Attorney-Approved Deed in Lieu of Foreclosure Template for the State of New York

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is an agreement where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | The process is governed by New York State law, particularly under the Real Property Actions and Proceedings Law (RPAPL). |

| Eligibility | Homeowners facing financial hardship may qualify, but the lender must agree to accept the deed. |

| Benefits | This option can help borrowers avoid the lengthy foreclosure process and may have less impact on their credit score. |

| Process | To initiate, the borrower must provide the lender with a written request, along with any required documentation. |

| Potential Risks | Borrowers may still be liable for any remaining debt if the property value is less than the mortgage balance. |

Dos and Don'ts

When filling out the New York Deed in Lieu of Foreclosure form, it is important to follow specific guidelines to ensure accuracy and compliance. Below are some recommended actions and common pitfalls to avoid.

- Do ensure that all parties involved are clearly identified, including the borrower and lender.

- Do provide accurate property descriptions, including the address and legal description.

- Do sign the form in the presence of a notary public to validate the document.

- Do keep copies of the completed form for your records.

- Don't leave any sections blank; fill out all required fields completely.

- Don't use vague language; be specific about the terms and conditions.

- Don't rush the process; take the time to review all information for accuracy.

Following these guidelines can help ensure a smoother process when submitting the Deed in Lieu of Foreclosure form. Careful attention to detail is essential.

Create Popular Deed in Lieu of Foreclosure Forms for Different States

California Pre-foreclosure Property Transfer - The deed serves as a formal recognition of the borrower’s inability to continue payments.

Deed in Lieu of Foreclosure Form - This option is typically considered when the property value is less than the mortgage balance.

The California Judicial Council form is a standardized document used in California courts to streamline legal processes. It allows individuals to provide necessary information in a clear and organized manner, ensuring that all required details are included for court filings. This form can be attached to any Judicial Council form or other court papers, making it a versatile tool in legal proceedings. For more information, you can visit californiadocsonline.com/california-judicial-council-form/.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - A Deed in Lieu of Foreclosure can help homeowners escape the financial burden of an impending foreclosure.

Sale in Lieu of Foreclosure - Using a Deed in Lieu can often be faster than going through the entire foreclosure process.

Common mistakes

-

Not reading the instructions carefully. Many people overlook the guidelines provided for filling out the form. This can lead to errors that may delay the process.

-

Failing to provide accurate property information. Ensure that the property address and legal description are correct. Inaccurate details can cause significant issues.

-

Not including all required signatures. All parties involved in the property must sign the deed. Missing signatures can invalidate the document.

-

Ignoring the need for notarization. The deed must be notarized to be legally binding. Skipping this step can lead to complications.

-

Not consulting with a legal professional. Many individuals attempt to fill out the form without seeking advice. Legal guidance can help avoid costly mistakes.

-

Overlooking tax implications. Some may not consider the tax consequences of a deed in lieu of foreclosure. Understanding these can prevent unexpected financial burdens.

-

Failing to communicate with the lender. It’s crucial to keep the lender informed throughout the process. Lack of communication can lead to misunderstandings.

-

Not keeping copies of submitted documents. Always retain copies of the completed form and any correspondence. This can be important for future reference.

-

Assuming the process is quick and easy. Many people underestimate the time it takes to complete a deed in lieu of foreclosure. Patience is essential.

-

Neglecting to review the final document. Before submitting, always review the completed form for any errors. A final check can save a lot of trouble.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer ownership of their property to the lender in order to avoid foreclosure. This process often involves several other forms and documents that facilitate the transaction and ensure compliance with legal requirements. Below is a list of documents commonly used alongside the New York Deed in Lieu of Foreclosure form.

- Loan Modification Agreement: This document outlines changes to the terms of the original loan, such as interest rates or payment schedules, which may be proposed before opting for a deed in lieu.

- Notice of Default: A formal notification sent to the borrower indicating that they have defaulted on their loan payments, often required before initiating foreclosure proceedings.

- Release of Liability: A document that releases the borrower from further obligations under the mortgage after the deed in lieu is executed, ensuring they are no longer responsible for the debt.

- Property Inspection Report: A report assessing the condition of the property, which may be required by the lender to evaluate its value and any potential repairs needed.

- Divorce Settlement Agreement Form: To facilitate the equitable distribution of assets, refer to the essential Divorce Settlement Agreement guidelines for a comprehensive approach to your divorce proceedings.

- Settlement Statement: A document detailing the financial aspects of the transaction, including any costs or fees associated with the deed in lieu process.

- Title Search Report: An examination of the property’s title history to ensure there are no outstanding liens or claims that could complicate the transfer of ownership.

- Affidavit of Title: A sworn statement by the borrower affirming their ownership of the property and disclosing any encumbrances or legal issues related to the title.

- Power of Attorney: A legal document that allows one party to act on behalf of another, which may be necessary if the borrower is unable to sign the deed in lieu in person.

- Deed Transfer Form: This form is used to officially record the transfer of property ownership from the borrower to the lender in the public records.

These documents collectively ensure that the deed in lieu process is conducted smoothly and legally. Each plays a vital role in protecting the interests of both the borrower and the lender, facilitating a more efficient resolution to the mortgage default situation.

Misconceptions

Understanding the New York Deed in Lieu of Foreclosure can be challenging. Here are six common misconceptions about this legal process:

- It eliminates all debt immediately. Many believe that signing a deed in lieu of foreclosure wipes out all mortgage debt. However, this is not always the case. Sometimes, lenders may still pursue deficiency judgments for the remaining balance.

- It is a quick and easy solution. Some think that a deed in lieu is a fast way to resolve financial issues. In reality, the process can take time and requires careful negotiation with the lender.

- It will not affect your credit score. People often assume that a deed in lieu of foreclosure has no impact on their credit. In fact, it can significantly lower credit scores, similar to a foreclosure.

- All lenders accept deeds in lieu. Many homeowners believe that all lenders will agree to a deed in lieu of foreclosure. However, some lenders may refuse this option and prefer to proceed with foreclosure.

- It absolves you of any future liability. There is a misconception that signing a deed in lieu protects homeowners from any future claims. In some cases, lenders may still hold borrowers liable for certain debts.

- It is the same as a short sale. Some individuals confuse a deed in lieu with a short sale. While both involve transferring property to avoid foreclosure, they are distinct processes with different implications.

Understanding these misconceptions can help homeowners make informed decisions regarding their financial situations.

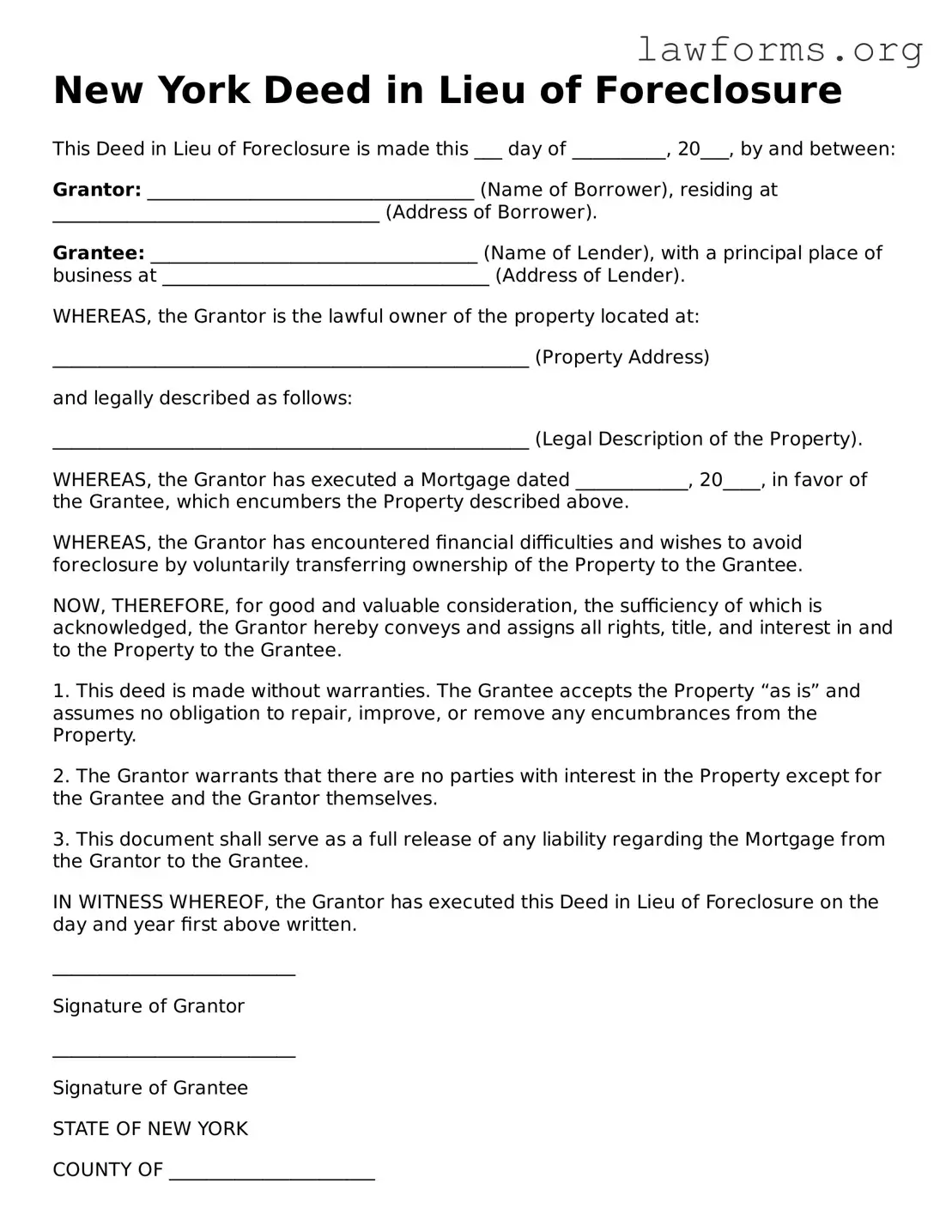

Preview - New York Deed in Lieu of Foreclosure Form

New York Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made this ___ day of __________, 20___, by and between:

Grantor: ___________________________________ (Name of Borrower), residing at ___________________________________ (Address of Borrower).

Grantee: ___________________________________ (Name of Lender), with a principal place of business at ___________________________________ (Address of Lender).

WHEREAS, the Grantor is the lawful owner of the property located at:

___________________________________________________ (Property Address)

and legally described as follows:

___________________________________________________ (Legal Description of the Property).

WHEREAS, the Grantor has executed a Mortgage dated ____________, 20____, in favor of the Grantee, which encumbers the Property described above.

WHEREAS, the Grantor has encountered financial difficulties and wishes to avoid foreclosure by voluntarily transferring ownership of the Property to the Grantee.

NOW, THEREFORE, for good and valuable consideration, the sufficiency of which is acknowledged, the Grantor hereby conveys and assigns all rights, title, and interest in and to the Property to the Grantee.

1. This deed is made without warranties. The Grantee accepts the Property “as is” and assumes no obligation to repair, improve, or remove any encumbrances from the Property.

2. The Grantor warrants that there are no parties with interest in the Property except for the Grantee and the Grantor themselves.

3. This document shall serve as a full release of any liability regarding the Mortgage from the Grantor to the Grantee.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure on the day and year first above written.

__________________________

Signature of Grantor

__________________________

Signature of Grantee

STATE OF NEW YORK

COUNTY OF ______________________

On this ___ day of ____________, 20___, before me personally appeared ____________, to me known to be the person described in and who executed the foregoing instrument and acknowledged that he/she executed the same.

______________________________

Notary Public

My commission expires: _______________

Key takeaways

When filling out and using the New York Deed in Lieu of Foreclosure form, keep the following key points in mind:

- The form transfers property ownership from the borrower to the lender to avoid foreclosure.

- Both parties must agree to the terms outlined in the deed.

- It is important to ensure that all information is accurate and complete to avoid delays.

- Consult with a legal professional to understand the implications of signing the deed.

- Be aware that this action may impact your credit score and future borrowing ability.

- Once the deed is executed, the borrower relinquishes all rights to the property.

Similar forms

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage, with the lender's approval. Both processes aim to avoid foreclosure.

- Loan Modification Agreement: This agreement changes the terms of the original loan, such as the interest rate or payment schedule, to make it more manageable for the borrower, similar to how a deed in lieu seeks to resolve the mortgage issue.

- Forebearance Agreement: This document allows the borrower to temporarily pause or reduce mortgage payments, providing relief and preventing foreclosure, akin to a deed in lieu.

- Quitclaim Deed: This document transfers any interest the owner has in the property to another party. While not necessarily resolving a mortgage issue, it can facilitate a property transfer similar to a deed in lieu.

- Release of Mortgage: This document indicates that the lender has released its claim on the property. It can occur after a deed in lieu is executed, signifying the end of the borrower's obligation.

- Property Settlement Agreement: Often used in divorce, this document outlines how property will be divided. Like a deed in lieu, it can help resolve ownership issues without going through foreclosure.

- Deed of Trust: This document secures a loan by placing the property as collateral. While it serves a different purpose, it is related to the security interests involved in a deed in lieu.

- Bankruptcy Filing: This legal process can halt foreclosure proceedings and allow for debt restructuring. It provides an alternative to a deed in lieu for those facing financial distress.

- Settlement Statement: This document outlines the financial details of a real estate transaction. It can be relevant in both short sales and deeds in lieu, detailing the transfer of property and any outstanding debts.

- Trailer Bill of Sale: This essential form captures the transfer of ownership for a trailer in Ohio, ensuring that both the seller and buyer are protected during the transaction. For more information, you can visit Ohio PDF Forms.

- Affidavit of Title: This document confirms the property owner’s legal right to sell the property. It can be used in conjunction with a deed in lieu to affirm ownership before the transfer occurs.