Attorney-Approved Articles of Incorporation Template for the State of New York

Form Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The New York Articles of Incorporation are governed by the New York Business Corporation Law. |

| Purpose | The form is used to officially create a corporation in New York State. |

| Filing Requirement | To incorporate, the form must be filed with the New York Department of State. |

| Information Needed | Basic information about the corporation, such as name, address, and purpose, is required. |

| Corporate Name | The name must be unique and include “Incorporated,” “Corporation,” or “Limited.” |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Duration | The corporation can be formed for a specific duration or indefinitely. |

| Filing Fee | A filing fee is required at the time of submission, which varies based on the type of corporation. |

| Publication Requirement | New York law requires corporations to publish their formation in local newspapers for a certain period. |

| Amendments | Changes to the Articles of Incorporation can be made by filing an amendment form with the state. |

Dos and Don'ts

When filling out the New York Articles of Incorporation form, it's essential to approach the task with care. Here are some important do's and don'ts to keep in mind:

- Do ensure that all information is accurate and up-to-date. Double-check names, addresses, and other details.

- Do clearly specify the purpose of your corporation. This helps define your business and can impact future legal matters.

- Do include the names and addresses of the initial directors. This is a requirement and helps establish your corporation’s leadership.

- Do sign and date the form. An unsigned form will not be processed, delaying your incorporation.

- Don't leave any required fields blank. Incomplete forms can lead to rejection or delays in processing.

- Don't use vague language when describing your business purpose. Be specific to avoid confusion later.

- Don't forget to check the filing fee. Ensure you include the correct payment to avoid processing issues.

- Don't rush through the process. Take your time to review everything before submission to ensure compliance.

Create Popular Articles of Incorporation Forms for Different States

Starting an Llc in California - May include clauses on indemnification for corporate officers and directors.

Florida Corporation - Detailed sections can assist with compliance during the corporation's operation.

Common mistakes

-

Incorrect Business Name: Many people fail to ensure that their chosen business name is unique and not already in use by another corporation in New York. This can lead to delays in the approval process.

-

Missing Registered Agent Information: The form requires the designation of a registered agent, but some applicants neglect to provide accurate contact information. This can hinder official communications and notifications.

-

Improper Purpose Statement: The purpose of the corporation must be clearly stated. Some individuals use vague language or fail to specify their business activities, which can result in rejection of the application.

-

Failure to Include Initial Directors: The form asks for the names and addresses of initial directors. Omitting this information or providing incorrect details can lead to complications in the incorporation process.

Documents used along the form

When forming a corporation in New York, the Articles of Incorporation is a crucial document. However, several other forms and documents are often necessary to ensure compliance with state regulations and to establish your corporation effectively. Below is a list of commonly used documents that accompany the Articles of Incorporation.

- Bylaws: Bylaws outline the internal rules and procedures for managing the corporation. They cover topics such as the roles of officers, how meetings are conducted, and voting procedures. Bylaws help ensure smooth operations and clarify expectations for all members.

- Certificate of Incorporation: This document is often used interchangeably with the Articles of Incorporation. It serves as the formal declaration that a corporation has been legally created. It includes essential information like the corporation's name, purpose, and registered agent.

- Initial Board of Directors Meeting Minutes: After incorporation, the initial meeting of the board of directors is crucial. The minutes from this meeting document important decisions, such as the appointment of officers and the adoption of bylaws. This record helps establish a clear governance structure.

- Employer Identification Number (EIN): An EIN is required for tax purposes and is used to identify your corporation to the IRS. Obtaining an EIN is essential if your corporation plans to hire employees or open a business bank account.

- State Business Licenses and Permits: Depending on the nature of your business, you may need various licenses or permits to operate legally. These can include local business licenses, zoning permits, and industry-specific licenses. Researching and obtaining the necessary permissions is vital for compliance.

Each of these documents plays a significant role in establishing and maintaining your corporation. Being thorough and organized when preparing these forms can lead to a smoother process and a solid foundation for your business's future.

Misconceptions

When it comes to the New York Articles of Incorporation form, there are several misconceptions that can lead to confusion. Here are six common misunderstandings:

-

All businesses must file Articles of Incorporation.

This is not true. Only corporations need to file Articles of Incorporation. Other business entities, such as sole proprietorships or partnerships, do not require this document.

-

Filing Articles of Incorporation guarantees a successful business.

While filing the form is an important step in establishing a corporation, it does not ensure business success. Success depends on various factors, including management, market conditions, and financial planning.

-

The Articles of Incorporation are the same as a business license.

This is a misconception. The Articles of Incorporation establish the corporation's existence, while a business license is a separate requirement that permits the business to operate legally.

-

Once filed, Articles of Incorporation cannot be changed.

In reality, amendments can be made to the Articles of Incorporation after they have been filed. This allows corporations to adapt to changes in their structure or operations.

-

Only lawyers can file Articles of Incorporation.

While it is common for legal professionals to assist with the filing process, individuals can file the form themselves if they understand the requirements and procedures.

-

The process is the same for all states.

This is incorrect. Each state has its own requirements and procedures for filing Articles of Incorporation. It is essential to follow New York's specific guidelines.

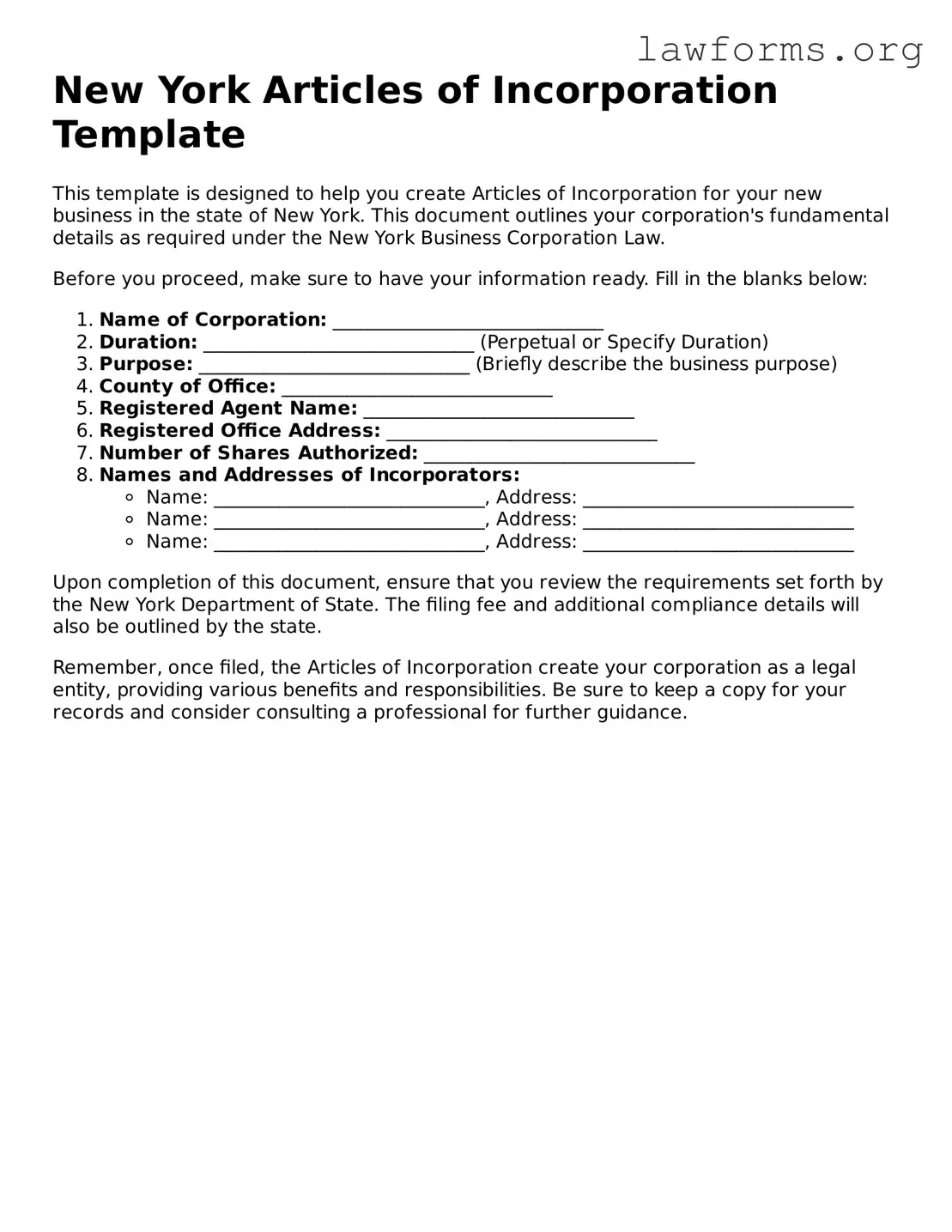

Preview - New York Articles of Incorporation Form

New York Articles of Incorporation Template

This template is designed to help you create Articles of Incorporation for your new business in the state of New York. This document outlines your corporation's fundamental details as required under the New York Business Corporation Law.

Before you proceed, make sure to have your information ready. Fill in the blanks below:

- Name of Corporation: _____________________________

- Duration: _____________________________ (Perpetual or Specify Duration)

- Purpose: _____________________________ (Briefly describe the business purpose)

- County of Office: _____________________________

- Registered Agent Name: _____________________________

- Registered Office Address: _____________________________

- Number of Shares Authorized: _____________________________

- Names and Addresses of Incorporators:

- Name: _____________________________, Address: _____________________________

- Name: _____________________________, Address: _____________________________

- Name: _____________________________, Address: _____________________________

Upon completion of this document, ensure that you review the requirements set forth by the New York Department of State. The filing fee and additional compliance details will also be outlined by the state.

Remember, once filed, the Articles of Incorporation create your corporation as a legal entity, providing various benefits and responsibilities. Be sure to keep a copy for your records and consider consulting a professional for further guidance.

Key takeaways

- Purpose of the Form: The New York Articles of Incorporation is essential for establishing a corporation in the state. It serves as the official document that creates the corporation.

- Filing Requirements: Ensure that you meet all state requirements, including the necessary fees and information about the corporation.

- Name of the Corporation: Choose a unique name for your corporation that complies with New York naming rules. The name must not be similar to existing entities.

- Registered Agent: Designate a registered agent who will receive legal documents on behalf of the corporation. This agent must have a physical address in New York.

- Business Purpose: Clearly state the purpose of your corporation. This can be broad, but it should reflect the nature of your business activities.

- Duration: Specify the duration of the corporation. Most corporations are set to exist perpetually unless stated otherwise.

- Incorporators: Include the names and addresses of the incorporators. These individuals are responsible for filing the Articles and may be different from the initial directors.

- Initial Directors: List the initial directors of the corporation. This information helps establish the governance structure from the outset.

- Filing Process: Submit the completed form to the New York Department of State, along with the required filing fee. Ensure you keep a copy for your records.

Similar forms

- Bylaws: These govern the internal management of a corporation, outlining the roles of officers, procedures for meetings, and other operational details.

- Certificate of Incorporation: Often used interchangeably with Articles of Incorporation, this document formally establishes a corporation in a specific state.

- Operating Agreement: For LLCs, this document details the management structure and operational procedures, similar to how bylaws function for corporations.

- Partnership Agreement: This outlines the terms and conditions of a partnership, detailing roles and responsibilities, akin to how Articles of Incorporation define corporate structure.

- Business License: This document grants permission to operate a business legally, similar to how Articles of Incorporation establish a corporation’s legal existence.

- Employee Handbook: The Employee Handbook form is an important document that outlines a company's policies, procedures, and expectations for its employees. This form serves as a resource to help employees understand their rights and responsibilities within the workplace. Ensure you're informed—fill out the form by clicking the button below. For more detailed templates, visit Top Document Templates.

- Tax Identification Number (TIN): This number is necessary for tax purposes, similar to how Articles of Incorporation are essential for establishing a corporation's legal identity.

- Shareholder Agreement: This document outlines the rights and obligations of shareholders, paralleling how Articles of Incorporation define the structure and purpose of the corporation.

- Annual Report: Required by many states, this document provides updated information about the corporation, reflecting changes similar to how Articles of Incorporation initially establish corporate details.