Attorney-Approved Durable Power of Attorney Template for the State of New York

Form Specifications

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to appoint someone to make financial and legal decisions on their behalf. |

| Governing Law | The New York Durable Power of Attorney is governed by New York General Obligations Law, Article 5, Title 15. |

| Durability | This form remains effective even if the principal becomes incapacitated. |

| Principal | The individual who creates the Durable Power of Attorney is known as the principal. |

| Agent | The person appointed to act on behalf of the principal is called the agent or attorney-in-fact. |

| Signing Requirements | The form must be signed by the principal in the presence of a notary public. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time as long as they are competent. |

| Limitations | Some powers, such as making medical decisions, require a separate document. |

| Effective Date | The Durable Power of Attorney becomes effective immediately upon signing, unless otherwise specified. |

| Fiduciary Duty | The agent has a legal obligation to act in the best interest of the principal. |

Dos and Don'ts

When filling out the New York Durable Power of Attorney form, it is essential to follow certain guidelines to ensure that the document is valid and meets your needs. Below is a list of things you should and shouldn't do.

- Do ensure you understand the powers you are granting to your agent.

- Do choose a trustworthy individual as your agent.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank.

- Don't choose an agent who may have conflicts of interest.

- Don't forget to date the document when signing.

- Don't assume that verbal agreements are sufficient; written documentation is necessary.

Create Popular Durable Power of Attorney Forms for Different States

Power of Attorney Texas Form - Choosing a trusted person as your agent ensures that your best interests will be prioritized.

How to File for Power of Attorney in Florida - The form is particularly important for aging individuals who may face health challenges in the future.

Ohio Durable Power of Attorney - It can help avoid lengthy court procedures in case of incapacity.

Common mistakes

-

Not Selecting the Right Agent: One common mistake is failing to choose an agent who is trustworthy and capable of handling financial matters. It’s essential to select someone who understands your wishes and can act in your best interest.

-

Ignoring Specific Powers: Some individuals overlook the importance of specifying the powers granted to the agent. Clearly defining what your agent can and cannot do helps prevent misunderstandings and potential misuse of authority.

-

Failing to Sign and Date: A durable power of attorney is not valid unless it is properly signed and dated. Neglecting this step can render the document ineffective when you need it most.

-

Not Having Witnesses or Notarization: In New York, a durable power of attorney must be signed in the presence of a notary public. Some people forget this requirement, leading to complications when the document is needed.

-

Using Outdated Forms: Many individuals mistakenly use outdated forms that do not comply with current laws. Always ensure you are using the latest version of the New York Durable Power of Attorney form.

-

Overlooking Revocation: Failing to revoke an old power of attorney when creating a new one can create confusion. It is crucial to clearly indicate that any prior documents are no longer valid.

-

Not Reviewing the Document: After filling out the form, some people neglect to review it for accuracy. Double-checking the information can help avoid errors that could impact the document's effectiveness.

Documents used along the form

A Durable Power of Attorney (DPOA) is a vital legal document that allows an individual, known as the principal, to appoint someone else, called the agent, to make decisions on their behalf. This arrangement can be crucial in various situations, particularly when the principal becomes incapacitated. Alongside the DPOA, there are several other forms and documents that may be used to ensure comprehensive legal coverage. Below is a list of such documents commonly associated with a Durable Power of Attorney.

- Health Care Proxy: This document allows an individual to designate someone to make medical decisions on their behalf if they are unable to do so. It is essential for ensuring that healthcare preferences are respected.

- Living Will: A living will outlines a person's wishes regarding medical treatment in situations where they cannot communicate their desires. It often addresses end-of-life care and other critical health decisions.

- Last Will and Testament: This document specifies how an individual’s assets and estate should be distributed after their death. It is crucial for ensuring that personal wishes are honored.

- Revocable Trust: A revocable trust allows an individual to transfer assets into a trust during their lifetime, which can help avoid probate and provide for asset management in the event of incapacity.

- Advance Directive: An advance directive is a broader term that includes both a living will and a health care proxy. It provides guidance on medical decisions and appoints an agent for health care matters.

- Financial Power of Attorney: Similar to a DPOA, this document specifically grants an agent authority to manage financial matters. It can be useful for handling bills, investments, and other financial obligations.

- Articles of Incorporation: Essential for businesses aiming to establish a corporation in New York, this document is the first step to legal recognition, enabling entrepreneurs to protect their personal assets. Further guidance can be found at Formaid Org.

- Guardian Designation: This document allows an individual to designate a guardian for their minor children or dependents in the event of their death or incapacity, ensuring that their care is managed according to their wishes.

- Property Transfer Deed: This document facilitates the transfer of real estate property to another individual or entity. It is important for estate planning and can help avoid probate issues.

- HIPAA Authorization: This authorization allows an individual to grant access to their medical records to designated persons. It ensures that those individuals can receive necessary health information when making decisions.

Each of these documents serves a specific purpose and can work in conjunction with a Durable Power of Attorney to create a robust legal framework. It is advisable to consult with a legal expert to ensure that all necessary documents are properly executed and aligned with personal wishes and state laws.

Misconceptions

Many people have misunderstandings about the New York Durable Power of Attorney (DPOA) form. Here are five common misconceptions and clarifications for each:

- A Durable Power of Attorney is only for financial matters. While it is commonly used for financial decisions, a DPOA can also cover health care decisions if specified. You can grant your agent authority over both areas.

- Once I sign a Durable Power of Attorney, I lose control over my affairs. This is not true. You can still manage your own affairs as long as you are capable. The DPOA only activates when you become incapacitated or if you specify that it should take effect immediately.

- All Durable Power of Attorney forms are the same. Each state has its own requirements and forms. The New York DPOA has specific language and provisions that must be followed to ensure it is valid in New York.

- I can revoke a Durable Power of Attorney anytime. While you can revoke a DPOA, it must be done in writing and communicated to your agent and any institutions relying on the DPOA. If you become incapacitated, revoking it may not be possible.

- Only lawyers can create a Durable Power of Attorney. While it is advisable to consult a lawyer to ensure that the document meets your needs and complies with the law, you can create a DPOA on your own. However, legal guidance can help avoid potential pitfalls.

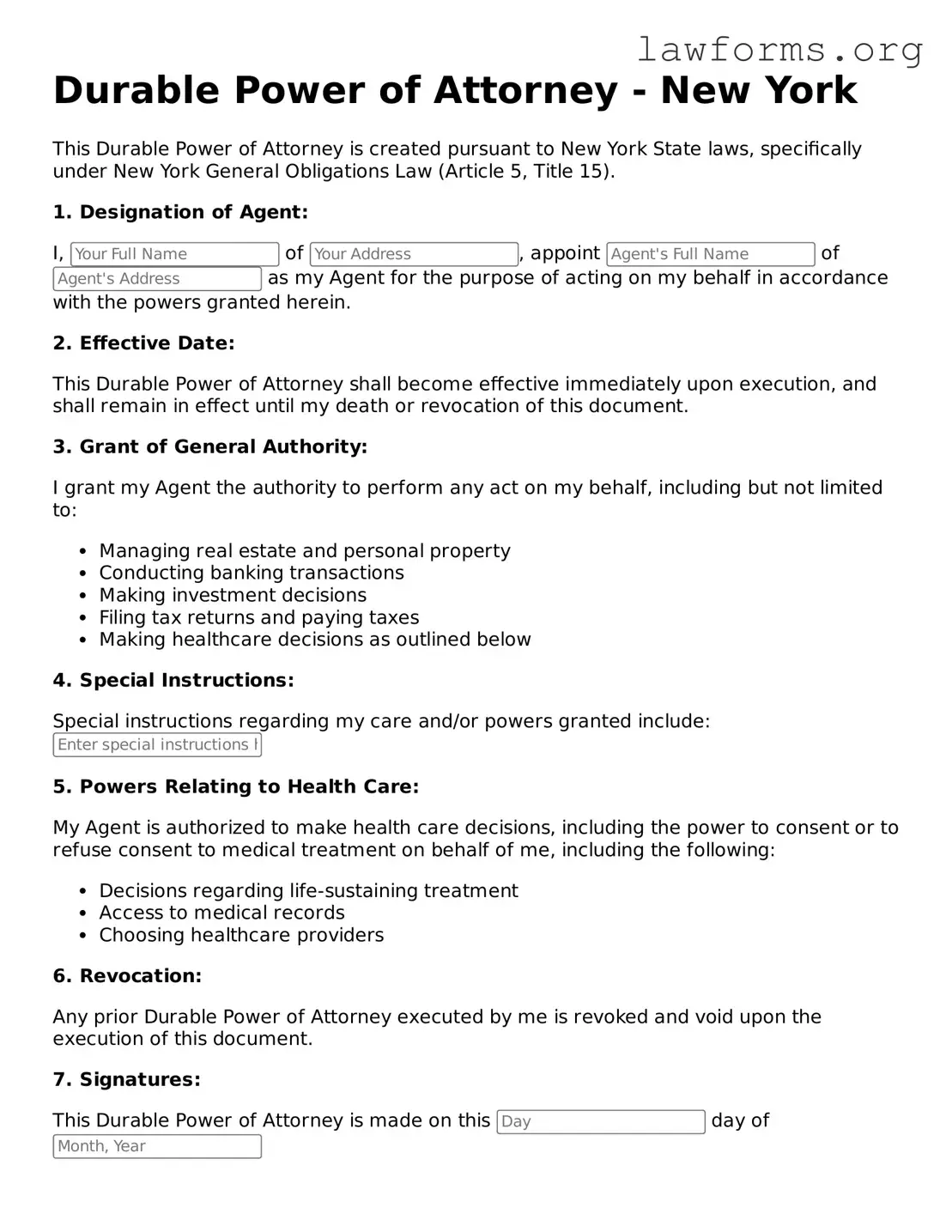

Preview - New York Durable Power of Attorney Form

Durable Power of Attorney - New York

This Durable Power of Attorney is created pursuant to New York State laws, specifically under New York General Obligations Law (Article 5, Title 15).

1. Designation of Agent:

I, of , appoint of as my Agent for the purpose of acting on my behalf in accordance with the powers granted herein.

2. Effective Date:

This Durable Power of Attorney shall become effective immediately upon execution, and shall remain in effect until my death or revocation of this document.

3. Grant of General Authority:

I grant my Agent the authority to perform any act on my behalf, including but not limited to:

- Managing real estate and personal property

- Conducting banking transactions

- Making investment decisions

- Filing tax returns and paying taxes

- Making healthcare decisions as outlined below

4. Special Instructions:

Special instructions regarding my care and/or powers granted include:

5. Powers Relating to Health Care:

My Agent is authorized to make health care decisions, including the power to consent or to refuse consent to medical treatment on behalf of me, including the following:

- Decisions regarding life-sustaining treatment

- Access to medical records

- Choosing healthcare providers

6. Revocation:

Any prior Durable Power of Attorney executed by me is revoked and void upon the execution of this document.

7. Signatures:

This Durable Power of Attorney is made on this day of

Signature: ____________________

Print Name:

Witness: I hereby attest that the principal appeared to be of sound mind and was acting of their own free will.

Witness Signature: ____________________

Print Name:

Notary Public:

State of New York

County of _______________

On this day of , before me, a Notary Public in and for said State, personally appeared , known to me to be the individual described in and who executed this Durable Power of Attorney.

Notary Signature: ____________________

Notary Name:

Key takeaways

When filling out and using the New York Durable Power of Attorney form, there are several important points to keep in mind:

- Understand the Purpose: The Durable Power of Attorney allows you to appoint someone to manage your financial affairs if you become unable to do so yourself.

- Choose Your Agent Wisely: Select a trustworthy person as your agent, as they will have significant authority over your financial matters.

- Be Specific: Clearly outline the powers you wish to grant your agent. This could include managing bank accounts, paying bills, or handling investments.

- Sign and Notarize: Ensure that the form is properly signed and notarized to make it legally binding. This step is crucial for the document to be effective.

Similar forms

The Durable Power of Attorney (DPOA) is an important legal document that grants someone the authority to make decisions on behalf of another person. It is similar to several other documents that serve related purposes. Here are four documents that share similarities with the DPOA:

- General Power of Attorney: This document allows one person to act on behalf of another in a wide range of legal and financial matters. Unlike the DPOA, a General Power of Attorney typically becomes invalid if the principal becomes incapacitated.

- Healthcare Power of Attorney: This document specifically designates an individual to make medical decisions for someone who is unable to do so. Like the DPOA, it remains effective even if the principal becomes incapacitated.

- Living Will: A Living Will outlines a person's wishes regarding medical treatment and end-of-life care. While it does not appoint an agent like the DPOA, it complements the Healthcare Power of Attorney by providing guidance on the principal's preferences.

- Revocable Trust: This legal arrangement allows a person to place assets into a trust during their lifetime, with the ability to change or revoke it. Similar to a DPOA, a revocable trust can help manage assets if the individual becomes incapacitated, but it is typically more comprehensive in managing estate matters.