Attorney-Approved Quitclaim Deed Template for the State of New York

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of real property from one party to another without any warranties. |

| Governing Law | In New York, the quitclaim deed is governed by the New York Real Property Law. |

| Usage | This type of deed is often used between family members or in situations where the grantor does not want to guarantee the title. |

| Requirements | The quitclaim deed must be in writing, signed by the grantor, and acknowledged by a notary public. |

| Consideration | While consideration is not required, it is common to include a nominal amount, such as $1, to validate the transaction. |

| Property Description | A clear and accurate description of the property being transferred must be included in the deed. |

| Recording | To protect the rights of the grantee, the quitclaim deed should be recorded in the county clerk's office where the property is located. |

| Tax Implications | Transfer taxes may apply, and it is advisable to consult a tax professional regarding any potential liabilities. |

| Limitations | The quitclaim deed does not guarantee that the grantor holds a valid title, which poses risks for the grantee. |

| Revocation | Once executed and delivered, a quitclaim deed cannot be revoked without the consent of the grantee. |

Dos and Don'ts

When filling out the New York Quitclaim Deed form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are four important do's and don'ts to consider:

- Do provide complete and accurate information about the property being transferred.

- Do include the names of all parties involved in the transaction, ensuring they match official identification.

- Don't leave any sections of the form blank, as this may lead to delays or rejection.

- Don't forget to sign the form in the presence of a notary public to validate the deed.

Create Popular Quitclaim Deed Forms for Different States

Florida Quit Claim Deed Rules - Always consult a professional when considering a Quitclaim Deed to ensure your interests are protected.

The Washington Employment Verification form is a crucial document used by employers to confirm the employment status of their workers. This form serves as a reliable tool for both employers and employees, ensuring that accurate employment information is provided when needed. For additional resources and templates related to employment verification, you can refer to Forms Washington. Understanding its purpose and proper usage is essential for navigating employment-related processes in Washington.

Quitclaim Deed Form New Jersey - This document helps avoid disputes over property ownership.

Common mistakes

-

Incorrect Names: Ensure that all names are spelled correctly. This includes both the grantor (the person transferring the property) and the grantee (the person receiving the property). Any misspellings can lead to complications later.

-

Missing Signatures: All required signatures must be present. The grantor must sign the deed, and in some cases, witnesses or a notary may also be required. Omitting a signature can invalidate the deed.

-

Improper Description of Property: Clearly describe the property being transferred. This includes the address and any legal descriptions. Vague or incomplete descriptions can lead to disputes over what property is actually being conveyed.

-

Failure to Notarize: In New York, a quitclaim deed typically needs to be notarized. Skipping this step can render the document ineffective. Always check the requirements for notarization.

-

Ignoring Local Filing Requirements: After filling out the quitclaim deed, it must be filed with the appropriate county office. Be aware of any specific filing fees or local regulations that apply.

-

Not Understanding Tax Implications: Transferring property can have tax consequences. Consult with a tax professional to understand any potential liabilities or benefits before completing the deed.

Documents used along the form

When completing a real estate transaction in New York, a Quitclaim Deed is often accompanied by several other important documents. Each of these forms serves a specific purpose and helps ensure a smooth transfer of property ownership. Below is a list of commonly used forms along with a brief description of each.

- Title Search Report: This document outlines the history of the property’s ownership. It helps identify any liens, claims, or encumbrances that may affect the title. A thorough title search is essential to ensure that the seller has the right to transfer the property.

- Property Transfer Tax Form: This form is required by the state of New York to document the transfer of property and assess any applicable taxes. It must be completed and submitted along with the Quitclaim Deed to ensure compliance with local tax regulations.

- Dog Bill of Sale: This legal document is essential for transferring ownership of a dog and includes details about the dog's breed, age, and health information, protecting both parties in the transaction. For more information, you can visit californiadocsonline.com/dog-bill-of-sale-form.

- Affidavit of Title: This sworn statement is provided by the seller, affirming that they hold clear title to the property and disclosing any potential issues. It serves to protect the buyer by ensuring that the seller has not concealed any relevant information about the property.

- Notice of Sale: This document informs interested parties of the sale of the property. It may be required in certain situations to notify neighbors or other stakeholders about the change in ownership.

Understanding these accompanying documents can help facilitate a successful property transfer. Each form plays a crucial role in protecting the interests of both the buyer and the seller, ensuring that all legal requirements are met during the transaction process.

Misconceptions

Understanding the New York Quitclaim Deed form is crucial for anyone involved in property transactions. However, several misconceptions persist about its use and implications. Below is a list of seven common misconceptions.

- A Quitclaim Deed transfers ownership of a property. This is misleading. A Quitclaim Deed conveys whatever interest the grantor has in the property but does not guarantee that the grantor holds any valid interest.

- A Quitclaim Deed is only used between family members. While often used in familial transactions, Quitclaim Deeds can be utilized in various situations, including sales, transfers, and divorces.

- A Quitclaim Deed eliminates the need for title insurance. This is not true. Title insurance is still recommended to protect against any undisclosed claims or issues with the title.

- All states use the same Quitclaim Deed form. This is incorrect. Each state has its own requirements and forms, including New York, which has specific regulations regarding Quitclaim Deeds.

- A Quitclaim Deed can be used to remove a co-owner from the title. This is a misconception. While it can transfer a co-owner's interest, it does not legally remove them from the title; that requires additional legal steps.

- A Quitclaim Deed is the same as a Warranty Deed. This is false. A Warranty Deed provides guarantees about the title, while a Quitclaim Deed offers no such assurances.

- A Quitclaim Deed must be notarized. While notarization is highly recommended for validity, New York law does not strictly require it for the deed to be effective.

Being aware of these misconceptions can help individuals make informed decisions when dealing with property transactions in New York.

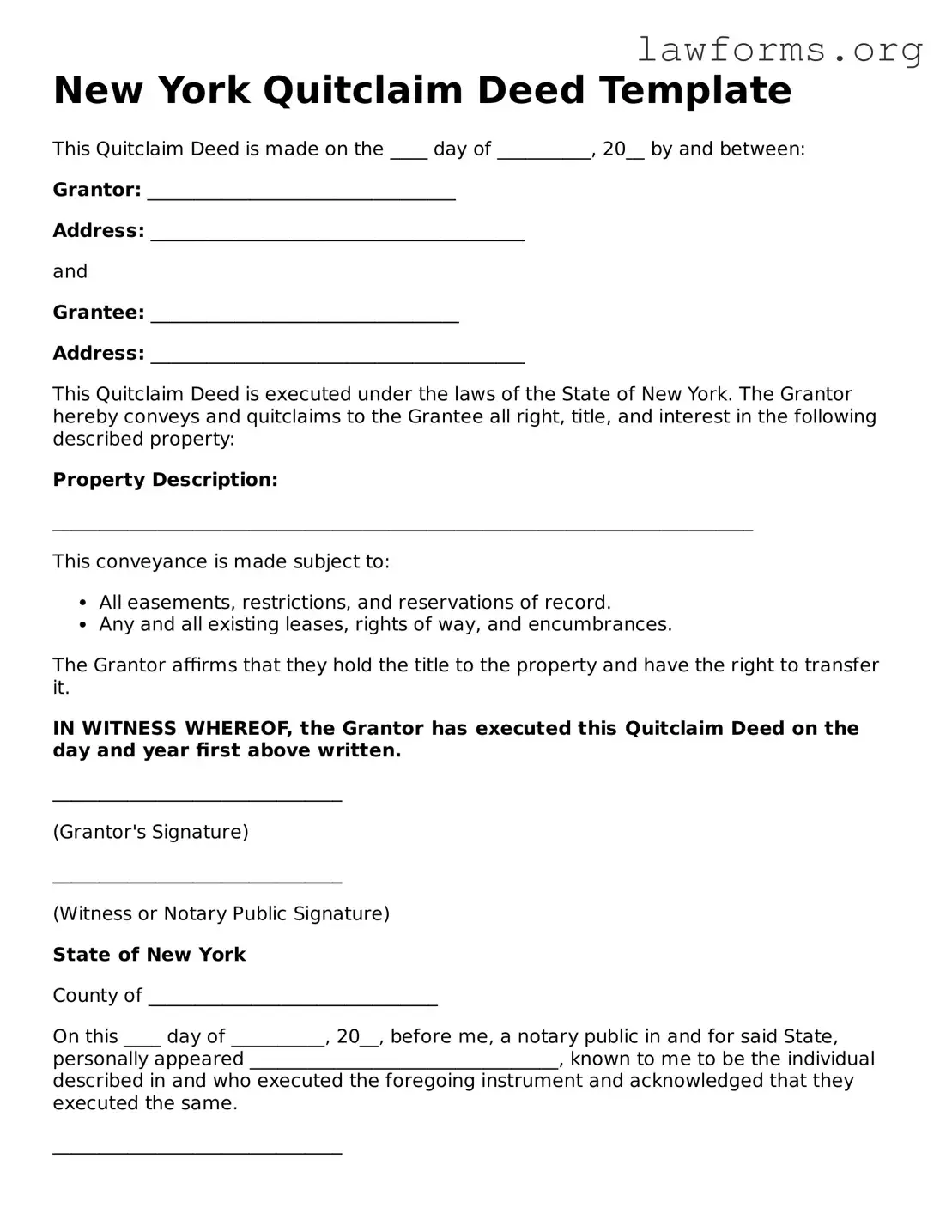

Preview - New York Quitclaim Deed Form

New York Quitclaim Deed Template

This Quitclaim Deed is made on the ____ day of __________, 20__ by and between:

Grantor: _________________________________

Address: ________________________________________

and

Grantee: _________________________________

Address: ________________________________________

This Quitclaim Deed is executed under the laws of the State of New York. The Grantor hereby conveys and quitclaims to the Grantee all right, title, and interest in the following described property:

Property Description:

___________________________________________________________________________

This conveyance is made subject to:

- All easements, restrictions, and reservations of record.

- Any and all existing leases, rights of way, and encumbrances.

The Grantor affirms that they hold the title to the property and have the right to transfer it.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on the day and year first above written.

_______________________________

(Grantor's Signature)

_______________________________

(Witness or Notary Public Signature)

State of New York

County of _______________________________

On this ____ day of __________, 20__, before me, a notary public in and for said State, personally appeared _________________________________, known to me to be the individual described in and who executed the foregoing instrument and acknowledged that they executed the same.

_______________________________

(Notary Public Signature)

My Commission Expires: _______________

Key takeaways

Filling out and using the New York Quitclaim Deed form requires careful attention to detail and an understanding of its implications. Below are key takeaways to consider:

- The Quitclaim Deed is primarily used to transfer ownership interest in a property without guaranteeing that the title is clear. This means the grantor is not responsible for any claims against the property.

- It is essential to include the full names of both the grantor (the person transferring the property) and the grantee (the person receiving the property) to avoid any confusion.

- The form must clearly identify the property being transferred. This includes a complete legal description, which can often be found in previous deeds or property tax records.

- While not required, it is advisable to have the Quitclaim Deed notarized. This adds an extra layer of authenticity and may be necessary for recording the deed with local authorities.

- Once completed, the deed should be filed with the county clerk's office in the county where the property is located. This step is crucial to ensure the transfer is legally recognized.

- Consider consulting with a legal professional before completing the deed, especially if there are any concerns about the property title or if the transfer involves multiple parties.

Similar forms

- Warranty Deed: A warranty deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. Like a quitclaim deed, it transfers ownership, but it offers more protection to the buyer against any claims on the property.

- Grant Deed: Similar to a quitclaim deed, a grant deed transfers property ownership. However, it includes assurances that the property has not been sold to anyone else and that there are no undisclosed liens, offering more security to the buyer.

- Deed of Trust: A deed of trust is used in real estate transactions to secure a loan. While it does not transfer ownership outright like a quitclaim deed, it involves the transfer of an interest in the property as collateral for a loan.

- Life Estate Deed: This type of deed allows a person to live in and use a property for their lifetime. Similar to a quitclaim deed, it transfers ownership but also creates a life estate, which can complicate future transfers.

- Special Purpose Deed: A special purpose deed, such as a tax deed or a sheriff's deed, transfers property ownership under specific circumstances. It is similar to a quitclaim deed in that it may not provide warranties about the title.

- Lease Agreement: For those renting properties in Texas, our essential lease agreement form template provides clarity on rental terms and conditions.

- Affidavit of Heirship: This document is used to establish ownership of property after someone passes away without a will. Like a quitclaim deed, it can facilitate the transfer of property, but it does not convey title in the same way.

- Transfer on Death Deed: A transfer on death deed allows property owners to designate a beneficiary to receive their property upon death. It is similar to a quitclaim deed in that it transfers ownership, but it does so only after the owner's death.