Valid Loan Agreement Form

State-specific Loan Agreement Documents

Loan Agreement Document Categories

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement outlines the terms and conditions under which a borrower receives funds from a lender. |

| Governing Law | The governing law for the Loan Agreement varies by state. For example, in California, it is governed by California Civil Code. |

| Key Components | Typical components include loan amount, interest rate, repayment schedule, and default terms. |

| Signatures | Both the borrower and lender must sign the agreement for it to be legally binding. |

Dos and Don'ts

When filling out a Loan Agreement form, it's important to approach the task with care. Here are some guidelines to help you navigate the process effectively.

- Do: Read the entire form carefully before starting.

- Do: Provide accurate and truthful information.

- Do: Double-check all numbers and calculations.

- Do: Use clear and legible handwriting if filling it out by hand.

- Do: Ask questions if you don’t understand any part of the form.

- Don’t: Rush through the form; take your time to ensure accuracy.

- Don’t: Leave any required fields blank.

- Don’t: Use abbreviations or slang that may confuse the lender.

- Don’t: Sign the form until all information is complete and correct.

- Don’t: Ignore instructions or guidelines provided with the form.

Popular Templates:

Sample Non Disclosure Agreement - Signing a Non-disclosure Agreement builds trust between business partners.

Ncoer Support Form Fillable - This evaluation plays a significant role in maintaining accountability within the ranks of the Army.

Sos Hcp Updates - It is advisable to discuss your Living Will with family to ensure everyone understands your wishes.

Common mistakes

-

Not Reading the Entire Agreement: Many individuals skip over sections of the loan agreement, missing important terms and conditions. This can lead to misunderstandings about repayment obligations.

-

Incorrect Personal Information: Errors in names, addresses, or Social Security numbers can cause significant delays in processing the loan. Always double-check this information.

-

Failing to Disclose Financial Information: Omitting income details or existing debts can result in an inaccurate assessment of your financial situation. Full transparency is crucial.

-

Not Understanding Interest Rates: Some borrowers overlook how interest rates are calculated, which can lead to confusion about total repayment amounts. Take the time to clarify this aspect.

-

Ignoring Fees and Penalties: Loan agreements often include fees for late payments or early repayment. Failing to acknowledge these can lead to unexpected costs down the line.

-

Not Asking Questions: Many people hesitate to seek clarification on terms they do not understand. Engaging with the lender can prevent future issues.

-

Overlooking the Repayment Schedule: Some borrowers do not pay attention to the repayment timeline. Understanding when payments are due is essential for managing finances effectively.

-

Assuming All Loans Are the Same: Each loan agreement can differ significantly. Assuming that terms are standard can lead to unfavorable borrowing conditions.

-

Neglecting to Keep Copies: After signing, many forget to keep a copy of the agreement. Retaining this document is important for reference in the future.

-

Not Considering Alternatives: Some individuals fill out a loan agreement without exploring other financing options. Researching alternatives can sometimes yield better terms.

Documents used along the form

When entering into a loan agreement, several other forms and documents may be needed to ensure a smooth process. Each of these documents serves a specific purpose and helps both parties understand their rights and responsibilities. Here’s a list of commonly used documents that accompany a loan agreement:

- Promissory Note: This is a written promise from the borrower to repay the loan under specified terms. It includes details like the loan amount, interest rate, and repayment schedule.

- Loan Application: This document is completed by the borrower to provide the lender with information about their financial situation, including income, debts, and credit history.

- Credit Report: A detailed report of the borrower's credit history. Lenders use this to assess the borrower's creditworthiness before approving the loan.

- Collateral Agreement: If the loan is secured, this document outlines the assets pledged by the borrower as security for the loan. It specifies what happens if the borrower defaults.

- Disclosure Statement: This document provides important information about the loan terms, including fees, interest rates, and other costs associated with the loan.

- Loan Closing Statement: This is a summary of the final terms of the loan. It includes all the costs associated with closing the loan and is reviewed by both parties before finalizing the agreement.

- Personal Guarantee: In some cases, a personal guarantee may be required. This document holds an individual personally responsible for repaying the loan if the borrower defaults.

- Amortization Schedule: This schedule outlines each payment over the life of the loan, showing how much of each payment goes toward interest and how much goes toward principal.

Having these documents in order can help clarify expectations and protect both parties involved in the loan agreement. It’s important to review each document carefully and seek assistance if needed to ensure a clear understanding of all terms and conditions.

Misconceptions

Loan agreements are crucial documents in the world of finance, yet many people harbor misconceptions about their purpose and function. Understanding these misconceptions can help individuals navigate the borrowing process with greater confidence and clarity.

- Misconception 1: A loan agreement is only necessary for large loans.

- Misconception 2: Loan agreements are only for business transactions.

- Misconception 3: Once signed, a loan agreement cannot be changed.

- Misconception 4: All loan agreements are the same.

- Misconception 5: You don't need to read a loan agreement before signing it.

This is not true. Regardless of the loan amount, a loan agreement serves as a formal record of the terms and conditions of the borrowing arrangement. Even small loans benefit from having a written agreement to clarify expectations and responsibilities.

While businesses often utilize loan agreements, individuals can also benefit from them. Personal loans, whether between friends or family members, can lead to misunderstandings without a clear, written agreement outlining the terms.

This misconception can be misleading. Although loan agreements are binding, parties can negotiate modifications if both sides agree. It is important to document any changes in writing to avoid confusion later on.

Loan agreements can vary significantly based on the lender, the type of loan, and the borrower's circumstances. Each agreement should be reviewed carefully to ensure it meets the specific needs and expectations of both parties involved.

This is perhaps one of the most dangerous misconceptions. Reading and understanding a loan agreement is essential. It is the borrower's responsibility to know the terms, interest rates, and any potential fees that may apply. Taking the time to review the document can prevent future disputes and financial hardship.

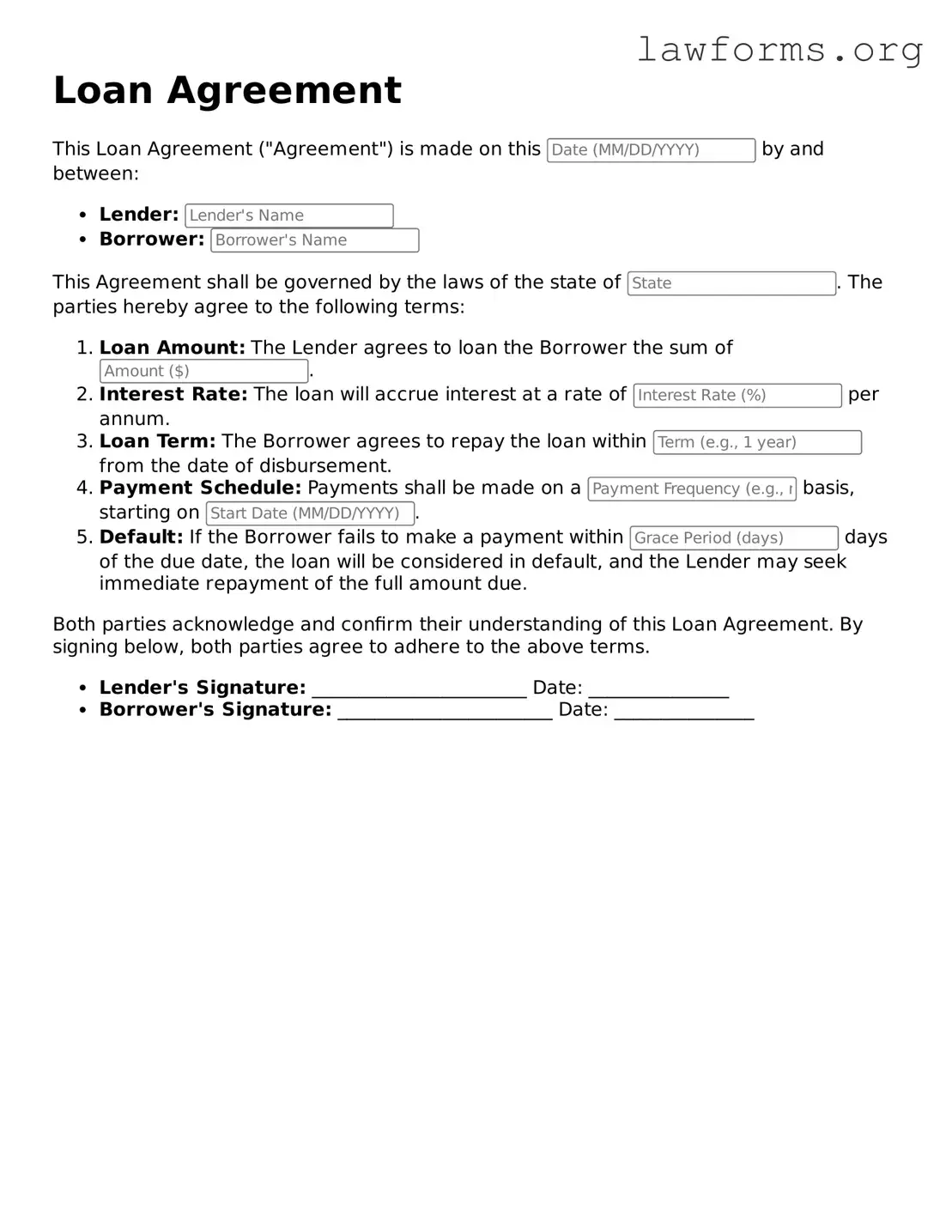

Preview - Loan Agreement Form

Loan Agreement

This Loan Agreement ("Agreement") is made on this by and between:

- Lender:

- Borrower:

This Agreement shall be governed by the laws of the state of . The parties hereby agree to the following terms:

- Loan Amount: The Lender agrees to loan the Borrower the sum of .

- Interest Rate: The loan will accrue interest at a rate of per annum.

- Loan Term: The Borrower agrees to repay the loan within from the date of disbursement.

- Payment Schedule: Payments shall be made on a basis, starting on .

- Default: If the Borrower fails to make a payment within days of the due date, the loan will be considered in default, and the Lender may seek immediate repayment of the full amount due.

Both parties acknowledge and confirm their understanding of this Loan Agreement. By signing below, both parties agree to adhere to the above terms.

- Lender's Signature: _______________________ Date: _______________

- Borrower's Signature: _______________________ Date: _______________

Key takeaways

Filling out and using a Loan Agreement form is a critical step in securing a loan. Here are seven key takeaways to keep in mind:

- Accurate Information: Ensure all personal and financial details are correct. Errors can delay processing.

- Clear Terms: Understand the terms of the loan, including interest rates, repayment schedules, and fees.

- Signatures Required: Both parties must sign the agreement for it to be legally binding.

- Read Thoroughly: Review the entire document before signing. Ask questions if something is unclear.

- Keep Copies: Retain a copy of the signed agreement for your records. This is important for future reference.

- Compliance: Be aware of any state or federal regulations that may apply to your loan agreement.

- Amendments: If changes are needed after signing, document them properly and have both parties agree to the amendments.

Following these guidelines will help ensure a smooth loan process. Take action now to avoid complications later.

Similar forms

- Promissory Note: A promissory note is a written promise to pay a specified amount of money at a certain time. Like a loan agreement, it outlines the terms of repayment and the interest rate. However, it is often simpler and may not include all the terms that a loan agreement would cover.

- Incorporation Article: To establish a corporation in New York, businesses must submit the Articles of Incorporation. This form provides essential information required by the state, such as the corporation's name and purpose, and is vital for legal recognition. For a template, you can refer to Formaid Org.

- Mortgage Agreement: A mortgage agreement is a specific type of loan agreement used for real estate transactions. It secures the loan with the property itself, detailing the rights and responsibilities of both the lender and the borrower.

- Credit Agreement: A credit agreement governs the terms under which a borrower can access credit from a lender. Similar to a loan agreement, it includes details about interest rates, repayment terms, and fees, but it may cover a revolving line of credit rather than a fixed loan amount.

- Lease Agreement: A lease agreement outlines the terms under which one party rents property from another. While primarily for rental situations, it shares similarities with loan agreements in that both documents specify payment terms, duration, and responsibilities of each party.

- Personal Guarantee: A personal guarantee is a document where an individual agrees to be responsible for a loan or debt if the primary borrower defaults. Like a loan agreement, it involves financial obligations and can help the lender secure their interests.