Attorney-Approved Durable Power of Attorney Template for the State of North Carolina

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney in North Carolina allows an individual to designate another person to make financial and legal decisions on their behalf, even if they become incapacitated. |

| Governing Law | The Durable Power of Attorney in North Carolina is governed by the North Carolina General Statutes, specifically Chapter 32A. |

| Durability | This form remains effective even if the principal becomes mentally incapacitated, ensuring continuous management of their affairs. |

| Principal and Agent | The person creating the Durable Power of Attorney is called the principal, while the person designated to act on their behalf is known as the agent or attorney-in-fact. |

| Execution Requirements | To be valid, the form must be signed by the principal in the presence of a notary public and two witnesses, who must also sign the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Agent’s Authority | The agent's authority can be broad or limited, depending on the specific powers granted in the document. |

| Legal Advice | It is advisable for individuals to seek legal advice when creating a Durable Power of Attorney to ensure that their wishes are clearly articulated and legally binding. |

Dos and Don'ts

When filling out the North Carolina Durable Power of Attorney form, it’s essential to approach the task with care. This legal document allows someone to make decisions on your behalf if you become unable to do so. Here are some important dos and don’ts to consider:

- Do choose a trustworthy agent who understands your wishes.

- Do clearly define the powers you are granting to your agent.

- Do date the document to ensure its validity.

- Do sign the form in front of a notary public to enhance its legal standing.

- Don’t leave any sections blank; incomplete forms can lead to confusion.

- Don’t assume your agent knows your preferences; communicate them clearly.

- Don’t forget to provide copies to your agent and any relevant parties.

By following these guidelines, you can ensure that your Durable Power of Attorney form is completed accurately and effectively. This can provide peace of mind for you and your loved ones.

Create Popular Durable Power of Attorney Forms for Different States

How to File for Power of Attorney in Florida - The process of revocation is straightforward as long as the individual is mentally competent.

When engaging in the sale of a vehicle, it is crucial to utilize the Minnesota Motor Vehicle Bill of Sale form to formalize the transaction and protect both parties involved. For those looking for assistance in creating this essential document, resources such as Formaid Org can provide valuable templates and guidance, ensuring that all necessary details are properly documented.

How to Do Power of Attorney - With this power, your agent can make urgent decisions in your best interest.

Common mistakes

-

Not Specifying Powers Clearly: Individuals often fail to clearly outline the specific powers granted to the agent. This can lead to confusion about what decisions the agent can make on behalf of the principal.

-

Choosing the Wrong Agent: Selecting someone who is not trustworthy or lacks the necessary skills can result in poor decision-making. It’s crucial to choose an agent who understands the principal’s values and wishes.

-

Not Signing or Dating the Document: A common oversight is neglecting to sign and date the form. Without a signature and date, the document may not be considered valid.

-

Failing to Have Witnesses or Notarization: In North Carolina, the form must be witnessed or notarized. Skipping this step can invalidate the document.

-

Using Outdated Forms: Some individuals mistakenly use old versions of the Durable Power of Attorney form. Always ensure that the most current version is utilized to comply with legal requirements.

-

Not Reviewing or Updating the Document: Life changes, such as marriage, divorce, or changes in health, may necessitate updates to the Durable Power of Attorney. Failing to review the document regularly can lead to complications.

Documents used along the form

When preparing a Durable Power of Attorney in North Carolina, it is often beneficial to consider additional documents that can complement this important legal instrument. Each document serves a specific purpose and can enhance the effectiveness of your planning. Below is a list of commonly used forms and documents.

- Advance Healthcare Directive: This document outlines your preferences for medical treatment and appoints someone to make healthcare decisions on your behalf if you are unable to do so.

- Living Will: A living will specifies your wishes regarding life-sustaining treatment in situations where you are terminally ill or in a persistent vegetative state.

- Last Will and Testament: This document details how you want your assets distributed after your death and can appoint guardians for minor children.

- Revocable Living Trust: A trust allows you to manage your assets during your lifetime and specify how they should be distributed after your death, often avoiding probate.

- Healthcare Power of Attorney: Similar to an Advance Healthcare Directive, this document designates a specific individual to make healthcare decisions for you if you cannot make them yourself.

- Employment Verification Form: This form is essential for validating an employee's status within a company. It acts as a reliable reference for prospective employers and can streamline the hiring process, as emphasized by Forms Washington.

- Financial Power of Attorney: This document grants someone the authority to manage your financial affairs, which can be separate from your Durable Power of Attorney.

- Beneficiary Designations: These forms specify who will receive your assets, such as life insurance policies and retirement accounts, upon your death.

- Property Deed: A property deed transfers ownership of real estate and may be necessary to clarify ownership issues or facilitate estate planning.

Considering these additional documents can provide a more comprehensive approach to your legal and financial planning. Each serves a unique purpose and can help ensure your wishes are honored in various circumstances.

Misconceptions

Many people have misunderstandings about the North Carolina Durable Power of Attorney form. Here are six common misconceptions, along with explanations to clarify them:

- It only applies to financial matters. Some believe that a Durable Power of Attorney is limited to financial decisions. In reality, it can cover a wide range of decisions, including healthcare and personal matters, depending on how it is drafted.

- It becomes invalid upon incapacity. A common misconception is that this document loses its power if the principal becomes incapacitated. However, a Durable Power of Attorney remains effective even if the principal can no longer make decisions for themselves.

- It requires a lawyer to create. While having legal assistance can be beneficial, it is not mandatory to have a lawyer draft a Durable Power of Attorney. Individuals can complete the form themselves as long as they meet the legal requirements.

- It is permanent and cannot be revoked. Many think that once a Durable Power of Attorney is signed, it cannot be changed or revoked. In fact, the principal has the right to revoke or modify the document at any time, as long as they are mentally competent.

- Only one person can be designated as an agent. Some people believe they can only appoint one agent. However, multiple agents can be designated, and they can have different powers or responsibilities as outlined in the document.

- It must be notarized to be valid. While notarization can add an extra layer of authenticity, it is not always required for the Durable Power of Attorney to be valid in North Carolina. Witness signatures may suffice in certain situations.

Understanding these misconceptions can help individuals make informed decisions about their legal documents and ensure their wishes are honored.

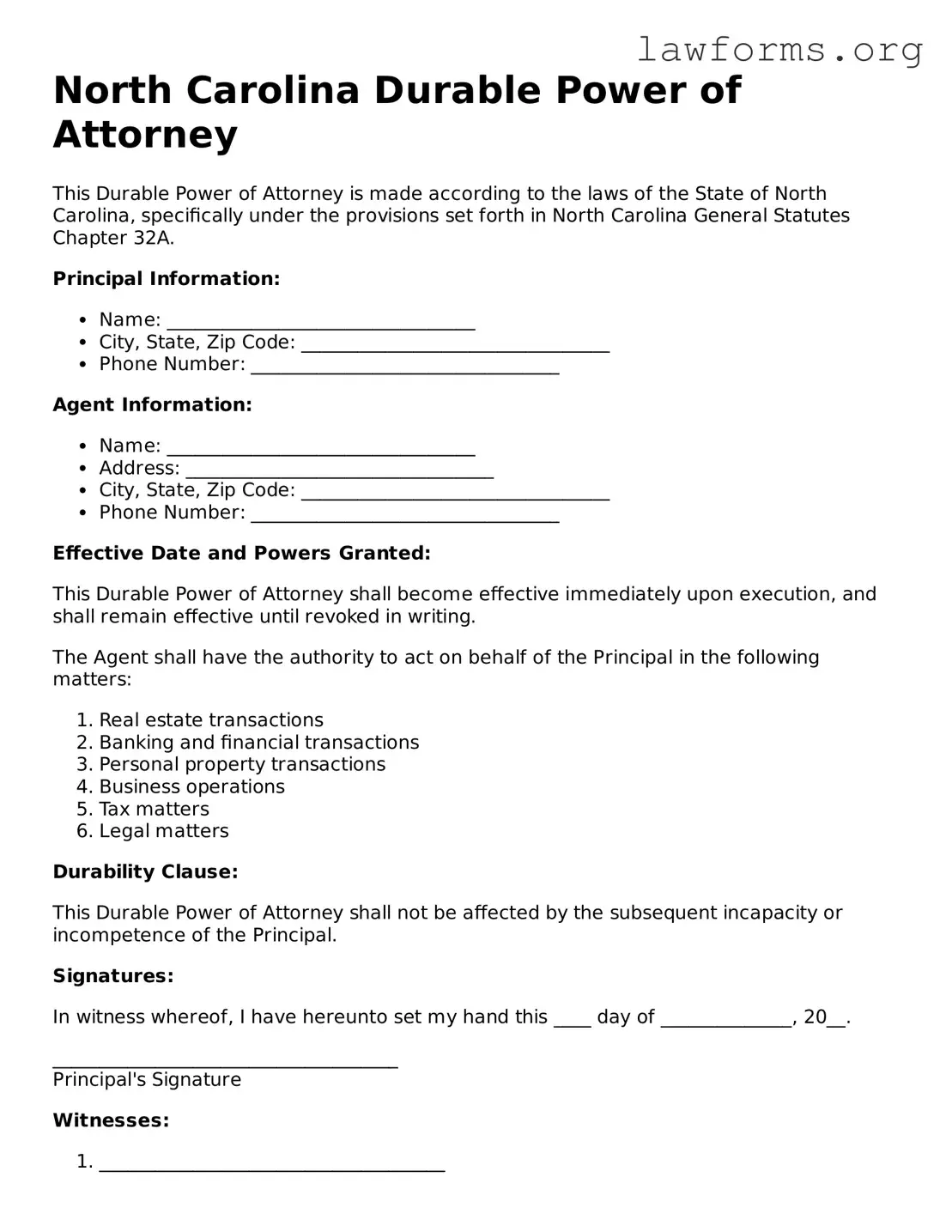

Preview - North Carolina Durable Power of Attorney Form

North Carolina Durable Power of Attorney

This Durable Power of Attorney is made according to the laws of the State of North Carolina, specifically under the provisions set forth in North Carolina General Statutes Chapter 32A.

Principal Information:

- Name: _________________________________

- City, State, Zip Code: _________________________________

- Phone Number: _________________________________

Agent Information:

- Name: _________________________________

- Address: _________________________________

- City, State, Zip Code: _________________________________

- Phone Number: _________________________________

Effective Date and Powers Granted:

This Durable Power of Attorney shall become effective immediately upon execution, and shall remain effective until revoked in writing.

The Agent shall have the authority to act on behalf of the Principal in the following matters:

- Real estate transactions

- Banking and financial transactions

- Personal property transactions

- Business operations

- Tax matters

- Legal matters

Durability Clause:

This Durable Power of Attorney shall not be affected by the subsequent incapacity or incompetence of the Principal.

Signatures:

In witness whereof, I have hereunto set my hand this ____ day of ______________, 20__.

_____________________________________

Principal's Signature

Witnesses:

- _____________________________________

- _____________________________________

Notarization:

State of North Carolina

County of ____________________________

Subscribed, sworn to, and acknowledged before me this ____ day of ______________, 20__.

_____________________________________

Notary Public

My commission expires: _______________

Key takeaways

Filling out and using the North Carolina Durable Power of Attorney form is a significant step in ensuring that your financial and medical decisions are managed according to your wishes. Here are some key takeaways to consider:

- Understand the Purpose: The Durable Power of Attorney allows you to appoint someone to make decisions on your behalf if you become incapacitated.

- Choose Your Agent Wisely: Select a trusted individual who will act in your best interest. This person should be reliable and capable of handling financial matters.

- Be Specific: Clearly outline the powers you are granting to your agent. You can specify which financial or health-related decisions they can make.

- Sign and Date: Ensure that you sign and date the form in the presence of a notary public. This step is crucial for the document’s validity.

- Keep Copies Accessible: After completing the form, provide copies to your agent, family members, and any relevant financial institutions to avoid confusion later.

- Review Periodically: Life circumstances change. Regularly review and update the Durable Power of Attorney to reflect your current wishes and situation.

Similar forms

- General Power of Attorney: This document grants broad authority to an agent to act on behalf of the principal in various matters, similar to the Durable Power of Attorney but typically ceases upon the principal's incapacitation.

- Medical Power of Attorney: This form specifically allows an agent to make healthcare decisions for the principal if they become unable to do so themselves, focusing on medical choices rather than financial or legal matters.

- Living Will: While not a power of attorney, a living will outlines the principal's wishes regarding medical treatment and end-of-life care, complementing the medical power of attorney.

- Advance Healthcare Directive: This combines a living will and medical power of attorney, providing instructions for medical care and designating an agent to make decisions if the principal is incapacitated.

- Living Will: To ensure your medical preferences are respected, consider using the Texas Living Will form guidelines for clear documentation of your wishes.

- Revocable Trust: Similar in purpose, a revocable trust allows a trustee to manage assets on behalf of the principal, providing flexibility and control over financial matters during the principal's lifetime.

- Financial Power of Attorney: This document specifically focuses on financial matters, granting the agent authority to handle the principal's financial affairs, much like a Durable Power of Attorney but without the emphasis on health-related decisions.

- Guardianship Documents: These legal documents establish a guardian for an individual who cannot care for themselves, similar in that they grant authority over another person’s well-being, though typically more formal and court-involved.