Attorney-Approved Deed Template for the State of New York

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | A New York Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deeds, Quitclaim Deeds, and Bargain and Sale Deeds. |

| Governing Law | The transfer of property in New York is governed by the New York Real Property Law. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property) to be valid. |

| Notarization | To ensure authenticity, the deed must be notarized before it can be recorded. |

| Recording | Recording the deed with the county clerk's office protects the new owner's rights against future claims. |

| Consideration | The deed should state the consideration (payment) involved in the transfer, although it can be nominal. |

| Legal Description | A precise legal description of the property is essential for the deed to be valid and enforceable. |

| Tax Implications | Transferring property may trigger transfer taxes, which should be considered during the transaction. |

Dos and Don'ts

When filling out the New York Deed form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check the property description for accuracy.

- Do ensure all names are spelled correctly and match legal documents.

- Do provide the correct county where the property is located.

- Do sign the form in the presence of a notary public.

- Do include the date of the transaction.

- Don’t leave any required fields blank.

- Don’t use abbreviations for names or addresses.

- Don’t forget to check local filing fees before submitting.

- Don’t submit the form without a proper notarization.

Create Popular Deed Forms for Different States

Grant Deed in California - The seller’s disclosure of known issues with the property may be required.

Nc Deed Transfer Form - Completing a Deed accurately is crucial to avoid future disputes over property rights.

Florida Deed Form - Requires signatures from both the buyer and seller to be valid.

When engaging in the sale of a trailer, it’s crucial to utilize the Ohio Trailer Bill of Sale form to formalize the ownership transfer. This important document not only safeguards the interests of both the seller and the buyer but also aids in the proper registration of the trailer with state authorities. To ensure you have the correct version, you can access the necessary paperwork from Ohio PDF Forms.

Deed Transfer Nj - A special purpose deed can facilitate specific transactions, such as property transfers between spouses.

Common mistakes

-

Incorrect Names: People often misspell names or use nicknames instead of legal names. It’s essential to use the full legal name as it appears on identification documents.

-

Wrong Property Description: Failing to accurately describe the property can lead to issues. The description should match what is on the property deed or tax records.

-

Not Including Signatures: Some individuals forget to sign the deed. A deed must be signed by the grantor to be valid.

-

Missing Notarization: A deed typically requires notarization. Without a notary’s signature, the document may not be legally binding.

-

Incorrect Date: The date of signing is crucial. An incorrect date can create confusion about when the transfer took place.

-

Failure to Include Consideration: This refers to the value exchanged for the property. Not stating this can lead to misunderstandings about the transaction.

-

Improperly Filling Out the Form: Some people overlook specific sections or fail to fill them out completely. Each section should be reviewed carefully.

-

Not Following Local Laws: Different areas may have unique requirements for deeds. Ignoring local laws can result in invalid documents.

-

Neglecting to Record the Deed: After completing the deed, some forget to file it with the appropriate county office. Recording the deed is essential for public notice.

Documents used along the form

When transferring property in New York, the deed form is just one piece of the puzzle. Several other documents often accompany the deed to ensure a smooth transaction. Each of these documents serves a specific purpose, helping to clarify the terms of the transfer and protect the interests of all parties involved.

- Title Search Report: This document confirms the property's ownership and identifies any liens or claims against it. A thorough title search helps prevent disputes after the transfer.

- Durable Power of Attorney: This document enables an individual to appoint an agent who can make financial decisions on their behalf, extending its validity even during incapacity. For assistance in creating this document, visit https://formsillinois.com.

- Affidavit of Title: This sworn statement is provided by the seller, affirming their ownership of the property and disclosing any known issues. It adds a layer of protection for the buyer.

- Property Transfer Tax Form: This form is required to report the transfer of property to the tax authorities. It ensures that any applicable taxes are calculated and paid during the transaction.

- Closing Statement: Also known as a HUD-1 statement, this document outlines the financial details of the transaction. It lists all costs associated with the closing process, including fees and adjustments.

- Bill of Sale: If personal property is included in the sale, a bill of sale provides a written record of the items being transferred. This document can help avoid misunderstandings later.

- Power of Attorney: In some cases, a seller may not be able to attend the closing. A power of attorney allows another person to sign documents on their behalf, ensuring the transaction can proceed smoothly.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules and regulations governing the community. They inform the buyer about their responsibilities and rights as a member.

Understanding these documents can make the property transfer process more manageable. Each plays a vital role in protecting the interests of both buyers and sellers, ensuring that the transaction is legally sound and transparent.

Misconceptions

Understanding the New York Deed form is essential for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are four common myths:

- All Deeds Are the Same: Many people believe that all deeds serve the same purpose. In reality, different types of deeds, such as warranty deeds and quitclaim deeds, have distinct legal implications and protections.

- Notarization Is Optional: Some assume that notarization is not necessary for a deed to be valid. In New York, however, a deed must be notarized to be legally effective and enforceable.

- Only the Seller Signs the Deed: A common misconception is that only the seller needs to sign the deed. In fact, both the seller and the buyer should sign to ensure the transfer of ownership is legally recognized.

- Deeds Are Only Needed for Sales: Many think that deeds are only required when property is sold. Deeds are also necessary for transfers through gifts, inheritance, or other means of conveyance.

Clearing up these misconceptions can help ensure a smoother property transaction process. Always consult with a legal professional when dealing with deeds to avoid potential pitfalls.

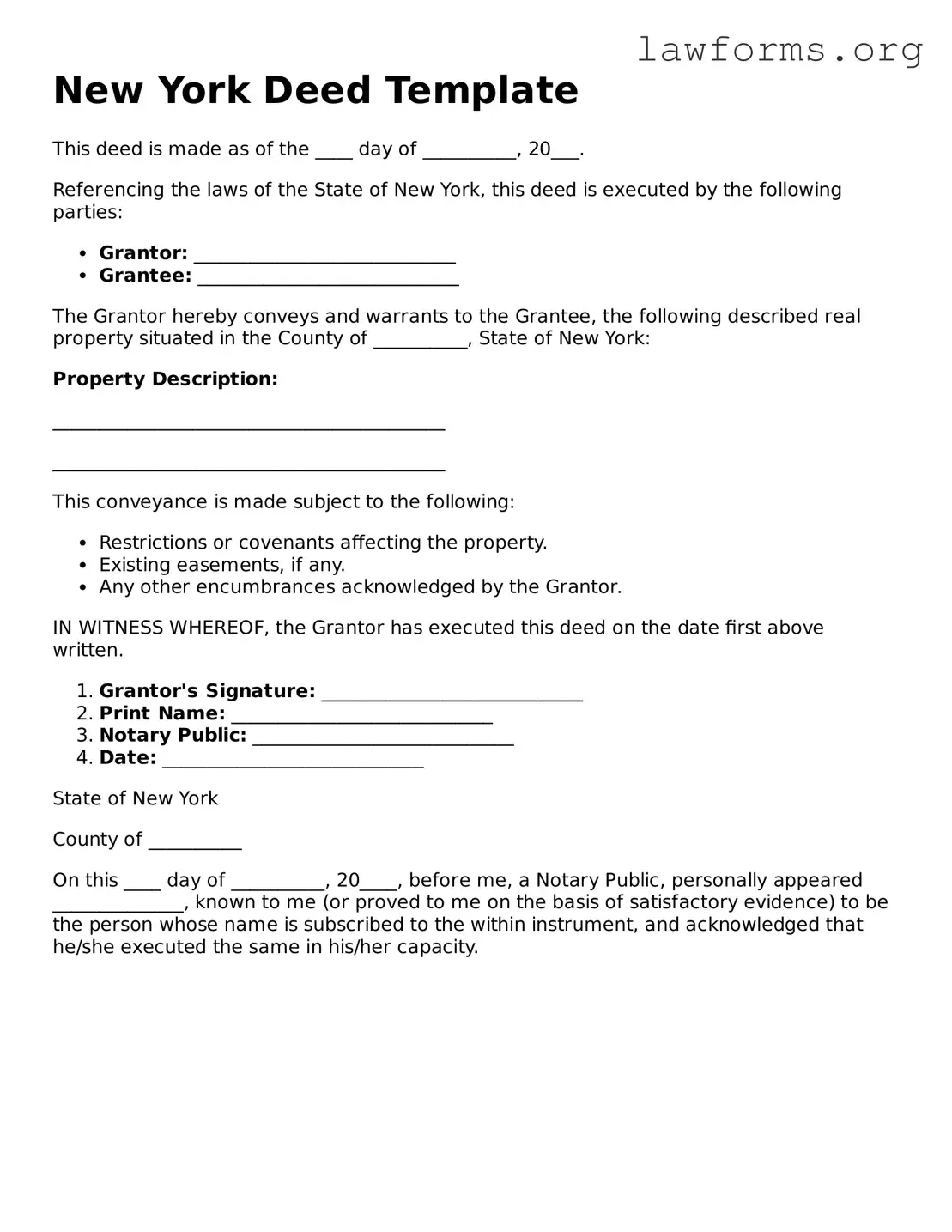

Preview - New York Deed Form

New York Deed Template

This deed is made as of the ____ day of __________, 20___.

Referencing the laws of the State of New York, this deed is executed by the following parties:

- Grantor: ____________________________

- Grantee: ____________________________

The Grantor hereby conveys and warrants to the Grantee, the following described real property situated in the County of __________, State of New York:

Property Description:

__________________________________________

__________________________________________

This conveyance is made subject to the following:

- Restrictions or covenants affecting the property.

- Existing easements, if any.

- Any other encumbrances acknowledged by the Grantor.

IN WITNESS WHEREOF, the Grantor has executed this deed on the date first above written.

- Grantor's Signature: ____________________________

- Print Name: ____________________________

- Notary Public: ____________________________

- Date: ____________________________

State of New York

County of __________

On this ____ day of __________, 20____, before me, a Notary Public, personally appeared ______________, known to me (or proved to me on the basis of satisfactory evidence) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same in his/her capacity.

Key takeaways

When filling out and using the New York Deed form, keep these key takeaways in mind:

- Ensure all parties' names are accurate and match their legal identification. This helps prevent future disputes.

- Include a clear and concise description of the property. A well-defined description avoids confusion and ensures proper transfer of ownership.

- Sign the deed in the presence of a notary public. This step is crucial for validating the document and making it legally binding.

- File the completed deed with the appropriate county clerk's office. This action officially records the change of ownership and protects your rights as a property owner.

Similar forms

- Warranty Deed: This document guarantees that the seller has clear title to the property and provides a promise to defend against any claims. It ensures the buyer receives full ownership rights.

- Quitclaim Deed: Unlike a warranty deed, a quitclaim deed transfers whatever interest the seller has in the property without any guarantees. It is often used to transfer property between family members.

-

California Judicial Council Form: This standardized document is essential for legal proceedings in California, ensuring that all necessary information is presented clearly and organized efficiently. For more details, visit californiadocsonline.com/california-judicial-council-form.

- Grant Deed: This type of deed conveys property and includes a guarantee that the seller has not sold the property to anyone else. It provides some level of protection for the buyer.

- Special Purpose Deed: Used for specific transactions, such as transferring property to a trust or a government entity. This deed may have unique provisions tailored to the situation.

- Executor’s Deed: This document is used by an executor of an estate to transfer property from a deceased person’s estate to the beneficiaries. It reflects the authority granted by the will.

- Trustee’s Deed: When property is held in a trust, a trustee can use this deed to transfer property to beneficiaries. It outlines the trustee's authority to act on behalf of the trust.

- Deed of Trust: This document is used in real estate transactions involving a loan. It secures the loan by transferring the property to a trustee until the loan is paid off.

- Mineral Deed: This deed transfers ownership of mineral rights beneath the surface of the property. It is often used in transactions involving oil, gas, or other natural resources.

- Bill of Sale: While not a deed, a bill of sale serves to transfer ownership of personal property, such as vehicles or equipment. It documents the sale and provides proof of ownership.