Attorney-Approved Quitclaim Deed Template for the State of New Jersey

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | A Quitclaim Deed in New Jersey is used to transfer ownership of property without any warranties regarding the title. |

| Governing Law | The Quitclaim Deed is governed by the New Jersey Statutes Annotated, Title 46, Chapter 3. |

| Execution Requirements | The deed must be signed by the grantor and notarized to be valid. |

| Recording | To protect the interest of the grantee, the Quitclaim Deed should be recorded in the county where the property is located. |

Dos and Don'ts

When filling out a Quitclaim Deed form in New Jersey, it’s important to ensure accuracy and compliance with local regulations. Here’s a helpful list of what to do and what to avoid:

- Do ensure that the names of all parties involved are spelled correctly.

- Don't leave any fields blank; every section should be completed.

- Do provide a clear legal description of the property.

- Don't use abbreviations or shorthand in the property description.

- Do sign the deed in the presence of a notary public.

- Don't forget to include the date of the transaction.

- Do check for any local requirements that may apply.

- Don't assume that a Quitclaim Deed is the same as a Warranty Deed; they serve different purposes.

- Do keep a copy of the completed deed for your records.

Following these guidelines can help ensure a smooth process when transferring property ownership in New Jersey.

Create Popular Quitclaim Deed Forms for Different States

Florida Quit Claim Deed Rules - It’s important to ensure full understanding and consent from all parties before executing a Quitclaim Deed.

When transferring ownership of a vehicle or vessel in California, it's crucial to understand the requirements surrounding the California Form REG 262. This form, a Vehicle/Vessel Transfer and Reassignment Form, must accompany the title or application for a duplicate title. To ensure all legal obligations are met, you can find more information and access the form at https://californiadocsonline.com/california-fotm-reg-262-form/, safeguarding the interests of both buyers and sellers during the transaction.

How Much Does a Deed Cost - A Quitclaim Deed can serve various purposes beyond real estate transactions.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. Each section of the Quitclaim Deed must be filled out completely. Missing names, addresses, or property descriptions can lead to legal complications.

-

Incorrect Property Description: The property description must be precise. People often use vague language or fail to include the legal description of the property. This can cause confusion about what is actually being transferred.

-

Not Notarizing the Document: A Quitclaim Deed needs to be notarized to be valid. Some individuals forget this crucial step, which can render the deed ineffective. Always ensure that a notary public is present during the signing.

-

Improper Signatures: All parties involved in the transfer must sign the deed. Failing to have the correct signatures can lead to disputes later on. It's essential to check that everyone’s signature is present and correctly placed.

-

Ignoring Local Requirements: Each county may have specific requirements for filing a Quitclaim Deed. People sometimes overlook these local regulations. It's important to research and comply with local laws to avoid rejection of the deed.

-

Not Recording the Deed: After completing the Quitclaim Deed, it should be recorded with the county clerk's office. Some individuals neglect this step, thinking it’s unnecessary. Failing to record the deed can lead to issues with ownership rights in the future.

Documents used along the form

The New Jersey Quitclaim Deed is an essential document for transferring property ownership. However, several other forms and documents often accompany it to ensure a smooth transaction. Below is a list of these related documents, along with brief descriptions of their purposes.

- Property Transfer Tax Declaration Form: This form is required to report the sale price of the property and calculate the applicable transfer taxes.

- Affidavit of Title: This document confirms that the seller holds clear title to the property and that there are no outstanding liens or claims against it.

- Residential Lease Agreement: The Ohio PDF Forms provide the framework for establishing rental terms, protecting the rights of both landlords and tenants in Ohio.

- Title Search Report: A report that provides information on the property’s ownership history, including any encumbrances or legal issues that may affect the title.

- Seller's Disclosure Statement: This statement discloses any known defects or issues with the property, ensuring transparency between the buyer and seller.

- Mortgage Satisfaction Document: If applicable, this document indicates that any existing mortgage on the property has been paid off and released.

- Buyer's Offer to Purchase: This is a formal offer made by the buyer to purchase the property, outlining the terms and conditions of the sale.

- Deed of Trust: This document may be used if the buyer is financing the purchase, serving as a security instrument for the lender.

- Closing Statement: A detailed account of all financial transactions related to the sale, including fees, taxes, and the final sale price.

- Power of Attorney: If the seller cannot be present at closing, this document allows another person to act on their behalf in the transaction.

Each of these documents plays a crucial role in the property transfer process in New Jersey. Ensuring that all necessary forms are completed accurately and submitted on time can help prevent delays and legal complications.

Misconceptions

Understanding the New Jersey Quitclaim Deed form can be challenging, especially with the many misconceptions surrounding it. Here are eight common misunderstandings that people often have:

-

Quitclaim Deeds Transfer Ownership Completely

Many believe that a quitclaim deed transfers full ownership rights. In reality, it only transfers whatever interest the grantor has in the property, which may not be complete or even valid.

-

Quitclaim Deeds Are Only for Family Transfers

While it’s common to use quitclaim deeds among family members, they are not limited to familial transactions. They can be used in various situations, including sales or transfers between unrelated parties.

-

Quitclaim Deeds Eliminate Liens

Some think that using a quitclaim deed removes any existing liens on the property. However, liens remain attached to the property regardless of the deed used.

-

All Quitclaim Deeds Are the Same

Not all quitclaim deeds are identical. Variations can exist based on specific state requirements, and it’s essential to ensure that the form complies with New Jersey laws.

-

Quitclaim Deeds Require a Notary Public

While it is advisable to have a quitclaim deed notarized for authenticity, it is not a strict requirement in New Jersey. However, having it notarized can aid in preventing disputes.

-

Using a Quitclaim Deed Is Complicated

Some people think that preparing a quitclaim deed is a complex process. In fact, it can be straightforward if you have the necessary information and follow the correct steps.

-

Quitclaim Deeds Are Irrevocable

Many assume that once a quitclaim deed is executed, it cannot be changed. However, grantors may be able to revoke or alter the deed under certain circumstances.

-

Quitclaim Deeds Are Only for Real Estate

While quitclaim deeds are most commonly associated with real estate, they can also be used for other types of property transfers, such as personal property.

Being aware of these misconceptions can help individuals make informed decisions when considering a quitclaim deed in New Jersey. Understanding the nuances of this legal document is crucial for ensuring a smooth transfer of property rights.

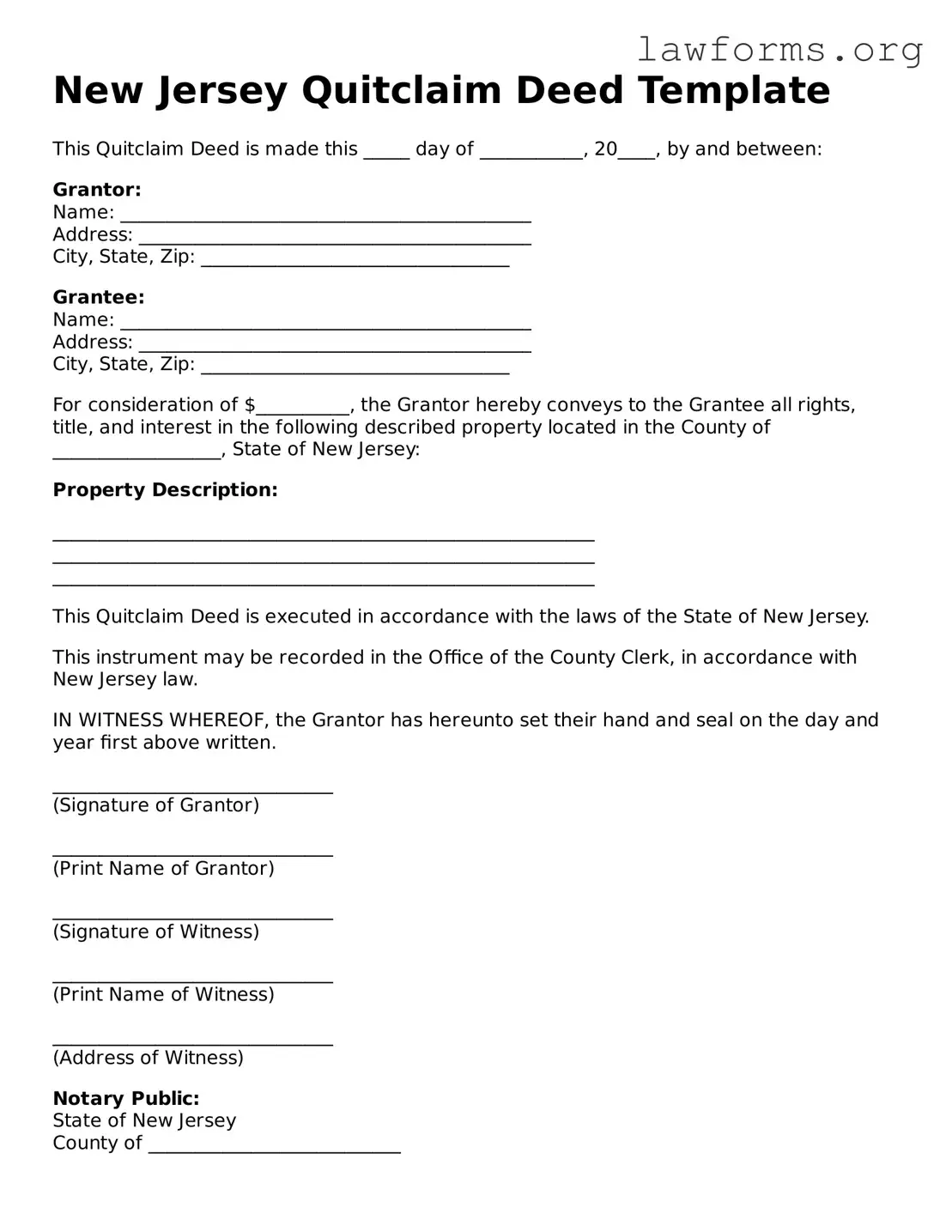

Preview - New Jersey Quitclaim Deed Form

New Jersey Quitclaim Deed Template

This Quitclaim Deed is made this _____ day of ___________, 20____, by and between:

Grantor:

Name: ____________________________________________

Address: __________________________________________

City, State, Zip: _________________________________

Grantee:

Name: ____________________________________________

Address: __________________________________________

City, State, Zip: _________________________________

For consideration of $__________, the Grantor hereby conveys to the Grantee all rights, title, and interest in the following described property located in the County of __________________, State of New Jersey:

Property Description:

__________________________________________________________

__________________________________________________________

__________________________________________________________

This Quitclaim Deed is executed in accordance with the laws of the State of New Jersey.

This instrument may be recorded in the Office of the County Clerk, in accordance with New Jersey law.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal on the day and year first above written.

______________________________

(Signature of Grantor)

______________________________

(Print Name of Grantor)

______________________________

(Signature of Witness)

______________________________

(Print Name of Witness)

______________________________

(Address of Witness)

Notary Public:

State of New Jersey

County of ___________________________

On this _____ day of __________, 20____, before me, a Notary Public in and for said State, personally appeared _________________________, known to me to be the person [or persons] described in and who executed the within instrument and acknowledged that they executed the same.

My commission expires: ________________

Key takeaways

Filling out and using the New Jersey Quitclaim Deed form requires attention to detail and an understanding of its implications. Here are six key takeaways to consider:

- Purpose of the Quitclaim Deed: This form is primarily used to transfer ownership of property from one party to another without any warranties. It effectively conveys whatever interest the grantor has in the property.

- Identifying Parties: The form requires clear identification of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Full names and addresses should be included to avoid confusion.

- Property Description: A precise description of the property being transferred is essential. This includes the address and, if applicable, the lot and block numbers as recorded in local property records.

- Notarization Requirement: To be legally effective, the Quitclaim Deed must be signed in the presence of a notary public. This step ensures that the identities of the parties are verified and adds a layer of authenticity to the document.

- Recording the Deed: After completing the form, it is crucial to record the Quitclaim Deed with the county clerk's office where the property is located. This step protects the grantee's interest in the property and provides public notice of the transfer.

- Tax Implications: Be aware that transferring property through a Quitclaim Deed may have tax consequences. It is advisable to consult a tax professional to understand any potential liabilities or benefits.

Similar forms

-

Warranty Deed: Like a quitclaim deed, a warranty deed transfers property ownership. However, a warranty deed offers guarantees about the title's validity, ensuring that the seller has the right to sell the property and that there are no undisclosed claims against it.

-

Grant Deed: A grant deed also transfers ownership of property. It provides some assurances to the buyer, such as the promise that the seller has not sold the property to anyone else and that the property is free from undisclosed encumbrances.

-

Deed of Trust: This document is used in real estate transactions involving loans. A deed of trust secures a loan by transferring the property title to a trustee until the loan is paid off. While it serves a different purpose, it also involves the transfer of property rights.

- Articles of Incorporation: This essential document establishes a corporation in Illinois, detailing its name, purpose, and initial officers. For more information, you can refer to formsillinois.com/.

-

Bill of Sale: A bill of sale transfers ownership of personal property, such as vehicles or equipment. Similar to a quitclaim deed, it is a straightforward document that conveys ownership without warranties regarding the item's condition.

-

Affidavit of Title: This document is often used in real estate transactions to affirm the seller's ownership and the absence of liens. It provides some level of assurance to the buyer, similar to the quitclaim deed, but it is a sworn statement rather than a transfer of title.