Attorney-Approved Promissory Note Template for the State of New Jersey

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money at a specified time. |

| Governing Law | New Jersey's promissory notes are governed by the Uniform Commercial Code (UCC), specifically N.J.S.A. 12A:3-104. |

| Parties Involved | The note involves two main parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The interest rate can be fixed or variable, depending on the agreement between the parties. |

| Payment Terms | Payment terms must be clearly stated, including the due date and any installment requirements. |

| Signature Requirement | The maker's signature is essential for the note to be valid and enforceable. |

| Transferability | Promissory notes can be transferred or sold to another party, subject to certain conditions. |

| Default Provisions | Provisions regarding default should be included, outlining the consequences of non-payment. |

| Legal Recourse | If the maker defaults, the payee has the right to pursue legal action to recover the owed amount. |

| State-Specific Requirements | New Jersey does not require notarization, but it is recommended for added legal protection. |

Dos and Don'ts

When filling out the New Jersey Promissory Note form, there are important guidelines to follow. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before filling it out.

- Do provide accurate information regarding the loan amount and terms.

- Do sign and date the document in the appropriate sections.

- Do keep a copy of the completed form for your records.

- Do consult with a legal professional if you have any questions.

- Don’t leave any required fields blank.

- Don’t use vague language when describing the loan terms.

- Don’t sign the document without fully understanding its contents.

- Don’t forget to include the interest rate, if applicable.

- Don’t ignore state-specific regulations that may apply.

Create Popular Promissory Note Forms for Different States

Create Promissory Note - The lender’s signature may also be required to validate the note.

A Washington Non-disclosure Agreement (NDA) is a legal document that helps protect sensitive information shared between parties. It ensures that confidential details remain private and are not disclosed to unauthorized individuals. This agreement is essential for businesses and individuals looking to safeguard their proprietary information, and you can find a useful template at Forms Washington.

Texas Promissory Note - A Promissory Note can be a valuable resource for both informal and formal lending situations.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. Borrowers and lenders must include their full names, addresses, and contact information. Missing even one piece of information can lead to confusion later.

-

Incorrect Loan Amount: Accurately stating the loan amount is crucial. Errors in this figure can create disputes about the terms of repayment. Double-check the amount before finalizing the document.

-

Omitting Interest Rate: The interest rate should be clearly specified. Not including it can lead to misunderstandings regarding the total amount to be repaid. Be explicit about whether the rate is fixed or variable.

-

Neglecting Repayment Terms: Clearly outlining the repayment schedule is essential. Many people forget to specify due dates or the frequency of payments. This omission can result in missed payments and potential legal issues.

-

Failure to Sign: A promissory note is not valid without signatures from both parties. Ensure that all required signatures are present, including dates. An unsigned note cannot be enforced in court.

-

Not Including Default Terms: It’s important to define what happens in case of default. Many people overlook this aspect, which can lead to complications if a borrower fails to repay the loan.

-

Ignoring State Laws: Each state has its own regulations regarding promissory notes. Failing to comply with New Jersey’s specific requirements can render the document invalid. Researching state laws is a crucial step in the process.

Documents used along the form

When dealing with financial agreements in New Jersey, the Promissory Note is often accompanied by several other important forms and documents. Each of these documents serves a specific purpose and helps clarify the terms of the agreement between the parties involved. Below is a list of commonly used documents that you may encounter alongside a New Jersey Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets that back the loan. It details the rights of the lender in case the borrower defaults.

- Personal Guarantee: This document is signed by an individual who agrees to be personally responsible for the loan if the borrower fails to repay. It adds an extra layer of security for the lender.

- Disclosure Statement: This statement provides important information regarding the terms of the loan, including any fees, interest rates, and other costs. It ensures transparency between the parties.

- Amortization Schedule: This document outlines the repayment plan, showing how much of each payment goes toward principal and interest over the life of the loan. It helps borrowers understand their payment obligations.

- Letter of Intent: This preliminary document expresses the intention of the parties to enter into a formal agreement. It can help set the stage for negotiations and clarify initial terms.

- Default Notice: If the borrower fails to meet their obligations, this notice serves as a formal communication from the lender, outlining the default and the actions that may be taken.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligations and confirms that the lender has no claims against them.

- Operating Agreement: This essential document outlines the operational framework for an LLC, ensuring that all members understand their roles and responsibilities, and can be conveniently accessed at https://formsillinois.com/.

- Assignment of Rights: This document allows the lender to transfer their rights under the Promissory Note to another party, often used in cases of selling the loan to another lender.

Understanding these documents is crucial for both lenders and borrowers. Each plays a vital role in ensuring that the terms of the loan are clear and enforceable, ultimately protecting the interests of all parties involved.

Misconceptions

Understanding the New Jersey Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions often arise regarding its use and implications. Below is a list of eight common misconceptions along with clarifications.

- It must be notarized. Many believe that a promissory note requires notarization to be valid. In New Jersey, notarization is not a legal requirement; however, it can provide an added layer of authenticity.

- All promissory notes are the same. Some assume that all promissory notes are interchangeable. In reality, the terms and conditions can vary significantly based on the agreement between the parties involved.

- Only banks can issue promissory notes. There is a misconception that only financial institutions can create these documents. Individuals and businesses can also draft and execute promissory notes.

- They are not enforceable in court. A common belief is that promissory notes lack legal enforceability. However, if properly executed, they can be enforced in a court of law.

- Interest rates must be included. Some think that a promissory note must specify an interest rate. While it is common to include one, it is not a requirement; a note can be interest-free.

- They are only for large loans. Many people assume that promissory notes are only relevant for significant amounts of money. In fact, they can be used for any loan amount, regardless of size.

- Once signed, they cannot be modified. There is a belief that once a promissory note is signed, it is set in stone. However, parties can agree to modify the terms, provided both sides consent to the changes.

- They are only necessary for formal transactions. Some individuals think that promissory notes are only needed for formal or business transactions. In reality, they can be useful in informal agreements between friends or family as well.

By addressing these misconceptions, individuals can better understand the role and function of promissory notes in financial agreements.

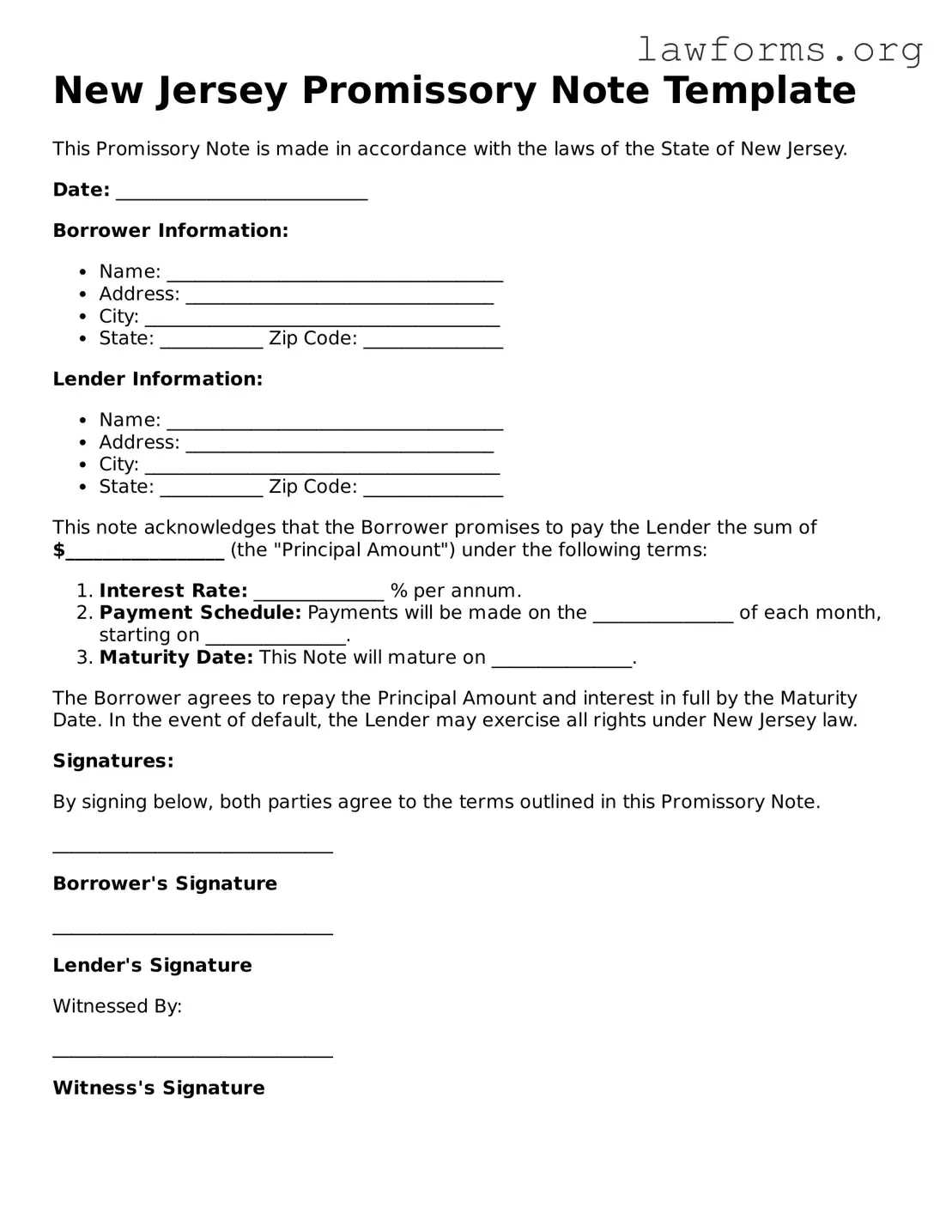

Preview - New Jersey Promissory Note Form

New Jersey Promissory Note Template

This Promissory Note is made in accordance with the laws of the State of New Jersey.

Date: ___________________________

Borrower Information:

- Name: ____________________________________

- Address: _________________________________

- City: ______________________________________

- State: ___________ Zip Code: _______________

Lender Information:

- Name: ____________________________________

- Address: _________________________________

- City: ______________________________________

- State: ___________ Zip Code: _______________

This note acknowledges that the Borrower promises to pay the Lender the sum of $_________________ (the "Principal Amount") under the following terms:

- Interest Rate: ______________ % per annum.

- Payment Schedule: Payments will be made on the _______________ of each month, starting on _______________.

- Maturity Date: This Note will mature on _______________.

The Borrower agrees to repay the Principal Amount and interest in full by the Maturity Date. In the event of default, the Lender may exercise all rights under New Jersey law.

Signatures:

By signing below, both parties agree to the terms outlined in this Promissory Note.

______________________________

Borrower's Signature

______________________________

Lender's Signature

Witnessed By:

______________________________

Witness's Signature

Key takeaways

When it comes to filling out and using the New Jersey Promissory Note form, there are several important points to keep in mind. Here are some key takeaways:

- Clear Terms: Ensure that the terms of the loan are clearly defined. This includes the amount borrowed, interest rate, repayment schedule, and any fees. Clarity helps avoid misunderstandings later.

- Signatures Matter: Both the borrower and lender must sign the document. Without signatures, the note may not be enforceable, so make sure everyone involved puts their name on the line.

- Record Keeping: Keep a copy of the signed Promissory Note for your records. This document serves as proof of the loan agreement and can be crucial if any disputes arise.

- Legal Compliance: Ensure that the Promissory Note complies with New Jersey laws. Familiarize yourself with any specific requirements, such as interest rate limits or disclosure obligations, to avoid potential legal issues.

Similar forms

-

Loan Agreement: A loan agreement outlines the terms under which one party lends money to another. Similar to a promissory note, it includes details about the loan amount, interest rate, and repayment schedule. However, a loan agreement often contains more comprehensive terms and conditions.

-

Mortgage: A mortgage is a specific type of loan secured by real property. Like a promissory note, it includes a promise to repay the borrowed amount. However, a mortgage also establishes a lien on the property, giving the lender rights to the property if the borrower defaults.

-

Installment Agreement: An installment agreement is a plan that allows a borrower to pay off a debt in regular installments. It shares similarities with a promissory note in that it details the payment terms. However, it may also include additional stipulations regarding penalties for late payments.

- Hold Harmless Agreement: A legal document that protects one party from liability for certain actions or events, often used in contracts and rental agreements. For more details, visit https://californiadocsonline.com/hold-harmless-agreement-form/.

-

Personal Guarantee: A personal guarantee is a promise made by an individual to repay another party's debt. It resembles a promissory note in its intent to secure repayment. However, it is typically used to back business loans, holding the individual personally responsible for the debt.