Fill Out a Valid Netspend Dispute Template

Form Specs

| Fact Name | Description |

|---|---|

| Submission Deadline | This form must be completed and submitted to Netspend within 60 days of the disputed transaction. |

| Response Time | Netspend will make a decision regarding the disputed funds within 10 business days after receiving the completed form. |

| Liability for Unauthorized Use | If your card was lost or stolen, you may be liable for unauthorized transactions unless you reported the loss and requested to block the card. |

| Supporting Documentation | Including supporting documents like police reports or receipts can help in the dispute process. |

Dos and Don'ts

When filling out the Netspend Dispute form, it's essential to follow specific guidelines to ensure your dispute is processed smoothly. Here are nine key do's and don'ts to keep in mind:

- Do complete the form as soon as possible, ideally within 60 days of the disputed transaction.

- Do provide all required personal information, including your name, phone number, and address.

- Do include detailed information about each disputed transaction, such as the date, time, and merchant name.

- Do indicate whether you have contacted the merchant regarding the dispute.

- Do attach any supporting documentation, like receipts or a police report, to strengthen your case.

- Don't submit the form without checking for errors or missing information.

- Don't delay in sending the form, as this can affect the outcome of your dispute.

- Don't forget to sign the form before submitting it.

- Don't include irrelevant information or documentation that does not pertain to the dispute.

By following these guidelines, you can help ensure that your dispute is handled efficiently and effectively.

Other PDF Documents

Credit Application Business - The form is the first step in securing credit for your business.

To effectively document the sale of a vehicle in Texas, it is important to utilize the Texas Motor Vehicle Bill of Sale form, which serves as an official record of ownership transfer and the transaction details. To ensure everything is properly recorded, interested parties can download and complete the form that captures all necessary information related to the sale.

Voucher Template - For every special moment, this gift certificate fits the bill.

Dd Form 2656 March 2022 - This document captures the member's preferences regarding who benefits from their service.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can delay the processing of your dispute. Ensure that you provide your full name, address, and card or account number.

-

Missing Documentation: Not including supporting documents, such as a police report or receipts, can weaken your case. Always attach relevant evidence to strengthen your claim.

-

Incorrect Dates: Providing wrong transaction dates can lead to confusion. Double-check the dates of disputed transactions to ensure accuracy.

-

Neglecting to Contact the Merchant: Forgetting to indicate whether you contacted the merchant can hinder the process. Always note your communication efforts with the merchant.

-

Not Indicating Card Status: Failing to specify if your card was lost or stolen can result in liability for unauthorized transactions. Make sure to clearly state your card's status.

-

Signature Issues: Omitting your signature or date can invalidate your form. Always sign and date the form before submission to ensure it is processed correctly.

Documents used along the form

When filing a dispute with Netspend, several additional forms and documents may be necessary to support your claim. These documents help establish the context of the dispute and provide essential information for a thorough review. Below is a list of common forms and documents that are often used alongside the Netspend Dispute form.

- Police Report: If your card was lost or stolen, a police report can serve as crucial evidence. It provides official documentation of the incident and may assist in verifying your claim.

- Notice to Quit Form: This form is essential for landlords to properly notify tenants of their obligations under the rental agreement and the necessity to vacate the property. For assistance with filling out this document, please visit https://formsillinois.com.

- Transaction Receipts: Copies of receipts for disputed transactions can help substantiate your claim. These documents show proof of the original transaction and may clarify discrepancies.

- Email Correspondence: Any emails exchanged with the merchant regarding the disputed transaction can support your case. This includes requests for refunds or clarifications about the transaction.

- Shipping or Tracking Information: If the dispute involves a product that was not received, providing shipping or tracking information can demonstrate that the item was never delivered.

- Cancellation Confirmation: If you canceled a service or order, including the cancellation confirmation can help validate your dispute. This document shows that you took steps to prevent the charge.

- Identity Theft Affidavit: In cases of identity theft, this affidavit can help establish that the transactions were not authorized by you. It is often used in conjunction with a police report.

- Bank Statements: Recent bank statements showing the disputed transaction can provide context. They can help illustrate your account activity and confirm the transaction in question.

- Written Explanation: A detailed written explanation of the circumstances surrounding the dispute is essential. This narrative should outline what happened and why you believe the transaction is unauthorized.

Gathering these documents can significantly enhance the effectiveness of your dispute. Providing comprehensive information helps ensure that your claim is reviewed promptly and accurately, increasing the likelihood of a favorable outcome.

Misconceptions

Misconceptions about the Netspend Dispute Form can lead to confusion and delays in resolving issues. Here are eight common misconceptions clarified:

- Misconception 1: The dispute form must be submitted immediately after noticing a transaction.

- Misconception 2: You can submit an unlimited number of disputes on one form.

- Misconception 3: Supporting documentation is optional.

- Misconception 4: You are liable for all unauthorized transactions.

- Misconception 5: A decision on your dispute will take weeks.

- Misconception 6: You must contact the merchant before submitting the dispute form.

- Misconception 7: You do not need to file a police report for lost or stolen cards.

- Misconception 8: The form is only for debit transactions.

While it is important to act quickly, you have up to 60 days from the transaction date to submit the form.

The form allows for up to five disputed transactions at a time. Additional disputes require separate forms.

Providing supporting documents, such as receipts or emails, is highly recommended. They can strengthen your case.

You are not liable for unauthorized transactions that occur after you report your card as lost or stolen.

Netspend typically makes a decision within 10 business days after receiving the completed form.

Contacting the merchant is not a requirement, but it may help resolve the issue more quickly.

Filing a police report is recommended, especially if your card was stolen, as it can provide additional support for your dispute.

The dispute form can be used for both unauthorized credit and debit transactions.

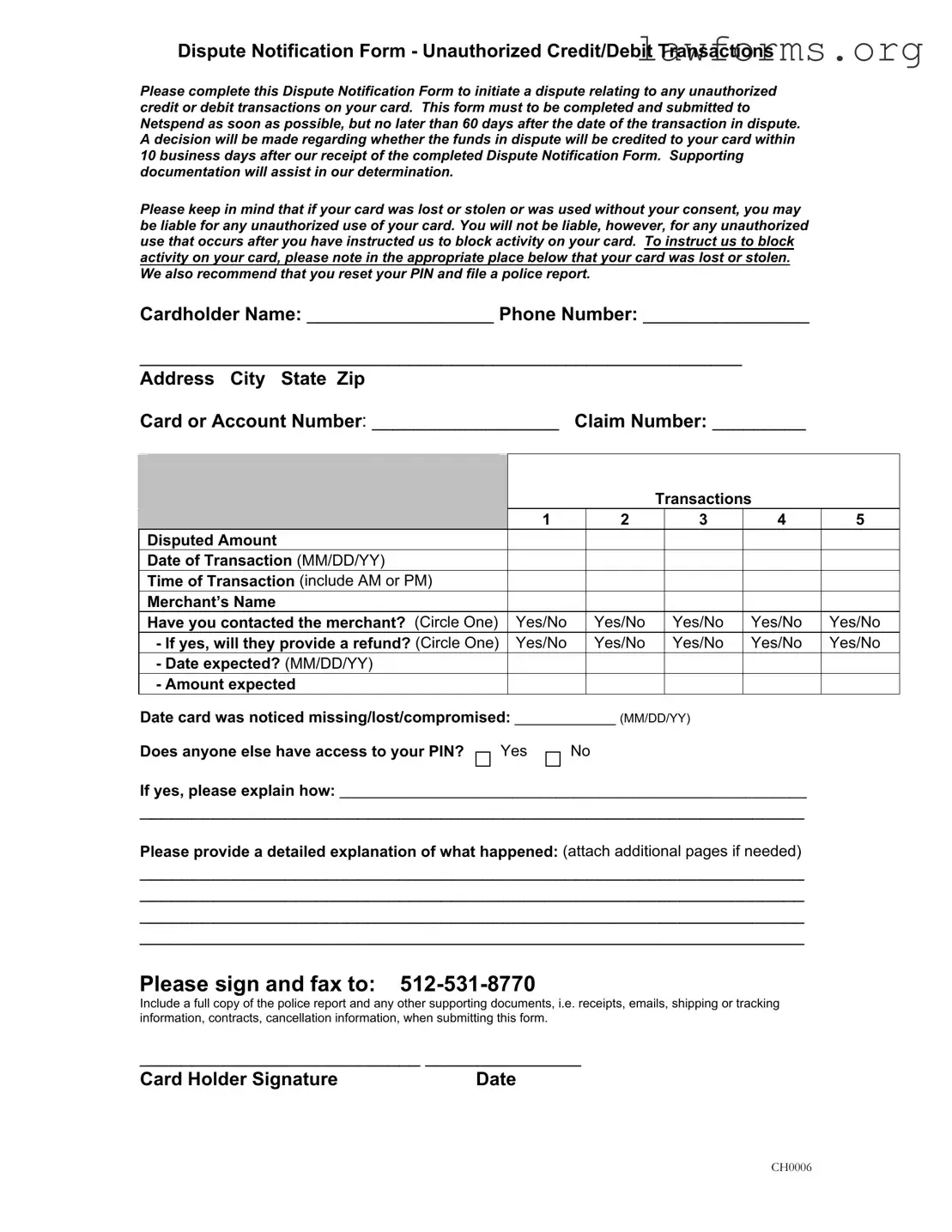

Preview - Netspend Dispute Form

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006

Key takeaways

When filling out and using the Netspend Dispute form, keep the following key takeaways in mind:

- Timeliness is crucial: Submit the completed Dispute Notification Form within 60 days of the transaction date to ensure your dispute is considered.

- Clear documentation: Include supporting documents, such as receipts or emails, to strengthen your case.

- Transaction details matter: Provide specific information for each disputed transaction, including date, time, merchant name, and the amount.

- Merchant contact: Indicate whether you have contacted the merchant regarding the dispute. This information can influence the resolution process.

- Liability awareness: Understand that you may be liable for unauthorized transactions if your card was lost or stolen, but not for transactions after you reported the card missing.

- Blocking your card: If your card is lost or stolen, indicate this on the form so that Netspend can block further activity on your account.

- PIN security: If someone else has access to your PIN, provide an explanation, as this may affect the outcome of your dispute.

- Detailed explanation: Use the space provided to give a thorough account of the situation, which can help clarify your case.

- Signature requirement: Don’t forget to sign and date the form before submission, as this is necessary for processing your dispute.

By following these guidelines, you can navigate the dispute process more effectively and increase the likelihood of a favorable resolution.

Similar forms

The Netspend Dispute form serves a specific purpose in addressing unauthorized transactions, but it shares similarities with several other documents used in various financial and legal contexts. Below are five documents that resemble the Netspend Dispute form, highlighting how they relate to each other.

- Chargeback Request Form: This form is used by consumers to dispute a charge on their credit or debit card. Like the Netspend Dispute form, it requires details about the transaction, including the amount, date, and reason for the dispute. Both forms aim to protect consumers from unauthorized transactions.

- Fraud Report Form: Financial institutions often provide this form for customers to report suspected fraud. Similar to the Netspend Dispute form, it asks for personal information, transaction details, and a description of the fraudulent activity. Both documents are designed to initiate investigations into unauthorized transactions.

- Identity Theft Report: This document is used when an individual believes their personal information has been compromised. Like the Netspend Dispute form, it requires detailed information about the victim and the nature of the theft. Both forms aim to address and mitigate the effects of unauthorized use of personal information.

- Unauthorized Transaction Notification: Many banks have a standard notification form for customers to report unauthorized transactions. This document, akin to the Netspend Dispute form, typically requires information about the transaction and the account holder. Both serve to alert the financial institution to potential fraud and initiate corrective measures.

- Hold Harmless Agreement: A crucial document that helps protect parties from liability, similar to other agreements, such as the https://californiadocsonline.com/hold-harmless-agreement-form/, that clarify responsibilities and risks involved in various transactions.

- Consumer Complaint Form: Organizations like the Consumer Financial Protection Bureau (CFPB) offer this form for consumers to report issues with financial products or services. Similar to the Netspend Dispute form, it allows consumers to provide detailed accounts of their experiences, aiming to resolve disputes and improve financial practices.