Attorney-Approved Transfer-on-Death Deed Template for the State of New York

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The New York Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by New York Estates, Powers and Trusts Law (EPTL) § 13-16. |

| Revocation | Property owners can revoke the deed at any time before their death, ensuring flexibility in estate planning. |

| Requirements | The deed must be signed, notarized, and filed with the county clerk where the property is located to be effective. |

Dos and Don'ts

When filling out the New York Transfer-on-Death Deed form, it is important to follow certain guidelines to ensure the process goes smoothly. Here are six things you should and shouldn't do:

- Do ensure that you are eligible to use the Transfer-on-Death Deed by confirming that you own the property outright.

- Do clearly identify the property by including the correct legal description.

- Do list the beneficiaries accurately to avoid any confusion later.

- Do sign the deed in the presence of a notary public.

- Don't forget to file the deed with the county clerk's office where the property is located.

- Don't use vague language or terms that could lead to misinterpretation of your intentions.

Create Popular Transfer-on-Death Deed Forms for Different States

Transfer on Death Deed Florida Form - A Transfer-on-Death Deed can also be a strategic tool for tax planning, as beneficiaries may benefit from a step-up in basis.

Transfer on Death - Filing a Transfer-on-Death Deed can bring peace of mind, knowing that property will be distributed according to your intentions.

For those looking to understand the legalities involved, this comprehensive guide to the Dirt Bike Bill of Sale can help navigate the sales process effectively. By utilizing this form, you can ensure all necessary information is captured, giving both parties peace of mind during the transaction. For more details, visit the dirt bike bill of sale template resource.

Transfer on Death Deed Form Ohio - It's important to be aware of any tax implications for the beneficiary upon inheriting property through a Transfer-on-Death Deed.

Problems With Transfer on Death Deeds Ohio - A Transfer-on-Death Deed does not affect how the property is taxed during the owner's lifetime.

Common mistakes

-

Incomplete Information: Failing to provide all required information can lead to delays or rejections. Each section of the form must be filled out completely, including names, addresses, and property details.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can create confusion. Ensure that the legal description matches what is recorded in public records.

-

Improper Signatures: All necessary parties must sign the form. If a signature is missing, the deed may not be valid. Verify that everyone involved has signed in the correct locations.

-

Failure to Notarize: Many states require the deed to be notarized for it to be legally binding. Neglecting this step can result in the deed being unenforceable.

-

Not Recording the Deed: After completing the form, it must be recorded with the appropriate county office. Failing to do so means that the transfer may not be recognized legally.

-

Ignoring State-Specific Rules: Each state has its own regulations regarding Transfer-on-Death Deeds. It is crucial to understand and comply with New York’s specific requirements to ensure validity.

-

Overlooking Beneficiary Designations: Clearly identifying beneficiaries is essential. If beneficiaries are not named or are incorrectly identified, the property may not transfer as intended.

Documents used along the form

The New York Transfer-on-Death Deed form allows individuals to transfer property to a beneficiary upon their death without going through probate. When preparing this deed, there are several other forms and documents that may be helpful to consider. Here’s a list of related documents that often accompany the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. It can complement a Transfer-on-Death Deed by addressing other assets not covered by the deed.

- California DV-260 Form: It is crucial for individuals navigating domestic violence situations to fill out the californiadocsonline.com/california-dv-260-form, as it supports the establishment of restraining orders and protects sensitive information during legal proceedings.

- Living Will: A living will specifies an individual's wishes regarding medical treatment in case they become unable to communicate. It’s essential for ensuring healthcare preferences are respected.

- Power of Attorney: This document allows someone to act on behalf of another person in financial or legal matters. It can be useful if the individual becomes incapacitated before passing.

- Beneficiary Designation Forms: These forms are used to name beneficiaries for accounts like life insurance and retirement plans. They ensure that these assets transfer directly to the named individuals.

- Real Property Deed: This document officially transfers ownership of real estate. It may be necessary to prepare a new deed if the property is sold or otherwise transferred during the owner’s lifetime.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. It can be helpful in clarifying ownership when there is no will or deed in place.

- Estate Tax Return: This form may be required if the estate exceeds a certain value. It ensures that any taxes owed are calculated and paid appropriately.

- Trust Documents: If a trust is created, these documents outline how assets within the trust will be managed and distributed. They can work alongside a Transfer-on-Death Deed for comprehensive estate planning.

- Notice of Death: This document informs relevant parties of an individual's passing. It can be important for settling accounts and notifying beneficiaries.

Having these documents prepared and organized can streamline the transfer process and help ensure that your wishes are honored. It’s always wise to consult with a professional when dealing with estate planning to make sure everything is in order.

Misconceptions

Misconceptions about the New York Transfer-on-Death Deed can lead to confusion and potential issues for property owners. Here are nine common misunderstandings:

- It is the same as a will. Many people believe that a Transfer-on-Death Deed functions like a will. However, it allows for the direct transfer of property upon death, bypassing the probate process entirely.

- It can only be used for residential properties. Some think this deed is limited to homes. In reality, it can apply to various types of real estate, including commercial properties.

- It requires the consent of all heirs. This is incorrect. The property owner can create and record the deed without needing permission from heirs or beneficiaries.

- It is irrevocable once signed. Many assume that signing the deed means it cannot be changed. In fact, the owner can revoke or modify the deed at any time before death.

- It does not affect taxes. Some believe that using a Transfer-on-Death Deed has no tax implications. However, the property may still be subject to estate taxes, depending on the overall value of the estate.

- It automatically transfers all property rights. This deed only transfers ownership upon death. Until then, the owner retains full rights to the property.

- It is only for single individuals. Many think this deed is only applicable to single property owners. In reality, married couples can also use it to transfer property to each other or to their heirs.

- It eliminates the need for a will. Some believe that using a Transfer-on-Death Deed makes a will unnecessary. While it simplifies property transfer, a will may still be needed for other assets and personal matters.

- It must be notarized to be valid. While notarization can help establish validity, it is not a strict requirement for the deed to be legally effective in New York.

Understanding these misconceptions can help property owners make informed decisions about their estate planning strategies.

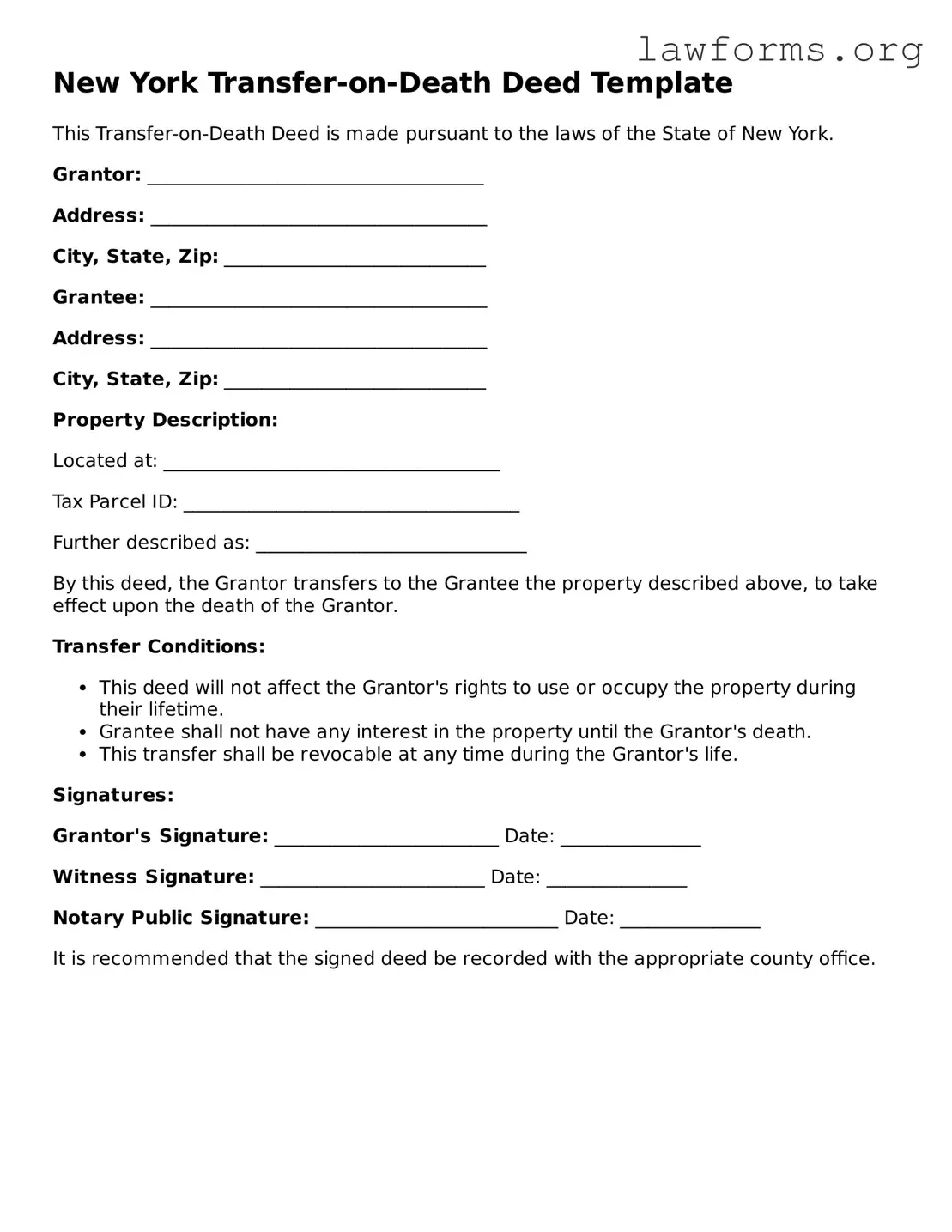

Preview - New York Transfer-on-Death Deed Form

New York Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to the laws of the State of New York.

Grantor: ____________________________________

Address: ____________________________________

City, State, Zip: ____________________________

Grantee: ____________________________________

Address: ____________________________________

City, State, Zip: ____________________________

Property Description:

Located at: ____________________________________

Tax Parcel ID: ____________________________________

Further described as: _____________________________

By this deed, the Grantor transfers to the Grantee the property described above, to take effect upon the death of the Grantor.

Transfer Conditions:

- This deed will not affect the Grantor's rights to use or occupy the property during their lifetime.

- Grantee shall not have any interest in the property until the Grantor's death.

- This transfer shall be revocable at any time during the Grantor's life.

Signatures:

Grantor's Signature: ________________________ Date: _______________

Witness Signature: ________________________ Date: _______________

Notary Public Signature: __________________________ Date: _______________

It is recommended that the signed deed be recorded with the appropriate county office.

Key takeaways

Filling out and using the New York Transfer-on-Death Deed form can be a straightforward process if you keep a few key points in mind. Here are some essential takeaways:

- Understand the Purpose: The Transfer-on-Death Deed allows property owners to transfer their real estate to a designated beneficiary upon their death, avoiding the probate process.

- Eligibility Requirements: Only individuals who own real property in New York can use this deed. Ensure that you meet the eligibility criteria before proceeding.

- Complete the Form Accurately: Fill out the form with precise information, including the property description and the beneficiary's details. Mistakes can lead to complications later on.

- Sign and Notarize: To make the deed legally binding, you must sign it in front of a notary public. This step is crucial for the document's validity.

- File with the County Clerk: After completing the deed, file it with the appropriate County Clerk’s office where the property is located. This ensures that the transfer is recognized by the state.

By keeping these takeaways in mind, you can navigate the process of creating a Transfer-on-Death Deed with confidence and ease.

Similar forms

- Last Will and Testament: A Last Will and Testament outlines how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries, but it typically requires probate, which can be a lengthy and costly process.

- Living Trust: A Living Trust is a legal arrangement where a person places their assets into a trust during their lifetime. Similar to a Transfer-on-Death Deed, it allows for the direct transfer of assets to beneficiaries without going through probate, ensuring a smoother transition.

- Prenuptial Agreement: A prenuptial agreement is a vital legal document that couples should consider before marriage, as it effectively outlines asset distribution and responsibilities. For more information regarding this important form, you can refer to Ohio PDF Forms.

- Beneficiary Designation Forms: These forms are used for financial accounts, such as bank accounts or retirement plans, to designate who will receive the assets upon the account holder's death. Like the Transfer-on-Death Deed, they allow for a direct transfer to beneficiaries without probate.

- Payable-on-Death (POD) Accounts: A POD account allows the account holder to name a beneficiary who will receive the funds upon their death. This process is similar to a Transfer-on-Death Deed in that it facilitates a straightforward transfer of assets, bypassing the probate process.