Attorney-Approved Durable Power of Attorney Template for the State of New Jersey

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to designate another person to make financial decisions on their behalf. |

| Durability | This type of power of attorney remains effective even if the principal becomes incapacitated. |

| Governing Law | The New Jersey Durable Power of Attorney is governed by the New Jersey Statutes, specifically N.J.S.A. 46:2B-8. |

| Principal | The person who creates the Durable Power of Attorney is referred to as the principal. |

| Agent | The individual appointed to act on behalf of the principal is known as the agent or attorney-in-fact. |

| Signing Requirements | The form must be signed by the principal and witnessed by at least one person or notarized. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent. |

| Use Cases | This document is often used for managing finances, real estate transactions, and other legal matters when the principal is unavailable. |

Dos and Don'ts

When filling out the New Jersey Durable Power of Attorney form, it's important to follow certain guidelines to ensure the document is valid and effective. Here are five things you should and shouldn't do:

- Do: Clearly identify the person you are appointing as your agent.

- Do: Specify the powers you are granting to your agent in detail.

- Do: Sign the form in the presence of a notary public.

- Do: Keep a copy of the completed form for your records.

- Do: Review the form periodically to ensure it still meets your needs.

- Don't: Leave any sections blank; incomplete forms may be rejected.

- Don't: Use vague language when describing the powers granted.

- Don't: Forget to date the document when signing.

- Don't: Assume your agent knows your wishes without discussing them first.

- Don't: Ignore state-specific requirements that may apply to the form.

Create Popular Durable Power of Attorney Forms for Different States

Ohio Durable Power of Attorney - A Durable Power of Attorney can cover financial and property matters.

Durable Power of Attorney Forms - It protects you against the risks of unexpected health issues or accidents.

When preparing for future uncertainties, it's crucial to have a robust estate plan in place, and one essential component is the Durable Power of Attorney. This document enables the principal to designate an agent who will have the authority to manage their financial and legal responsibilities, even in the event of incapacitation. For detailed guidance on how to complete this form, you can visit californiadocsonline.com/durable-power-of-attorney-form, ensuring your affairs are handled properly according to your wishes.

Durable Power Printable Power of Attorney Form - Many people choose to create this document as part of their estate planning.

Power of Attorney Texas Form - Your designated agent can manage banking transactions, pay bills, and handle property transactions.

Common mistakes

-

Not Choosing the Right Agent: One of the most common mistakes is failing to select an appropriate agent. The agent is the person you trust to make decisions on your behalf. It’s crucial to choose someone who is responsible, trustworthy, and understands your wishes.

-

Leaving Out Important Powers: Some individuals overlook the importance of specifying the powers granted to the agent. This can lead to confusion or disputes later on. Clearly outline the powers you want to give your agent, such as handling financial transactions, managing real estate, or making healthcare decisions.

-

Not Signing and Dating the Document: A common oversight is forgetting to sign and date the Durable Power of Attorney form. Without your signature and the date, the document may not be considered valid. Ensure that you complete this step to make your wishes legally binding.

-

Failing to Have Witnesses or Notarization: Depending on the requirements in New Jersey, you may need witnesses or notarization for your Durable Power of Attorney to be valid. Neglecting this step can render the document ineffective. Always check the current requirements and ensure compliance.

Documents used along the form

When creating a Durable Power of Attorney (DPOA) in New Jersey, it is often beneficial to consider additional documents that can complement this important legal instrument. These documents can help ensure that your wishes are honored and provide clarity regarding your preferences in various situations. Below is a list of commonly used forms and documents that may accompany a Durable Power of Attorney.

- Advance Healthcare Directive: This document outlines your medical preferences in case you become unable to communicate your wishes. It can include instructions regarding life-sustaining treatments and appoints a healthcare proxy to make decisions on your behalf.

- Living Will: A living will specifically details your wishes regarding end-of-life care. It serves as a guide for healthcare providers and family members, ensuring that your treatment preferences are respected.

- Last Will and Testament: This legal document outlines how your assets should be distributed after your death. It can also name guardians for minor children and designate an executor to manage your estate.

- Marital Separation Agreement: When planning for a separation, consider creating a comprehensive Marital Separation Agreement form to outline the division of assets and responsibilities.

- Revocable Trust: A revocable trust allows you to manage your assets during your lifetime and specifies how they should be distributed upon your death. It can help avoid probate and provide privacy regarding your estate.

- HIPAA Authorization: This form allows you to authorize specific individuals to access your medical records and discuss your health information with healthcare providers. It ensures that your chosen representatives can make informed decisions regarding your care.

- Financial Power of Attorney: While a Durable Power of Attorney covers a broad range of powers, a financial power of attorney can specifically focus on financial matters, allowing someone to manage your finances if you are unable to do so.

- Property Transfer Deed: This document is used to transfer ownership of real estate from one person to another. It can be useful in estate planning to ensure that property is passed on according to your wishes.

Incorporating these documents alongside your Durable Power of Attorney can provide a comprehensive approach to managing your affairs and ensuring your wishes are honored. Each document serves a unique purpose, and together they can help create a clear and organized plan for your future.

Misconceptions

- Misconception 1: A Durable Power of Attorney is only for elderly individuals.

- Misconception 2: A Durable Power of Attorney can be used to make decisions after death.

- Misconception 3: A Durable Power of Attorney is the same as a living will.

- Misconception 4: Once signed, a Durable Power of Attorney cannot be revoked.

- Misconception 5: All Durable Power of Attorney forms are the same.

- Misconception 6: A Durable Power of Attorney automatically gives the agent access to all financial accounts.

- Misconception 7: You do not need a witness or notarization for a Durable Power of Attorney to be valid.

- Misconception 8: A Durable Power of Attorney is only for financial matters.

- Misconception 9: Once you create a Durable Power of Attorney, you lose control over your affairs.

This is not true. Anyone, regardless of age, can benefit from a Durable Power of Attorney. It is a useful tool for anyone who wants to ensure their financial and medical decisions are managed by someone they trust in case they become incapacitated.

This is incorrect. A Durable Power of Attorney ceases to be effective upon the principal's death. After death, the authority to make decisions transfers to the executor of the estate or a court-appointed representative.

This is a common misunderstanding. A Durable Power of Attorney grants someone the authority to make financial and legal decisions on your behalf, while a living will specifically addresses your medical treatment preferences in the event you cannot communicate them yourself.

This is false. The principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent. Revocation should be done in writing to avoid confusion.

This is misleading. While many forms may serve a similar purpose, the specific provisions and requirements can vary by state. It is essential to use a form that complies with New Jersey laws to ensure its validity.

This is not accurate. The principal can specify which powers the agent has, including limitations on access to certain accounts or types of decisions. Clarity in the document is crucial.

This is incorrect in New Jersey. The state requires that the Durable Power of Attorney be signed by the principal in the presence of a notary public or two witnesses to be legally binding.

This is a misconception. While it is commonly used for financial decisions, it can also grant authority for medical decisions, depending on how it is drafted. It is important to be specific about the powers granted.

This is not the case. The principal retains control over their affairs as long as they are competent. The Durable Power of Attorney only comes into effect when the principal is incapacitated, and they can revoke it at any time while competent.

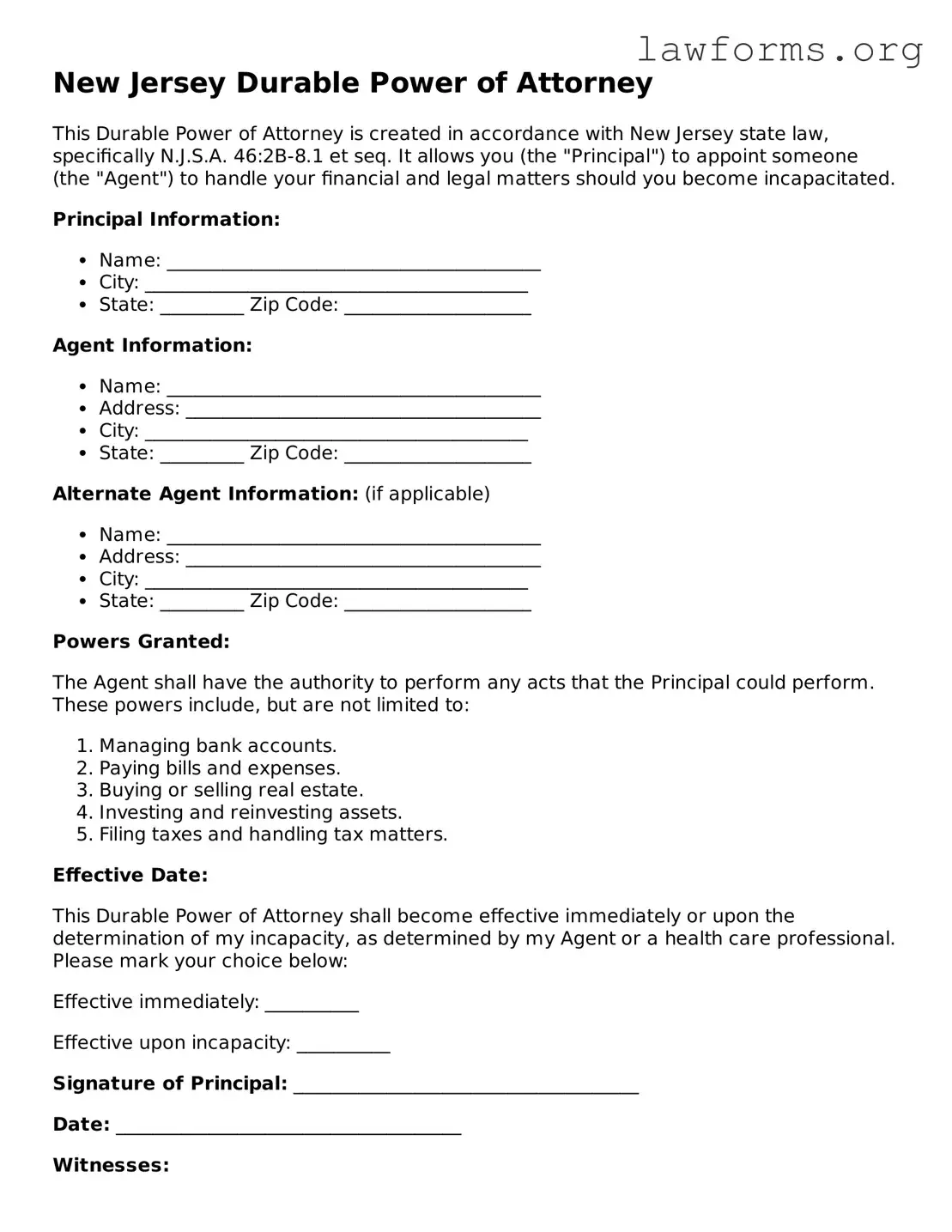

Preview - New Jersey Durable Power of Attorney Form

New Jersey Durable Power of Attorney

This Durable Power of Attorney is created in accordance with New Jersey state law, specifically N.J.S.A. 46:2B-8.1 et seq. It allows you (the "Principal") to appoint someone (the "Agent") to handle your financial and legal matters should you become incapacitated.

Principal Information:

- Name: ________________________________________

- City: _________________________________________

- State: _________ Zip Code: ____________________

Agent Information:

- Name: ________________________________________

- Address: ______________________________________

- City: _________________________________________

- State: _________ Zip Code: ____________________

Alternate Agent Information: (if applicable)

- Name: ________________________________________

- Address: ______________________________________

- City: _________________________________________

- State: _________ Zip Code: ____________________

Powers Granted:

The Agent shall have the authority to perform any acts that the Principal could perform. These powers include, but are not limited to:

- Managing bank accounts.

- Paying bills and expenses.

- Buying or selling real estate.

- Investing and reinvesting assets.

- Filing taxes and handling tax matters.

Effective Date:

This Durable Power of Attorney shall become effective immediately or upon the determination of my incapacity, as determined by my Agent or a health care professional. Please mark your choice below:

Effective immediately: __________

Effective upon incapacity: __________

Signature of Principal: _____________________________________

Date: _____________________________________

Witnesses:

Two witnesses must sign below. They may not be relatives or designated agents.

- Witness 1: ____________________________________ Date: ___________

- Witness 2: ____________________________________ Date: ___________

Notary Public:

If required, please have this document notarized below.

Notary Signature: ___________________________________

Commission Number: _______________________________

My Commission Expires: ___________________________

Key takeaways

Filling out and using the New Jersey Durable Power of Attorney form is an important process that can help manage your affairs if you become unable to do so. Here are key takeaways to keep in mind:

- The form allows you to designate someone to act on your behalf in financial matters.

- It remains effective even if you become incapacitated.

- You must be of sound mind when you complete the form.

- Choose your agent carefully; this person will have significant authority over your financial decisions.

- Clearly outline the powers you are granting to your agent to avoid confusion.

- Consider having the document notarized for added legal strength.

- You can revoke the Durable Power of Attorney at any time, as long as you are mentally competent.

- It is advisable to discuss your wishes with your agent before completing the form.

- Keep copies of the completed form in a safe place and provide copies to your agent and relevant institutions.

Understanding these points will help ensure that your Durable Power of Attorney serves your needs effectively.

Similar forms

- General Power of Attorney: This document grants broad authority to an agent to act on behalf of the principal in various matters, similar to a Durable Power of Attorney, but it typically becomes void if the principal becomes incapacitated.

- Health Care Power of Attorney: This form specifically allows an agent to make medical decisions for the principal if they are unable to do so. It focuses on health care, unlike the Durable Power of Attorney, which can cover a wider range of financial and legal matters.

- Living Will: A living will outlines the principal's wishes regarding medical treatment and end-of-life care. While it does not appoint an agent, it complements the Health Care Power of Attorney by providing guidance on treatment preferences.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically addresses financial matters, allowing an agent to manage the principal's financial affairs, but it may not remain effective during incapacitation unless specified.

- Mobile Home Bill of Sale: This form is essential for transferring ownership of a mobile home and can be sourced from Forms Washington, ensuring that all necessary details are legally documented for both the buyer and seller.

- Advance Directive: This document combines elements of a living will and a health care power of attorney, providing instructions for medical care and designating an agent for health care decisions.

- Revocable Trust: A revocable trust allows a person to manage their assets during their lifetime and specifies how those assets should be distributed after death. It can serve similar purposes as a Durable Power of Attorney, particularly in asset management.

- Guardianship Documents: These documents establish a legal guardian for an individual who cannot make decisions for themselves. While not directly similar, they address the need for decision-making authority when an individual is incapacitated.

- Will: A will outlines how a person's assets should be distributed after their death. While it does not grant authority during life, it is similar in that both documents deal with the management of a person's affairs.