Attorney-Approved Operating Agreement Template for the State of North Carolina

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The North Carolina Operating Agreement form outlines the management structure and operational guidelines for a limited liability company (LLC). It serves as a foundational document for the business. |

| Governing Law | This form is governed by the North Carolina General Statutes, specifically Chapter 57D, which covers the formation and operation of LLCs in the state. |

| Members' Rights | The agreement defines the rights and responsibilities of the members, ensuring clarity in decision-making and profit-sharing among owners. |

| Flexibility | North Carolina allows LLCs to customize their Operating Agreements. Members can tailor provisions to fit their specific business needs and goals. |

| Importance | Having a well-drafted Operating Agreement can help prevent disputes among members and provides a clear framework for resolving issues that may arise. |

Dos and Don'ts

When filling out the North Carolina Operating Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do read the entire form carefully before starting to fill it out.

- Don't leave any required fields blank, as this may delay processing.

- Do provide clear and accurate information about all members of the LLC.

- Don't use legal jargon or complex language that may confuse readers.

- Do review the completed form for any errors or omissions before submission.

Create Popular Operating Agreement Forms for Different States

Is an Operating Agreement Required for an Llc - This agreement can specify limitations on members' authority to bind the LLC.

How Much to Start an Llc in Texas - The form helps ensure compliance with state regulations.

Ohio Llc Operating Agreement Pdf - The agreement may include procedures for adding or removing members.

When engaging in the sale or purchase of significant assets in Minnesota, it's essential to utilize a Minnesota Bill of Sale form to document the transaction effectively. This legal document not only ensures that the transfer of ownership is clear but also protects both the buyer and seller by outlining the terms of the sale. For those seeking a reliable template to facilitate this process, they can refer to Formaid Org, which provides helpful resources to simplify the creation of this important document.

New Jersey Operating Agreement - The Operating Agreement can specify which members have authority to bind the LLC legally.

Common mistakes

-

Not Including All Members: One common mistake is failing to list all members of the LLC. Every member should be clearly identified to avoid confusion later on.

-

Inaccurate Information: Providing incorrect details about members, such as names or addresses, can lead to legal issues. Double-check all entries for accuracy.

-

Missing Signatures: All members must sign the agreement. Forgetting to include a signature can render the document invalid.

-

Omitting Important Provisions: Some people overlook key sections, like profit distribution or decision-making processes. These details are crucial for smooth operations.

-

Using Vague Language: Ambiguous terms can lead to misunderstandings. Be specific in your language to ensure everyone is on the same page.

-

Not Updating the Agreement: Failing to revise the operating agreement after changes in membership or business structure can cause complications. Regular updates are necessary.

-

Ignoring State Requirements: Each state has specific rules regarding operating agreements. Not adhering to North Carolina’s requirements can lead to compliance issues.

Documents used along the form

When forming a limited liability company (LLC) in North Carolina, several documents complement the Operating Agreement. Each of these forms plays a vital role in establishing and maintaining the business structure. Below are some commonly used documents that may accompany the North Carolina Operating Agreement.

- Articles of Organization: This document officially registers the LLC with the state. It includes essential information such as the company name, address, and the names of the members.

- Bylaws: While not required for LLCs, bylaws outline the internal rules and procedures for the company. They can cover topics such as meetings, voting rights, and member responsibilities.

- Membership Certificates: These certificates serve as proof of ownership for members. They can be issued to document each member's investment in the LLC.

- Operating Procedures: This document details the day-to-day operations of the LLC. It can include guidelines for decision-making, financial management, and member roles.

- Durable Power of Attorney: This crucial document allows individuals to appoint someone to make important decisions on their behalf during incapacity, ensuring peace of mind. You can obtain a template from Forms Washington.

- Tax Forms: Depending on the LLC's structure, various tax forms may be required. These could include forms for federal and state taxes, ensuring compliance with tax obligations.

Having these documents in order can help ensure that your LLC operates smoothly and remains compliant with state regulations. Each form serves a specific purpose, contributing to the overall structure and governance of the business.

Misconceptions

When it comes to the North Carolina Operating Agreement form, several misconceptions can lead to confusion for business owners and members of limited liability companies (LLCs). Understanding these myths is crucial for ensuring compliance and effective management of the LLC. Here are six common misconceptions:

- Operating Agreements are optional. Many believe that an operating agreement is not necessary for LLCs in North Carolina. However, while the state does not require one, having an operating agreement is highly recommended. It provides clarity on management structure and member responsibilities, which can help prevent disputes.

- All members must sign the Operating Agreement. Some think that every member of the LLC must sign the operating agreement for it to be valid. In reality, the agreement is enforceable even if not all members sign, as long as it is agreed upon by the majority or as specified in the document.

- Operating Agreements are set in stone. Another misconception is that once an operating agreement is created, it cannot be changed. In fact, operating agreements can be amended as needed. Members can agree to modifications, allowing the document to evolve with the business.

- Operating Agreements only cover financial matters. Some believe that these agreements only address financial aspects of the LLC. While they do include financial arrangements, they also cover management structure, member roles, and procedures for decision-making, among other important topics.

- All LLCs in North Carolina need the same Operating Agreement. It is a common misunderstanding that there is a one-size-fits-all template for operating agreements. Each LLC is unique, and the operating agreement should reflect the specific needs, goals, and structure of the business.

- Filing the Operating Agreement with the state is required. Many assume that they must submit the operating agreement to the North Carolina Secretary of State. However, this is not necessary. The operating agreement is an internal document and should be kept with the company’s records.

By addressing these misconceptions, LLC members can better understand the importance of the North Carolina Operating Agreement and ensure their business operates smoothly and effectively.

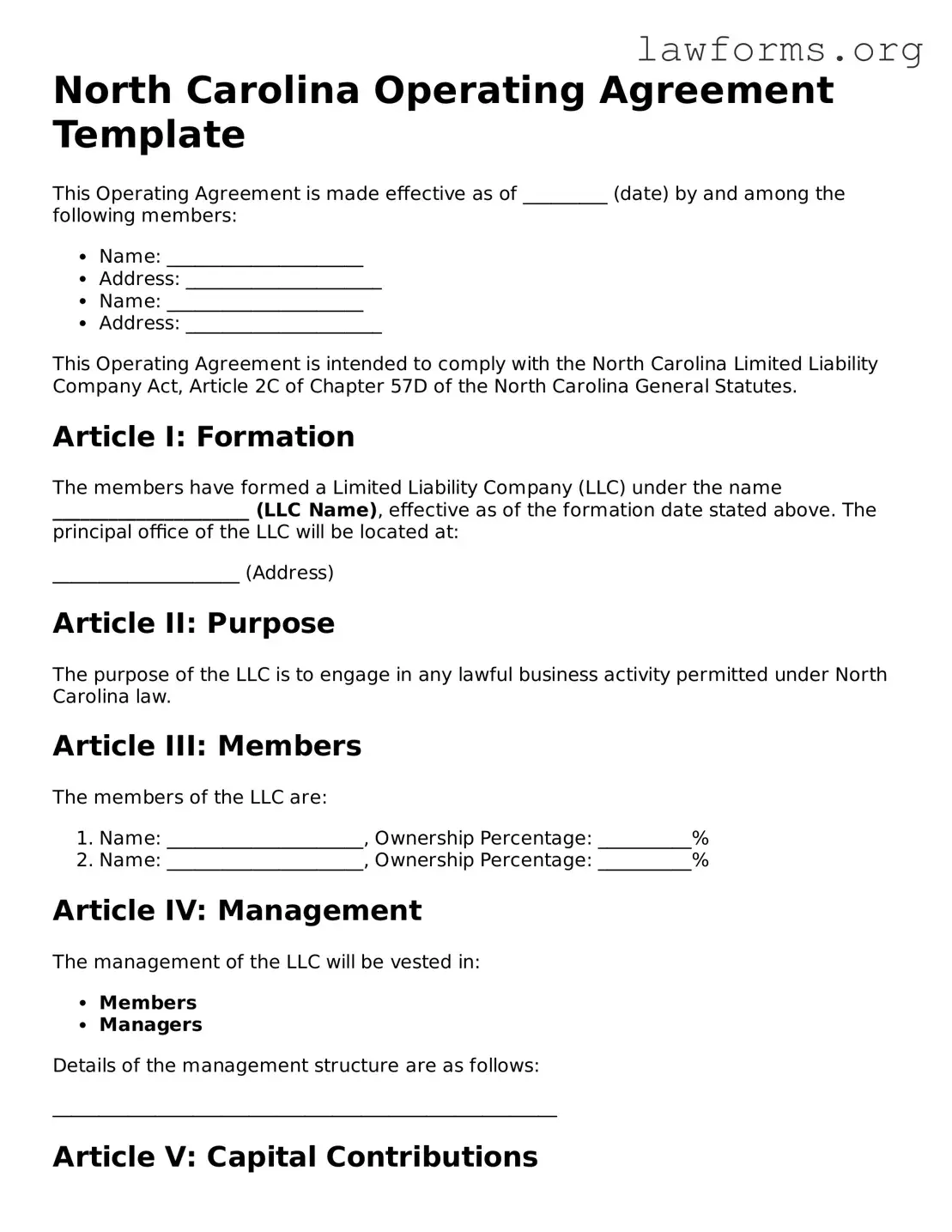

Preview - North Carolina Operating Agreement Form

North Carolina Operating Agreement Template

This Operating Agreement is made effective as of _________ (date) by and among the following members:

- Name: _____________________

- Address: _____________________

- Name: _____________________

- Address: _____________________

This Operating Agreement is intended to comply with the North Carolina Limited Liability Company Act, Article 2C of Chapter 57D of the North Carolina General Statutes.

Article I: Formation

The members have formed a Limited Liability Company (LLC) under the name _____________________ (LLC Name), effective as of the formation date stated above. The principal office of the LLC will be located at:

____________________ (Address)

Article II: Purpose

The purpose of the LLC is to engage in any lawful business activity permitted under North Carolina law.

Article III: Members

The members of the LLC are:

- Name: _____________________, Ownership Percentage: __________%

- Name: _____________________, Ownership Percentage: __________%

Article IV: Management

The management of the LLC will be vested in:

- Members

- Managers

Details of the management structure are as follows:

______________________________________________________

Article V: Capital Contributions

The initial capital contributions from each member will be as follows:

- Name: _____________________, Contribution Amount: $_________

- Name: _____________________, Contribution Amount: $_________

Article VI: Distributions

Distributions of profits and losses will be allocated to members based on their respective ownership percentages. The distribution schedule will be determined as follows:

______________________________________________________

Article VII: Indemnification

The LLC shall indemnify its members to the fullest extent permitted by North Carolina law against any losses or expenses incurred in connection with the LLC.

Article VIII: Amendment

This Operating Agreement may be amended only by a written agreement signed by all members.

Article IX: Governing Law

This agreement will be governed by the laws of the State of North Carolina.

IN WITNESS WHEREOF

The members have executed this Operating Agreement as of the date first above written.

Signature: _____________________, Name: ____________________, Date: ____________

Signature: _____________________, Name: ____________________, Date: ____________

Key takeaways

When filling out and using the North Carolina Operating Agreement form, keep these key takeaways in mind:

- Understand the Purpose: The Operating Agreement outlines the management structure and operational procedures of your business. It is crucial for establishing clear expectations among members.

- Customize the Agreement: Each business is unique. Tailor the agreement to reflect your specific needs, including member roles, profit distribution, and decision-making processes.

- Include Essential Details: Ensure the agreement covers important aspects such as the business name, address, member contributions, and procedures for adding or removing members.

- Legal Compliance: While North Carolina does not require an Operating Agreement, having one can help protect your limited liability status and clarify internal operations.

- Review Regularly: As your business evolves, so should your Operating Agreement. Regularly review and update the document to ensure it remains relevant and effective.

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the internal rules governing a corporation. They define the roles of officers, the process for meetings, and voting procedures, ensuring that all members understand their rights and responsibilities.

- Partnership Agreement: This document serves a similar purpose for partnerships, detailing the terms of the partnership, including profit sharing, responsibilities, and decision-making processes. It helps prevent misunderstandings among partners.

- Shareholder Agreement: Like an Operating Agreement for LLCs, a shareholder agreement governs the relationship between shareholders in a corporation. It addresses issues such as share transfers, voting rights, and management structure, promoting clarity among shareholders.

- Joint Venture Agreement: This agreement outlines the terms of collaboration between two or more parties for a specific project. It defines each party's contributions, responsibilities, and profit-sharing, similar to how an Operating Agreement delineates member roles in an LLC.

- Firearm Bill of Sale Form: For a secure transfer of firearm ownership, you can fill out the essential firearm bill of sale documentation to ensure compliance with legal requirements.

- Membership Agreement: Often used in limited liability companies, this document details the rights and obligations of members. It shares similarities with an Operating Agreement by specifying how profits and losses are distributed among members.

- Franchise Agreement: This document governs the relationship between a franchisor and a franchisee. It sets forth operational procedures, fees, and obligations, much like how an Operating Agreement establishes the framework for running an LLC.

- Nonprofit Bylaws: For nonprofit organizations, bylaws serve a similar function to an Operating Agreement. They outline governance structures, roles of board members, and operational procedures, ensuring that everyone involved understands their duties.

- Employment Agreement: While primarily focused on the employer-employee relationship, this document can include terms about company policies and procedures. Like an Operating Agreement, it sets clear expectations for all parties involved.