Valid LLC Share Purchase Agreement Form

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The LLC Share Purchase Agreement outlines the terms and conditions under which one party agrees to buy shares in a limited liability company from another party. |

| Key Components | This agreement typically includes details about the purchase price, payment terms, and representations and warranties made by both the seller and buyer. |

| Governing Law | The agreement is generally governed by the laws of the state in which the LLC is formed, such as Delaware, California, or New York. |

| Importance | Having a well-drafted agreement is crucial for protecting the interests of both the buyer and seller, ensuring clarity in the transaction. |

Dos and Don'ts

When filling out the LLC Share Purchase Agreement form, it’s important to ensure accuracy and clarity. Here are some key dos and don’ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate information about the parties involved.

- Do ensure that all signatures are present and dated.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use abbreviations or shorthand that could cause confusion.

Following these guidelines can help prevent issues and ensure that the agreement is valid and enforceable.

Popular Templates:

Employment Application in Spanish - We look forward to reviewing your application.

Filing the California LLC 12 form is vital for LLCs operating in California, as it ensures that the necessary information is kept up to date with the state. Companies should be particularly mindful of compliance to avoid penalties, and for a detailed guide on the filing process and requirements, you can visit https://californiadocsonline.com/california-llc-12-form.

Hunting Lease Agreement Template - A Hunting Lease Agreement may include provisions for renewal and termination of the lease after the specified term.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. This includes missing names, addresses, or specific terms of the agreement. When information is incomplete, it can lead to misunderstandings or disputes later on.

-

Incorrect Valuation of Shares: Accurately valuing the shares being purchased is crucial. Many individuals either overestimate or underestimate the worth of the shares. This miscalculation can affect negotiations and the overall fairness of the transaction.

-

Neglecting to Include Conditions: Some people forget to outline any conditions that must be met before the purchase is finalized. These conditions might include financing arrangements or approval from other members of the LLC. Omitting these details can lead to complications down the line.

-

Failing to Obtain Signatures: A signed agreement is essential for it to be legally binding. Individuals sometimes forget to sign the document or neglect to get the necessary signatures from all parties involved. Without these signatures, the agreement may not hold up in a legal context.

Documents used along the form

When engaging in the purchase or sale of shares in a Limited Liability Company (LLC), several important documents often accompany the LLC Share Purchase Agreement. Each of these documents serves a specific purpose in ensuring that the transaction is clear, legal, and binding. Understanding these documents can help both buyers and sellers navigate the complexities of such transactions.

- Operating Agreement: This document outlines the management structure and operational procedures of the LLC. It details the rights and responsibilities of the members and may include provisions about share transfers.

- Letter of Intent: A preliminary agreement that expresses the intention of the buyer to purchase shares. It often outlines the main terms of the deal and serves as a basis for further negotiations.

- Due Diligence Checklist: A comprehensive list used by buyers to evaluate the financial, legal, and operational aspects of the LLC before finalizing the purchase. It helps identify any potential risks.

- Disclosure Schedule: This document provides detailed information about the LLC’s assets, liabilities, and any potential legal issues. It is essential for transparency and for the buyer’s informed decision-making.

- Purchase Price Allocation Agreement: This agreement specifies how the total purchase price will be allocated among the various assets and liabilities of the LLC. This can have tax implications for both parties.

- Shareholder Consent: A document that indicates that existing shareholders agree to the sale of shares. This is often required by the LLC's operating agreement.

- Bill of Sale: A legal document that transfers ownership of the shares from the seller to the buyer. It serves as proof of the transaction.

- Non-Disclosure Agreement (NDA): A contract that protects sensitive information shared during the negotiation process. It ensures that proprietary information remains confidential.

- General Bill of Sale: For ensuring clear ownership transfers, refer to the comprehensive General Bill of Sale documentation to formalize your transactions appropriately.

- Closing Statement: A final document that summarizes the terms of the sale and outlines the financial details of the transaction. It is typically signed at the closing of the deal.

In summary, these documents play crucial roles in the process of buying and selling shares in an LLC. Each one addresses different aspects of the transaction, ensuring that all parties are informed and protected. Familiarity with these documents can enhance the overall transaction experience and contribute to a successful outcome.

Misconceptions

When it comes to LLC Share Purchase Agreements, misunderstandings are common. Here are ten misconceptions that often arise, along with clarifications to help demystify this important document.

-

All LLC Share Purchase Agreements are the same.

This is not true. Each agreement can be tailored to the specific needs of the parties involved, reflecting unique terms and conditions.

-

Only lawyers can draft an LLC Share Purchase Agreement.

While legal expertise is valuable, many business owners can create effective agreements with the right guidance and resources.

-

Once signed, an LLC Share Purchase Agreement cannot be changed.

Agreements can be amended if both parties agree to the changes. Flexibility is often built into these contracts.

-

LLC Share Purchase Agreements are only for large transactions.

In reality, these agreements can be used for transactions of any size, making them accessible for small businesses as well.

-

All terms in the agreement are negotiable.

While many terms can be negotiated, some may be standard or required by law, limiting flexibility in certain areas.

-

Signing an agreement means you understand everything in it.

Signing does not imply full understanding. It’s crucial to read and comprehend the document before agreeing to its terms.

-

Verbal agreements are sufficient to replace a written LLC Share Purchase Agreement.

Verbal agreements can be difficult to enforce. A written agreement provides clarity and protection for both parties.

-

Once the purchase is complete, the agreement is no longer relevant.

The agreement may still contain obligations or warranties that extend beyond the completion of the purchase.

-

LLC Share Purchase Agreements are only about price.

While price is a key component, these agreements also cover terms like payment methods, timelines, and responsibilities.

-

You don't need an LLC Share Purchase Agreement if you know the buyer/seller well.

Even with familiarity, a written agreement helps prevent misunderstandings and protects everyone’s interests.

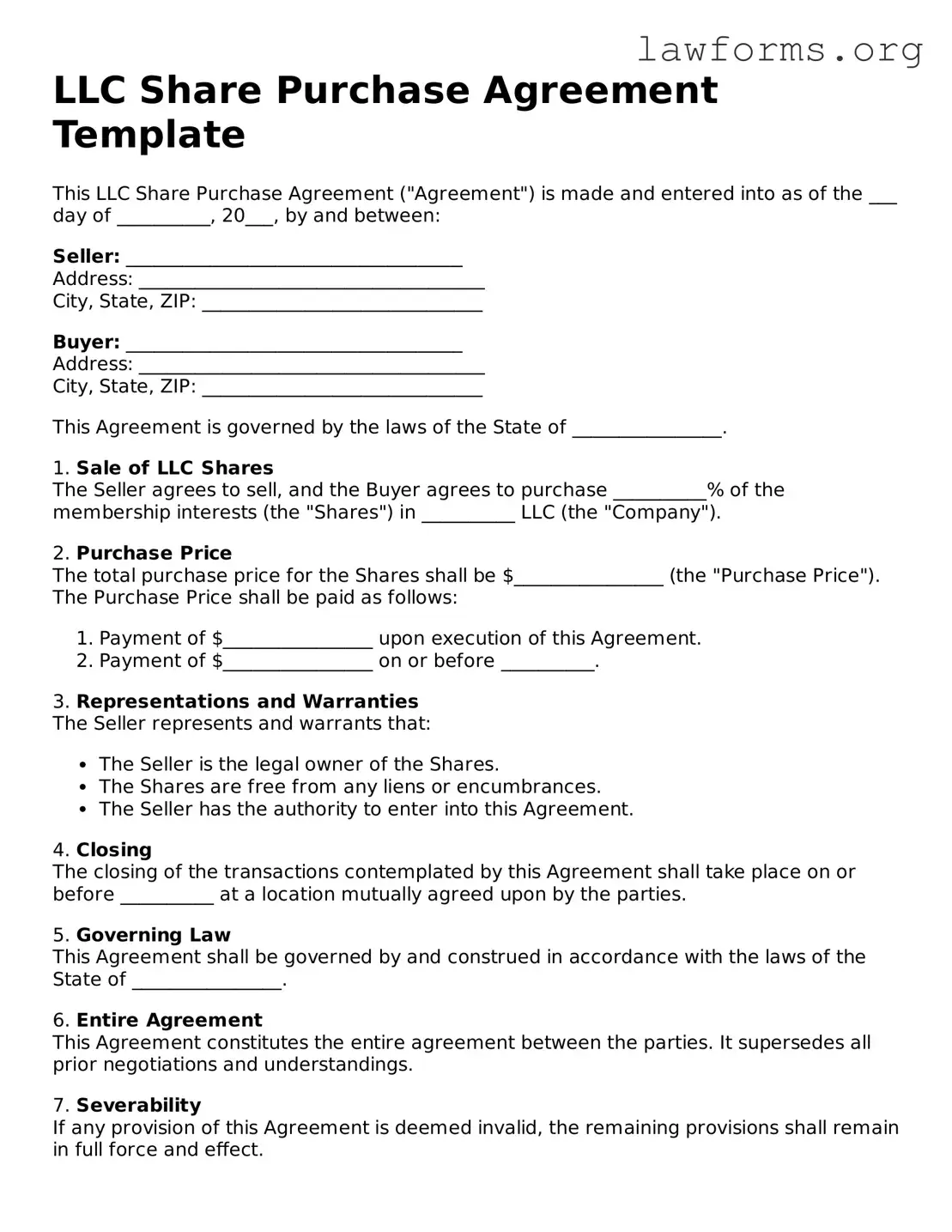

Preview - LLC Share Purchase Agreement Form

LLC Share Purchase Agreement Template

This LLC Share Purchase Agreement ("Agreement") is made and entered into as of the ___ day of __________, 20___, by and between:

Seller: ____________________________________

Address: _____________________________________

City, State, ZIP: ______________________________

Buyer: ____________________________________

Address: _____________________________________

City, State, ZIP: ______________________________

This Agreement is governed by the laws of the State of ________________.

1. Sale of LLC Shares

The Seller agrees to sell, and the Buyer agrees to purchase __________% of the membership interests (the "Shares") in __________ LLC (the "Company").

2. Purchase Price

The total purchase price for the Shares shall be $________________ (the "Purchase Price"). The Purchase Price shall be paid as follows:

- Payment of $________________ upon execution of this Agreement.

- Payment of $________________ on or before __________.

3. Representations and Warranties

The Seller represents and warrants that:

- The Seller is the legal owner of the Shares.

- The Shares are free from any liens or encumbrances.

- The Seller has the authority to enter into this Agreement.

4. Closing

The closing of the transactions contemplated by this Agreement shall take place on or before __________ at a location mutually agreed upon by the parties.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ________________.

6. Entire Agreement

This Agreement constitutes the entire agreement between the parties. It supersedes all prior negotiations and understandings.

7. Severability

If any provision of this Agreement is deemed invalid, the remaining provisions shall remain in full force and effect.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Seller Signature: __________________________

Date: ________________

Buyer Signature: __________________________

Date: ________________

Key takeaways

When filling out and using the LLC Share Purchase Agreement form, keep these key takeaways in mind:

- Understand the Purpose: This agreement outlines the terms of the sale of shares in an LLC, ensuring clarity between the buyer and seller.

- Accurate Information: Fill in all required fields with precise information to avoid misunderstandings later.

- Review Terms Carefully: Pay attention to the terms and conditions, including payment details and transfer of ownership.

- Consult Legal Guidance: If uncertain about any aspect, seek advice from a legal professional to ensure compliance with state laws.

- Signatures Matter: Ensure that all parties sign the agreement. This step is crucial for the document's validity.

- Keep Copies: After finalizing the agreement, keep copies for your records. This can be important for future reference.

Similar forms

- Stock Purchase Agreement: This document outlines the terms under which one party agrees to purchase shares of stock from another party. Like the LLC Share Purchase Agreement, it specifies the purchase price, representations, and warranties of the seller.

- Membership Interest Purchase Agreement: This agreement details the sale of membership interests in an LLC. It is similar in that it covers the transfer of ownership, payment terms, and conditions for the sale.

- Divorce Settlement Agreement: This legal document outlines the terms of a divorce settlement, including property division and custody arrangements. For templates and more information, you can visit Forms Washington.

- Asset Purchase Agreement: This document is used when one party purchases the assets of a business rather than its stock or membership interests. It shares similarities in terms of outlining the purchase price and the responsibilities of both parties.

- Partnership Buy-Sell Agreement: This agreement governs the sale of a partner's interest in a partnership. It is comparable to the LLC Share Purchase Agreement as it includes terms for valuation and payment upon a partner's exit.

- Shareholder Agreement: This document sets the rights and obligations of shareholders in a corporation. Like the LLC Share Purchase Agreement, it can address issues such as buy-sell provisions and voting rights.

- Joint Venture Agreement: This agreement outlines the terms under which two or more parties collaborate on a specific project. It resembles the LLC Share Purchase Agreement in that it defines the contributions and profit-sharing arrangements of the parties involved.

- Confidentiality Agreement: Often used in conjunction with purchase agreements, this document protects sensitive information shared during negotiations. It parallels the LLC Share Purchase Agreement by ensuring that both parties maintain confidentiality regarding the transaction details.