Attorney-Approved Operating Agreement Template for the State of New Jersey

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The New Jersey Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Governing Law | The agreement is governed by the New Jersey Limited Liability Company Act, specifically N.J.S.A. 42:2C-1 et seq. |

| Members | It defines the rights and responsibilities of the members, who are the owners of the LLC. |

| Management Structure | The agreement can specify whether the LLC is member-managed or manager-managed. |

| Profit Distribution | It outlines how profits and losses will be distributed among members, which can be in proportion to their ownership interests. |

| Decision-Making | The document may detail the voting rights of members and the process for making decisions. |

| Amendments | It provides a framework for how the agreement can be amended in the future, ensuring flexibility for the LLC. |

| Indemnification | The agreement often includes provisions for indemnifying members and managers against certain liabilities. |

| Dispute Resolution | It may outline the methods for resolving disputes among members, such as mediation or arbitration. |

| Compliance | Having an operating agreement is not legally required in New Jersey, but it is highly recommended to avoid misunderstandings. |

Dos and Don'ts

When filling out the New Jersey Operating Agreement form, it’s important to be thorough and accurate. Here are some key do's and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information about the members and their roles.

- Do include the purpose of your LLC in the agreement.

- Do specify how profits and losses will be distributed.

- Do ensure that all members sign the agreement.

- Don't leave any sections blank; fill out all required fields.

- Don't use vague language; be clear and specific.

- Don't forget to keep a copy for your records.

- Don't rush through the process; take your time to avoid mistakes.

By following these guidelines, you can help ensure that your Operating Agreement is properly completed and serves its intended purpose.

Create Popular Operating Agreement Forms for Different States

Ohio Llc Operating Agreement Pdf - This document is vital for establishing the professional framework of an LLC.

A Washington Non-disclosure Agreement (NDA) is a legal document that helps protect sensitive information shared between parties. It ensures that confidential details remain private and are not disclosed to unauthorized individuals. This agreement is essential for businesses and individuals looking to safeguard their proprietary information, and you can find a helpful template at Forms Washington.

Ny Llc Operating Agreement Template - An Operating Agreement can help clarify the expectations of each member from the business.

How Much to Start an Llc in Texas - This document can serve as evidence of your business's existence.

Operating Agreement Llc Florida Template - The agreement defines how profits and losses are distributed among members.

Common mistakes

-

Failing to include all members' names and addresses. Each member's information is crucial for legal recognition.

-

Not specifying the percentage of ownership. This detail clarifies each member's stake in the business.

-

Leaving out the purpose of the business. A clear statement of purpose helps define the scope of operations.

-

Overlooking the voting rights of members. Clearly outlining how decisions are made prevents future disputes.

-

Neglecting to outline the process for adding new members. This ensures a smooth transition when bringing in new partners.

-

Not addressing how profits and losses will be distributed. This section is vital for financial clarity among members.

-

Failing to include a process for resolving disputes. A clear procedure can save time and resources in the event of disagreements.

-

Not updating the agreement when changes occur. Keeping the document current is essential for ongoing compliance.

-

Ignoring state-specific requirements. Each state may have unique regulations that need to be followed.

-

Not having all members sign the agreement. Signatures are necessary for the document to be legally binding.

Documents used along the form

When forming a business in New Jersey, the Operating Agreement is a key document that outlines the management structure and operational procedures of a limited liability company (LLC). However, several other forms and documents are often used in conjunction with the Operating Agreement to ensure compliance and smooth operation. Here are some of the commonly used documents:

- Articles of Organization: This document is filed with the New Jersey Division of Revenue and Enterprise Services to officially create the LLC. It includes basic information such as the LLC's name, address, and registered agent.

- Bylaws: While not mandatory for LLCs, bylaws can provide additional structure. They detail the rules governing the internal management of the company, including meetings, voting rights, and responsibilities of members.

- Membership Certificate: This certificate serves as proof of ownership for each member in the LLC. It can help clarify the percentage of ownership and rights associated with each member.

- Initial Resolution: This document records the initial decisions made by the members of the LLC, such as appointing officers or approving the Operating Agreement. It helps establish a formal record of these important actions.

- Employer Identification Number (EIN): Obtaining an EIN from the IRS is crucial for tax purposes. This number is necessary for opening a business bank account and hiring employees.

- State Business License: Depending on the type of business and location, a state business license may be required. This document ensures that the LLC is compliant with local regulations.

- Motorcycle Bill of Sale: This form serves as proof of purchase for a motorcycle transaction in Minnesota, ensuring all details are formally recorded and protecting the rights of both parties involved. For more information, visit Formaid Org.

- Operating Procedures: This document outlines specific processes and procedures for daily operations. It can include information on how decisions are made and how disputes are resolved.

- Annual Report: New Jersey requires LLCs to file an annual report to maintain good standing. This document updates the state on the LLC's information, including changes in members or management.

These documents work together to create a comprehensive framework for managing and operating an LLC in New Jersey. Understanding each of these forms can help ensure that the business remains compliant with state laws and operates smoothly.

Misconceptions

When it comes to the New Jersey Operating Agreement form, several misconceptions can lead to confusion among business owners and partners. Understanding these myths is crucial for ensuring compliance and making informed decisions. Here are six common misconceptions:

- It is not necessary for all LLCs. Many people believe that an Operating Agreement is optional for Limited Liability Companies (LLCs). However, in New Jersey, while it is not legally required, having one is highly recommended to outline the management structure and operating procedures.

- All Operating Agreements are the same. Some assume that a standard template will suffice for every LLC. In reality, each Operating Agreement should be tailored to the specific needs and goals of the business and its members.

- Verbal agreements are sufficient. There is a misconception that a verbal agreement among members is enough. However, without a written Operating Agreement, disputes can arise, and it may be challenging to prove the terms of the agreement in court.

- Operating Agreements are only for multi-member LLCs. Some believe that only LLCs with multiple members need an Operating Agreement. In truth, single-member LLCs can also benefit from having a formal document to clarify the owner's intentions and protect their limited liability status.

- It cannot be changed once created. A common myth is that once an Operating Agreement is drafted, it cannot be modified. In fact, members can amend the agreement as needed, provided that the process for amendments is outlined within the document.

- It has no legal significance. Some individuals think that an Operating Agreement is just a formality with no real legal impact. On the contrary, it serves as a binding contract among members and can be enforced in court, making it an essential part of the LLC's operations.

Addressing these misconceptions can empower business owners in New Jersey to create effective Operating Agreements that protect their interests and clarify their business relationships.

Preview - New Jersey Operating Agreement Form

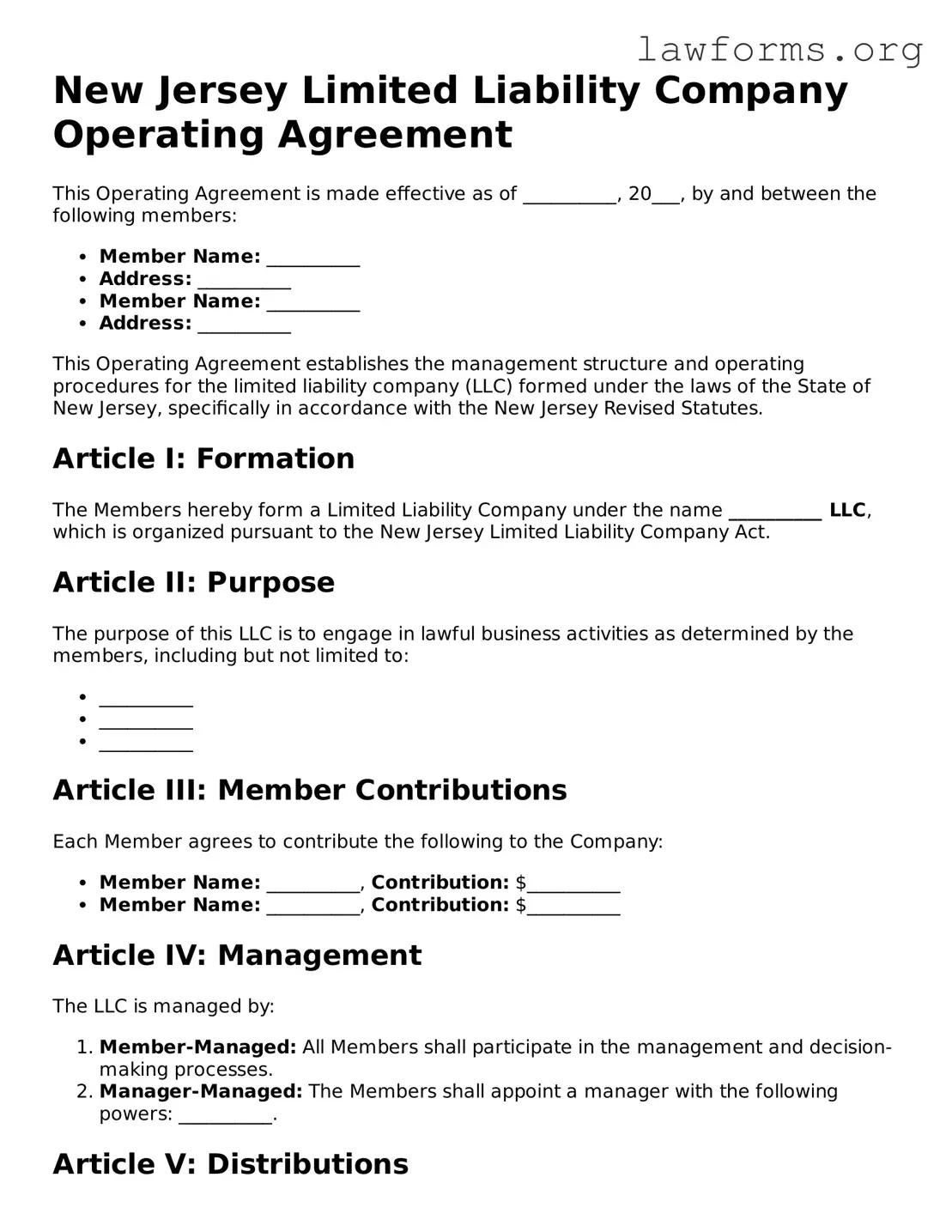

New Jersey Limited Liability Company Operating Agreement

This Operating Agreement is made effective as of __________, 20___, by and between the following members:

- Member Name: __________

- Address: __________

- Member Name: __________

- Address: __________

This Operating Agreement establishes the management structure and operating procedures for the limited liability company (LLC) formed under the laws of the State of New Jersey, specifically in accordance with the New Jersey Revised Statutes.

Article I: Formation

The Members hereby form a Limited Liability Company under the name __________ LLC, which is organized pursuant to the New Jersey Limited Liability Company Act.

Article II: Purpose

The purpose of this LLC is to engage in lawful business activities as determined by the members, including but not limited to:

- __________

- __________

- __________

Article III: Member Contributions

Each Member agrees to contribute the following to the Company:

- Member Name: __________, Contribution: $__________

- Member Name: __________, Contribution: $__________

Article IV: Management

The LLC is managed by:

- Member-Managed: All Members shall participate in the management and decision-making processes.

- Manager-Managed: The Members shall appoint a manager with the following powers: __________.

Article V: Distributions

Any profits and losses from the business shall be allocated to the members in proportion to their respective contributions as outlined in Article III.

Article VI: Meetings

Meetings of the members shall be held:

- At least once a year.

- When deemed necessary by any member.

Article VII: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article VIII: Miscellaneous

If any provision of this Operating Agreement is held to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

IN WITNESS WHEREOF, the undersigned members hereby consent to and execute this Operating Agreement as of the date first above written.

SIGNED: _____________________________________

NAME: __________ DATE: __________

SIGNED: _____________________________________

NAME: __________ DATE: __________

Key takeaways

When filling out and using the New Jersey Operating Agreement form, consider the following key takeaways:

- Understand the Purpose: The Operating Agreement outlines the management structure and operational guidelines for your LLC, ensuring all members are on the same page.

- Customize to Your Needs: Each agreement should reflect the unique circumstances of your LLC, including member roles, profit distribution, and decision-making processes.

- Include Essential Details: Be sure to specify the LLC's name, address, and duration, along with the names and addresses of all members.

- Member Contributions: Clearly state the contributions of each member, whether in cash, property, or services, to avoid disputes later.

- Review and Update: Regularly review the agreement to ensure it remains relevant as your business evolves, making updates as necessary.

- Legal Compliance: Ensure that the agreement complies with New Jersey laws to protect your LLC and its members from potential legal issues.

Similar forms

- Partnership Agreement: Similar to an Operating Agreement, a Partnership Agreement outlines the roles, responsibilities, and profit-sharing arrangements among partners in a business. Both documents aim to clarify expectations and prevent disputes.

- Bylaws: Bylaws govern the internal management of a corporation. Like an Operating Agreement, they define the structure and procedures for decision-making, meetings, and roles of officers.

- Hold Harmless Agreement: This crucial legal document protects one party from liability in various situations, similar to other agreements, and can be learned more about at https://californiadocsonline.com/hold-harmless-agreement-form/.

- Shareholder Agreement: This document details the rights and obligations of shareholders in a corporation. It is akin to an Operating Agreement in that it establishes rules for ownership transfer and dispute resolution.

- Joint Venture Agreement: A Joint Venture Agreement outlines the terms of collaboration between two or more parties for a specific project. It shares similarities with an Operating Agreement in defining each party's contributions and responsibilities.

- LLC Membership Agreement: This agreement is specific to Limited Liability Companies and details the rights and duties of members. It serves a similar purpose to an Operating Agreement by governing the operations of the LLC.

- Franchise Agreement: A Franchise Agreement sets the terms between a franchisor and franchisee. Like an Operating Agreement, it outlines operational guidelines and expectations for both parties.

- Employment Agreement: This document defines the relationship between an employer and employee. It is similar to an Operating Agreement in that it clarifies roles, responsibilities, and compensation.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared between parties. While its focus is different, it serves to establish clear expectations regarding privacy, similar to how an Operating Agreement sets forth operational guidelines.

- Asset Purchase Agreement: This document details the terms of buying and selling assets between parties. It resembles an Operating Agreement in its specificity regarding the terms of ownership and responsibilities related to the assets involved.