Fill Out a Valid Louisiana act of donation Template

Form Specs

| Fact Name | Details |

|---|---|

| Definition | The Louisiana Act of Donation form is a legal document used to transfer ownership of property from one person to another as a gift. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1468 to 1478. |

| Requirements | For a valid donation, the donor must have the legal capacity to give, and the donation must be accepted by the donee. |

| Types of Donations | Donations can be either inter vivos (during the donor's lifetime) or mortis causa (effective upon the donor's death). |

| Form of Donation | Donations of immovable property must be made in writing and require notarization to be legally binding. |

| Tax Implications | Donations may have tax implications for both the donor and the donee, including potential gift tax liabilities. |

| Revocation | A donor can revoke the donation under certain conditions, such as if the donee fails to fulfill specific obligations. |

Dos and Don'ts

When filling out the Louisiana act of donation form, it is essential to approach the process with care. Here are some important do's and don'ts to consider:

- Do ensure that all information provided is accurate and complete.

- Do have the form notarized to validate the donation.

- Do consult with a legal advisor if you have any questions regarding the form.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank unless instructed.

- Don't rush through the process; take your time to review the information.

- Don't sign the form until you are in the presence of a notary.

- Don't forget to inform the recipient about the donation and any conditions attached.

Other PDF Documents

Simple Shared Well Agreement Form - This document includes a detailed legal description of the properties involved.

The importance of accurately completing the California Form REG 262 cannot be overstated, as it plays a crucial role in the legal transfer of vehicle or vessel ownership in California. Whether you are a buyer or seller, understanding the requirements and implications of this form is vital. To streamline the process, you can find more detailed information and access the form directly at https://californiadocsonline.com/california-fotm-reg-262-form.

I 864 Form - The form can be used for spouses, children, parents, and siblings of U.S. citizens.

Common mistakes

-

Incomplete Information: Many people forget to fill out all required fields. Every section needs attention, including names, addresses, and property details.

-

Incorrect Property Description: Providing an inaccurate description of the property can lead to confusion. Ensure the legal description matches official documents.

-

Not Notarizing the Document: Failing to have the form notarized can invalidate the act. Always include a notary signature where required.

-

Ignoring Witness Requirements: Some donations require witnesses. Check if your situation mandates this and include them as needed.

-

Not Understanding Tax Implications: Donors often overlook potential tax consequences. Consult a tax professional to avoid surprises.

-

Using Outdated Forms: Using an old version of the form can lead to issues. Always download the latest version from a reliable source.

-

Failing to Keep Copies: After submission, many forget to keep copies of the completed form. Store a copy for your records to avoid future disputes.

Documents used along the form

The Louisiana Act of Donation form is an important legal document that allows one person to donate property to another. However, several other forms and documents often accompany this act to ensure clarity and legality in the transfer of property. Below is a list of these documents, each serving a unique purpose in the donation process.

- Donation Agreement: This document outlines the terms of the donation, including the property being donated and any conditions attached to the donation.

- Notarized Affidavit: A sworn statement that confirms the identity of the donor and the voluntary nature of the donation. This adds an extra layer of authenticity.

- Property Deed: The official document that transfers ownership of real property. It is often recorded in the parish where the property is located.

- Title Search Report: A report that verifies the legal ownership of the property and checks for any liens or encumbrances that may affect the donation.

- Articles of Incorporation Form: Before establishing a corporation in Florida, it is essential to complete the Articles of Incorporation form, which can be found at floridadocuments.net/fillable-articles-of-incorporation-form. This form outlines vital details about the corporation and is a crucial step in the business creation process.

- Gift Tax Return: A form that may need to be filed with the IRS if the value of the donated property exceeds a certain threshold, ensuring compliance with federal tax laws.

- Witness Statements: Written statements from individuals who witnessed the donation process, providing additional proof that the transaction was legitimate.

- Change of Ownership Form: A document submitted to local authorities to officially record the change in ownership of the property after the donation.

- Power of Attorney: If the donor is unable to sign the donation form themselves, this document allows another person to act on their behalf in the donation process.

Each of these documents plays a vital role in ensuring that the donation process is smooth and legally binding. By understanding these forms, both donors and recipients can navigate the complexities of property donation with greater confidence.

Misconceptions

The Louisiana act of donation form is a critical document in the realm of property law, particularly in the context of donations. However, several misconceptions surround its use and implications. Below are some common misunderstandings that individuals may have regarding this form.

- Misconception 1: The act of donation is only for large gifts.

- Misconception 2: The form is only necessary for real estate transactions.

- Misconception 3: Once the act of donation is signed, it cannot be revoked.

- Misconception 4: The act of donation does not require witnesses.

- Misconception 5: The donor must be present when the act is executed.

- Misconception 6: The act of donation is a simple formality with no legal consequences.

- Misconception 7: All acts of donation are treated equally by the law.

- Misconception 8: The act of donation does not need to be filed with any authority.

Many believe that only substantial donations require this formal documentation. In reality, even smaller gifts of property or assets can benefit from the clarity and legality provided by the act of donation form.

This is not accurate. While the act of donation is often associated with real estate, it can also apply to personal property, such as vehicles or valuable items.

Some individuals think that signing this document permanently relinquishes ownership. However, under certain conditions, a donor can revoke the donation before the recipient takes possession.

Contrary to this belief, Louisiana law mandates that the act of donation be executed in the presence of witnesses. This requirement adds a layer of protection and legitimacy to the transaction.

Some assume that the donor must be physically present during the signing. However, the law allows for the donor to authorize someone else to sign on their behalf, provided there is proper documentation.

This notion underestimates the legal weight of the document. An act of donation can have significant tax implications and affect the donor's estate planning.

Not all donations are created equal. The nature of the property, the relationship between the donor and recipient, and the specific terms of the donation can all influence how the law treats an act of donation.

Some people believe that once the document is signed, no further action is required. In many cases, filing the act with the appropriate local authority is necessary to ensure the donation is recognized legally.

Preview - Louisiana act of donation Form

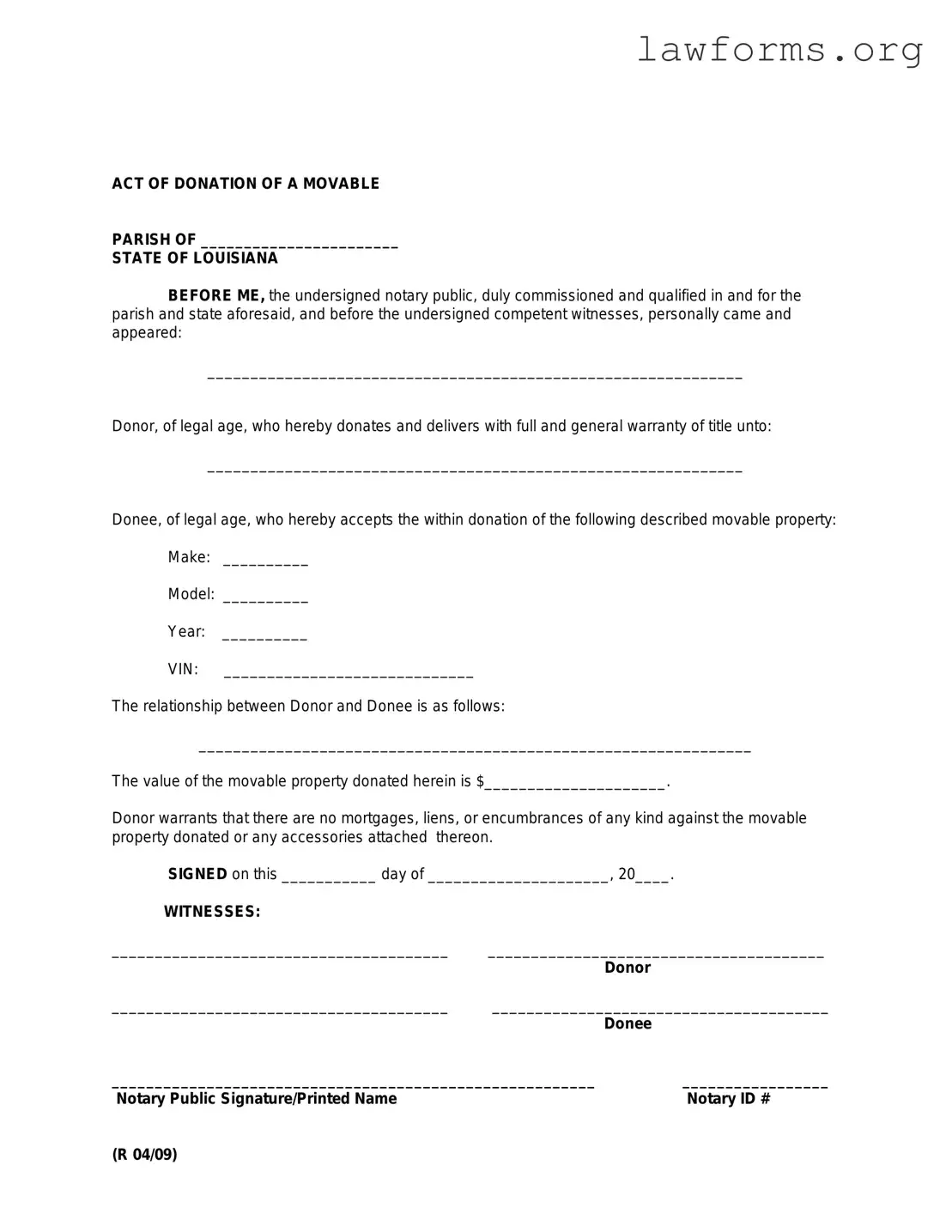

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

Key takeaways

When considering the Louisiana Act of Donation form, it's important to understand its implications and the process involved. Here are some key takeaways to keep in mind:

- The Act of Donation is a legal document that allows a person to give property or assets to another person without expecting anything in return.

- It is essential to clearly identify the property being donated. This includes providing a detailed description to avoid any confusion later on.

- Both the donor and the recipient must sign the form for it to be legally binding. Make sure to have witnesses present during the signing process.

- Consideration of taxes is crucial. Donors may need to report the donation on their tax returns, so it’s wise to consult with a tax professional.

- Once completed, the form should be filed with the appropriate local government office to ensure it is officially recognized.

- Keep a copy of the signed form for your records. This will serve as proof of the donation and can be useful for future reference.

Understanding these points can help ensure that the donation process goes smoothly and that both parties are protected legally.

Similar forms

- Will: Like the act of donation, a will is a legal document that outlines how a person’s assets will be distributed after their death. Both documents require the testator's or donor's intent to transfer ownership.

- Trust Agreement: A trust agreement allows a person to place their assets into a trust for the benefit of others. Similar to the act of donation, it involves the transfer of property, but it can also provide ongoing management of those assets.

- Living Trust: A living trust is a legal document that allows an individual to place their assets into a trust for their benefit during their lifetime and stipulate how the assets should be distributed upon their death. It can help avoid probate and simplify the transfer of property ownership, similar to a quitclaim deed, which can be completed through platforms like Ohio PDF Forms.

- Gift Deed: A gift deed is a document that formally transfers ownership of property from one person to another without any exchange of money. It shares the same intent as the act of donation, which is to give property voluntarily.

- Power of Attorney: This document grants someone the authority to act on another's behalf. While it does not transfer ownership, it can facilitate the donation process by allowing the designated person to manage the donor's assets.

- Bill of Sale: A bill of sale is used to transfer ownership of personal property. Although it typically involves a sale, it can resemble an act of donation if the transaction is made without consideration.

- Charitable Donation Receipt: This document acknowledges a donation made to a charitable organization. It serves a similar purpose of formalizing the transfer of property or funds, although it is directed towards charitable intent.

- Quitclaim Deed: A quitclaim deed transfers whatever interest a person has in a property without guaranteeing that the title is clear. It can be similar to an act of donation when property is given without further claims.