Attorney-Approved Bill of Sale Template for the State of North Carolina

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The North Carolina Bill of Sale form is used to document the sale of personal property between a buyer and a seller. |

| Governing Law | This form is governed by North Carolina General Statutes, specifically § 25-2-101 et seq. regarding the sale of goods. |

| Types of Property | The Bill of Sale can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not required for all sales, it is recommended for vehicle transfers to ensure authenticity. |

| Tax Implications | Sales tax may apply to the transaction, and both parties should keep a copy of the Bill of Sale for tax purposes. |

| Buyer and Seller Information | The form requires complete names and addresses of both the buyer and seller to establish clear ownership. |

| As-Is Clause | The Bill of Sale often includes an "as-is" clause, indicating that the buyer accepts the property in its current condition without warranties. |

Dos and Don'ts

When filling out the North Carolina Bill of Sale form, it is essential to approach the process with care. Here are six important guidelines to follow:

- Do ensure all information is accurate. Double-check names, addresses, and vehicle details to avoid any discrepancies.

- Do include the date of sale. This establishes a clear record of when the transaction took place.

- Do sign the document. Both the seller and buyer should sign the Bill of Sale to validate the agreement.

- Do provide a clear description of the item being sold. Include details such as make, model, year, and VIN for vehicles.

- Don’t leave any fields blank. Incomplete forms can lead to complications later on.

- Don’t forget to keep a copy for your records. Having a copy can be useful for future reference or in case of disputes.

Following these guidelines will help ensure that the Bill of Sale is completed correctly and serves its purpose effectively.

Create Popular Bill of Sale Forms for Different States

What Does a Car Bill of Sale Look Like - A key component in documenting the sale of high-value items.

Nj Title Transfer - Buyers may find it easier to insure their purchases with documentation from a Bill of Sale.

Boat Bill of Sale - This document can support financing applications related to the sale.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. The form requires specific information about the buyer and seller, including names, addresses, and contact information. Omitting any of this can lead to confusion or disputes later on.

-

Incorrect Vehicle Identification Number (VIN): Another frequent error is entering the wrong VIN. This number uniquely identifies a vehicle, and inaccuracies can create significant issues during registration or title transfer. Always double-check this critical piece of information.

-

Not Including the Sale Price: Some individuals neglect to specify the sale price of the item being sold. This detail is essential, as it establishes the value of the transaction for both parties and for tax purposes. Without it, the document may not hold up in legal situations.

-

Failure to Sign: Lastly, many people forget to sign the document. Both the buyer and seller must sign the Bill of Sale for it to be valid. A missing signature can render the form ineffective, leaving both parties without legal protection.

Documents used along the form

A Bill of Sale is an important document for transferring ownership of personal property in North Carolina. However, several other forms and documents often accompany it to ensure a smooth transaction. Below is a list of these documents, each playing a vital role in the process.

- Title Transfer Form: This document officially transfers the title of a vehicle from the seller to the buyer. It is crucial for registering the vehicle in the buyer's name.

- Odometer Disclosure Statement: Required for vehicle sales, this form records the mileage at the time of sale. It helps prevent fraud by ensuring that the odometer reading is accurate.

- Affidavit of Ownership: In cases where the seller cannot provide a title, this affidavit serves as a sworn statement affirming ownership of the property being sold.

- Sales Tax Form: This form documents the sales tax collected during the transaction. It is important for compliance with state tax laws.

- Purchase Agreement: This contract outlines the terms of the sale, including price, payment method, and any warranties or guarantees. It protects both parties by clarifying expectations.

- Inspection Report: For vehicles, this report details the condition of the car at the time of sale. It can help buyers make informed decisions and provides a record of the vehicle's state.

- Power of Attorney: If someone is handling the sale on behalf of the owner, a power of attorney document grants them the legal authority to act in the owner's stead.

- Release of Liability: This form protects the seller from future claims related to the property after the sale. It confirms that the buyer assumes responsibility once the transaction is complete.

Using these documents alongside the Bill of Sale can help ensure that all legal aspects of the transaction are covered. Each form serves a specific purpose, contributing to a transparent and secure exchange between the buyer and seller.

Misconceptions

Here are nine common misconceptions about the North Carolina Bill of Sale form:

- A Bill of Sale is only for vehicles. Many believe that a Bill of Sale is exclusively for vehicle transactions. In reality, it can be used for any personal property sale, including furniture, electronics, and other items.

- All Bill of Sale forms are the same. Not all Bill of Sale forms are created equal. Each state has specific requirements, and the North Carolina form may include unique elements that differ from those in other states.

- A Bill of Sale is not legally binding. Some people think that a Bill of Sale holds no legal weight. However, it is a valid contract that can be enforced in court if necessary.

- You don’t need a Bill of Sale for small transactions. Many assume that small transactions do not require documentation. Even for minor sales, having a Bill of Sale provides proof of the transaction.

- A Bill of Sale must be notarized. While notarization can add an extra layer of security, it is not a requirement for a Bill of Sale in North Carolina. The form is valid as long as both parties sign it.

- Only the seller needs to sign the Bill of Sale. This misconception overlooks the fact that both the buyer and seller should sign the document to make it valid and enforceable.

- A Bill of Sale protects against all future claims. While a Bill of Sale provides evidence of the transaction, it does not necessarily protect against all future claims or disputes regarding the item sold.

- You can create a Bill of Sale without any specific information. A Bill of Sale must include essential details, such as the names of the buyer and seller, a description of the item, and the sale price, to be effective.

- A Bill of Sale is only necessary for private sales. Some believe that only private sales require a Bill of Sale. However, it can also be useful in transactions involving businesses or dealerships.

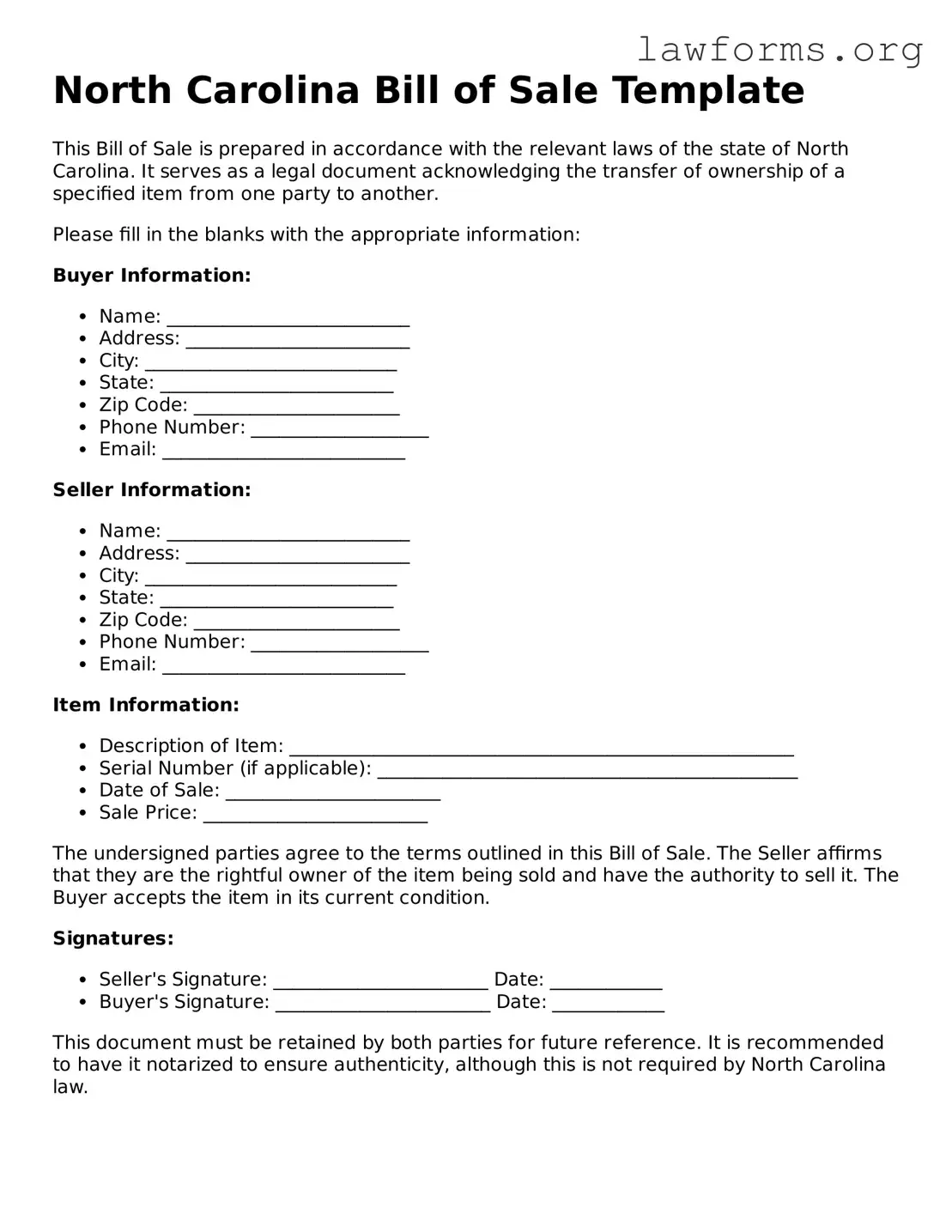

Preview - North Carolina Bill of Sale Form

North Carolina Bill of Sale Template

This Bill of Sale is prepared in accordance with the relevant laws of the state of North Carolina. It serves as a legal document acknowledging the transfer of ownership of a specified item from one party to another.

Please fill in the blanks with the appropriate information:

Buyer Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: _________________________

- Zip Code: ______________________

- Phone Number: ___________________

- Email: __________________________

Seller Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: _________________________

- Zip Code: ______________________

- Phone Number: ___________________

- Email: __________________________

Item Information:

- Description of Item: ______________________________________________________

- Serial Number (if applicable): _____________________________________________

- Date of Sale: _______________________

- Sale Price: ________________________

The undersigned parties agree to the terms outlined in this Bill of Sale. The Seller affirms that they are the rightful owner of the item being sold and have the authority to sell it. The Buyer accepts the item in its current condition.

Signatures:

- Seller's Signature: _______________________ Date: ____________

- Buyer's Signature: _______________________ Date: ____________

This document must be retained by both parties for future reference. It is recommended to have it notarized to ensure authenticity, although this is not required by North Carolina law.

Key takeaways

When filling out and using the North Carolina Bill of Sale form, there are several important points to consider. These takeaways will ensure that the process is smooth and legally sound.

- Understand the Purpose: A Bill of Sale serves as a legal document that records the transfer of ownership of personal property from one party to another.

- Include Accurate Information: Ensure that all details, such as the names of both the buyer and seller, are correctly filled out. This includes addresses and contact information.

- Describe the Item Clearly: Provide a detailed description of the item being sold. This may include make, model, year, and any identifying numbers.

- Consider Payment Terms: Clearly state the purchase price and any terms related to payment. This can help avoid disputes later.

- Signatures Are Essential: Both parties should sign the document. This signifies agreement to the terms outlined in the Bill of Sale.

- Keep Copies: After the Bill of Sale is completed and signed, both the buyer and seller should retain copies for their records.

- Check Local Requirements: Verify if there are any additional requirements specific to your county or municipality regarding the Bill of Sale.

By following these key takeaways, individuals can ensure that their transactions in North Carolina are documented properly and legally binding.

Similar forms

The Bill of Sale form serves as a crucial document in various transactions, particularly those involving the transfer of ownership. Several other documents share similarities with the Bill of Sale, each fulfilling a unique role in different contexts. Below are four such documents:

- Purchase Agreement: This document outlines the terms and conditions of a sale between a buyer and a seller. Like the Bill of Sale, it confirms the transfer of ownership and includes details such as the purchase price and description of the item. However, it often encompasses broader terms, including warranties and contingencies.

- Title Transfer Document: Used primarily in vehicle sales, this document officially transfers the title of the vehicle from the seller to the buyer. Similar to a Bill of Sale, it provides proof of ownership. However, it is specifically tailored for motor vehicles and may require additional information, such as the vehicle identification number (VIN).

- Lease Agreement: This document outlines the terms under which one party rents property from another. While it may not involve an outright sale, it establishes rights and responsibilities similar to those found in a Bill of Sale. Both documents serve to protect the interests of the parties involved and provide clarity on ownership rights.

-

Articles of Incorporation: This document is essential for businesses looking to incorporate in New York. It provides necessary details to the state and legally recognizes a business entity, ensuring personal asset protection. For more details, you can refer to Formaid Org.

- Gift Deed: This document is used when property is transferred as a gift rather than a sale. Like the Bill of Sale, it signifies a change in ownership and may include details about the item. However, it typically does not involve any exchange of money, focusing instead on the intent to give.