Attorney-Approved Last Will and Testament Template for the State of New York

Form Specifications

| Fact Name | Details |

|---|---|

| Legal Requirement | In New York, a Last Will and Testament must be in writing and signed by the testator (the person making the will) in the presence of at least two witnesses. |

| Age Requirement | The testator must be at least 18 years old to create a valid will in New York. |

| Revocation of Will | A will can be revoked by the testator at any time, either by creating a new will or by physically destroying the old one. |

| Governing Law | The New York Estates, Powers and Trusts Law (EPTL) governs the creation and execution of Last Wills and Testaments in New York. |

Dos and Don'ts

When filling out the New York Last Will and Testament form, it is essential to approach the task with care and attention to detail. The following list outlines important do's and don'ts to ensure that your will is valid and reflects your wishes accurately.

- Do clearly identify yourself in the document, including your full name and address.

- Do specify the beneficiaries and what they will receive from your estate.

- Do appoint an executor who will be responsible for managing your estate after your passing.

- Do sign the will in the presence of at least two witnesses, who must also sign it.

- Don't use vague language that could lead to confusion about your intentions.

- Don't forget to date the will; this helps establish the most current version.

- Don't attempt to create a will without understanding the legal requirements in New York.

- Don't store the will in a location that is not accessible to your executor or beneficiaries.

By adhering to these guidelines, you can help ensure that your Last Will and Testament is legally sound and accurately reflects your wishes.

Create Popular Last Will and Testament Forms for Different States

How to Write a Will in Nc - A Last Will is a vital part of estate planning, regardless of the size of your estate.

The Illinois Unclaimed Property Reporting form, or UPD601, is essential for businesses and organizations to report any unclaimed assets, which the state holds for the rightful owners. It is important for compliant submissions to ensure that forgotten bank accounts, uncashed checks, and similar properties are noted properly. For additional resources and assistance with the reporting process, visit formsillinois.com/ to guide you through the requirements and help you avoid any penalties.

Simple Will Florida - Indicates preferences for how debts should be settled posthumously.

California Last Will and Testament - Allows you to name an executor to manage your estate upon your passing.

Free Ohio Last Will and Testament Form Pdf - May vary in complexity based on the size and nature of the estate involved.

Common mistakes

-

Not clearly identifying the testator. It’s essential to include your full name and address. This helps to avoid confusion about who the will belongs to.

-

Failing to date the document. A will should always have a date on it. This indicates when the will was created and helps prevent disputes over which version is valid.

-

Neglecting to include a revocation clause. If there are previous wills, a clear statement revoking them is necessary to ensure that only the most recent will is considered valid.

-

Not naming an executor. An executor is responsible for managing your estate after your passing. Clearly naming this person avoids potential conflicts.

-

Overlooking the need for witnesses. In New York, a will must be signed in the presence of at least two witnesses. Failing to do this can render the will invalid.

-

Using vague language. Being specific about your wishes helps prevent misunderstandings. Clearly state who receives what, and avoid ambiguous terms.

-

Not considering the needs of minor children. If you have children under 18, appoint a guardian in your will to ensure they are cared for according to your wishes.

-

Failing to update the will. Life changes, such as marriage, divorce, or the birth of a child, may require updates to your will. Regular reviews are important.

-

Ignoring state laws. Each state has specific requirements for wills. Familiarizing yourself with New York's laws ensures your will is valid and enforceable.

Documents used along the form

When preparing a Last Will and Testament in New York, it is often beneficial to consider additional documents that can support your estate planning. These documents help clarify your wishes and ensure that your affairs are managed according to your preferences. Below are some commonly used forms and documents that accompany a will.

- Living Will: This document outlines your preferences for medical treatment in the event that you become unable to communicate your wishes. It helps guide healthcare providers and loved ones during critical situations.

- Durable Power of Attorney: This allows you to designate someone to make financial decisions on your behalf if you become incapacitated. It ensures that your financial affairs can be managed without delay.

- Healthcare Proxy: Similar to a living will, this document appoints someone to make medical decisions for you if you are unable to do so. This person will advocate for your healthcare preferences.

- Horse Bill of Sale: When transferring ownership of a horse, utilize the step-by-step Horse Bill of Sale template to ensure all legal aspects are properly addressed.

- Trust Agreement: A trust can hold and manage your assets for your beneficiaries. It can provide more control over how and when your assets are distributed, potentially avoiding probate.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, require you to name beneficiaries. These designations take precedence over your will and can ensure that your assets are distributed quickly.

- Letter of Intent: While not a legal document, this letter can express your wishes regarding the distribution of personal items and provide guidance to your executor. It can clarify your intentions and ease the decision-making process for your loved ones.

Considering these documents alongside your Last Will and Testament can help create a comprehensive estate plan. This approach not only protects your wishes but also provides peace of mind for you and your loved ones.

Misconceptions

Understanding the New York Last Will and Testament form is essential for anyone looking to plan their estate. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- A handwritten will is not valid. Many believe that only formally typed documents can serve as a will. In New York, a handwritten will, known as a holographic will, can be valid if it meets certain criteria, although it is less common.

- All assets must be listed in the will. Some think that every asset must be itemized in the will. While it is advisable to specify significant assets, a will can refer to general categories, allowing for flexibility in asset distribution.

- You cannot change your will once it is created. This misconception can be misleading. A will can be amended or revoked at any time, as long as the testator is of sound mind. Changes should be documented properly to avoid disputes.

- Only lawyers can create a valid will. While legal assistance can be beneficial, it is not mandatory. Individuals can create their own will, provided they follow New York's legal requirements for execution and witness signatures.

- Wills take effect immediately after signing. Some people believe that a will is effective as soon as it is signed. In reality, a will only takes effect upon the death of the testator, which is when its provisions are executed.

- Witnesses must be disinterested parties. There is a belief that witnesses to a will cannot inherit anything from it. In New York, while it is preferable for witnesses to be disinterested, a will can still be valid even if a witness is a beneficiary.

Clarifying these misconceptions can help individuals make informed decisions about their estate planning and ensure their wishes are honored after their passing.

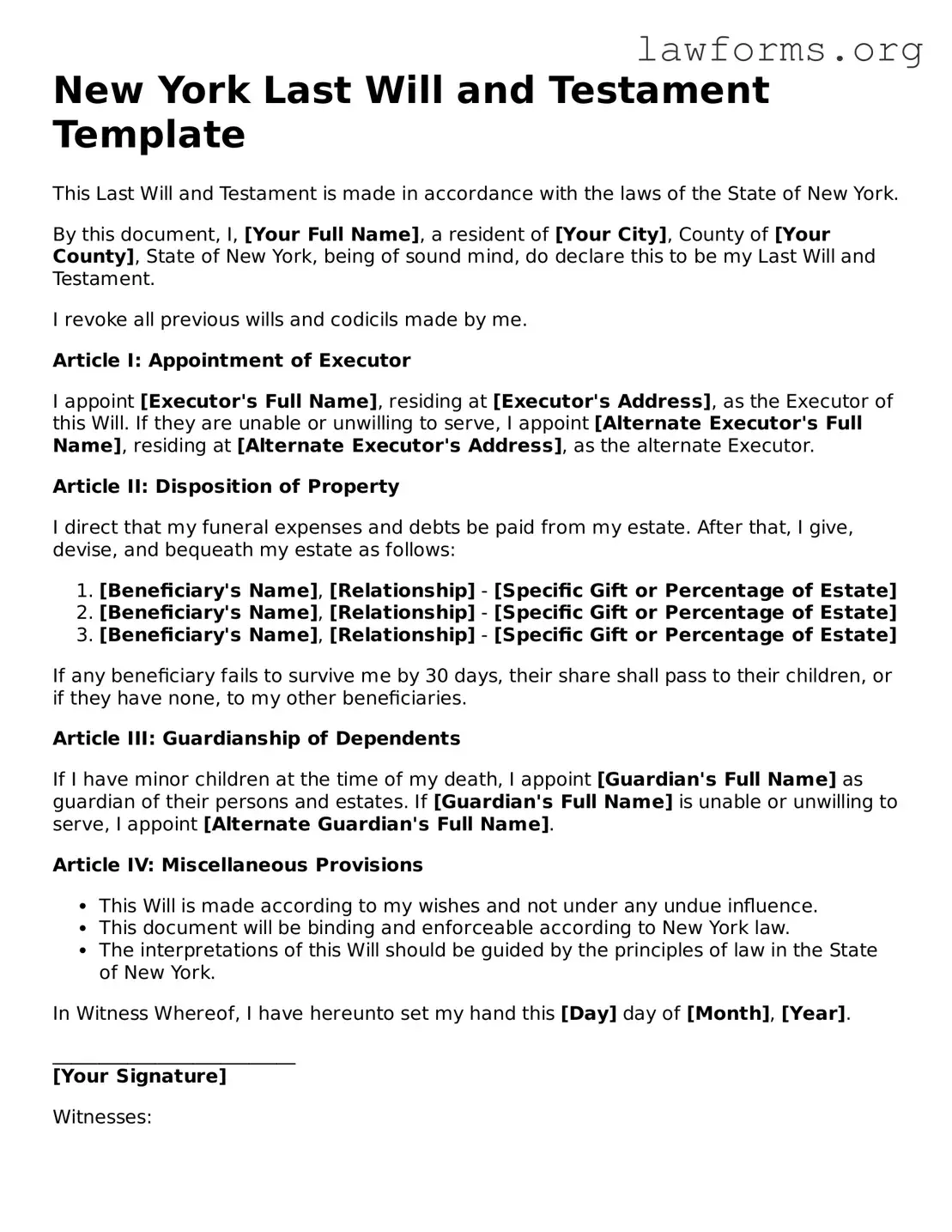

Preview - New York Last Will and Testament Form

New York Last Will and Testament Template

This Last Will and Testament is made in accordance with the laws of the State of New York.

By this document, I, [Your Full Name], a resident of [Your City], County of [Your County], State of New York, being of sound mind, do declare this to be my Last Will and Testament.

I revoke all previous wills and codicils made by me.

Article I: Appointment of Executor

I appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of this Will. If they are unable or unwilling to serve, I appoint [Alternate Executor's Full Name], residing at [Alternate Executor's Address], as the alternate Executor.

Article II: Disposition of Property

I direct that my funeral expenses and debts be paid from my estate. After that, I give, devise, and bequeath my estate as follows:

- [Beneficiary's Name], [Relationship] - [Specific Gift or Percentage of Estate]

- [Beneficiary's Name], [Relationship] - [Specific Gift or Percentage of Estate]

- [Beneficiary's Name], [Relationship] - [Specific Gift or Percentage of Estate]

If any beneficiary fails to survive me by 30 days, their share shall pass to their children, or if they have none, to my other beneficiaries.

Article III: Guardianship of Dependents

If I have minor children at the time of my death, I appoint [Guardian's Full Name] as guardian of their persons and estates. If [Guardian's Full Name] is unable or unwilling to serve, I appoint [Alternate Guardian's Full Name].

Article IV: Miscellaneous Provisions

- This Will is made according to my wishes and not under any undue influence.

- This document will be binding and enforceable according to New York law.

- The interpretations of this Will should be guided by the principles of law in the State of New York.

In Witness Whereof, I have hereunto set my hand this [Day] day of [Month], [Year].

__________________________

[Your Signature]

Witnesses:

We, the undersigned, have witnessed this Last Will and Testament. We affirm that the Testator is of sound mind and freely executes this document.

__________________________

[Witness 1 Full Name], residing at [Witness 1 Address]

__________________________

[Witness 2 Full Name], residing at [Witness 2 Address]

Key takeaways

When preparing a Last Will and Testament in New York, it’s essential to understand a few key points to ensure that your wishes are honored and the document is legally valid.

- Clear Identification: Clearly identify yourself in the will. Include your full name, address, and any other identifying information to avoid confusion.

- Executor Appointment: Choose a reliable executor. This person will be responsible for carrying out your wishes, so select someone trustworthy and capable.

- Witness Requirements: New York law requires that your will be signed in the presence of at least two witnesses. Ensure these witnesses are not beneficiaries to avoid potential conflicts.

- Revocation of Previous Wills: If you have made previous wills, explicitly state that this new will revokes any prior documents. This clarity helps prevent disputes among heirs.

Similar forms

The Last Will and Testament is an important legal document, but it shares similarities with several other documents that serve related purposes. Here are eight documents that are similar to a Last Will and Testament:

- Living Will: This document outlines a person's wishes regarding medical treatment in case they become unable to communicate their preferences. Like a Last Will, it addresses important decisions but focuses on health care rather than asset distribution.

- Trust Agreement: A trust agreement allows a person to place assets into a trust for the benefit of others. Similar to a will, it provides instructions on how assets should be managed and distributed, often avoiding probate.

- Power of Attorney: This document grants someone the authority to make decisions on behalf of another person. While a will distributes assets after death, a power of attorney is effective during a person's lifetime.

- Healthcare Proxy: A healthcare proxy designates an individual to make medical decisions for someone if they are incapacitated. This is similar to a living will but focuses on appointing a decision-maker rather than stating preferences.

- Letter of Intent: This informal document provides guidance to heirs and executors regarding a person's wishes. While it is not legally binding like a will, it can clarify intentions and help with the distribution of assets.

- Codicil: A codicil is an amendment to an existing will. It allows individuals to make changes without drafting an entirely new will, similar in function but serving as an update.

- Joint Will: A joint will is created by two individuals, usually spouses, to outline their shared wishes for asset distribution. It serves a similar purpose to a traditional will but is designed for multiple parties.

- Dog Bill of Sale: This document is essential for transferring ownership of a dog, detailing important information about the animal. For a comprehensive understanding, you can refer to californiadocsonline.com/dog-bill-of-sale-form.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, such as life insurance or retirement accounts, upon death. They are similar to a will in that they dictate asset distribution but operate outside of probate.