Attorney-Approved Deed Template for the State of North Carolina

Form Specifications

| Fact Name | Details |

|---|---|

| Governing Law | The North Carolina Deed form is governed by North Carolina General Statutes, specifically Chapter 47. |

| Types of Deeds | North Carolina recognizes several types of deeds, including General Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds. |

| Requirements | The deed must be in writing, signed by the grantor, and include a description of the property. |

| Notarization | A North Carolina Deed must be notarized to be valid and enforceable. |

| Recording | To provide public notice, the deed must be recorded in the county where the property is located. |

| Transfer Tax | North Carolina imposes a transfer tax on real estate transactions, which must be paid at the time of recording. |

Dos and Don'ts

When filling out the North Carolina Deed form, it is important to approach the process with care. Here are some key points to consider:

- Do ensure that all names are spelled correctly. Accuracy is crucial in legal documents.

- Don't leave any sections blank. Every part of the form should be completed to avoid delays.

- Do include a clear and concise description of the property. This helps in identifying the property accurately.

- Don't forget to sign the document in the presence of a notary. A signature without notarization may render the deed invalid.

- Do check for any local requirements that may apply. Different counties may have specific rules regarding deeds.

- Don't use white-out or any correction fluid on the form. If a mistake is made, it is better to cross it out and initial the change.

Taking these steps can help ensure that the deed is filled out correctly and is legally valid.

Create Popular Deed Forms for Different States

Sample Deed - In some cases, a deed can include provisions for dividing property interests among heirs.

The California Civil form, specifically the Civil Case Cover Sheet (CM-010), is a document required for initiating civil cases in California. This form helps the court categorize and manage cases effectively by gathering essential information about the nature of the case. For more information on this process, you can visit californiadocsonline.com/california-civil-form/. Completing this form accurately is crucial, as it can impact case management and judicial resources.

Warranty Deed Form Ohio - A deed serves as proof of ownership and is crucial for real estate transactions.

Common mistakes

-

Incorrect Names: One of the most common mistakes is misspelling the names of the grantor or grantee. It's essential to ensure that the names match exactly as they appear on legal documents.

-

Omitting Required Information: Failing to include all necessary details, such as the property description or tax identification number, can lead to significant issues. Every section of the deed must be filled out completely.

-

Improper Signatures: The deed must be signed by the grantor, and if there are multiple grantors, all must sign. Not obtaining the correct signatures can invalidate the deed.

-

Not Notarizing: In North Carolina, a deed typically requires notarization. Skipping this step can render the deed unenforceable.

-

Wrong Notary Information: Providing incorrect information about the notary, such as their commission expiration date, can lead to complications. Ensure all notary details are accurate and up to date.

-

Failure to Record: After completing the deed, it must be recorded with the county register of deeds. Neglecting this step means the deed may not be recognized publicly.

-

Ignoring Local Laws: Each county may have specific requirements for deeds. Failing to check local regulations can result in errors that affect the validity of the deed.

Documents used along the form

In North Carolina, the deed form is a critical document for transferring property ownership. However, several other forms and documents are often used in conjunction with the deed to ensure a smooth and legally compliant transaction. Below are some of the key documents that may accompany the North Carolina deed form.

- Property Disclosure Statement: This document provides potential buyers with important information about the property's condition. Sellers are required to disclose known issues, such as structural problems or pest infestations, which can affect the property's value and desirability.

- Title Search Report: A title search report outlines the history of the property’s ownership. It identifies any liens, easements, or encumbrances that may affect the title. This report is essential for confirming that the seller has the legal right to transfer ownership.

- Boat Bill of Sale Form: For those finalizing their boat purchases, the important Boat Bill of Sale documentation guide is essential for legal compliance and protection.

- Settlement Statement (HUD-1): This form details all financial aspects of the real estate transaction. It includes costs associated with the sale, such as closing fees, taxes, and any credits. Both buyers and sellers review this document to ensure transparency in the financial transaction.

- Affidavit of Title: This sworn statement is provided by the seller, confirming their ownership of the property and the absence of any undisclosed liens or claims. It serves as a legal assurance to the buyer regarding the property’s title status.

Each of these documents plays a vital role in the property transfer process in North Carolina. Together, they help protect the interests of both buyers and sellers, ensuring that all necessary information is disclosed and that the transaction proceeds without legal complications.

Misconceptions

Many people have misconceptions about the North Carolina Deed form. Understanding these misconceptions can help individuals navigate property transactions more effectively. Here are seven common misunderstandings:

- All deeds are the same. Many believe that all deeds serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each serving specific legal functions.

- A deed is the same as a title. Some think that having a deed means they own the title to the property. However, a deed is simply a document that transfers ownership, while the title is the legal right to own and use the property.

- Deeds do not need to be recorded. There is a belief that recording a deed is optional. In North Carolina, it is crucial to record the deed with the county register of deeds to protect ownership rights against claims from third parties.

- Only lawyers can prepare a deed. While it is advisable to consult a lawyer, many people can prepare a deed themselves, especially if they use templates or online resources. However, care must be taken to ensure accuracy.

- All property transfers require a new deed. Some individuals think that every transfer of property ownership necessitates a new deed. In certain cases, such as when transferring property between spouses, a new deed may not be required.

- Once a deed is signed, it cannot be changed. Many assume that a signed deed is set in stone. However, deeds can be amended or corrected under certain circumstances, provided the proper legal procedures are followed.

- Only the buyer needs to sign the deed. Some believe that only the buyer's signature is necessary on a deed. In fact, the seller must also sign to validate the transfer of ownership.

By addressing these misconceptions, individuals can better understand the North Carolina Deed form and ensure a smoother property transaction process.

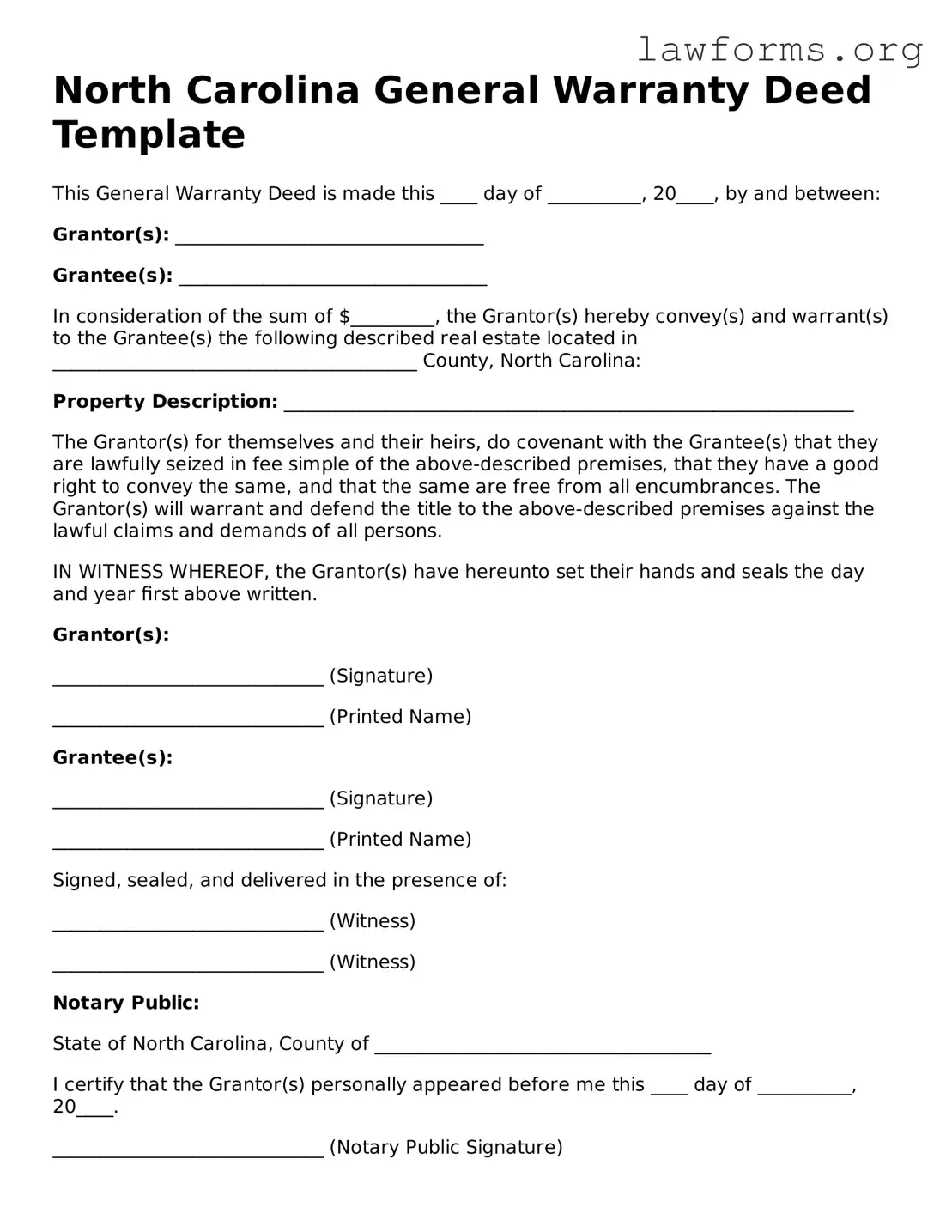

Preview - North Carolina Deed Form

North Carolina General Warranty Deed Template

This General Warranty Deed is made this ____ day of __________, 20____, by and between:

Grantor(s): _________________________________

Grantee(s): _________________________________

In consideration of the sum of $_________, the Grantor(s) hereby convey(s) and warrant(s) to the Grantee(s) the following described real estate located in _______________________________________ County, North Carolina:

Property Description: _____________________________________________________________

The Grantor(s) for themselves and their heirs, do covenant with the Grantee(s) that they are lawfully seized in fee simple of the above-described premises, that they have a good right to convey the same, and that the same are free from all encumbrances. The Grantor(s) will warrant and defend the title to the above-described premises against the lawful claims and demands of all persons.

IN WITNESS WHEREOF, the Grantor(s) have hereunto set their hands and seals the day and year first above written.

Grantor(s):

_____________________________ (Signature)

_____________________________ (Printed Name)

Grantee(s):

_____________________________ (Signature)

_____________________________ (Printed Name)

Signed, sealed, and delivered in the presence of:

_____________________________ (Witness)

_____________________________ (Witness)

Notary Public:

State of North Carolina, County of ____________________________________

I certify that the Grantor(s) personally appeared before me this ____ day of __________, 20____.

_____________________________ (Notary Public Signature)

My commission expires: ____________

Prepared by: ___________________________________ (Prepared by Name)

Key takeaways

When filling out and using the North Carolina Deed form, there are several important considerations to keep in mind. Below are key takeaways that can guide individuals through the process.

- The deed must include the names of the grantor (seller) and grantee (buyer) clearly to establish ownership transfer.

- It is essential to provide a legal description of the property. This description should be precise to avoid any ambiguity regarding the property being conveyed.

- Ensure that the deed is signed by the grantor. In North Carolina, the signature must be notarized to validate the document.

- Consider the type of deed being used. Different types, such as warranty deeds or quitclaim deeds, offer varying levels of protection and rights.

- After completing the deed, it must be filed with the appropriate county register of deeds office to be effective. This step is crucial for public record purposes.

- Review any applicable state and local laws that may impact the deed's validity or the property transfer process.

- Consulting with a real estate professional or attorney can help clarify any uncertainties and ensure compliance with all legal requirements.

Similar forms

- Bill of Sale: This document transfers ownership of personal property from one party to another. Like a deed, it serves as proof of the transaction and includes details about the item being sold.

- Lease Agreement: A lease outlines the terms under which one party rents property from another. Similar to a deed, it establishes rights and responsibilities regarding the property.

- Power of Attorney: This form allows one individual to act on behalf of another in legal or financial matters. Similar to a deed, it requires clear identification of the parties and their authority. For more information, you can access the Ohio PDF Forms.

- Title Certificate: This document proves ownership of a vehicle or property. It shares similarities with a deed in that it serves as legal evidence of ownership and may be required for transactions.

- Trust Agreement: A trust agreement sets up a legal arrangement where one party holds property for the benefit of another. Both documents define ownership and rights regarding the property involved.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. It is similar to a deed in that it can convey rights or interests in property, although it does so indirectly.

- Quitclaim Deed: A quitclaim deed transfers any interest one person has in a property to another without guaranteeing that the title is clear. It is a specific type of deed that shares the same purpose of transferring property rights.

- Warranty Deed: This type of deed guarantees that the grantor holds clear title to the property and has the right to sell it. Like a standard deed, it is used to transfer ownership but includes additional protections for the buyer.