Attorney-Approved Power of Attorney Template for the State of New Jersey

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) in New Jersey allows one person to grant another the authority to make decisions on their behalf. |

| Governing Law | The New Jersey Power of Attorney is governed by the New Jersey Revised Statutes, specifically Title 46, Chapter 2B. |

| Types of POA | New Jersey recognizes different types of Power of Attorney, including General, Limited, and Durable POA. |

| Durable POA | A Durable Power of Attorney remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke a Power of Attorney at any time, provided they are mentally competent. |

| Signature Requirements | The document must be signed by the principal and acknowledged before a notary public. |

| Agent's Responsibilities | The agent must act in the best interest of the principal and manage their affairs responsibly. |

| Limitations | Certain actions, like making healthcare decisions, may require a separate healthcare proxy or advance directive. |

Dos and Don'ts

Filling out a Power of Attorney (POA) form in New Jersey is an important step in ensuring that your financial and medical decisions can be handled by someone you trust. To help you navigate this process, here’s a list of things you should and shouldn't do.

- Do choose a trustworthy agent.

- Do clearly outline the powers you are granting.

- Do discuss your wishes with your agent beforehand.

- Do sign the document in the presence of a notary.

- Do keep a copy of the signed POA for your records.

- Don't rush through the form; take your time to understand it.

- Don't grant powers that you are uncomfortable with.

- Don't forget to update the POA if your circumstances change.

- Don't assume that all agents have the same authority; clarify roles if needed.

By following these guidelines, you can ensure that your Power of Attorney form serves its intended purpose effectively and provides peace of mind for you and your loved ones.

Create Popular Power of Attorney Forms for Different States

California Poa - Always consult a legal professional for proper completion.

A California Hold Harmless Agreement is a legal document designed to protect one party from liability for certain actions or events. This form is commonly used in various situations, such as contracts and rental agreements, where one party agrees to assume the risk and hold another party harmless from any potential claims. For more information about this important document, you can refer to the details at https://californiadocsonline.com/hold-harmless-agreement-form. Understanding this agreement is essential for anyone looking to navigate liability issues effectively in California.

Printable Power of Attorney Form Texas - Individuals can appoint a single agent or multiple agents to share responsibilities.

General Power of Attorney Form Florida - It can be used for financial, medical, and legal matters.

Common mistakes

-

Not specifying the powers granted: Some individuals fail to clearly outline the specific powers they wish to grant to their agent. This can lead to confusion and potential disputes later on.

-

Forgetting to date the document: A common oversight is neglecting to include the date when the Power of Attorney is signed. Without a date, the validity of the document may be questioned.

-

Not having the document notarized: In New Jersey, a Power of Attorney must be notarized to be legally binding. Failing to do so can render the document ineffective.

-

Choosing an untrustworthy agent: Selecting someone who is not trustworthy or reliable can lead to misuse of the granted powers. It is essential to choose an agent who will act in the best interest of the principal.

-

Overlooking witness signatures: In some cases, additional witness signatures may be required. Not including these can cause complications in the future.

-

Failing to communicate with the agent: It is crucial to discuss the responsibilities and expectations with the chosen agent before finalizing the document. Lack of communication can lead to misunderstandings about the agent's role.

Documents used along the form

When creating a Power of Attorney in New Jersey, several other documents may be necessary to ensure comprehensive legal coverage. These forms complement the Power of Attorney and help clarify the principal's wishes, protect assets, and manage healthcare decisions. Below is a list of commonly used documents.

- Advance Healthcare Directive: This document outlines an individual's healthcare preferences in case they become unable to communicate their wishes. It can include instructions regarding life-sustaining treatment and appoints a healthcare proxy to make decisions on behalf of the individual.

- Living Will: A Living Will specifies the types of medical treatment a person does or does not want at the end of life. It serves as a guide for healthcare providers and family members when critical decisions must be made.

- Notary Acknowledgement Form: To validate the authenticity of signatures, utilize our Texas Notary Acknowledgement document guidelines for ensuring legal compliance and security.

- Last Will and Testament: This document details how a person's assets will be distributed upon their death. It can appoint an executor to manage the estate and ensure that the deceased's wishes are honored.

- Financial Power of Attorney: Similar to a general Power of Attorney, this form specifically grants authority to an agent to manage financial matters. It can be limited to specific transactions or be comprehensive, covering all financial decisions.

- Property Transfer Document: This document is used to transfer ownership of real estate or other property from one person to another. It is often necessary when a Power of Attorney is utilized for real estate transactions.

Utilizing these documents in conjunction with a Power of Attorney can provide clarity and ensure that an individual's wishes are respected in various situations. It is advisable to consult with a legal professional to ensure all forms are completed correctly and reflect the individual's intentions.

Misconceptions

Understanding the New Jersey Power of Attorney form is crucial for anyone considering this important legal document. However, several misconceptions often cloud people's understanding. Here are five common misconceptions:

- All Power of Attorney forms are the same. Many people believe that a Power of Attorney (POA) is a one-size-fits-all document. In reality, different states have specific requirements and forms. New Jersey has its own unique Power of Attorney form that must comply with state laws.

- A Power of Attorney is only for financial matters. While many associate a POA with financial decisions, it can also cover medical and personal matters. A comprehensive POA can grant authority for both financial and healthcare decisions, depending on how it is drafted.

- Once a Power of Attorney is signed, it cannot be revoked. This is a common myth. In New Jersey, you can revoke a Power of Attorney at any time, as long as you are mentally competent. It’s essential to communicate the revocation to all relevant parties to avoid confusion.

- Only lawyers can create a Power of Attorney. While having a lawyer draft your POA can ensure it meets all legal requirements, individuals can create a valid Power of Attorney on their own. However, it is wise to seek legal advice to ensure that the document reflects your wishes accurately.

- A Power of Attorney ends when the principal becomes incapacitated. This is not entirely true. In New Jersey, a durable Power of Attorney remains in effect even if the principal becomes incapacitated. This feature allows the appointed agent to continue making decisions on behalf of the principal when they can no longer do so.

By dispelling these misconceptions, individuals can make informed decisions about utilizing the New Jersey Power of Attorney form effectively. Understanding the nuances of this document can lead to better planning and peace of mind.

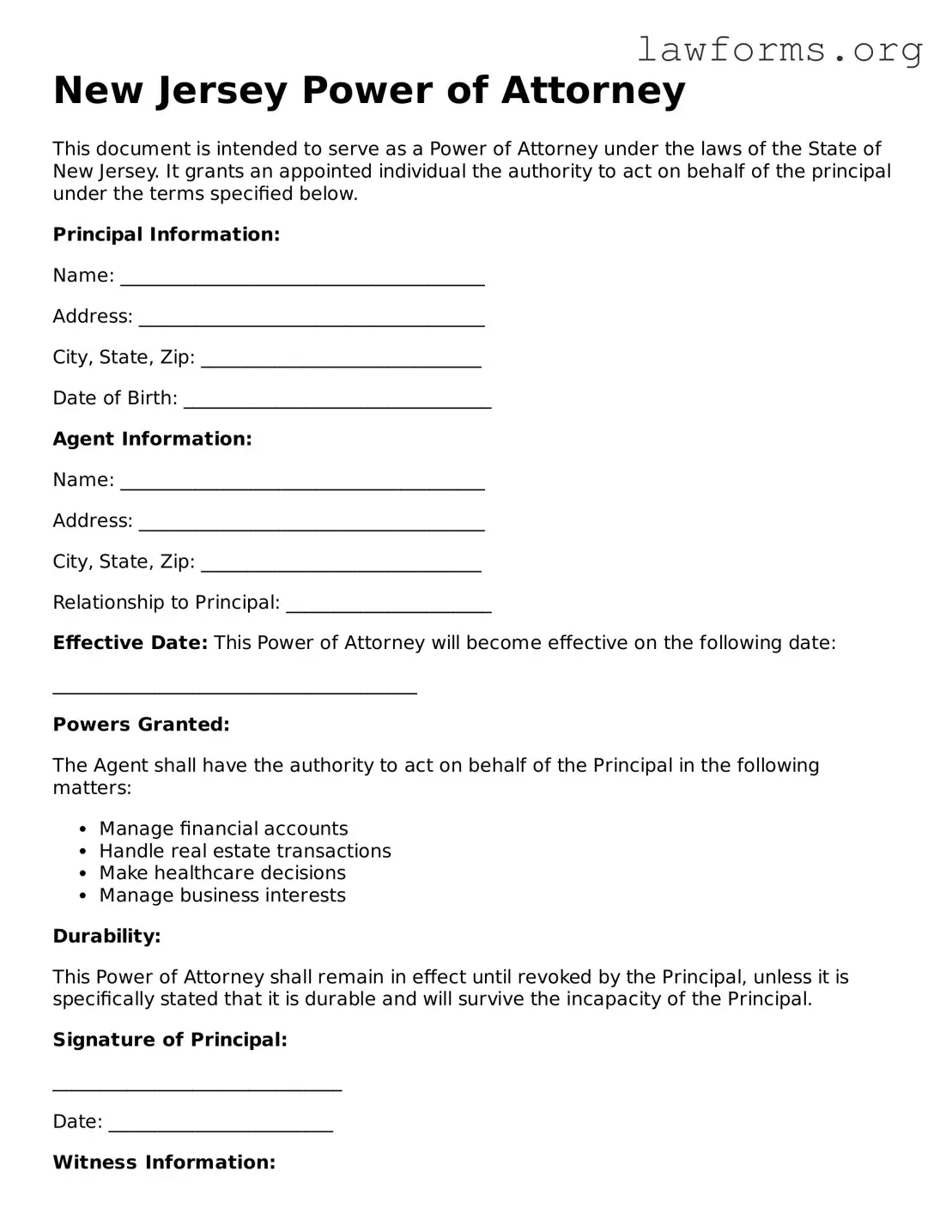

Preview - New Jersey Power of Attorney Form

New Jersey Power of Attorney

This document is intended to serve as a Power of Attorney under the laws of the State of New Jersey. It grants an appointed individual the authority to act on behalf of the principal under the terms specified below.

Principal Information:

Name: _______________________________________

Address: _____________________________________

City, State, Zip: ______________________________

Date of Birth: _________________________________

Agent Information:

Name: _______________________________________

Address: _____________________________________

City, State, Zip: ______________________________

Relationship to Principal: ______________________

Effective Date: This Power of Attorney will become effective on the following date:

_______________________________________

Powers Granted:

The Agent shall have the authority to act on behalf of the Principal in the following matters:

- Manage financial accounts

- Handle real estate transactions

- Make healthcare decisions

- Manage business interests

Durability:

This Power of Attorney shall remain in effect until revoked by the Principal, unless it is specifically stated that it is durable and will survive the incapacity of the Principal.

Signature of Principal:

_______________________________

Date: ________________________

Witness Information:

Name: _______________________________________

Address: _____________________________________

Signature: ________________________________

Date: ________________________

Notary Acknowledgement:

State of New Jersey

County of ____________________________

Subscribed and sworn to before me on this _____ day of ____________, 20___.

______________________________

Notary Public Signature

My commission expires: ______________________

Key takeaways

In New Jersey, a Power of Attorney (POA) form allows an individual to designate another person to act on their behalf in financial or legal matters.

The form must be completed with clear and specific instructions regarding the powers granted to the agent. Ambiguities can lead to misunderstandings.

The principal, or the person granting the authority, must sign the document in the presence of a notary public or two witnesses to ensure its validity.

It is important to choose a trustworthy agent, as they will have significant control over the principal's affairs.

New Jersey law allows the principal to revoke or modify the Power of Attorney at any time, provided they are mentally competent.

Individuals should keep copies of the completed POA form in a safe place and provide copies to the agent and any relevant financial institutions.

Similar forms

- Living Will: A living will outlines a person's wishes regarding medical treatment in case they become unable to communicate. Like a Power of Attorney, it allows someone to make decisions on behalf of another, particularly in medical situations.

- Healthcare Proxy: This document designates someone to make healthcare decisions for an individual if they are incapacitated. Similar to a Power of Attorney, it grants authority to act in specific situations, focusing on health-related matters.

- Durable Power of Attorney: This is a specific type of Power of Attorney that remains effective even if the principal becomes incapacitated. It shares the same purpose but adds a layer of durability for ongoing authority.

- Financial Power of Attorney: This document specifically grants someone the authority to handle financial matters. While a general Power of Attorney may cover various aspects, this one is focused solely on financial decisions.

- Trust Agreement: A trust agreement allows a person to transfer assets to a trustee for the benefit of beneficiaries. Like a Power of Attorney, it involves delegating authority and responsibilities regarding property and assets.

- Guardianship Agreement: This document appoints someone to make decisions for a minor or incapacitated adult. It is similar in that it involves the delegation of authority, but it often includes broader responsibilities than a Power of Attorney.

- Advance Directive: An advance directive combines a living will and healthcare proxy. It provides instructions for medical care and designates someone to make decisions, paralleling the decision-making aspect of a Power of Attorney.

- Non-disclosure Agreement: A vital legal tool to protect sensitive information, a Non-disclosure Agreement helps ensure that proprietary details remain confidential, which is crucial for business operations. For further information, you can refer to Forms Washington.

- Bill of Sale: A bill of sale transfers ownership of personal property. While it does not grant decision-making authority, it involves the delegation of rights regarding property, akin to the transfer of authority in a Power of Attorney.

- Release of Liability: This document releases one party from responsibility for certain actions or outcomes. It shares a similar concept of delegating authority or responsibility but is more focused on liability than decision-making.

- Business Partnership Agreement: This agreement outlines the roles and responsibilities of partners in a business. It involves delegating authority and decision-making powers, similar to how a Power of Attorney grants authority to act on behalf of another.