Attorney-Approved Prenuptial Agreement Template for the State of New York

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement in New York is a legal contract created by two individuals before marriage, outlining the division of assets and responsibilities in case of divorce. |

| Governing Law | New York Domestic Relations Law governs prenuptial agreements in the state. |

| Enforceability | For a prenuptial agreement to be enforceable, it must be in writing and signed by both parties. |

| Full Disclosure | Both parties must fully disclose their assets and debts to ensure fairness and transparency. |

| Independent Legal Counsel | It is advisable for both parties to seek independent legal advice to avoid claims of coercion or unfairness. |

| Modification | A prenuptial agreement can be modified after marriage, but any changes must also be in writing and signed by both parties. |

| Judicial Review | A court may review the agreement for fairness and may not enforce it if it finds it unconscionable or if one party did not understand the terms. |

Dos and Don'ts

When filling out the New York Prenuptial Agreement form, it is essential to approach the process with care and attention. Here are eight important considerations to keep in mind:

- Do be honest about your financial situation. Full disclosure is crucial for the agreement's validity.

- Do discuss the terms openly with your partner. Communication can prevent misunderstandings later.

- Do consult with an attorney. Legal advice ensures that the agreement complies with state laws.

- Do consider future changes. Address how you will handle potential changes in circumstances.

- Don't rush the process. Take the time necessary to understand all terms and implications.

- Don't include unreasonable demands. Fairness is key to an enforceable agreement.

- Don't ignore your partner's input. Their perspective is important in creating a balanced agreement.

- Don't forget to update the agreement if circumstances change significantly. Regular reviews are wise.

Create Popular Prenuptial Agreement Forms for Different States

Ohio Premarital Agreement - A prenuptial agreement can help preserve family inheritances for future generations.

To streamline the process of creating a Washington Durable Power of Attorney, consider utilizing resources from Forms Washington, which provides valuable templates and guidance to help you designate a trusted person to manage your affairs should you become incapacitated.

Florida Premarital Agreement - This legal document can allow for peace during what can be a difficult time if marriage ends.

North Carolina Premarital Agreement - Using a prenuptial agreement can foster open communication about finances.

Common mistakes

-

Not Being Honest About Assets: One of the most common mistakes is failing to disclose all assets. Transparency is crucial. If one partner hides assets, it can lead to disputes later on.

-

Forgetting to Include Debts: Just as assets should be disclosed, debts must also be included. Ignoring liabilities can create an imbalance in the agreement and lead to complications.

-

Using Vague Language: Clarity is key. Using ambiguous terms can lead to misunderstandings. Clearly define all terms and conditions to avoid confusion.

-

Not Considering Future Changes: Life is unpredictable. Failing to account for potential changes, like career shifts or children, can render the agreement less effective in the long run.

-

Not Seeking Legal Advice: This is a crucial step. Many individuals attempt to fill out the form without professional guidance. Consulting with a lawyer can provide essential insights and ensure the agreement is enforceable.

-

Rushing the Process: Prenuptial agreements require careful thought and consideration. Rushing through the process can lead to mistakes that may affect both parties negatively.

-

Not Reviewing the Agreement Periodically: Once the agreement is in place, it should not be forgotten. Regular reviews ensure that it remains relevant and reflective of both partners' current situations.

-

Failing to Sign in the Presence of Witnesses: Proper execution is vital. Many people overlook the need for witnesses or notarization, which can impact the agreement's validity.

Documents used along the form

When preparing for a marriage, a prenuptial agreement can be an important document for couples to consider. Alongside this agreement, several other forms and documents may also be useful in establishing clear expectations and protections for both parties. Here’s a list of some commonly used documents that complement a New York Prenuptial Agreement.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It outlines how assets and debts will be handled in case of divorce or separation.

- Financial Disclosure Statement: This document requires both parties to fully disclose their financial situations, including income, assets, and liabilities. Transparency is key in any agreement.

- Dog Bill of Sale: To ensure a smooth transition of pet ownership, it is essential to complete a Dog Bill of Sale form, which is a legal document that outlines critical details about the dog, including its breed and age. For more information, you can visit https://californiadocsonline.com/dog-bill-of-sale-form/.

- Marriage Certificate: This official document is issued by the state and verifies that a marriage has taken place. It is often required when filing for divorce or legal separation.

- Power of Attorney: This document allows one spouse to make legal and financial decisions on behalf of the other in case of incapacitation. It’s essential for ensuring that wishes are honored.

- Living Will: A living will outlines a person's wishes regarding medical treatment in the event they cannot communicate their decisions. This can be crucial for couples in medical emergencies.

- Estate Plan: This includes wills, trusts, and other documents that specify how assets will be managed and distributed after death. It ensures that both parties’ wishes are respected.

- Separation Agreement: If a couple decides to separate, this document outlines the terms of their separation, including asset division and child custody arrangements, if applicable.

- Child Custody Agreement: For couples with children, this document details custody arrangements, visitation schedules, and responsibilities. It prioritizes the well-being of the children involved.

Having these documents in place can provide clarity and security for both partners. They help ensure that both parties understand their rights and responsibilities, ultimately fostering a healthier relationship.

Misconceptions

Many people have misunderstandings about prenuptial agreements in New York. Here are seven common misconceptions:

- Prenuptial agreements are only for the wealthy. Many believe that only rich individuals need a prenuptial agreement. However, these agreements can be beneficial for anyone who wants to clarify financial matters before marriage.

- They are only about money. While finances are a key focus, prenuptial agreements can also address issues like property division and responsibilities during the marriage.

- They are not legally binding. A properly drafted prenuptial agreement is legally enforceable in New York, provided it meets certain requirements.

- Prenuptial agreements are only for divorce situations. These agreements can also help couples define their financial responsibilities during the marriage, not just in the event of a divorce.

- They can be created last minute. It's advisable to create a prenuptial agreement well in advance of the wedding. Last-minute agreements may lead to legal challenges later.

- Both parties need to have lawyers. While it is recommended for both parties to seek legal advice, it is not a strict requirement. However, having independent legal counsel can help ensure fairness.

- Prenuptial agreements are unromantic. Many view these agreements as a lack of trust. In reality, they can promote open communication about finances, which is crucial for a healthy marriage.

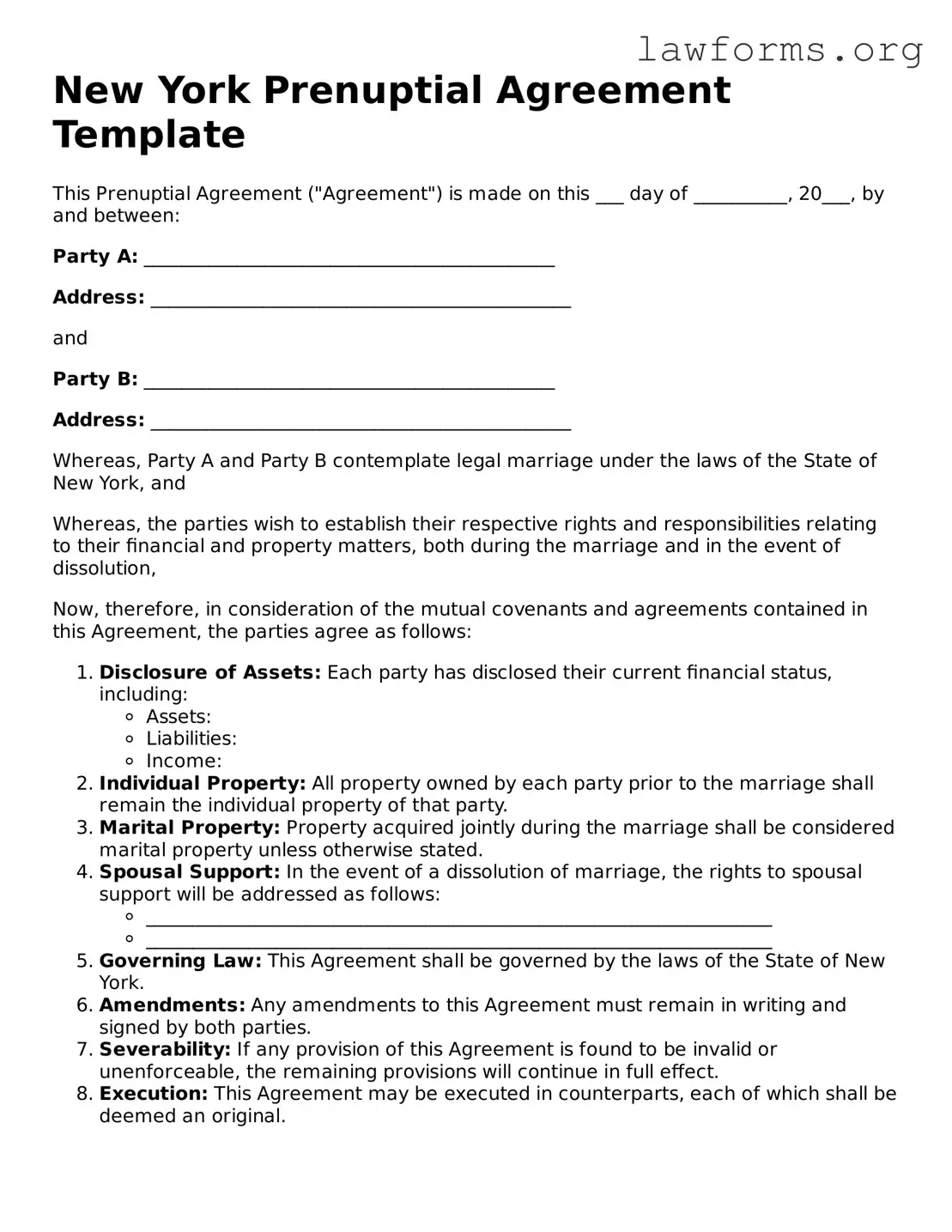

Preview - New York Prenuptial Agreement Form

New York Prenuptial Agreement Template

This Prenuptial Agreement ("Agreement") is made on this ___ day of __________, 20___, by and between:

Party A: ____________________________________________

Address: _____________________________________________

and

Party B: ____________________________________________

Address: _____________________________________________

Whereas, Party A and Party B contemplate legal marriage under the laws of the State of New York, and

Whereas, the parties wish to establish their respective rights and responsibilities relating to their financial and property matters, both during the marriage and in the event of dissolution,

Now, therefore, in consideration of the mutual covenants and agreements contained in this Agreement, the parties agree as follows:

- Disclosure of Assets: Each party has disclosed their current financial status, including:

- Assets:

- Liabilities:

- Income:

- Individual Property: All property owned by each party prior to the marriage shall remain the individual property of that party.

- Marital Property: Property acquired jointly during the marriage shall be considered marital property unless otherwise stated.

- Spousal Support: In the event of a dissolution of marriage, the rights to spousal support will be addressed as follows:

- ___________________________________________________________________

- ___________________________________________________________________

- Governing Law: This Agreement shall be governed by the laws of the State of New York.

- Amendments: Any amendments to this Agreement must remain in writing and signed by both parties.

- Severability: If any provision of this Agreement is found to be invalid or unenforceable, the remaining provisions will continue in full effect.

- Execution: This Agreement may be executed in counterparts, each of which shall be deemed an original.

IN WITNESS WHEREOF, the parties have executed this Prenuptial Agreement as of the date first above written.

Party A Signature: ___________________________ Date: _______________

Party B Signature: ___________________________ Date: _______________

Witness Signature: __________________________ Date: _______________

Key takeaways

Filling out and using a prenuptial agreement in New York can seem daunting, but it’s a valuable tool for couples looking to protect their assets and clarify expectations before tying the knot. Here are some key takeaways to keep in mind:

- Understand the Purpose: A prenuptial agreement outlines how assets will be divided in the event of a divorce or separation. It can also address spousal support and other financial matters.

- Full Disclosure is Essential: Both parties must fully disclose their assets and debts. Transparency is crucial to ensure that the agreement is enforceable.

- Consult with Legal Professionals: Each partner should have their own attorney to review the agreement. This helps ensure that both parties’ interests are represented fairly.

- Timing Matters: Draft and sign the agreement well before the wedding. Last-minute agreements can lead to claims of coercion and may be challenged later.

- Consider Future Changes: Life circumstances change. It’s wise to include provisions that allow for modifications to the agreement as needed.

- Keep it Reasonable: Courts may not enforce terms that are deemed unfair or unreasonable. Strive for balance and fairness in the agreement.

- Be Clear and Specific: Vague language can lead to misunderstandings. Clearly define terms and conditions to avoid confusion down the road.

- Review Regularly: After marriage, revisit the agreement periodically. Changes in finances, family, or circumstances may necessitate updates.

By keeping these points in mind, couples can navigate the process of creating a prenuptial agreement with confidence and clarity.

Similar forms

- Postnuptial Agreement: Similar to a prenuptial agreement, a postnuptial agreement is created after marriage. It outlines how assets will be divided in the event of a divorce or separation.

- Separation Agreement: This document is used when a couple decides to live apart. It details the terms of the separation, including asset division and support obligations, much like a prenuptial agreement.

- Divorce Settlement Agreement: In the event of a divorce, this agreement outlines how the couple will divide their assets and responsibilities. It serves a similar purpose to a prenuptial agreement but is executed after the marriage has ended.

- Horse Bill of Sale Form: For those selling or purchasing horses, the valuable Horse Bill of Sale documentation is essential for formalizing ownership transfer.

- Living Together Agreement: For couples who are cohabitating but not married, this agreement clarifies financial responsibilities and property rights, similar to what a prenuptial agreement does for married couples.

- Will: A will specifies how a person's assets will be distributed after their death. While it serves a different purpose, both documents address asset management and protection.