Attorney-Approved Articles of Incorporation Template for the State of New Jersey

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The New Jersey Articles of Incorporation form is used to officially create a corporation in the state of New Jersey. |

| Governing Law | This form is governed by the New Jersey Business Corporation Act (N.J.S.A. 14A). |

| Filing Requirement | To incorporate, you must file the Articles of Incorporation with the New Jersey Division of Revenue and Enterprise Services. |

| Information Needed | Key information required includes the corporation's name, registered agent, and the purpose of the business. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which is currently set at $125. |

| Processing Time | The processing time for the Articles of Incorporation can vary, but it typically takes about 7-10 business days. |

| Post-Filing Obligations | After filing, corporations must comply with ongoing requirements, such as annual reports and maintaining a registered agent. |

Dos and Don'ts

When completing the New Jersey Articles of Incorporation form, it is essential to approach the process with care and attention to detail. Below are some important guidelines to consider, including both actions to take and pitfalls to avoid.

- Do ensure all information is accurate. Double-check names, addresses, and any other details to avoid delays.

- Do include the required fees. Make sure to submit the correct payment along with your application to facilitate processing.

- Do specify the purpose of the corporation clearly. A well-defined purpose helps in understanding the nature of your business.

- Do provide a registered agent's information. This person or entity will receive legal documents on behalf of the corporation.

- Do keep a copy of the completed form. Having a record for your own files can be helpful for future reference.

- Don't leave any sections blank. Each part of the form must be filled out to avoid rejection.

- Don't use abbreviations for names. Write out full names to prevent confusion or misidentification.

- Don't forget to review the filing instructions. Each form may have specific requirements that must be followed.

- Don't submit outdated forms. Always use the most current version available to ensure compliance.

- Don't rush the process. Take your time to ensure everything is completed correctly before submission.

Create Popular Articles of Incorporation Forms for Different States

Incorporating in Nc - Filing these Articles is a crucial step to legally operate your business.

Articles of Incorporation Texas - This form is often the first step in establishing a new business entity.

Florida Corporation - Once filed, the Articles must be adhered to unless amended formally.

To further understand the importance of having a solid legal document for your motorcycle transactions, it’s essential to be informed about the specifics of the New York Motorcycle Bill of Sale. For detailed guidance on how to properly fill out this form, you can read here.

Llc Filing Ohio - State regulations dictate specific information required in this form.

Common mistakes

-

Incorrect Business Name: Many individuals fail to ensure that the chosen business name is unique and not already in use by another entity in New Jersey. This oversight can lead to delays or rejections of the application.

-

Omitting Required Information: Some applicants neglect to include all necessary details, such as the purpose of the corporation or the names and addresses of the initial directors. Incomplete forms often result in processing issues.

-

Improper Designation of Registered Agent: A registered agent must be appointed to receive legal documents on behalf of the corporation. Failing to designate a qualified individual or entity can create complications for the business.

-

Choosing the Wrong Corporate Structure: Applicants sometimes select a corporate structure that does not align with their business goals, such as choosing a nonprofit designation when a for-profit structure is more appropriate.

-

Ignoring State-Specific Requirements: Each state has unique regulations. Many overlook specific New Jersey requirements, such as filing fees or publication mandates, which can lead to noncompliance.

-

Incorrect Filing Fees: Submitting the wrong amount for filing fees is a common mistake. This can result in delays, as the application may be returned for correction.

-

Failure to Sign the Document: Some individuals forget to sign the Articles of Incorporation. Without a signature, the document is not valid, and the application cannot be processed.

-

Not Keeping Copies: After submitting the form, failing to retain a copy for personal records can lead to issues later, especially if questions arise about the original submission.

Documents used along the form

When incorporating a business in New Jersey, the Articles of Incorporation is a crucial document. However, several other forms and documents are often required to complete the incorporation process. Below is a list of these essential documents.

- Bylaws: This document outlines the internal rules and regulations that govern the management of the corporation. Bylaws typically cover topics such as the roles of directors and officers, meeting procedures, and voting rights.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This report usually includes basic information about the corporation, such as its address, the names of its officers, and the nature of its business.

- Employer Identification Number (EIN): Obtaining an EIN from the IRS is essential for tax purposes. This unique number is required for opening a business bank account, hiring employees, and filing tax returns.

- Important Transaction Records: Proper documentation is vital for any business, just like having a Bill of Sale for RVs for vehicle transactions, which serves to verify the sale and establish ownership, ensuring that all parties know their rights and responsibilities.

- State Business Registration: Depending on the nature of the business, additional registrations may be necessary at the state level. This could include permits or licenses specific to the industry in which the corporation operates.

Understanding these documents can help streamline the incorporation process and ensure compliance with state requirements. Proper preparation will set a solid foundation for your new business venture.

Misconceptions

The New Jersey Articles of Incorporation form is often misunderstood. Below are ten common misconceptions about this important document.

- Only large businesses need to file Articles of Incorporation. Many small businesses and startups must also file to establish their legal entity.

- Filing Articles of Incorporation guarantees business success. While it provides legal recognition, success depends on various factors, including management and market conditions.

- The form is only required in New Jersey. Businesses operating in multiple states may need to file similar documents in each state where they do business.

- Articles of Incorporation can be filed at any time. There are specific timelines and requirements that must be adhered to for timely filing.

- Once filed, the Articles of Incorporation cannot be changed. Amendments can be made, but they require a formal process.

- Only attorneys can file the Articles of Incorporation. While legal assistance can be helpful, individuals can file the form themselves if they understand the requirements.

- All information in the Articles of Incorporation is public. Some details may be kept confidential, depending on state laws.

- Filing Articles of Incorporation is the only step to forming a corporation. Additional steps, such as obtaining licenses and permits, are often necessary.

- There is no fee for filing Articles of Incorporation. A filing fee is typically required, and it varies by state.

- Once incorporated, the business is shielded from all liabilities. Incorporation provides some protection, but it does not eliminate all personal liability.

Understanding these misconceptions can help individuals navigate the process of incorporation more effectively.

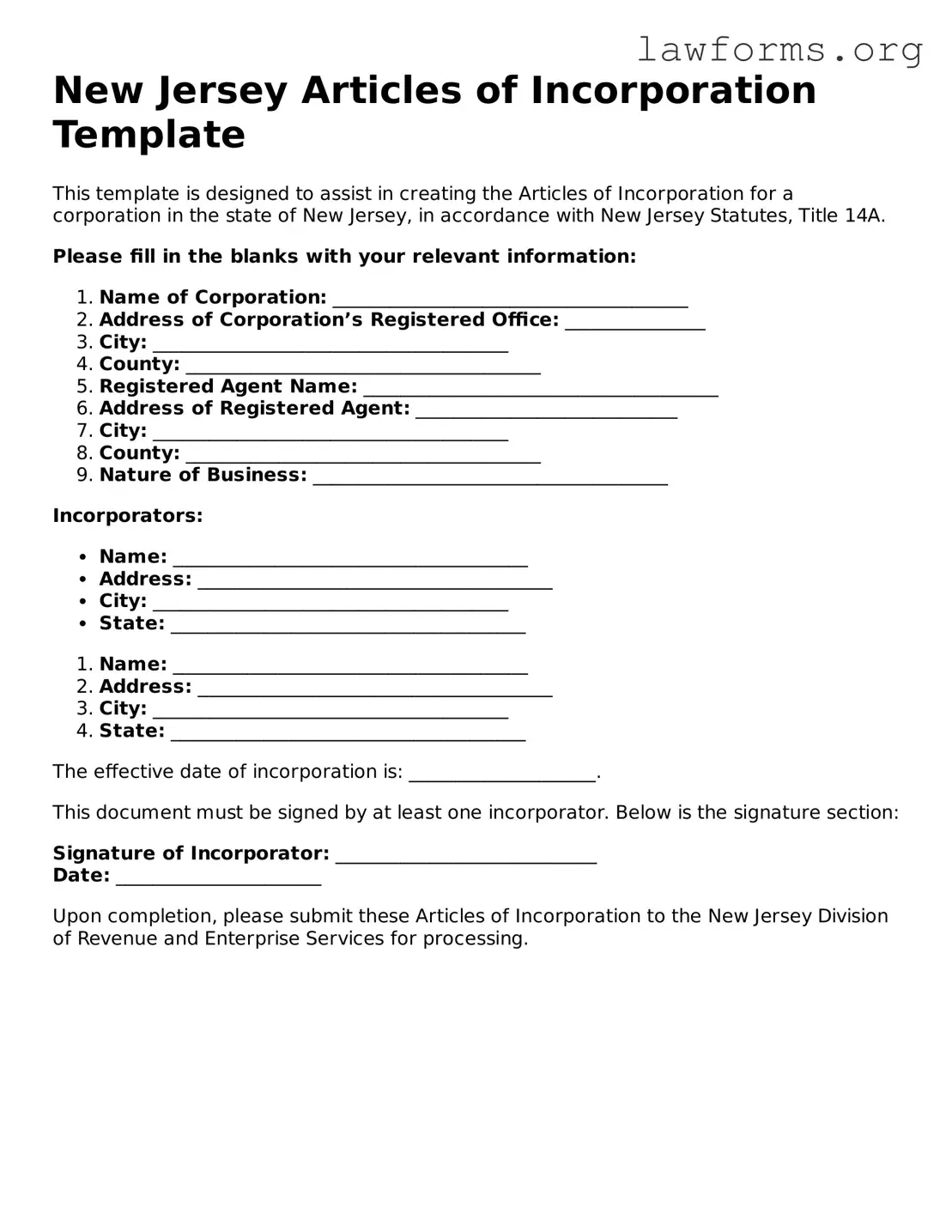

Preview - New Jersey Articles of Incorporation Form

New Jersey Articles of Incorporation Template

This template is designed to assist in creating the Articles of Incorporation for a corporation in the state of New Jersey, in accordance with New Jersey Statutes, Title 14A.

Please fill in the blanks with your relevant information:

- Name of Corporation: ______________________________________

- Address of Corporation’s Registered Office: _______________

- City: ______________________________________

- County: ______________________________________

- Registered Agent Name: ______________________________________

- Address of Registered Agent: ____________________________

- City: ______________________________________

- County: ______________________________________

- Nature of Business: ______________________________________

Incorporators:

- Name: ______________________________________

- Address: ______________________________________

- City: ______________________________________

- State: ______________________________________

- Name: ______________________________________

- Address: ______________________________________

- City: ______________________________________

- State: ______________________________________

The effective date of incorporation is: ____________________.

This document must be signed by at least one incorporator. Below is the signature section:

Signature of Incorporator: ____________________________

Date: ______________________

Upon completion, please submit these Articles of Incorporation to the New Jersey Division of Revenue and Enterprise Services for processing.

Key takeaways

When filling out and using the New Jersey Articles of Incorporation form, keep these key takeaways in mind:

- The form establishes your business as a legal entity in New Jersey.

- Provide accurate information about the corporation's name, which must be unique and not misleading.

- Include the registered agent's name and address; this person will receive legal documents on behalf of the corporation.

- Specify the purpose of the corporation clearly; this can be broad but should reflect your business activities.

- Indicate the number of shares the corporation is authorized to issue; this affects ownership structure and investment potential.

- Filing fees are required; ensure you check the current fee schedule to avoid delays.

- After submission, maintain a copy of the filed Articles of Incorporation for your records; this is essential for future reference.

Similar forms

-

Bylaws: Bylaws serve as the internal rules governing the management of a corporation. Like the Articles of Incorporation, they outline key aspects of the organization, including the roles of officers, procedures for meetings, and voting rights. Both documents are essential for establishing the framework of a corporation.

- Operating Agreement: For limited liability companies (LLCs), this document outlines the management structure and operational procedures, similar to how bylaws function for corporations. It is important to utilize resources such as Ohio PDF Forms to obtain the correct form tailored to your needs.

-

Operating Agreement: An Operating Agreement is similar to the Articles of Incorporation in that it outlines the management structure and operational procedures for a limited liability company (LLC). Both documents define the relationship among owners and provide guidelines for decision-making.

-

Certificate of Formation: A Certificate of Formation, also known as a Certificate of Incorporation in some states, is a document filed to officially create a corporation. It shares similarities with the Articles of Incorporation, as both serve as foundational documents that establish a business entity and its basic structure.

-

Partnership Agreement: A Partnership Agreement outlines the terms and conditions governing a partnership. Like the Articles of Incorporation, it details the roles and responsibilities of each partner, as well as profit-sharing arrangements. Both documents are crucial for clarifying expectations and reducing conflicts among business owners.