Attorney-Approved Last Will and Testament Template for the State of North Carolina

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Governing Laws | The North Carolina Last Will and Testament is governed by the North Carolina General Statutes, specifically Chapter 31. |

| Age Requirement | In North Carolina, individuals must be at least 18 years old to create a valid will. |

| Witness Requirement | A will must be signed by at least two witnesses who are present at the same time when the testator signs the document. |

| Revocation | A will can be revoked by the testator at any time, typically through a subsequent will or by destroying the original document. |

| Self-Proving Wills | North Carolina allows for self-proving wills, which can simplify the probate process by including a notarized affidavit from the witnesses. |

| Holographic Wills | Holographic wills, which are handwritten and signed by the testator, are recognized in North Carolina if they meet certain criteria. |

Dos and Don'ts

When filling out the North Carolina Last Will and Testament form, it is crucial to approach the process with care and attention. Here is a list of things you should and shouldn't do:

- Do ensure that you are of sound mind when creating your will.

- Do clearly identify yourself and your beneficiaries in the document.

- Do specify how you want your assets distributed.

- Do appoint an executor to manage your estate after your passing.

- Do sign the will in the presence of at least two witnesses.

- Don't use vague language that could lead to confusion.

- Don't forget to date the will.

- Don't leave out important details about debts or liabilities.

- Don't attempt to make changes without proper procedures, such as a codicil.

- Don't neglect to keep your will in a safe but accessible location.

Create Popular Last Will and Testament Forms for Different States

California Last Will and Testament - Can directly influence the financial future of your beneficiaries.

In order to facilitate a seamless transfer of ownership, it is important to utilize a properly filled out Washington Mobile Home Bill of Sale form, which can be found at Forms Washington. This document not only protects the interests of both the buyer and the seller but also outlines crucial information needed for the sale.

Last Will and Testament Sample - Can be a pivotal step in reducing estate administration complications.

Common mistakes

-

Not Naming an Executor: Failing to designate an executor can lead to confusion and delays in the probate process.

-

Inadequate Witness Signatures: North Carolina requires at least two witnesses. Omitting their signatures can invalidate the will.

-

Not Dating the Will: A will should always include the date it was signed. Without a date, it may be unclear which version of the will is the most current.

-

Using Ambiguous Language: Vague terms can lead to misunderstandings about the testator's intentions. Clear and specific language is essential.

-

Failing to Update the Will: Major life changes, such as marriage, divorce, or the birth of a child, should prompt a review and possible update of the will.

-

Not Including a Residual Clause: A residual clause ensures that any assets not specifically mentioned in the will are distributed according to the testator's wishes.

-

Overlooking Digital Assets: Many people forget to include online accounts and digital assets, which can complicate estate management.

-

Improperly Executing the Will: The will must be signed in front of witnesses who are present at the same time. Signing separately can lead to issues.

-

Neglecting to Inform Beneficiaries: Beneficiaries should be aware of their inclusion in the will. This can prevent disputes and confusion later on.

-

Not Storing the Will Safely: A will should be kept in a secure location, such as a safe deposit box or with a trusted attorney, to ensure it can be found when needed.

Documents used along the form

When preparing a Last Will and Testament in North Carolina, it is essential to consider several additional forms and documents that can complement your estate planning. Each of these documents serves a specific purpose and can help ensure that your wishes are honored after your passing.

- Living Will: This document outlines your preferences regarding medical treatment and life-sustaining measures in case you become incapacitated and cannot communicate your wishes.

- Durable Power of Attorney: This form allows you to designate someone to make financial and legal decisions on your behalf if you become unable to do so yourself.

- Motorcycle Bill of Sale: Essential for proving ownership in motorcycle transactions, the Minnesota Motorcycle Bill of Sale form protects the interests of both buyer and seller, ensuring all details are formally recorded. For more information, visit Formaid Org.

- Health Care Power of Attorney: Similar to the Durable Power of Attorney, this document specifically grants authority to someone to make health care decisions for you if you are unable to express your wishes.

- Revocable Living Trust: This trust allows you to manage your assets during your lifetime and facilitates the transfer of those assets upon your death, often avoiding probate.

- Beneficiary Designations: These are forms used to specify who will receive certain assets, such as life insurance policies and retirement accounts, directly upon your death.

- Transfer on Death Deed: This deed allows you to transfer real estate to a designated beneficiary upon your death without going through probate.

- Pet Trust: This document ensures that your pets are cared for according to your wishes after your passing, providing for their needs and appointing a caretaker.

- Letter of Instruction: While not a legally binding document, this letter provides guidance to your loved ones about your wishes, funeral arrangements, and other personal matters.

Each of these documents plays a vital role in comprehensive estate planning. By considering them alongside your Last Will and Testament, you can create a more robust plan that addresses various aspects of your life and ensures your wishes are respected. It is advisable to consult with a qualified professional to tailor these documents to your specific needs.

Misconceptions

When it comes to creating a Last Will and Testament in North Carolina, several misconceptions can lead to confusion. Here are four common misunderstandings:

- A handwritten will is not valid. Many believe that a will must be typed and formally printed. However, North Carolina does recognize handwritten wills, also known as holographic wills, as long as they are signed by the testator and reflect their intentions.

- All wills must be notarized. While notarization can add an extra layer of validity, it is not a requirement for a will to be valid in North Carolina. A will can be valid without a notary as long as it meets the state's basic requirements.

- You cannot change your will once it is made. Some people think that once a will is created, it cannot be altered. In reality, you can amend your will or create a new one at any time, as long as you follow the legal requirements for making changes.

- Only wealthy individuals need a will. This is a common myth. Everyone, regardless of their financial situation, can benefit from having a will. It ensures that your wishes are respected and your assets are distributed according to your desires.

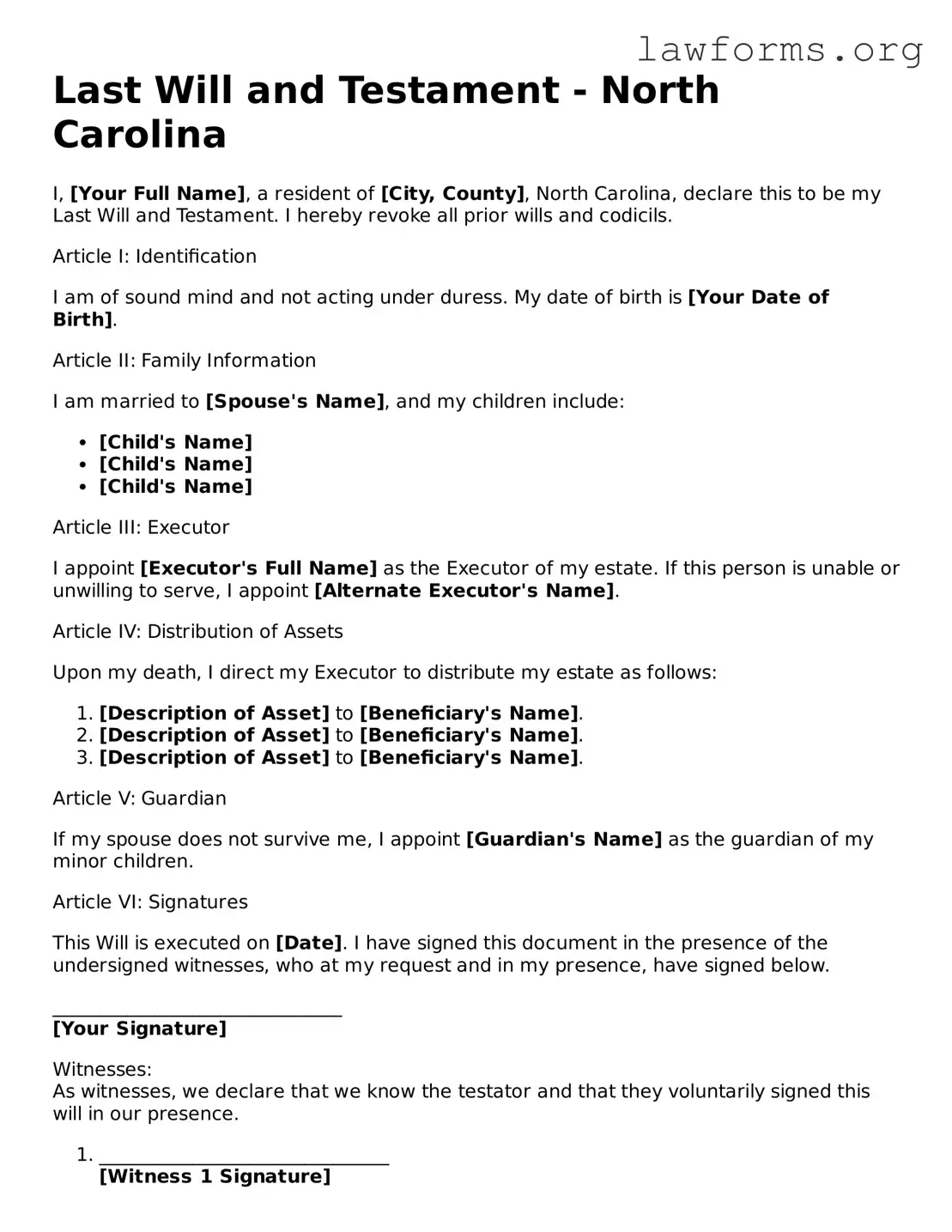

Preview - North Carolina Last Will and Testament Form

Last Will and Testament - North Carolina

I, [Your Full Name], a resident of [City, County], North Carolina, declare this to be my Last Will and Testament. I hereby revoke all prior wills and codicils.

Article I: Identification

I am of sound mind and not acting under duress. My date of birth is [Your Date of Birth].

Article II: Family Information

I am married to [Spouse's Name], and my children include:

- [Child's Name]

- [Child's Name]

- [Child's Name]

Article III: Executor

I appoint [Executor's Full Name] as the Executor of my estate. If this person is unable or unwilling to serve, I appoint [Alternate Executor's Name].

Article IV: Distribution of Assets

Upon my death, I direct my Executor to distribute my estate as follows:

- [Description of Asset] to [Beneficiary's Name].

- [Description of Asset] to [Beneficiary's Name].

- [Description of Asset] to [Beneficiary's Name].

Article V: Guardian

If my spouse does not survive me, I appoint [Guardian's Name] as the guardian of my minor children.

Article VI: Signatures

This Will is executed on [Date]. I have signed this document in the presence of the undersigned witnesses, who at my request and in my presence, have signed below.

_______________________________

[Your Signature]

Witnesses:

As witnesses, we declare that we know the testator and that they voluntarily signed this will in our presence.

- _______________________________

[Witness 1 Signature] - _______________________________

[Witness 2 Signature]

Article VII: Notarization (if desired)

This will may be acknowledged before a notary public:

_______________________________

[Notary Public Signature]

**Note:** This template is provided for informational purposes only and does not constitute legal advice. It is advisable to consult with a qualified attorney to ensure compliance with North Carolina’s laws regarding wills.

Key takeaways

When preparing a Last Will and Testament in North Carolina, it is important to consider the following key takeaways:

- Ensure that you are at least 18 years old and of sound mind when creating your will.

- Clearly identify yourself and your assets in the will to avoid confusion later.

- Designate an executor who will be responsible for carrying out the terms of your will.

- Include specific bequests to individuals or organizations, if desired, to outline how your assets should be distributed.

- Sign the will in the presence of at least two witnesses who are not beneficiaries to ensure its validity.

- Store the completed will in a safe place and inform your executor of its location.

Following these steps can help ensure that your wishes are honored after your passing.

Similar forms

- Living Will: This document outlines your wishes regarding medical treatment in case you become unable to communicate. Like a Last Will and Testament, it ensures your preferences are respected, but it focuses on healthcare decisions rather than asset distribution.

- Durable Power of Attorney: This form allows you to appoint someone to manage your financial affairs if you are unable to do so. Similar to a Last Will, it designates authority but applies to your finances during your lifetime instead of after your death.

- Healthcare Power of Attorney: This document lets you choose a person to make healthcare decisions on your behalf if you cannot. It shares similarities with a Living Will, as both address medical decisions, but the Healthcare Power of Attorney gives someone else the authority to act for you.

- Mobile Home Bill of Sale Form: When transferring ownership of a mobile home, it's essential to use the detailed Mobile Home Bill of Sale documentation to ensure a proper and legal transfer of rights.

- Trust: A trust allows you to manage your assets during your lifetime and after your death. Like a Last Will, it helps distribute your estate, but a trust can take effect immediately and avoid probate, providing more privacy and control.

- Codicil: This is an amendment to an existing will. It allows you to make changes without creating a new Last Will and Testament. Both documents serve the purpose of outlining your wishes, but a codicil is specifically used to modify what’s already in place.

- Letter of Instruction: This informal document provides guidance to your loved ones about your wishes, funeral arrangements, and other personal matters. While a Last Will legally dictates asset distribution, a letter of instruction offers additional context and personal touch.

- Affidavit of Heirship: This document is often used to establish the heirs of a deceased person when there is no will. Like a Last Will, it helps clarify who inherits assets, but it is typically used in situations where a will is absent.