Attorney-Approved Articles of Incorporation Template for the State of North Carolina

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Articles of Incorporation form is used to legally establish a corporation in North Carolina. |

| Governing Law | This form is governed by the North Carolina General Statutes, specifically Chapter 55. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for all corporations in North Carolina. |

| Information Needed | Key information includes the corporation's name, address, and the names of its initial directors. |

| Filing Fee | A filing fee is required, which is currently set at $125 for most corporations. |

| Processing Time | Typically, the processing time for the Articles of Incorporation is about 5 to 7 business days. |

| Amendments | If changes are needed after filing, amendments can be made by submitting a separate form. |

Dos and Don'ts

When filling out the North Carolina Articles of Incorporation form, it's important to follow specific guidelines to ensure a smooth process. Here are some things you should and shouldn't do:

- Do ensure that the name of your corporation is unique and complies with state regulations.

- Do include the purpose of your corporation clearly and concisely.

- Do provide the name and address of your registered agent.

- Do specify the number of shares your corporation is authorized to issue.

- Don't use abbreviations or informal language when describing your corporation's purpose.

- Don't forget to include the names and addresses of the incorporators.

- Don't leave any required fields blank; incomplete forms can delay processing.

- Don't submit the form without double-checking for errors or typos.

Create Popular Articles of Incorporation Forms for Different States

Corporate Form - Guide the corporation’s development and management.

The California Dog Bill of Sale form plays a vital role in the pet adoption process, as it serves as a legal document that facilitates the transfer of ownership between parties. By detailing essential information about the dog, such as its breed, age, and health status, this form protects both the seller and the buyer. To learn more about this important document and how to use it effectively, you can visit californiadocsonline.com/dog-bill-of-sale-form/.

Document Retrieval Center - Can include protections for minority shareholders.

Common mistakes

-

Incorrect Business Name: One common mistake is failing to choose a unique business name. The name must not be the same as or too similar to an existing business in North Carolina. It’s essential to conduct a name search before submitting the form.

-

Missing Registered Agent Information: Every corporation needs a registered agent. Some people forget to include the agent’s name and address. This information is crucial, as the registered agent will receive legal documents on behalf of the corporation.

-

Inaccurate Purpose Statement: The purpose of the corporation must be clearly stated. Many individuals provide vague descriptions or leave this section blank. A clear purpose helps define the corporation's activities and is required for approval.

-

Improperly Filled Out Signatures: The form requires signatures from the incorporators. Some people neglect to sign or provide the wrong titles. Ensure that all required signatures are present and that the titles reflect the correct roles.

-

Failure to Include Filing Fee: Submitting the Articles of Incorporation without the correct filing fee is a frequent error. Always check the current fee amount and ensure payment is included to avoid delays in processing.

Documents used along the form

When forming a corporation in North Carolina, several additional forms and documents may be required alongside the Articles of Incorporation. Each of these documents serves a specific purpose in ensuring compliance with state regulations and establishing the corporation's operational framework. Below is a list of common documents that are often used in conjunction with the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures governing the corporation's operations. Bylaws typically cover aspects such as board meetings, voting procedures, and the roles of officers.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This report may include information about the corporation's directors and officers, as well as its principal place of business.

- Employer Identification Number (EIN): Obtained from the IRS, an EIN is necessary for tax purposes and is used to identify the corporation for federal tax filings and employee payroll.

- Registered Agent Appointment: This document designates a registered agent who will receive legal documents on behalf of the corporation. It is essential for maintaining compliance with state laws.

- Stock Certificates: If the corporation issues stock, stock certificates serve as legal proof of ownership. These documents are important for shareholders and may include details about the number of shares and their value.

- Employment Verification Form: This document is essential for confirming the employment status of workers and can be found at Forms Washington.

- Resolution of Incorporation: This is a formal statement by the board of directors that confirms the decision to incorporate and may outline the corporation's purpose and structure.

- Business License: Depending on the nature of the business, a local or state business license may be required to operate legally within the jurisdiction.

- Annual Report: Most states require corporations to file an annual report to provide updated information about the business, including changes in directors, officers, or business address.

Understanding these documents can help ensure a smooth incorporation process in North Carolina. Proper preparation and filing can save time and prevent potential legal complications in the future.

Misconceptions

Understanding the North Carolina Articles of Incorporation form is crucial for anyone looking to start a business in the state. However, several misconceptions often cloud the process. Here are ten common misunderstandings:

- It’s only for large businesses. Many believe that only large corporations need to file Articles of Incorporation. In reality, any business entity, including small businesses and startups, must file this form to establish legal recognition.

- Filing is optional. Some think that filing Articles of Incorporation is optional. This is incorrect. Filing is a legal requirement for corporations to operate in North Carolina.

- It guarantees business success. Many assume that simply filing the Articles of Incorporation will ensure their business thrives. Success depends on various factors, including planning, marketing, and management.

- It’s a quick and easy process. While the form itself may seem straightforward, gathering the necessary information and ensuring compliance can be time-consuming.

- All businesses can use the same form. Some believe that one universal form exists for all types of businesses. Different business structures, such as nonprofits and LLCs, have specific forms tailored to their needs.

- Once filed, it never needs to be updated. This is a common myth. Changes in business structure, name, or address require updates to the Articles of Incorporation.

- It’s the same as a business license. Many confuse Articles of Incorporation with a business license. They are different; the Articles establish the business entity, while a license permits operation.

- It’s only needed at the start. Some think Articles of Incorporation are only necessary when starting a business. However, ongoing compliance is essential, including annual reports and updates.

- Legal advice isn’t necessary. Many believe they can complete the form without any guidance. While it’s possible, consulting with a legal advisor can help avoid mistakes that may lead to issues down the line.

- Filing is the only step to incorporation. Filing the Articles is just one step. Other tasks, such as obtaining an Employer Identification Number (EIN) and setting up bylaws, are also crucial.

Being aware of these misconceptions can help ensure a smoother process when filing the Articles of Incorporation in North Carolina. Understanding the requirements and implications is key to setting up a successful business.

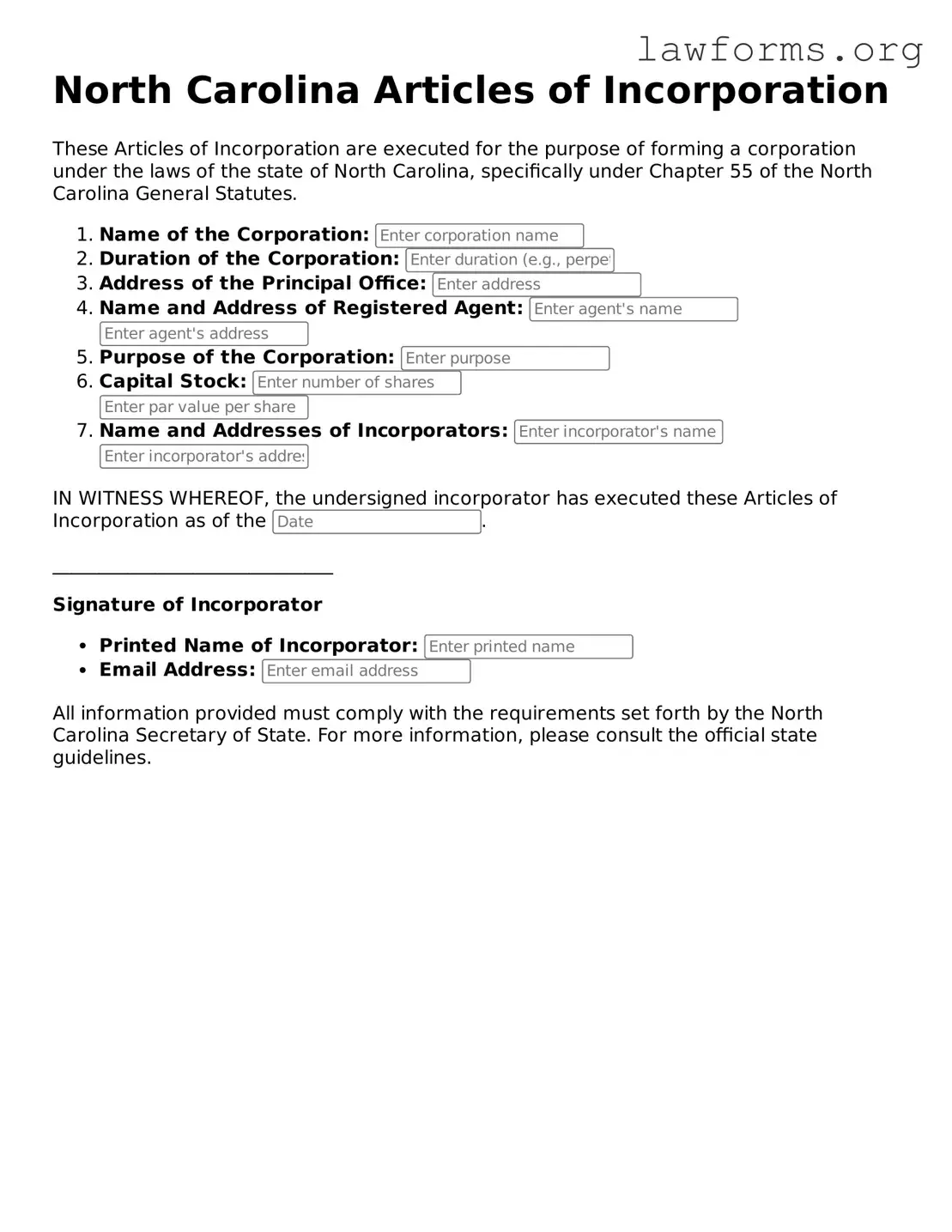

Preview - North Carolina Articles of Incorporation Form

North Carolina Articles of Incorporation

These Articles of Incorporation are executed for the purpose of forming a corporation under the laws of the state of North Carolina, specifically under Chapter 55 of the North Carolina General Statutes.

- Name of the Corporation:

- Duration of the Corporation:

- Address of the Principal Office:

-

Name and Address of Registered Agent:

- Purpose of the Corporation:

-

Capital Stock:

-

Name and Addresses of Incorporators:

IN WITNESS WHEREOF, the undersigned incorporator has executed these Articles of Incorporation as of the .

______________________________

Signature of Incorporator

- Printed Name of Incorporator:

- Email Address:

All information provided must comply with the requirements set forth by the North Carolina Secretary of State. For more information, please consult the official state guidelines.

Key takeaways

When filling out and using the North Carolina Articles of Incorporation form, keep these key takeaways in mind:

- Understand the Purpose: This form officially creates your corporation in North Carolina.

- Choose a Name: Your corporation's name must be unique and include "Corporation," "Incorporated," or "Limited."

- Registered Agent: Designate a registered agent who will receive legal documents on behalf of the corporation.

- Business Address: Provide a physical address for your corporation; a P.O. Box is not acceptable.

- Incorporators: List the names and addresses of the individuals who are forming the corporation.

- Duration: Specify whether your corporation will exist for a limited time or indefinitely.

- Purpose Statement: Clearly state the purpose of your corporation, which can be general or specific.

- Filing Fee: Be prepared to pay a filing fee when submitting your Articles of Incorporation.

- Submission: File the completed form with the North Carolina Secretary of State either online or by mail.

- Keep Copies: Always retain copies of your filed Articles of Incorporation for your records.

Following these steps can help ensure a smooth incorporation process in North Carolina.

Similar forms

- Bylaws: Bylaws outline the internal rules and procedures for managing a corporation. Like the Articles of Incorporation, they are essential for defining the structure and governance of the organization.

- Living Will: For individuals planning their medical care preferences, the essential Living Will guidelines are vital for ensuring that their wishes are understood during critical health situations.

- Operating Agreement: This document is similar to the Articles of Incorporation for limited liability companies (LLCs). It details the management structure and operating procedures, ensuring all members are on the same page.

- Certificate of Formation: Often used interchangeably with Articles of Incorporation, this document serves to officially establish a corporation or LLC. It includes basic information about the business and its owners.

- Partnership Agreement: This document outlines the terms and conditions of a partnership. Like the Articles of Incorporation, it defines roles, responsibilities, and the operational framework for the business.