Attorney-Approved Lady Bird Deed Template for the State of North Carolina

Form Specifications

| Fact Name | Details |

|---|---|

| Definition | The Lady Bird Deed, also known as an enhanced life estate deed, allows property owners to transfer their property upon death without going through probate. |

| Governing Law | The Lady Bird Deed is governed by North Carolina General Statutes, particularly Chapter 31, which outlines laws related to wills and property transfers. |

| Benefits | This deed helps avoid probate, allowing for a smoother transition of property to beneficiaries while maintaining control during the owner's lifetime. |

| Ownership Rights | The property owner retains the right to sell, mortgage, or change the deed at any time before death, ensuring flexibility in property management. |

| Tax Implications | Using a Lady Bird Deed can help preserve the property tax benefits for the owner while transferring the stepped-up basis to heirs. |

| Requirements | To create a valid Lady Bird Deed in North Carolina, it must be signed, notarized, and recorded in the county where the property is located. |

Dos and Don'ts

When filling out the North Carolina Lady Bird Deed form, there are several important guidelines to follow. Here’s a list of things you should and shouldn’t do:

- Do ensure that you have the correct legal description of the property.

- Do include the full names of all parties involved in the deed.

- Do verify that you are the current owner of the property.

- Do consider consulting with a legal professional if you have questions.

- Do sign the deed in the presence of a notary public.

- Don't leave any blank spaces on the form; fill in all required information.

- Don't use outdated forms; make sure you have the latest version.

- Don't forget to check for any specific state requirements that may apply.

- Don't rush through the process; take your time to ensure accuracy.

- Don't neglect to record the deed with the county register of deeds after completion.

Create Popular Lady Bird Deed Forms for Different States

Lady Bird Deed San Antonio - The Lady Bird Deed allows for a quick transfer of property, eliminating unnecessary delays.

Completing the North Carolina Motor Vehicle Bill of Sale accurately is essential to prevent any misunderstandings in the vehicle transaction process. This document not only acts as a receipt for the sale but also provides legal protection for both the buyer and seller involved. To get started with this important step in your vehicle sale, click here for the editable form that will guide you through the necessary information needed.

Transfer on Death Deed Florida Form - The Lady Bird Deed provides flexibility in terms of property management during the owner's life.

Common mistakes

-

Incorrect Names: People often misspell names or use nicknames instead of legal names. This can lead to confusion or disputes later on.

-

Missing Signatures: All required parties must sign the deed. Forgetting to include a signature can invalidate the document.

-

Improper Notarization: The deed must be notarized correctly. Failing to have a notary public witness the signing can cause issues.

-

Incorrect Property Description: A clear and accurate description of the property is essential. Errors in this section can lead to legal problems.

-

Not Understanding the Terms: Some individuals do not fully grasp the implications of a Lady Bird Deed. This can result in unintended consequences.

-

Ignoring State Laws: Each state has specific requirements for deeds. Not following North Carolina's rules can render the deed ineffective.

-

Failure to Update: After filling out the deed, individuals often forget to make updates if circumstances change, such as a change in beneficiaries.

-

Not Consulting a Lawyer: Many people skip seeking legal advice. This can lead to mistakes that might have been easily avoided with professional guidance.

Documents used along the form

When considering a Lady Bird Deed in North Carolina, it's essential to understand that this document often works in conjunction with several other forms and documents. Each of these plays a vital role in ensuring that property transfers are smooth, legally compliant, and reflect the wishes of the property owner. Below is a list of commonly used documents alongside the Lady Bird Deed.

- Property Deed: This is the fundamental document that establishes ownership of real estate. It details the property description, the names of the current owners, and any encumbrances on the property.

- Will: A legal document that outlines how a person's assets will be distributed after their death. It can work alongside a Lady Bird Deed to clarify intentions regarding property transfer.

- Durable Power of Attorney: This document allows someone to make financial decisions on behalf of another person if they become incapacitated. It can be crucial in managing property matters when the owner is unable to do so.

- Trust Agreement: A legal arrangement where one party holds property for the benefit of another. This can be used to manage assets during a person's lifetime and beyond, often working in tandem with a Lady Bird Deed.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. It can clarify ownership of property and support the transfer process under a Lady Bird Deed.

- Quitclaim Deed: A simple way to transfer interest in a property without making any guarantees about the title. This can be used to transfer property to a trust or another individual as part of estate planning.

- Residential Lease Agreement: This document is essential for landlords and tenants in Ohio, detailing their obligations and rights within the rental arrangement. For more comprehensive information, you can explore the Ohio PDF Forms.

- Title Search Report: This report provides information about the ownership history of a property and any liens or claims against it. It’s essential for ensuring that the property can be transferred without issues.

- Estate Tax Return: If applicable, this document reports the estate’s value and determines any taxes owed. It’s important for ensuring compliance with tax laws during the transfer process.

- Transfer Tax Declaration: This form is often required to report the transfer of property and any taxes due as a result. It helps ensure that all financial obligations are met during the transfer.

Understanding these documents can significantly ease the process of property transfer and estate planning. Each plays a unique role in ensuring that the wishes of the property owner are honored and that the legal requirements are met. Always consider consulting a legal professional for personalized guidance tailored to your specific situation.

Misconceptions

The North Carolina Lady Bird Deed is a valuable estate planning tool, yet several misconceptions surround its use. Understanding these can help individuals make informed decisions. Here are ten common misconceptions:

- It’s only for elderly homeowners. Many believe that only seniors can benefit from a Lady Bird Deed. In reality, anyone can use this deed to manage property transfer efficiently.

- It avoids probate entirely. While a Lady Bird Deed can help streamline the transfer of property and may reduce probate complications, it does not eliminate probate in all situations.

- It’s the same as a traditional deed. A Lady Bird Deed includes specific provisions that allow the original owner to retain certain rights, which is not the case with a standard deed.

- It’s only useful for real estate. Although primarily used for real estate, a Lady Bird Deed can also be part of a broader estate planning strategy that involves other assets.

- It cannot be revoked. A common myth is that once a Lady Bird Deed is executed, it cannot be changed. In fact, the grantor retains the right to revoke or modify the deed at any time during their lifetime.

- It automatically transfers property upon death. The deed does allow for automatic transfer, but the property must still be properly titled in the name of the grantor during their lifetime.

- It’s a one-size-fits-all solution. Each person’s financial and family situation is unique. A Lady Bird Deed may not be suitable for everyone, and individual circumstances should be considered.

- It’s too complicated to understand. While there are legal nuances, the basic concept of a Lady Bird Deed is straightforward. Many resources are available to help clarify its use.

- It’s only beneficial for those with large estates. Even individuals with modest assets can benefit from the flexibility and control a Lady Bird Deed offers in estate planning.

- It’s the best option for everyone. There are various estate planning tools available. A Lady Bird Deed may be advantageous for some, but others may find different options more suitable.

By dispelling these misconceptions, individuals can better navigate their estate planning options and make informed choices regarding their property and legacy.

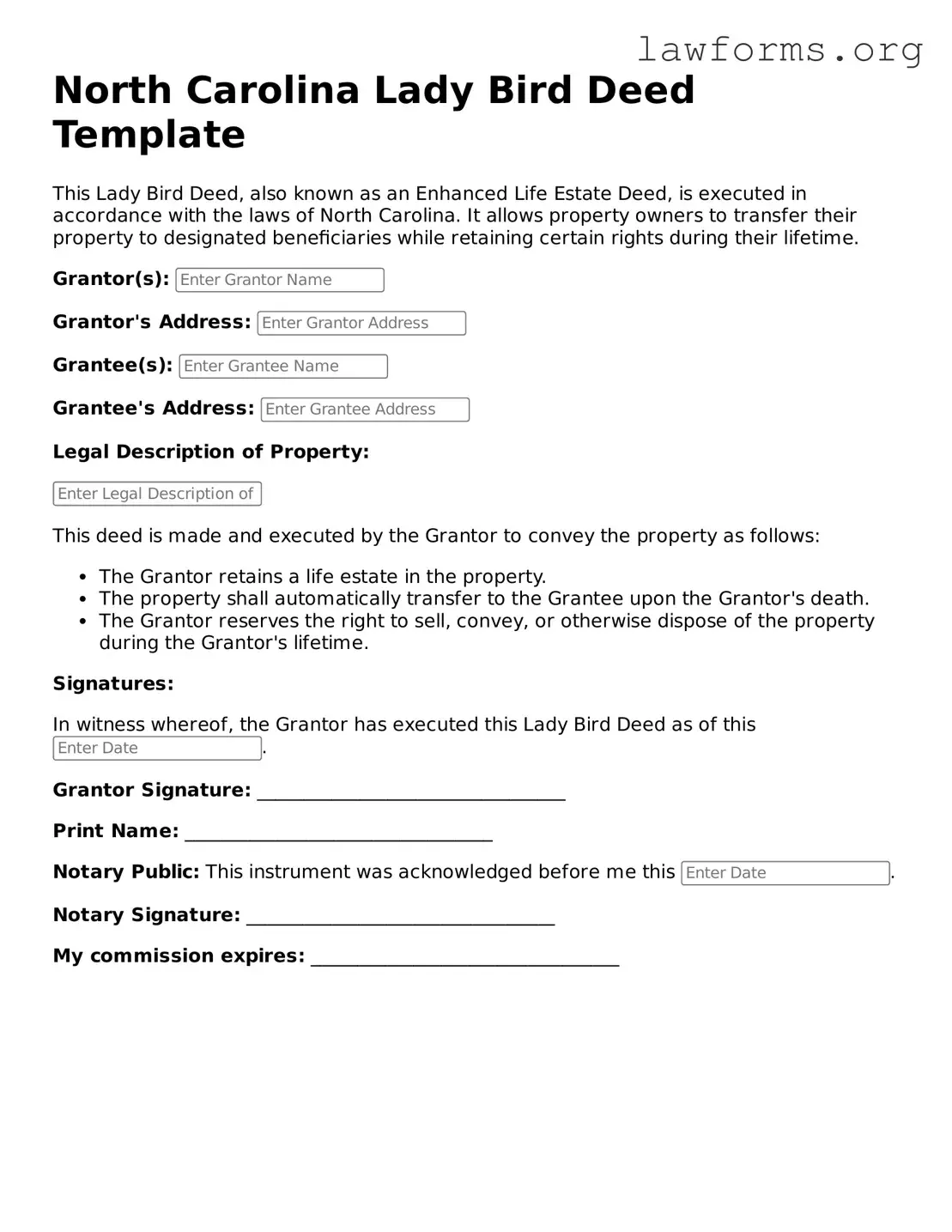

Preview - North Carolina Lady Bird Deed Form

North Carolina Lady Bird Deed Template

This Lady Bird Deed, also known as an Enhanced Life Estate Deed, is executed in accordance with the laws of North Carolina. It allows property owners to transfer their property to designated beneficiaries while retaining certain rights during their lifetime.

Grantor(s):

Grantor's Address:

Grantee(s):

Grantee's Address:

Legal Description of Property:

This deed is made and executed by the Grantor to convey the property as follows:

- The Grantor retains a life estate in the property.

- The property shall automatically transfer to the Grantee upon the Grantor's death.

- The Grantor reserves the right to sell, convey, or otherwise dispose of the property during the Grantor's lifetime.

Signatures:

In witness whereof, the Grantor has executed this Lady Bird Deed as of this .

Grantor Signature: _________________________________

Print Name: _________________________________

Notary Public: This instrument was acknowledged before me this .

Notary Signature: _________________________________

My commission expires: _________________________________

Key takeaways

When considering the North Carolina Lady Bird Deed form, keep these key takeaways in mind:

- Purpose: This deed allows property owners to transfer real estate to beneficiaries while retaining the right to live in and control the property during their lifetime.

- Avoids Probate: Properties transferred via a Lady Bird Deed bypass probate, simplifying the process for heirs.

- Retained Rights: The original owner can sell, mortgage, or change the property without needing the beneficiaries' consent.

- Tax Implications: The property receives a step-up in basis at the owner's death, which can minimize capital gains taxes for heirs.

- Revocable: The deed can be revoked or modified at any time before the owner’s death, providing flexibility.

- Legal Requirements: Ensure the deed is properly executed, notarized, and recorded with the local register of deeds to be effective.

Similar forms

-

Transfer on Death Deed (TODD): Similar to a Lady Bird Deed, a Transfer on Death Deed allows property owners to designate beneficiaries who will receive the property upon their death. This document avoids probate, ensuring a smoother transition of ownership.

-

Life Estate Deed: Like the Lady Bird Deed, a Life Estate Deed grants the property owner the right to live in and use the property during their lifetime. After their passing, the property automatically transfers to the designated beneficiaries, simplifying the inheritance process.

-

Revocable Living Trust: A Revocable Living Trust allows individuals to place their assets, including real estate, into a trust during their lifetime. Similar to a Lady Bird Deed, this document enables the property to bypass probate and ensures that assets are distributed according to the grantor's wishes.

-

Will: A Last Will and Testament outlines how a person's assets should be distributed after their death. While a Lady Bird Deed transfers property directly to beneficiaries, a Will requires the property to go through probate, making it a less direct method of transferring ownership.

-

California Judicial Council Form: This standardized document serves to streamline legal processes in California courts. It ensures that all necessary details are included for court filings, and can be attached to various judicial council forms or other court papers. For more details, visit californiadocsonline.com/california-judicial-council-form.

-

Joint Tenancy with Right of Survivorship: This arrangement allows two or more individuals to hold property together. Upon the death of one owner, their share automatically passes to the surviving owner(s). Like the Lady Bird Deed, this method avoids probate, facilitating a seamless transfer of ownership.