Attorney-Approved Real Estate Purchase Agreement Template for the State of New Jersey

Form Specifications

| Fact Name | Details |

|---|---|

| Governing Law | The New Jersey Real Estate Purchase Agreement is governed by New Jersey state law, specifically the New Jersey Statutes Annotated (N.J.S.A.) Title 46. |

| Parties Involved | The agreement typically involves a buyer and a seller, both of whom must be legally capable of entering into a contract. |

| Property Description | A complete description of the property being sold is required, including the address and any relevant property identification numbers. |

| Contingencies | The form may include various contingencies, such as financing, inspections, and the sale of the buyer's current home. |

| Closing Date | The agreement specifies a closing date, which is the date when the ownership of the property is officially transferred from the seller to the buyer. |

Dos and Don'ts

When filling out the New Jersey Real Estate Purchase Agreement form, attention to detail is crucial. Here are ten essential dos and don'ts to guide you through the process.

- Do read the entire agreement carefully before filling it out.

- Don't leave any fields blank; incomplete forms can lead to delays.

- Do include accurate contact information for all parties involved.

- Don't use abbreviations or shorthand that may cause confusion.

- Do specify the purchase price clearly and double-check the figures.

- Don't forget to include any contingencies that may apply.

- Do ensure all signatures are present and dated appropriately.

- Don't overlook the importance of reviewing the terms with a real estate professional.

- Do keep a copy of the completed agreement for your records.

- Don't rush through the process; take your time to ensure accuracy.

Create Popular Real Estate Purchase Agreement Forms for Different States

New York State Residential Contract of Sale - The form typically includes space for signatures to formalize the agreement.

Properly filling out the WC-1 Georgia form is crucial for employees who have sustained injuries while at work, as it streamlines their claims process and ensures they receive necessary benefits. For more information on the completion and submission of this essential form, visit georgiaform.com/.

House for Sale Contract - A legal document outlining the terms of a real estate sale.

Common mistakes

-

Not Reading the Entire Agreement: Many people skip over sections, assuming they understand the terms. This can lead to misunderstandings about obligations and rights.

-

Incorrectly Filling Out Buyer and Seller Information: Providing inaccurate names or contact details can create issues later. Always double-check this information.

-

Missing the Purchase Price: It’s crucial to clearly state the agreed-upon purchase price. Omitting this can lead to confusion or disputes.

-

Neglecting to Include Contingencies: Buyers often forget to specify contingencies, such as financing or inspection. Without these, they may face unexpected challenges.

-

Failing to Specify Closing Date: Leaving the closing date blank can create uncertainty. Both parties should agree on a specific date to avoid complications.

-

Ignoring the Importance of Signatures: All parties must sign the agreement. A missing signature can render the contract invalid.

-

Not Initialing Changes: If any changes are made to the original document, they should be initialed by all parties. This confirms mutual agreement on those changes.

-

Overlooking Addenda: Any additional documents or agreements should be referenced and attached. Failing to do so can lead to incomplete agreements.

-

Assuming Standard Terms Apply: Every real estate transaction is unique. Relying on standard terms without customization can lead to problems down the line.

Documents used along the form

When engaging in a real estate transaction in New Jersey, several documents often accompany the Real Estate Purchase Agreement. Each of these forms serves a specific purpose and helps facilitate the process of buying or selling property.

- Seller's Disclosure Statement: This document provides potential buyers with important information about the property's condition. It outlines any known defects, repairs, or issues that may affect the property’s value or safety.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential presence of lead-based paint. Sellers must disclose any known lead hazards and provide buyers with a pamphlet on lead safety.

- California DV-260 Form: This form is essential for individuals dealing with domestic violence situations, ensuring that their information is kept confidential while facilitating the management of restraining orders. For more details, visit californiadocsonline.com/california-dv-260-form/.

- Title Commitment: This document outlines the terms under which a title company will insure the buyer's ownership of the property. It details any liens, encumbrances, or issues that may affect the title and ensures that the buyer receives clear ownership.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document itemizes all costs associated with the transaction. It provides a detailed breakdown of the financial aspects, including the purchase price, closing costs, and any credits or debits for both the buyer and seller.

Understanding these documents is essential for both buyers and sellers in navigating the real estate process. Each form plays a critical role in ensuring transparency and protecting the interests of all parties involved.

Misconceptions

Understanding the New Jersey Real Estate Purchase Agreement form is crucial for anyone involved in a property transaction. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings:

- It’s a one-size-fits-all document. Many believe that a real estate purchase agreement can be used universally for all transactions. In reality, each agreement should be tailored to the specific deal and circumstances.

- Only the buyer needs to sign. Some think that only the buyer's signature is necessary. However, both the buyer and seller must sign the agreement for it to be legally binding.

- Verbal agreements are sufficient. Many assume that a verbal agreement is enough to secure a deal. This is false; a written agreement is essential to outline the terms and protect both parties.

- All contingencies are optional. Some people believe that contingencies can be ignored. In fact, including contingencies like financing or inspection can safeguard your interests.

- It doesn’t need to be reviewed by a lawyer. There’s a misconception that legal review is unnecessary. Having a lawyer review the agreement can help identify potential issues and ensure compliance with state laws.

- Once signed, it cannot be changed. Many think that signed agreements are set in stone. Modifications can be made, but they must be documented and signed by both parties.

- Only real estate agents understand the form. Some believe that only agents can interpret the agreement. However, buyers and sellers can educate themselves about the form to better understand their rights and obligations.

- It’s the same as a lease agreement. There is a common belief that a purchase agreement functions like a lease. In truth, a purchase agreement outlines a sale, while a lease governs rental terms.

- All terms are negotiable. While many terms can be negotiated, some aspects, like legal requirements, must be adhered to. Understanding which terms are flexible is key.

- It guarantees the sale of the property. Some may think that signing the agreement guarantees the sale. However, various factors, including contingencies, can affect whether the sale goes through.

Clearing up these misconceptions can help buyers and sellers navigate the real estate process more effectively and confidently.

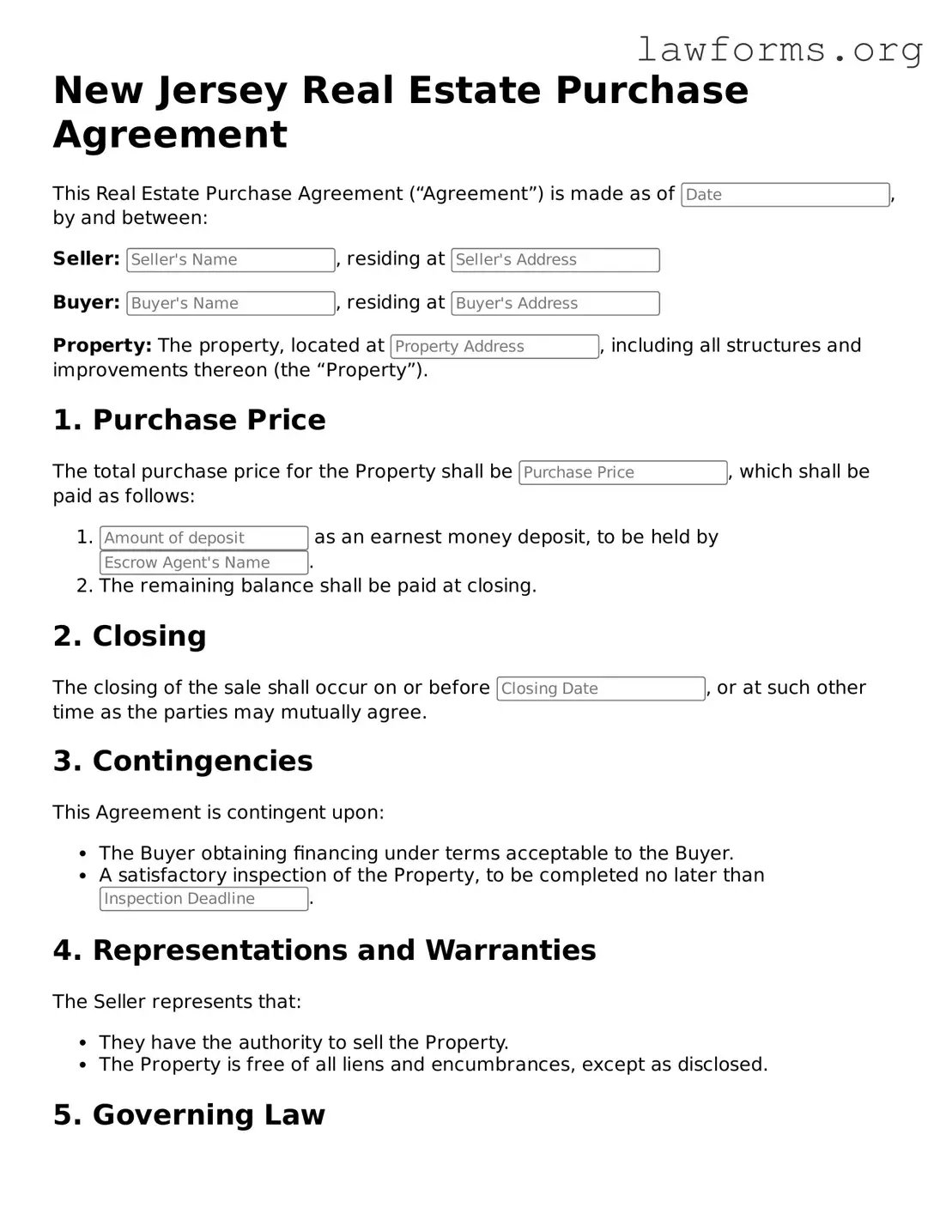

Preview - New Jersey Real Estate Purchase Agreement Form

New Jersey Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made as of , by and between:

Seller: , residing at

Buyer: , residing at

Property: The property, located at , including all structures and improvements thereon (the “Property”).

1. Purchase Price

The total purchase price for the Property shall be , which shall be paid as follows:

- as an earnest money deposit, to be held by .

- The remaining balance shall be paid at closing.

2. Closing

The closing of the sale shall occur on or before , or at such other time as the parties may mutually agree.

3. Contingencies

This Agreement is contingent upon:

- The Buyer obtaining financing under terms acceptable to the Buyer.

- A satisfactory inspection of the Property, to be completed no later than .

4. Representations and Warranties

The Seller represents that:

- They have the authority to sell the Property.

- The Property is free of all liens and encumbrances, except as disclosed.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of New Jersey.

6. Signatures

IN WITNESS WHEREOF, the parties have executed this Agreement as of the day and year first above written.

Seller's Signature: ___________________________ Date: _______________

Buyer's Signature: ___________________________ Date: _______________

Key takeaways

When filling out and using the New Jersey Real Estate Purchase Agreement form, it's essential to understand several key points to ensure a smooth transaction. Here are some important takeaways:

- Understand the Purpose: This agreement outlines the terms and conditions of the property sale, serving as a legally binding contract between the buyer and seller.

- Complete Information: Ensure that all parties' names, addresses, and contact information are accurately filled in to avoid confusion later.

- Property Description: Provide a detailed description of the property, including the address and any relevant features, to avoid disputes.

- Purchase Price: Clearly state the agreed-upon purchase price and any deposit amounts to ensure both parties are aligned.

- Contingencies: Include any contingencies, such as financing or inspection requirements, which allow the buyer to withdraw without penalty under specific conditions.

- Closing Date: Specify the closing date to establish a timeline for the transaction, helping both parties prepare accordingly.

- Disclosure Requirements: Familiarize yourself with New Jersey's disclosure requirements to ensure the seller provides necessary information about the property's condition.

- Signatures: Both parties must sign the agreement for it to be valid. Ensure all signatures are dated to confirm when the agreement was executed.

- Legal Review: It’s advisable to have a legal professional review the agreement before finalizing it to catch any potential issues.

- Keep Copies: After signing, keep copies of the agreement for both parties. This ensures that everyone has access to the same information.

By keeping these points in mind, you can navigate the New Jersey Real Estate Purchase Agreement process more effectively, reducing the chances of misunderstandings and ensuring a smoother transaction.

Similar forms

- Lease Agreement: Similar to a Real Estate Purchase Agreement, a lease agreement outlines the terms under which a tenant can occupy a property. Both documents specify the duration of the agreement, payment details, and responsibilities of each party.

- Quitclaim Deed: This form conveys property ownership from one party to another without any warranty. Similar to the Real Estate Purchase Agreement, it signifies a transfer, but it does not guarantee the property’s title or state, making it less secure than a purchase agreement. For more information on filling out this form, visit Ohio PDF Forms.

- Sales Contract: A sales contract is used for various types of transactions, including real estate. Like the purchase agreement, it details the terms of sale, including price, payment method, and any contingencies that must be met before the sale is finalized.

- Option to Purchase Agreement: This document gives a potential buyer the right to purchase a property at a later date. It shares similarities with the purchase agreement, as it includes price, terms, and conditions but allows for a delay in the actual sale.

- Real Estate Listing Agreement: This agreement is between a property owner and a real estate agent. It outlines the agent's authority to sell the property, similar to how the purchase agreement outlines the terms of the sale once a buyer is found.

- Buyer’s Agency Agreement: This document establishes a relationship between a buyer and their agent. It details the agent’s duties and responsibilities, akin to how a purchase agreement outlines the obligations of both the buyer and seller in a transaction.

- Closing Disclosure: This document is provided before the closing of a real estate transaction. It summarizes the final terms of the loan and all closing costs, similar to the purchase agreement, which outlines the financial aspects of the sale.

- Title Insurance Policy: While not a contract for sale, this document protects buyers from potential disputes over property ownership. It complements the purchase agreement by ensuring that the buyer receives clear title to the property as agreed upon.