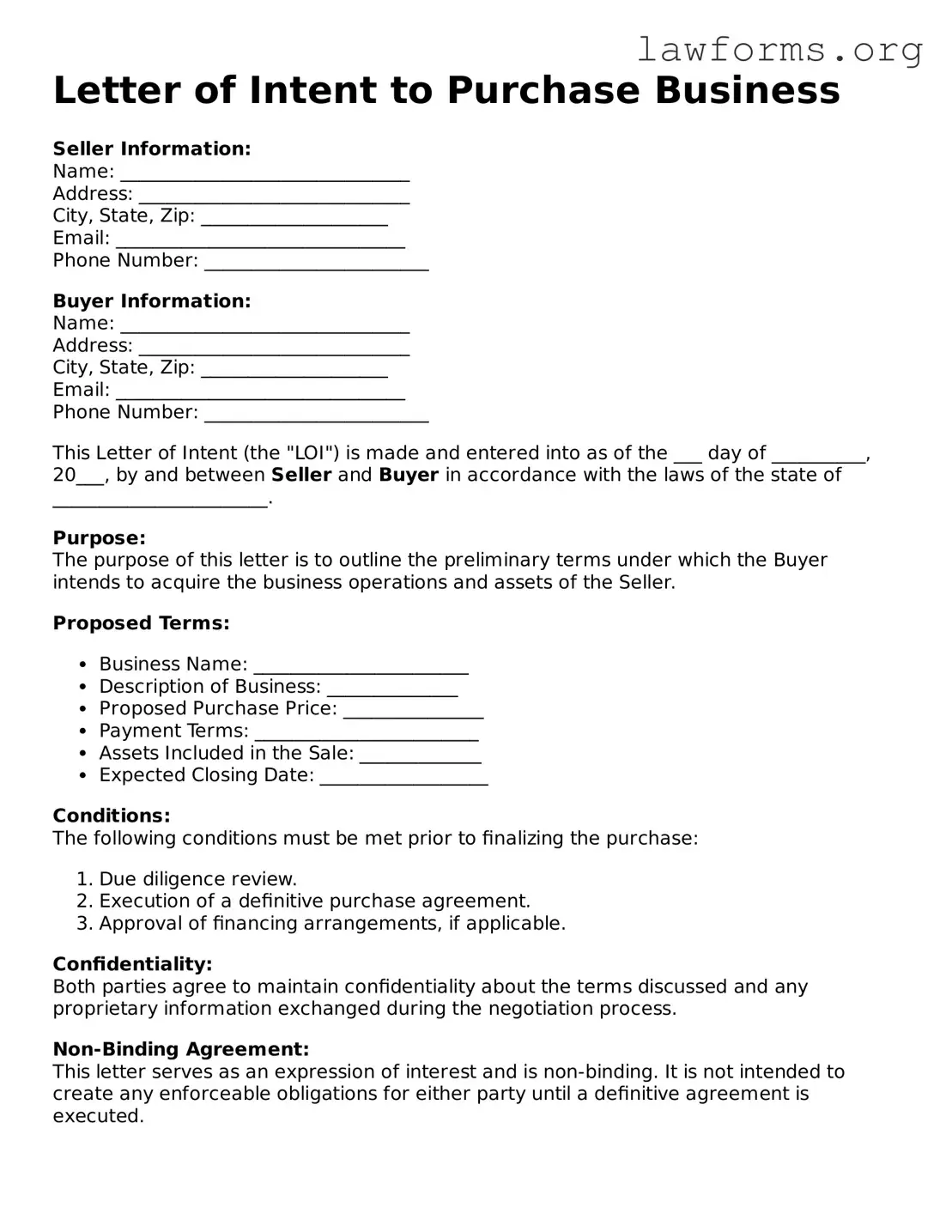

Preview - Letter of Intent to Purchase Business Form

Letter of Intent to Purchase Business

Seller Information:

Name: _______________________________

Address: _____________________________

City, State, Zip: ____________________

Email: _______________________________

Phone Number: ________________________

Buyer Information:

Name: _______________________________

Address: _____________________________

City, State, Zip: ____________________

Email: _______________________________

Phone Number: ________________________

This Letter of Intent (the "LOI") is made and entered into as of the ___ day of __________, 20___, by and between Seller and Buyer in accordance with the laws of the state of _______________________.

Purpose:

The purpose of this letter is to outline the preliminary terms under which the Buyer intends to acquire the business operations and assets of the Seller.

Proposed Terms:

- Business Name: _______________________

- Description of Business: ______________

- Proposed Purchase Price: _______________

- Payment Terms: ________________________

- Assets Included in the Sale: _____________

- Expected Closing Date: __________________

Conditions:

The following conditions must be met prior to finalizing the purchase:

- Due diligence review.

- Execution of a definitive purchase agreement.

- Approval of financing arrangements, if applicable.

Confidentiality:

Both parties agree to maintain confidentiality about the terms discussed and any proprietary information exchanged during the negotiation process.

Non-Binding Agreement:

This letter serves as an expression of interest and is non-binding. It is not intended to create any enforceable obligations for either party until a definitive agreement is executed.

Contact Information:

For any questions or further correspondence, communication may be directed to the respective parties through the contact information provided above.

Signatures:

Seller Signature: ___________________________ Date: __________________

Buyer Signature: ___________________________ Date: __________________

Key takeaways

When considering the purchase of a business, a Letter of Intent (LOI) serves as a crucial document. Here are some key takeaways to keep in mind when filling out and using this form:

- Purpose of the LOI: The LOI outlines the preliminary understanding between the buyer and seller, indicating a serious intent to negotiate a purchase.

- Non-Binding Nature: Typically, an LOI is non-binding, meaning it does not legally obligate either party to complete the transaction.

- Essential Terms: Include key terms such as purchase price, payment structure, and any contingencies that must be met.

- Confidentiality: If sensitive information is shared, consider including a confidentiality clause to protect both parties.

- Timeline: Specify a timeline for due diligence and the expected closing date to keep the process on track.

- Due Diligence: The LOI should outline the scope of due diligence, detailing what information the buyer will need to review.

- Exclusivity: If desired, include an exclusivity period during which the seller agrees not to negotiate with other potential buyers.

- Termination Clause: Clearly define conditions under which either party can terminate the negotiations without penalty.

- Legal Review: Before finalizing the LOI, it’s wise to have it reviewed by a legal professional to ensure clarity and protection.

- Communication: Maintain open lines of communication between both parties throughout the negotiation process to build trust and facilitate a smoother transaction.

Similar forms

A Letter of Intent (LOI) to Purchase a Business serves as a preliminary agreement between a buyer and a seller. It outlines the basic terms of the proposed transaction and signifies the buyer's serious interest. Several other documents share similarities with the LOI, each serving a unique purpose in the business transaction process. Here are five such documents:

- Purchase Agreement: This is a more detailed document that finalizes the terms of the sale. While the LOI outlines key points, the Purchase Agreement includes specific obligations, representations, and warranties of both parties.

- Confidentiality Agreement (NDA): Often signed alongside the LOI, this document protects sensitive information shared during negotiations. It ensures that both parties maintain confidentiality about proprietary business details.

- Term Sheet: Similar to the LOI, a Term Sheet outlines the fundamental terms of a deal. However, it often includes more financial details and is typically used in investment scenarios, making it slightly more formal than an LOI.

-

Homeschool Letter of Intent: This is a crucial document that parents or guardians must submit to comply with Alaska's educational regulations. For more information about the specifics of this form, you can visit homeschoolintent.com/editable-alaska-homeschool-letter-of-intent.

- Letter of Intent to Lease: This document is akin to the LOI but focuses on leasing property rather than purchasing a business. It outlines the intentions of both the landlord and tenant regarding lease terms.

- Memorandum of Understanding (MOU): An MOU serves as a non-binding agreement that details the intentions of both parties. Like an LOI, it outlines the framework for further negotiations but may cover broader aspects beyond just the purchase.