Attorney-Approved Power of Attorney Template for the State of New York

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) in New York allows an individual to appoint someone else to make decisions on their behalf, particularly regarding financial and legal matters. |

| Governing Law | The New York Power of Attorney form is governed by New York General Obligations Law, specifically Article 5, Title 15. |

| Durability | The New York POA can be durable, meaning it remains effective even if the principal becomes incapacitated, unless explicitly stated otherwise. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are mentally competent to do so. This revocation must be in writing. |

Dos and Don'ts

When filling out the New York Power of Attorney form, it’s essential to follow certain guidelines to ensure the document is valid and serves its intended purpose. Here are some do's and don'ts to keep in mind:

- Do ensure that you are of sound mind when completing the form.

- Do clearly identify the person you are appointing as your agent.

- Do specify the powers you are granting to your agent.

- Do sign the form in the presence of a notary public.

- Don't leave any sections of the form blank; fill in all required information.

- Don't use the form if you are under duress or pressure from others.

- Don't forget to provide copies of the signed document to your agent and relevant parties.

Create Popular Power of Attorney Forms for Different States

How to Get Power of Attorney in North Carolina - Can be an essential part of estate planning and preparation for the future.

To ensure a smooth transaction when buying or selling a vehicle, it is important to utilize a Motor Vehicle Bill of Sale form, which serves as an official document to record the details of the sale. This form, highlighting key information such as the make, model, year, VIN, and the terms of sale, can be easily accessed through resources like Formaid Org. Having this document protects both the seller and the buyer by providing a clear and mutual understanding of the agreement reached.

Printable Power of Attorney Form Texas - Individuals can specify when the Power of Attorney becomes active, such as immediately or upon incapacity.

Common mistakes

-

Not specifying powers clearly: Individuals often fail to clearly define the specific powers they wish to grant. This can lead to confusion and disputes later on.

-

Inadequate witness signatures: The form requires signatures from witnesses. Some people neglect this requirement or do not ensure that the witnesses meet the necessary criteria.

-

Incorrect date: Failing to include the correct date when signing the form can invalidate the document. It is important to ensure that the date reflects when the powers are granted.

-

Not updating the form: Changes in personal circumstances, such as marriage or divorce, may necessitate updates to the Power of Attorney. Many individuals overlook this important step.

-

Forgetting to revoke previous powers: If a new Power of Attorney is created, it is crucial to revoke any previous ones. Failing to do so can lead to conflicting authority.

Documents used along the form

A Power of Attorney (POA) in New York is a crucial document that allows one person to act on behalf of another in legal or financial matters. However, there are several other forms and documents that are often used in conjunction with a POA to ensure comprehensive management of affairs. Below is a list of these important documents, each serving a unique purpose.

- Health Care Proxy: This document designates someone to make medical decisions on your behalf if you become unable to do so. It ensures that your healthcare preferences are honored.

- Living Will: A living will outlines your wishes regarding medical treatment in situations where you may not be able to communicate your preferences, such as terminal illness or incapacitation.

- Advance Directive: This is a broader term that encompasses both a health care proxy and a living will. It provides guidance on medical treatment and appoints someone to make decisions for you.

- Durable Power of Attorney: Unlike a standard POA, a durable power of attorney remains effective even if you become incapacitated. This ensures continuous management of your financial affairs.

- Will: A will outlines how your assets should be distributed after your death. It can work alongside a POA to ensure your wishes are respected in both life and death.

- Trust: A trust is a legal arrangement where one party holds property for the benefit of another. It can help manage assets and avoid probate, working in tandem with a POA for comprehensive estate planning.

- Financial Power of Attorney: This specific type of POA grants authority to manage financial matters, such as banking, investments, and real estate, ensuring your financial affairs are handled according to your wishes.

- Property Management Agreement: This document outlines the terms under which someone manages your property. It is particularly useful for real estate and can complement a POA by specifying management duties.

Understanding these documents is essential for effective planning and management of personal and financial affairs. Each form plays a vital role in ensuring that your wishes are respected and that your affairs are handled appropriately, especially during times of incapacity or after your passing.

Misconceptions

Understanding the New York Power of Attorney form can be challenging. Here are some common misconceptions that people have about this important document.

- Misconception 1: A Power of Attorney is only for financial matters.

- Misconception 2: A Power of Attorney is permanent and cannot be revoked.

- Misconception 3: Anyone can be appointed as an agent.

- Misconception 4: The Power of Attorney takes effect immediately and cannot be limited.

This is not true. While many people associate Power of Attorney with financial decisions, it can also grant authority for healthcare decisions, legal matters, and more. The scope of authority depends on how the document is drafted.

This misconception is misleading. A Power of Attorney can be revoked at any time, as long as the person who created it is mentally competent. A written notice of revocation is usually required to inform the agent and any relevant parties.

While you can choose almost anyone to act as your agent, there are some restrictions. For instance, the person must be at least 18 years old and mentally competent. It's essential to choose someone you trust completely.

This is incorrect. A Power of Attorney can be set up to take effect immediately or at a future date. Additionally, you can specify the limits of authority granted to your agent, allowing you to maintain control over specific decisions.

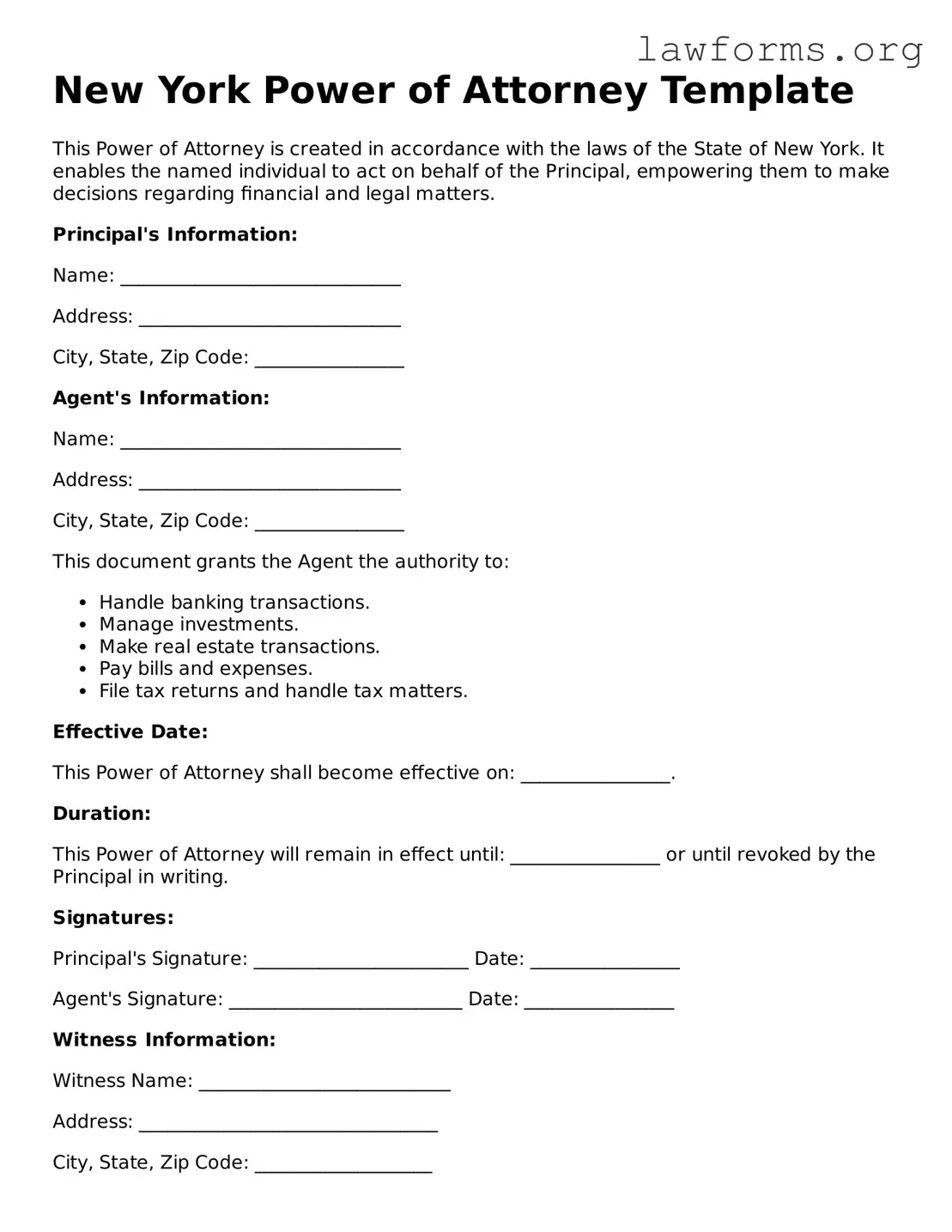

Preview - New York Power of Attorney Form

New York Power of Attorney Template

This Power of Attorney is created in accordance with the laws of the State of New York. It enables the named individual to act on behalf of the Principal, empowering them to make decisions regarding financial and legal matters.

Principal's Information:

Name: ______________________________

Address: ____________________________

City, State, Zip Code: ________________

Agent's Information:

Name: ______________________________

Address: ____________________________

City, State, Zip Code: ________________

This document grants the Agent the authority to:

- Handle banking transactions.

- Manage investments.

- Make real estate transactions.

- Pay bills and expenses.

- File tax returns and handle tax matters.

Effective Date:

This Power of Attorney shall become effective on: ________________.

Duration:

This Power of Attorney will remain in effect until: ________________ or until revoked by the Principal in writing.

Signatures:

Principal's Signature: _______________________ Date: ________________

Agent's Signature: _________________________ Date: ________________

Witness Information:

Witness Name: ___________________________

Address: ________________________________

City, State, Zip Code: ___________________

Witness Signature: _______________________ Date: ________________

Notary Acknowledgment:

State of New York, County of _______________:

On the ____ day of ______________, 20___, before me, a Notary Public, personally appeared ________________________, and proved to me through satisfactory evidence of identification to be the person whose name is subscribed to the within instrument, and acknowledged to me that he/she executed the same in his/her capacity as______________________ of _________________________ (entity name), and that by his/her signature on the instrument, the entity executed the instrument.

Notary Public Signature: __________________________________________

My Commission Expires: _________________________

Key takeaways

Filling out a Power of Attorney form in New York is an important step in ensuring that your financial and legal matters are handled according to your wishes. Here are some key takeaways to consider:

- Understand the Purpose: A Power of Attorney allows you to designate someone to make decisions on your behalf if you become unable to do so.

- Choose Your Agent Wisely: Select someone you trust completely, as they will have significant authority over your financial matters.

- Specify Powers Clearly: Be explicit about the powers you are granting. The form allows you to choose specific powers or general authority.

- Consider a Springing Power of Attorney: This type of document only becomes effective under certain conditions, such as incapacitation.

- Sign in the Presence of a Notary: New York requires that the Power of Attorney be signed in front of a notary public for it to be valid.

- Include a Witness: While not mandatory, having a witness can add an extra layer of validity to the document.

- Review Regularly: Life changes, and so might your needs. Regularly review and update your Power of Attorney as necessary.

- Inform Your Agent: Make sure your chosen agent understands their responsibilities and is willing to take on the role.

- Keep Copies Safe: Store the original document in a secure place and provide copies to your agent and any relevant institutions.

- Know the Revocation Process: If you need to revoke the Power of Attorney, you can do so at any time as long as you are competent.

By keeping these key points in mind, you can ensure that your Power of Attorney is filled out correctly and serves your needs effectively.

Similar forms

- Durable Power of Attorney: Similar to a standard Power of Attorney, this document remains effective even if the principal becomes incapacitated. It allows the agent to continue making decisions on behalf of the principal.

- Health Care Proxy: This document allows an individual to appoint someone to make medical decisions on their behalf if they are unable to do so. It focuses specifically on health care decisions.

- Living Will: A living will outlines an individual's wishes regarding medical treatment in situations where they cannot communicate their preferences. It works alongside a Health Care Proxy.

- Financial Power of Attorney: This document specifically grants authority to manage financial matters, such as banking and investments, rather than broader decision-making.

- Guardianship Documents: These documents establish a guardian for a minor or incapacitated adult, granting them authority to make decisions about the individual’s welfare.

- Trust Agreement: A trust allows a person to transfer assets to a trustee, who manages those assets for the benefit of beneficiaries. It can provide similar authority over assets as a Power of Attorney.

- Business Power of Attorney: This variant is used in business settings, allowing an agent to make decisions and sign documents on behalf of a business entity.

- Real Estate Power of Attorney: This document allows an individual to appoint someone to handle real estate transactions, such as buying or selling property.

- Advance Directive: This is a broader term that includes both a living will and a Health Care Proxy, providing guidance on medical decisions and appointing an agent for health care matters.