Fill Out a Valid Mortgage Statement Template

Form Specs

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for inquiries. |

| Payment Details | It specifies the payment due date, amount due, and any late fees that may apply if payment is not received on time. |

| Account Information | The statement provides details about the outstanding principal, interest rate, and whether a prepayment penalty applies. |

| Transaction Activity | It lists the transaction history, including charges, payments, and any late fees incurred during the specified period. |

| Important Messages | The form includes critical notices about partial payments, delinquency, and resources for financial assistance. |

Dos and Don'ts

When filling out the Mortgage Statement form, there are several important dos and don'ts to keep in mind. Following these guidelines can help ensure that your submission is accurate and complete.

- Do read the entire form carefully before starting.

- Do fill in all required fields, such as your name, address, and account number.

- Do double-check the payment due date and the amount due to avoid late fees.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless they are marked as optional.

- Don't forget to sign and date the form where required.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't ignore any instructions provided on the form or accompanying materials.

By adhering to these guidelines, you can help ensure that your Mortgage Statement form is processed smoothly and efficiently.

Other PDF Documents

Chick-fil-a Hiring Near Me - Develop essential skills that will benefit your future.

The Illinois Operating Agreement form is essential for any limited liability company (LLC) as it lays down the groundwork for the financial and operational decisions that keep all members aligned. By detailing the rules that govern daily activities and dispute resolution, this document is pivotal for smooth operations. To maximize your LLC's potential and mitigate future misunderstandings, consider completing the required form available at https://formsillinois.com/.

How to Get Pay Stubs - This pay stub format promotes transparency in employee compensation.

Common mistakes

-

Incomplete Information: One common mistake is failing to fill out all required fields. Ensure that you provide your name, address, account number, and payment details. Missing any of these can lead to confusion and delays in processing your mortgage statement.

-

Incorrect Dates: Double-check the dates you enter, especially the payment due date and the statement date. An incorrect date can result in missed payments or late fees. It's essential to verify that the dates align with your records.

-

Misunderstanding Fees: Many people overlook the details regarding fees. Make sure you understand any late fees or penalties that may apply if payments are not made on time. Review the section explaining the amount due to avoid surprises.

-

Neglecting to Review Account History: Ignoring the recent account history can lead to misunderstandings about your payment status. Take a moment to review this section to ensure that all payments are accurately recorded and that you are aware of any outstanding balances.

Documents used along the form

The Mortgage Statement form is a key document for homeowners managing their mortgage payments. Several other forms and documents often accompany it, providing essential information related to the mortgage account. Below is a list of these documents, each described briefly for clarity.

- Loan Agreement: This document outlines the terms and conditions of the mortgage loan, including the interest rate, repayment schedule, and obligations of both the borrower and lender.

- Amortization Schedule: This schedule details each payment over the life of the loan, breaking down how much goes toward principal and interest, as well as the remaining balance after each payment.

- Escrow Analysis Statement: This statement provides a summary of the escrow account, detailing how much is collected for property taxes and insurance, and any adjustments that may be needed.

- Payment History: This document lists all payments made on the mortgage, including dates, amounts, and whether they were made on time or late.

- Non-disclosure Agreement: This document protects sensitive information shared during the mortgage process, ensuring confidentiality between parties involved, which is essential for maintaining trust. For more information, visit Forms Washington.

- Delinquency Notice: If payments are missed, this notice informs the borrower of their delinquent status, potential fees, and consequences of continued non-payment.

- Notice of Default: This formal notice is sent when a borrower fails to make payments, indicating that the lender may initiate foreclosure proceedings if the default is not cured.

- Loan Modification Agreement: If the borrower and lender agree to change the terms of the loan, this document outlines the new terms, including any changes to interest rates or payment schedules.

- Mortgage Payoff Statement: This statement provides the total amount required to pay off the mortgage in full, including any fees or penalties that may apply.

These documents work together to provide a comprehensive view of the mortgage account, ensuring that borrowers have the information they need to manage their loans effectively.

Misconceptions

Misconceptions about the Mortgage Statement form can lead to confusion and mismanagement of your mortgage. Here are seven common misunderstandings:

- All payments are applied immediately. Many believe that once a payment is made, it is immediately applied to the mortgage balance. However, partial payments are held in a suspense account until the total balance is paid.

- The late fee is charged automatically. Some assume that a late fee is charged automatically without consideration. In reality, a late fee is only applied if payment is not received by the specified due date.

- The amount due is only principal and interest. It’s a common belief that the total amount due includes only principal and interest. In fact, it also includes escrow for taxes and insurance, as well as any applicable fees.

- Escrow payments are optional. Many homeowners think that escrow payments for taxes and insurance are optional. However, these payments are often required by lenders to ensure that property taxes and insurance premiums are paid on time.

- Delinquency notices are sent only after multiple missed payments. Some individuals believe that they will only receive a delinquency notice after several missed payments. In truth, notices can be issued after just one missed payment, highlighting the importance of timely payments.

- Mortgage counseling is only for those in severe financial distress. A misconception exists that mortgage counseling is only available to those facing foreclosure. In reality, assistance is available for anyone experiencing financial difficulty, regardless of the severity.

- Payments can be made at any time without penalty. Many borrowers think they can make payments whenever they choose without consequences. However, payments must be made by the due date to avoid late fees and potential negative impacts on credit scores.

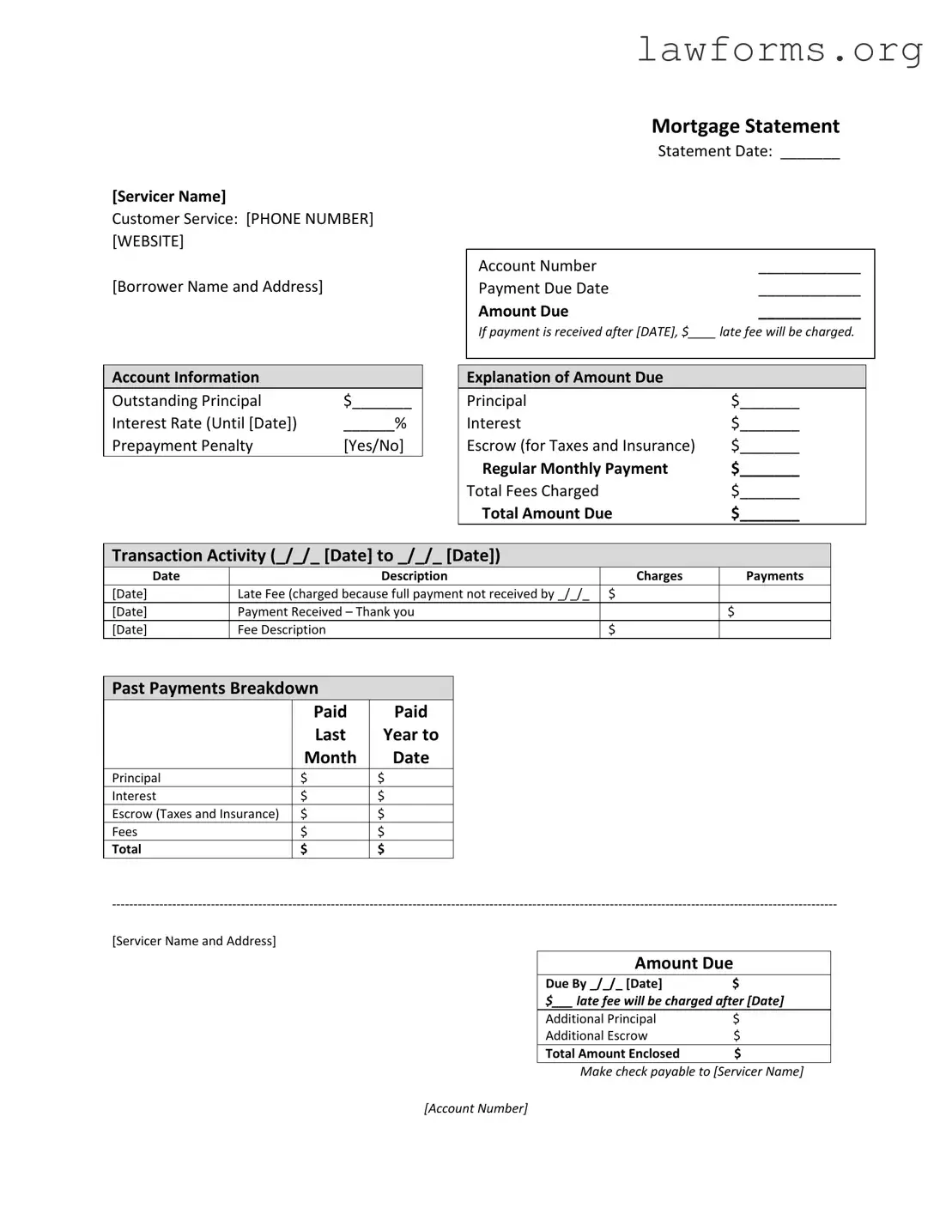

Preview - Mortgage Statement Form

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Key takeaways

Understanding the Mortgage Statement form is crucial for managing your mortgage effectively. Here are some key takeaways to keep in mind:

- Contact Information: Always check the servicer's name, customer service phone number, and website. This information is essential for any inquiries or issues regarding your mortgage.

- Payment Details: Note the payment due date and the amount due. If payment is not received by the specified date, a late fee will be charged.

- Account Information: Review the outstanding principal and interest rate. Understanding these figures helps you grasp your financial obligations.

- Transaction Activity: Keep track of your payment history and any fees charged. This section provides a clear overview of your recent transactions.

- Delinquency Notice: Pay attention to any notices regarding late payments. Being aware of your delinquency status can help you avoid further fees or foreclosure.

- Financial Assistance: If you are facing financial difficulties, the form may provide resources for mortgage counseling or assistance. Utilize these resources to explore your options.

Similar forms

- Billing Statement: A billing statement details the amounts owed for services rendered, similar to a mortgage statement. It includes account information, payment due dates, and any applicable fees. Both documents aim to inform the recipient about their financial obligations.

- Hold Harmless Agreement: This legal document is essential for those involved in contracts and rental agreements, as it ensures one party is protected from liability for certain actions or events. For more information, visit https://californiadocsonline.com/hold-harmless-agreement-form/.

- Loan Statement: A loan statement provides a summary of a borrower’s loan account, including outstanding balance and payment history. Like a mortgage statement, it outlines the amounts due, interest rates, and any fees charged, helping borrowers keep track of their financial responsibilities.

- Account Statement: An account statement summarizes transactions over a specific period. It may include deposits, withdrawals, and fees, much like a mortgage statement summarizes payment history and outstanding amounts due. Both documents serve to keep the account holder informed about their financial status.

- Payment Reminder: A payment reminder notifies individuals of upcoming payment deadlines and amounts due. Similar to a mortgage statement, it emphasizes the importance of timely payments and may include penalties for late payments, ensuring that borrowers are aware of their obligations.