Attorney-Approved Loan Agreement Template for the State of New York

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The New York Loan Agreement form outlines the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of New York. |

| Parties Involved | The form includes details about the lender and the borrower, including their names and addresses. |

| Loan Amount | The specific amount of money being borrowed is clearly stated in the agreement. |

| Interest Rate | The form specifies the interest rate applied to the loan, which can be fixed or variable. |

| Repayment Terms | It outlines the repayment schedule, including the due dates and the method of payment. |

| Default Conditions | The agreement details what constitutes a default and the consequences of defaulting on the loan. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

Dos and Don'ts

When filling out the New York Loan Agreement form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do double-check all figures and calculations.

- Do sign and date the form where required.

- Do keep a copy of the completed form for your records.

- Don’t leave any required fields blank.

- Don’t use incorrect or outdated information.

- Don’t rush through the process; take your time.

- Don’t forget to review the terms and conditions.

- Don’t submit the form without a final review.

Create Popular Loan Agreement Forms for Different States

Promissory Note Texas - In case of financial hardship, borrowers may seek to amend the Loan Agreement.

In California, understanding the necessary documentation for civil cases is essential, and one key resource is the California Civil form, specifically the Civil Case Cover Sheet (CM-010). This document plays a vital role in ensuring the effective categorization and management of cases by providing crucial information to the court. For further details and guidance, you can visit californiadocsonline.com/california-civil-form/, where relevant information can assist in properly filling out the required forms.

Promissory Note Template California - A loan agreement is a formal document outlining the terms between a lender and a borrower.

Promissory Note Template Florida - The Loan Agreement can detail how the interest on the loan is calculated.

Common mistakes

Filling out the New York Loan Agreement form can be a complex process. Many individuals make mistakes that could lead to delays or complications in securing their loans. Below is a list of common errors to avoid:

- Incomplete Information: Failing to provide all required personal information can result in processing delays. Ensure that all sections are filled out completely.

- Incorrect Loan Amount: Entering an incorrect loan amount may lead to misunderstandings with the lender. Double-check the figures before submission.

- Missing Signatures: Not signing the agreement can render it invalid. Be sure to sign in all required places.

- Failure to Read Terms: Skipping the fine print can lead to unexpected obligations. Take the time to read and understand all terms and conditions.

- Incorrect Dates: Providing incorrect dates can cause confusion regarding the loan's timeline. Verify all dates for accuracy.

- Omitting Contact Information: Not including current contact details can hinder communication. Always provide accurate phone numbers and addresses.

- Neglecting to Review: Submitting the form without reviewing it can lead to overlooked mistakes. A thorough review is essential before submission.

- Ignoring Required Documentation: Failing to attach necessary documents can delay the loan process. Ensure all required paperwork is included.

- Using Incorrect Formats: Not following specified formats for dates or numbers can create confusion. Adhere to the formats outlined in the agreement.

- Assuming Automatic Approval: Believing that submitting the form guarantees loan approval can lead to disappointment. Understand that approval is contingent on various factors.

By being aware of these common mistakes, individuals can improve their chances of a smooth loan application process. Attention to detail is crucial when filling out legal documents.

Documents used along the form

When entering into a loan agreement in New York, several other forms and documents may be necessary to ensure a smooth transaction. Each of these documents plays a crucial role in outlining the terms, responsibilities, and protections for both the borrower and the lender. Here are five commonly used documents that often accompany a New York Loan Agreement:

- Promissory Note: This document serves as a written promise from the borrower to repay the loan amount under specified terms, including interest rate and repayment schedule. It is a critical piece of evidence in case of default.

- Security Agreement: If the loan is secured by collateral, this agreement outlines what assets are being used as security. It details the lender's rights to the collateral if the borrower fails to repay the loan.

- Personal Guarantee: This document is often required when the borrower is a business entity. A personal guarantee holds an individual personally responsible for the loan, ensuring that the lender has recourse if the business defaults.

- Boat Bill of Sale Form: To facilitate a secure transfer of ownership, refer to the official Boat Bill of Sale form guidelines to ensure all legal requirements are met.

- Loan Application: This form collects essential information about the borrower, including financial history, employment status, and creditworthiness. It helps the lender assess the risk involved in granting the loan.

- Disclosure Statement: This document provides important information about the loan terms, fees, and any potential risks. It ensures that borrowers are fully informed before entering into the agreement.

Understanding these accompanying documents is vital for anyone involved in a loan agreement. They help clarify expectations and protect the interests of all parties involved. Always consider seeking professional advice to navigate these forms effectively.

Misconceptions

Misconceptions about the New York Loan Agreement form can lead to confusion and misunderstandings. Here are five common myths, along with explanations to clarify the truth.

- Misconception 1: The New York Loan Agreement form is only for large loans.

- Misconception 2: All loan agreements are the same.

- Misconception 3: Signing the form means you cannot negotiate terms.

- Misconception 4: The form protects only the lender's interests.

- Misconception 5: You do not need legal advice when using the form.

This is not true. The form can be used for various loan amounts, whether small or large. It is designed to accommodate different borrowing needs.

Every loan agreement is unique. The New York Loan Agreement form includes specific terms and conditions that reflect the particular agreement between the lender and borrower.

Many people believe that once the form is signed, the terms are set in stone. In reality, borrowers often have the opportunity to negotiate terms before finalizing the agreement.

This is misleading. The New York Loan Agreement form is designed to protect both parties. It outlines the rights and responsibilities of the borrower as well as the lender.

While it is possible to use the form without legal counsel, seeking advice is wise. An attorney can help ensure that the terms are fair and understood by both parties.

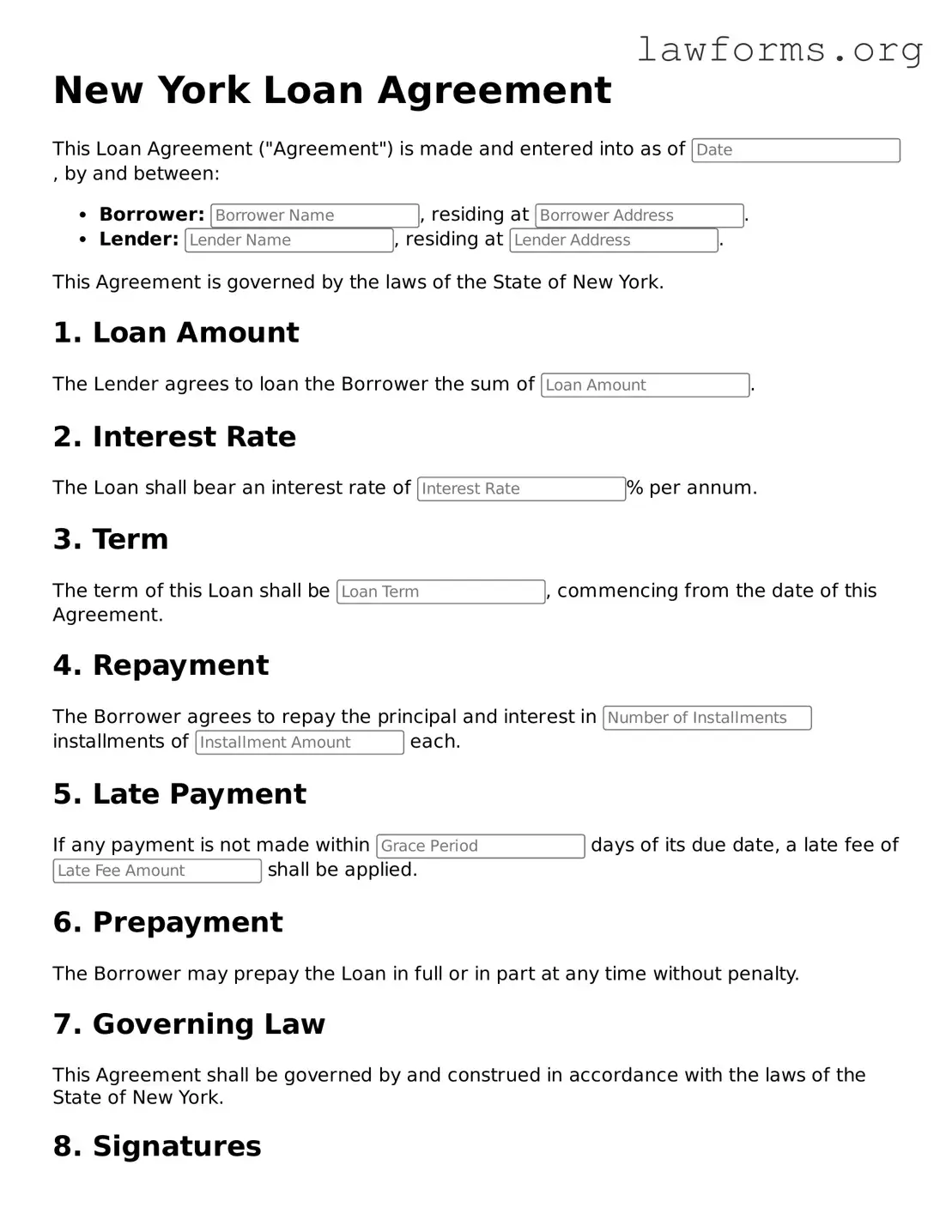

Preview - New York Loan Agreement Form

New York Loan Agreement

This Loan Agreement ("Agreement") is made and entered into as of , by and between:

- Borrower: , residing at .

- Lender: , residing at .

This Agreement is governed by the laws of the State of New York.

1. Loan Amount

The Lender agrees to loan the Borrower the sum of .

2. Interest Rate

The Loan shall bear an interest rate of % per annum.

3. Term

The term of this Loan shall be , commencing from the date of this Agreement.

4. Repayment

The Borrower agrees to repay the principal and interest in installments of each.

5. Late Payment

If any payment is not made within days of its due date, a late fee of shall be applied.

6. Prepayment

The Borrower may prepay the Loan in full or in part at any time without penalty.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

8. Signatures

Both parties agree to the terms outlined in this Loan Agreement.

______________________________

Borrower Signature

______________________________

Lender Signature

Key takeaways

When dealing with a New York Loan Agreement form, it’s essential to understand the following key points to ensure a smooth process.

- Accurate Information is Crucial: Fill in all required fields with precise details about the borrower, lender, loan amount, and repayment terms. Missing or incorrect information can lead to disputes later.

- Understand the Terms: Carefully review the terms of the loan, including interest rates, payment schedules, and any penalties for late payments. Clarity on these points helps prevent misunderstandings.

- Signatures Matter: Both parties must sign the agreement for it to be legally binding. Ensure that the signatures are dated and that all parties receive a copy of the signed document.

- Legal Compliance: Make sure the agreement complies with New York state laws. This includes adhering to regulations regarding interest rates and lending practices to avoid legal issues.

Similar forms

- Promissory Note: A promissory note is a written promise to pay a specific amount of money at a defined time. Like a loan agreement, it outlines the terms of repayment and can serve as evidence of the debt.

- Mortgage Agreement: This document secures a loan with real property. Similar to a loan agreement, it details the terms of the loan and the consequences of default, but it specifically involves real estate as collateral.

- Lease Agreement: A lease agreement allows one party to use property owned by another in exchange for payment. Both documents outline terms, conditions, and responsibilities of each party, though leases typically involve rental payments rather than loans.

- Credit Agreement: This document governs the terms of a credit facility, such as a line of credit. It shares similarities with a loan agreement in that it specifies interest rates, repayment terms, and conditions for borrowing.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a loan if the primary borrower defaults. It is similar to a loan agreement in that it establishes financial obligations and responsibilities.

- Power of Attorney: A Power of Attorney form in Ohio allows one person to grant another individual the authority to make decisions on their behalf, including financial matters and healthcare choices. Understanding this form is crucial, and you can learn more by visiting Ohio PDF Forms.

- Security Agreement: This document provides a lender with a security interest in collateral. Like a loan agreement, it outlines the obligations of the borrower and the lender’s rights in case of default.

- Debt Settlement Agreement: This agreement outlines the terms under which a debtor will repay a portion of their debt. It shares similarities with a loan agreement in that it details payment terms and obligations but is typically used in the context of negotiating reduced payments.

- Forbearance Agreement: A forbearance agreement allows a borrower to temporarily postpone payments. It is similar to a loan agreement in that it modifies the original loan terms but focuses on providing relief during financial hardship.

- Business Loan Agreement: This document is specifically tailored for business loans. It includes similar elements to a personal loan agreement, such as interest rates and repayment schedules, but is designed for business-related borrowing.

- Installment Agreement: An installment agreement outlines the terms for paying off a debt in installments over time. Like a loan agreement, it specifies the amount owed, payment schedule, and interest rates.