Attorney-Approved Promissory Note Template for the State of New York

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time. |

| Governing Law | The New York Promissory Note is governed by the Uniform Commercial Code (UCC) Article 3. |

| Parties Involved | Typically, there are two parties: the maker (borrower) and the payee (lender). |

| Key Elements | A valid promissory note must include the amount to be paid, the interest rate (if any), and the due date. |

| Interest Rates | New York law allows for the inclusion of interest rates, but they must comply with state usury laws. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the maker. |

| Transferability | Promissory notes can be transferred to other parties, making them negotiable instruments under UCC rules. |

| Default Consequences | If the maker defaults, the payee has the right to pursue legal remedies, including filing a lawsuit. |

| Record Keeping | It is advisable for both parties to keep a copy of the promissory note for their records. |

Dos and Don'ts

When filling out the New York Promissory Note form, attention to detail is essential. Here are some key dos and don'ts to keep in mind:

- Do clearly state the amount being borrowed.

- Do include the names and addresses of both the borrower and the lender.

- Do specify the interest rate, if applicable.

- Do outline the repayment schedule in detail.

- Don't leave any sections blank; complete every part of the form.

- Don't use vague language; be specific about terms and conditions.

- Don't forget to sign and date the document.

- Don't overlook the need for witnesses or notarization, if required.

Create Popular Promissory Note Forms for Different States

Texas Promissory Note - It’s important for both parties to keep a signed copy of the Promissory Note for their records.

In addition to the essential details outlined in the Washington Employment Verification form, employers may refer to resources like Forms Washington for guidance on how to properly complete and submit that documentation, further aiding in the verification process and enhancing clarity for all parties involved.

Create Promissory Note - In most cases, witnesses may need to sign to confirm the agreement.

Loan Note Template - The note can include options for early repayment without penalties.

California Promissory Note Requirements - A Promissory Note can alleviate potential concerns about future financial expectations.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required details. This includes the names of both the borrower and the lender, the loan amount, and the repayment terms. Omitting any of this information can lead to confusion or disputes later on.

-

Incorrect Dates: Entering the wrong date can create issues regarding the timeline of the loan. Ensure that the date of the agreement and any repayment dates are accurate. An incorrect date might affect the enforceability of the note.

-

Missing Signatures: Both parties must sign the document for it to be valid. A common oversight is neglecting to have the borrower or lender sign the note. Without signatures, the agreement lacks legal standing.

-

Ambiguous Terms: Using vague language can lead to misunderstandings. Clearly define the terms of the loan, including interest rates, payment schedules, and what happens in case of default. Ambiguity can complicate enforcement and compliance.

-

Neglecting to Include Collateral: If the loan is secured by collateral, this must be explicitly stated in the note. Failing to mention collateral can lead to complications if the borrower defaults. Clearly outline what collateral is being used to secure the loan.

Documents used along the form

When dealing with financial transactions in New York, a Promissory Note is often accompanied by several other important documents. Each of these forms serves a unique purpose and helps to clarify the terms of the agreement between the parties involved. Below is a list of documents commonly used alongside a New York Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged to guarantee repayment. It details the rights of the lender in the event of default.

- Lease Agreement: For a thorough understanding of rental terms, reference the comprehensive lease agreement overview to ensure all necessary details are covered.

- Personal Guarantee: This form is signed by an individual who agrees to be personally responsible for the loan if the borrower defaults. It provides an additional layer of security for the lender.

- Disclosure Statement: This document provides essential information about the loan, including fees, interest rates, and the total cost of borrowing. It ensures transparency between the parties.

- Payment Schedule: This form outlines the specific dates and amounts due for each payment. It helps both parties keep track of the repayment timeline.

- Amendment Agreement: If any terms of the original Promissory Note need to be changed, this document formalizes the amendments and ensures that all parties agree to the new terms.

- Default Notice: In the event of non-payment, this notice is sent to inform the borrower of their default status and the potential consequences, including legal action.

- Release of Liability: Once the loan is fully paid, this document releases the borrower from any further obligations and confirms that the lender has no claims against them.

- Assignment of Rights: If the lender wishes to transfer their rights under the Promissory Note to another party, this document facilitates that transfer and ensures all parties are aware of the change.

Understanding these documents can help ensure a smoother financial transaction and protect the interests of all parties involved. It is always advisable to consult with a professional to ensure that all necessary forms are completed accurately and appropriately.

Misconceptions

When dealing with financial agreements, particularly promissory notes in New York, several misconceptions can arise. Understanding these misconceptions can help individuals navigate their financial obligations more effectively. Below is a list of five common misconceptions about the New York Promissory Note form.

- 1. A promissory note must be notarized to be valid. Many believe that notarization is a requirement for a promissory note to be legally binding. In New York, while notarization can provide additional proof of authenticity, it is not a legal requirement for the note to be enforceable.

- 2. Only banks can issue promissory notes. Some people think that only financial institutions are allowed to create promissory notes. In reality, any individual or entity can draft a promissory note, provided it meets the necessary legal criteria.

- 3. The terms of a promissory note are set in stone. There is a misconception that once a promissory note is signed, its terms cannot be changed. However, the parties involved can modify the terms if both agree, and this should be documented in writing to avoid future disputes.

- 4. A promissory note guarantees repayment. Many assume that signing a promissory note ensures that the borrower will repay the loan. While the note serves as a legal promise to pay, it does not guarantee repayment; factors such as the borrower's financial situation can affect their ability to fulfill the obligation.

- 5. All promissory notes are the same. Some believe that all promissory notes are interchangeable and have the same legal weight. In truth, the specifics of each note, including the amount, interest rate, and repayment terms, can vary significantly, affecting their enforceability and implications.

By recognizing these misconceptions, individuals can approach promissory notes with a clearer understanding, ensuring they make informed decisions regarding their financial agreements.

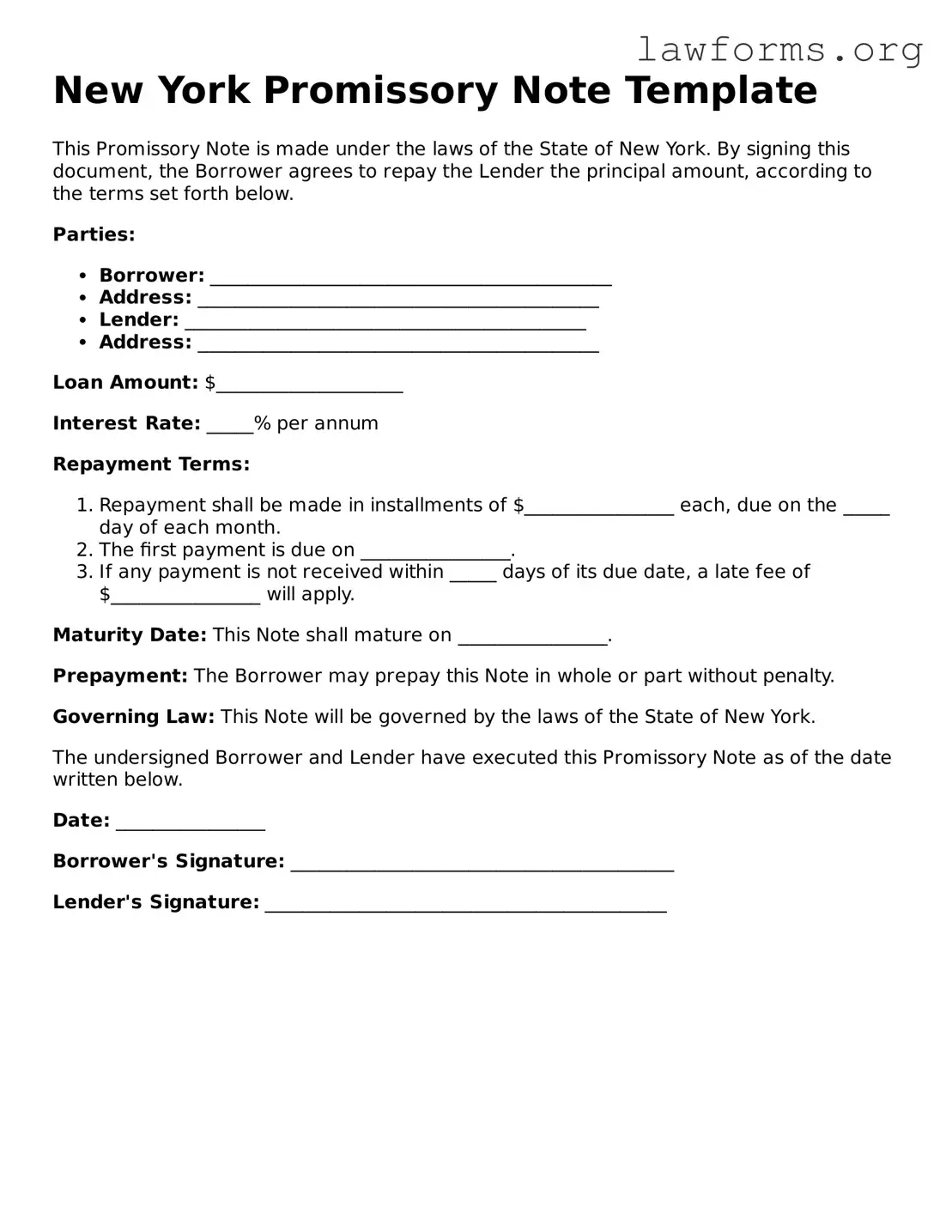

Preview - New York Promissory Note Form

New York Promissory Note Template

This Promissory Note is made under the laws of the State of New York. By signing this document, the Borrower agrees to repay the Lender the principal amount, according to the terms set forth below.

Parties:

- Borrower: ___________________________________________

- Address: ___________________________________________

- Lender: ___________________________________________

- Address: ___________________________________________

Loan Amount: $____________________

Interest Rate: _____% per annum

Repayment Terms:

- Repayment shall be made in installments of $________________ each, due on the _____ day of each month.

- The first payment is due on ________________.

- If any payment is not received within _____ days of its due date, a late fee of $________________ will apply.

Maturity Date: This Note shall mature on ________________.

Prepayment: The Borrower may prepay this Note in whole or part without penalty.

Governing Law: This Note will be governed by the laws of the State of New York.

The undersigned Borrower and Lender have executed this Promissory Note as of the date written below.

Date: ________________

Borrower's Signature: _________________________________________

Lender's Signature: ___________________________________________

Key takeaways

When filling out and using the New York Promissory Note form, it is important to keep several key points in mind. Below are essential takeaways to consider:

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that both parties are easily identifiable.

- Specify the Loan Amount: Indicate the exact amount being borrowed. This figure should be precise to avoid any confusion later.

- Detail the Interest Rate: Include the interest rate being charged on the loan. This can be a fixed or variable rate, and it should be clearly defined.

- Outline the Payment Terms: Specify how and when payments will be made. Include details such as due dates and acceptable payment methods.

- Include Maturity Date: State when the loan will be fully paid off. This is crucial for both parties to understand the timeline of the loan.

- Address Default Conditions: Clearly outline what constitutes a default and the consequences that follow. This can help prevent disputes later on.

- Signatures Required: Ensure that both the borrower and lender sign the document. This formalizes the agreement and provides legal validity.

- Keep Copies: After signing, both parties should keep a copy of the Promissory Note for their records. This can be important for future reference.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. However, it often contains more detailed provisions and conditions.

Unclaimed Property Report: In line with the importance of formal documentation, the Illinois Unclaimed Property Reporting form is essential for businesses declaring abandoned assets. To ensure compliance, organizations should refer to the guidelines available at https://formsillinois.com.

- Mortgage: A mortgage is a specific type of loan agreement secured by real property. Like a promissory note, it establishes the borrower's obligation to repay the loan, but it also includes the legal claim to the property as collateral.

- Credit Agreement: This document governs the terms of credit extended to a borrower. It shares similarities with a promissory note in defining the amount and repayment terms, but it may also cover other aspects like fees and covenants.

- Installment Agreement: An installment agreement allows a borrower to repay a debt in scheduled payments over time. It resembles a promissory note in that it specifies the repayment terms, but it may also include provisions for default and penalties.

- Personal Guarantee: A personal guarantee is a commitment by an individual to repay a loan if the primary borrower defaults. It is similar to a promissory note in that it establishes a financial obligation, but it typically involves a third party assuming responsibility.

- Lease Agreement: A lease agreement outlines the terms under which one party rents property from another. While it is not a loan document, it may include payment terms similar to those found in a promissory note.

- Debt Acknowledgment: This document serves as a formal recognition of a debt owed. It is similar to a promissory note in that it confirms the borrower's obligation but may lack the detailed repayment terms.

- Bill of Exchange: A bill of exchange is a financial document that orders one party to pay a fixed sum to another party. It shares characteristics with a promissory note in that both serve as instruments of payment and evidence of debt.

- Service Agreement: A service agreement outlines the terms of service provided by one party to another. It can include payment terms that resemble those in a promissory note, especially when payment is contingent on service delivery.

- Settlement Agreement: This document resolves disputes between parties and may include payment terms. While its primary purpose is to settle claims, it can function similarly to a promissory note when it establishes a payment obligation.