Attorney-Approved Transfer-on-Death Deed Template for the State of New Jersey

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows an individual to transfer real estate to a designated beneficiary upon the individual's death, avoiding probate. |

| Governing Law | The TOD Deed in New Jersey is governed by the New Jersey Statutes, specifically N.J.S.A. 46:3B-1 et seq. |

| Eligibility | Any individual who owns real property in New Jersey can create a TOD Deed, provided they are of sound mind and at least 18 years old. |

| Beneficiary Designation | Individuals can name one or more beneficiaries in the TOD Deed, and they can also specify alternate beneficiaries in case the primary ones predecease them. |

| Revocation | A TOD Deed can be revoked at any time before the death of the grantor. This can be done by executing a new deed or a written revocation. |

| Filing Requirements | The completed TOD Deed must be recorded with the county clerk in the county where the property is located to be effective. |

| Tax Implications | Property transferred via a TOD Deed is included in the grantor's estate for tax purposes, but it avoids probate, which can save time and costs. |

| Limitations | New Jersey law does not allow a TOD Deed for certain types of property, such as properties held in a trust or properties subject to a mortgage with specific restrictions. |

Dos and Don'ts

When filling out the New Jersey Transfer-on-Death Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do make sure to provide accurate property information, including the legal description.

- Do clearly identify the beneficiaries by their full names.

- Do sign the deed in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Do file the deed with the county clerk's office where the property is located.

- Don't leave any sections of the form blank; fill out all required fields.

- Don't use nicknames or abbreviations for beneficiaries' names.

- Don't forget to date the deed when you sign it.

- Don't assume that verbal agreements are sufficient; everything must be in writing.

- Don't wait too long to file the deed after completing it.

Create Popular Transfer-on-Death Deed Forms for Different States

Transfer on Death Deed Form Ohio - Recording the Transfer-on-Death Deed at the local recorder’s office is essential for its legal efficacy.

How to Transfer Deed of House - Consider future property developments that may affect your Transfer-on-Death Deed.

Having a properly completed Illinois Motorcycle Bill of Sale form is crucial for both buyers and sellers to solidify the transaction legally. This document not only helps in recording the details of the sale but also serves as proof of ownership transfer. For those looking to obtain the necessary form, you can find it conveniently at formsillinois.com, ensuring you have all required information in place for a smooth process.

Where Can I Get a Tod Form - Conflicts about property inheritance can often be avoided with a properly executed Transfer-on-Death Deed.

Common mistakes

-

Incorrect Property Description: Failing to accurately describe the property can lead to confusion or disputes. Ensure that the legal description matches the property records.

-

Missing Signatures: Both the owner and the witnesses must sign the deed. Omitting any required signatures invalidates the document.

-

Improper Witness Requirements: New Jersey law requires two witnesses. Not adhering to this requirement can result in the deed being unenforceable.

-

Not Notarizing the Document: While notarization is not always required, it is often advisable to ensure the document is legally binding and to prevent future challenges.

-

Failure to Record the Deed: After completing the form, it must be recorded with the county clerk. Neglecting this step means the deed may not be recognized.

-

Using an Outdated Form: Laws and forms can change. Always use the most current version of the Transfer-on-Death Deed form to avoid legal complications.

-

Ignoring Tax Implications: Not considering the tax consequences of transferring property can lead to unexpected liabilities for the beneficiaries.

-

Overlooking Beneficiary Designations: Clearly identify the beneficiaries. Ambiguities can lead to disputes among heirs or unintended consequences.

-

Not Consulting a Professional: Many individuals attempt to fill out the form without legal guidance. This can result in errors that may have been easily avoided with expert advice.

Documents used along the form

When preparing a New Jersey Transfer-on-Death Deed, several other forms and documents may be necessary to ensure a smooth transfer of property. These documents help clarify intentions, establish legal authority, and facilitate the overall process. Below is a list of commonly used forms that complement the Transfer-on-Death Deed.

- Property Deed: This is the primary document that establishes ownership of the property. It details the legal description of the property and identifies the current owner. A new deed may need to be created to reflect the transfer after the death of the original owner.

- Last Will and Testament: This document outlines the wishes of the deceased regarding the distribution of their assets. While the Transfer-on-Death Deed bypasses probate for the property it covers, a will may still address other assets and provide guidance for the overall estate.

- Employment Verification Form: For some transactions, especially those involving financial institutions, the californiadocsonline.com/employment-verification-form/ may be required to verify income and employment status, ensuring a smoother process for loan applications associated with property transfers.

- Affidavit of Death: This form serves as proof of the death of the property owner. It may be required when presenting the Transfer-on-Death Deed to the county clerk or other relevant authorities to complete the transfer.

- Transfer Tax Form: In New Jersey, certain property transfers may be subject to transfer taxes. This form is necessary to report the transfer and ensure compliance with state tax regulations.

- Notice of Death: This document may be filed with the county clerk’s office to formally notify interested parties of the property owner’s death. It helps to protect the interests of beneficiaries and can be useful in establishing the timeline for the transfer process.

Each of these documents plays a crucial role in the property transfer process in New Jersey. Ensuring that they are properly completed and filed can help avoid complications and ensure that the transfer occurs as intended.

Misconceptions

Understanding the New Jersey Transfer-on-Death Deed (TODD) can be tricky. Here are nine common misconceptions about this form that you should be aware of:

- It automatically transfers property upon death. The TODD does not transfer property until the owner passes away. Until then, the owner retains full control of the property.

- It eliminates the need for a will. A TODD does not replace a will. It only addresses the transfer of specific property, while a will covers all aspects of an estate.

- It can be used for any type of property. The TODD is limited to real estate. Personal property and other assets require different forms or methods for transfer.

- Once filed, it cannot be changed. A TODD can be revoked or changed at any time before the owner's death, as long as the proper procedures are followed.

- All heirs must agree to the TODD. The owner can designate beneficiaries without needing consent from heirs or family members.

- It avoids probate entirely. While a TODD can simplify the transfer process, it does not completely avoid probate for other assets in the estate.

- It is only for married couples. Anyone can use a TODD, regardless of marital status. Individuals and couples alike can benefit from this deed.

- It requires complicated legal processes. The form is relatively straightforward and can often be completed without legal assistance, though consulting a professional is always a good idea.

- It is only valid in New Jersey. While this deed is specific to New Jersey, other states have similar options. Always check local laws to understand your options.

Being informed about these misconceptions can help you make better decisions regarding property transfer in New Jersey.

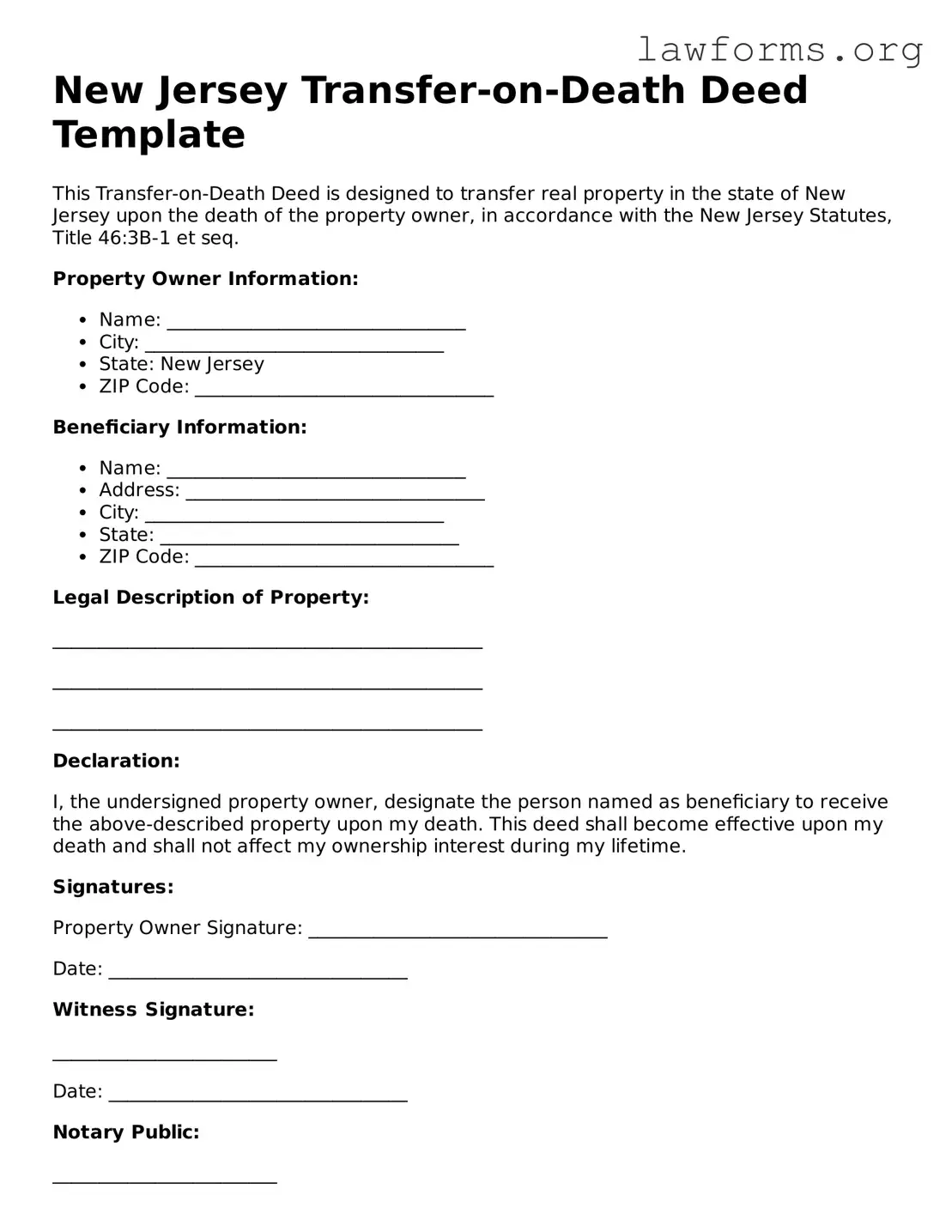

Preview - New Jersey Transfer-on-Death Deed Form

New Jersey Transfer-on-Death Deed Template

This Transfer-on-Death Deed is designed to transfer real property in the state of New Jersey upon the death of the property owner, in accordance with the New Jersey Statutes, Title 46:3B-1 et seq.

Property Owner Information:

- Name: ________________________________

- City: ________________________________

- State: New Jersey

- ZIP Code: ________________________________

Beneficiary Information:

- Name: ________________________________

- Address: ________________________________

- City: ________________________________

- State: ________________________________

- ZIP Code: ________________________________

Legal Description of Property:

______________________________________________

______________________________________________

______________________________________________

Declaration:

I, the undersigned property owner, designate the person named as beneficiary to receive the above-described property upon my death. This deed shall become effective upon my death and shall not affect my ownership interest during my lifetime.

Signatures:

Property Owner Signature: ________________________________

Date: ________________________________

Witness Signature:

________________________

Date: ________________________________

Notary Public:

________________________

Date: ________________________________

My Commission Expires: ________________________________

Ensure this deed is filed with the appropriate county clerk’s office in New Jersey to fulfill all legal requirements for the transfer to be valid.

Key takeaways

Filling out and using the New Jersey Transfer-on-Death Deed form can be a straightforward process if you keep a few key points in mind. Here are some important takeaways:

- Understand the Purpose: The Transfer-on-Death Deed allows you to transfer real estate directly to a beneficiary upon your death, avoiding probate.

- Eligibility: Ensure that the property you wish to transfer is eligible. This deed can only be used for residential real estate in New Jersey.

- Complete the Form Accurately: Fill out the form with accurate information about yourself and the beneficiary. Mistakes can lead to complications later.

- Sign and Notarize: Your signature must be notarized. This step is crucial for the deed to be legally binding.

- File the Deed: After signing, file the deed with the county clerk’s office where the property is located. This makes the deed part of the public record.

- Revocation: You can revoke the deed at any time before your death. To do this, you must file a revocation form with the county clerk.

- Consult with a Professional: If you have questions or concerns, consider speaking with a legal professional. They can provide guidance specific to your situation.

By keeping these points in mind, you can navigate the process of using a Transfer-on-Death Deed in New Jersey more confidently.

Similar forms

- Will: A will is a legal document that outlines how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries but typically requires probate, while the Transfer-on-Death Deed does not.

- Living Trust: A living trust is a legal arrangement where a person places their assets into a trust during their lifetime. Similar to a Transfer-on-Death Deed, it allows for the direct transfer of assets to beneficiaries without going through probate.

- Beneficiary Designation: This document is often used for financial accounts and insurance policies. It allows individuals to name beneficiaries who will receive the assets upon their death, similar to how a Transfer-on-Death Deed designates heirs for real property.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows two or more people to own property together. When one owner dies, their share automatically passes to the surviving owner(s), akin to the way a Transfer-on-Death Deed transfers property without probate.

- Motor Vehicle Bill of Sale: This form is essential for documenting the sale of a vehicle, providing protection to both buyer and seller, and facilitating registration. To learn more about this vital document, visit Forms Washington.

- Payable-on-Death (POD) Accounts: These are bank accounts that allow the account holder to designate a beneficiary who will receive the funds upon the account holder's death. This is similar to a Transfer-on-Death Deed in that it avoids probate and directly transfers assets to the designated person.

- Transfer-on-Death Registration for Securities: This allows individuals to name a beneficiary for their securities, such as stocks or bonds. Like a Transfer-on-Death Deed, it ensures that the assets pass directly to the named beneficiary without the need for probate.