Attorney-Approved Power of Attorney Template for the State of North Carolina

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) in North Carolina allows one person to authorize another to act on their behalf in legal and financial matters. |

| Governing Law | The North Carolina General Statutes, specifically Chapter 32A, govern the creation and use of Power of Attorney forms. |

| Types of POA | North Carolina recognizes several types of POA, including durable, non-durable, and springing powers of attorney, each serving different purposes. |

| Signing Requirements | The principal must sign the POA in the presence of a notary public. Witnesses are also required for certain types of POAs. |

| Revocation | A Power of Attorney can be revoked at any time by the principal, provided they are mentally competent to do so. |

Dos and Don'ts

When filling out the North Carolina Power of Attorney form, it's important to approach the task with care. Here are some key things to keep in mind:

- Do: Clearly identify the principal and the agent. Make sure their names and addresses are accurate.

- Do: Specify the powers granted to the agent. Be clear about what decisions the agent can make on your behalf.

- Do: Sign the document in front of a notary public. This adds an important layer of validity to your form.

- Do: Keep a copy of the completed form for your records. It's essential to have access to it if needed in the future.

- Don't: Rush through the form. Take your time to ensure all information is correct and complete.

- Don't: Leave any sections blank. Incomplete forms can lead to confusion or disputes later.

- Don't: Use vague language when describing the powers granted. Specificity helps avoid misunderstandings.

- Don't: Forget to inform your agent about their responsibilities. Open communication is key to a successful arrangement.

Create Popular Power of Attorney Forms for Different States

Printable Power of Attorney Form Texas - If the principal becomes unable to make decisions, the agent steps in seamlessly.

California Poa - Legal advice can help clarify any questions regarding your Power of Attorney.

To create a smooth transaction, it is essential to utilize a Minnesota Bill of Sale form, which can be accessed through Formaid Org, ensuring all necessary details are documented and agreed upon by both parties involved in the sale.

New York State Power of Attorney Form 2022 Pdf - This document does not allow the agent to change the principal's will.

General Power of Attorney Form Florida - This can help avoid potential conflicts among family members.

Common mistakes

-

Not Specifying the Powers Granted: Many individuals fail to clearly outline the specific powers they wish to grant to their agent. Without detailed instructions, the agent may not be able to act effectively on behalf of the principal.

-

Omitting the Principal's Signature: It is crucial for the principal to sign the Power of Attorney form. Some people forget this step, rendering the document invalid. The signature should be clear and in the appropriate space designated for it.

-

Neglecting Witnesses or Notarization: In North Carolina, the Power of Attorney must be either witnessed by two individuals or notarized. Failing to include these requirements can lead to challenges in the document's legitimacy.

-

Using Outdated Forms: Some individuals may use outdated versions of the Power of Attorney form. Laws and requirements can change, so it is important to ensure that the most current version is being used to avoid complications.

Documents used along the form

When establishing a Power of Attorney in North Carolina, it is often beneficial to consider additional forms and documents that can support your legal and financial needs. Below is a list of commonly used documents that may accompany the Power of Attorney form.

- Advance Directive: This document outlines your wishes regarding medical treatment and end-of-life care. It ensures that your healthcare preferences are known and respected, even if you cannot communicate them yourself.

- Living Will: Similar to an Advance Directive, a Living Will specifically addresses your desires regarding life-sustaining treatments in situations where you are terminally ill or incapacitated.

- Health Care Power of Attorney: This form designates someone to make medical decisions on your behalf if you are unable to do so. It is focused solely on health care matters, distinct from financial decisions covered by a general Power of Attorney.

- Durable Power of Attorney: This is a specific type of Power of Attorney that remains effective even if you become incapacitated. It is crucial for long-term planning and ensures that your financial affairs can be managed without interruption.

- California LLC 12 Form: An essential filing for limited liability companies in California, this document must be submitted within 90 days of registration and every two years thereafter. For detailed information, visit https://californiadocsonline.com/california-llc-12-form.

- Financial Power of Attorney: This document grants authority to someone to handle your financial matters, such as managing bank accounts, paying bills, and making investments. It can be limited or broad in scope, depending on your needs.

- Will: A will outlines how your assets will be distributed after your death. It can also appoint guardians for minor children and is an essential part of estate planning.

Each of these documents serves a unique purpose and can complement the Power of Attorney, providing a comprehensive approach to managing your legal and financial affairs. It is advisable to consult with a legal professional to ensure that all documents align with your specific needs and state laws.

Misconceptions

Many people have misconceptions about the North Carolina Power of Attorney form. Understanding these can help clarify its purpose and functionality. Here are five common misconceptions:

- Misconception 1: A Power of Attorney is only for financial matters.

- Misconception 2: A Power of Attorney is permanent and cannot be revoked.

- Misconception 3: The agent must be a lawyer or financial expert.

- Misconception 4: A Power of Attorney automatically goes into effect when signed.

- Misconception 5: Once a Power of Attorney is created, it cannot be changed.

This is not true. While many people use a Power of Attorney for financial decisions, it can also be used for health care decisions and other personal matters. It grants authority for various areas depending on how it is drafted.

This is incorrect. A Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. This flexibility allows individuals to change their minds or update their wishes as needed.

This is a common misunderstanding. The agent can be anyone the principal trusts, such as a family member or friend. It is essential that the agent understands the responsibilities involved.

This is not always the case. In North Carolina, a Power of Attorney can be set up to be effective immediately or to spring into action under certain conditions, such as the principal becoming incapacitated.

This is misleading. The principal can modify or create a new Power of Attorney at any time, as long as they are of sound mind. This allows for adjustments as life circumstances change.

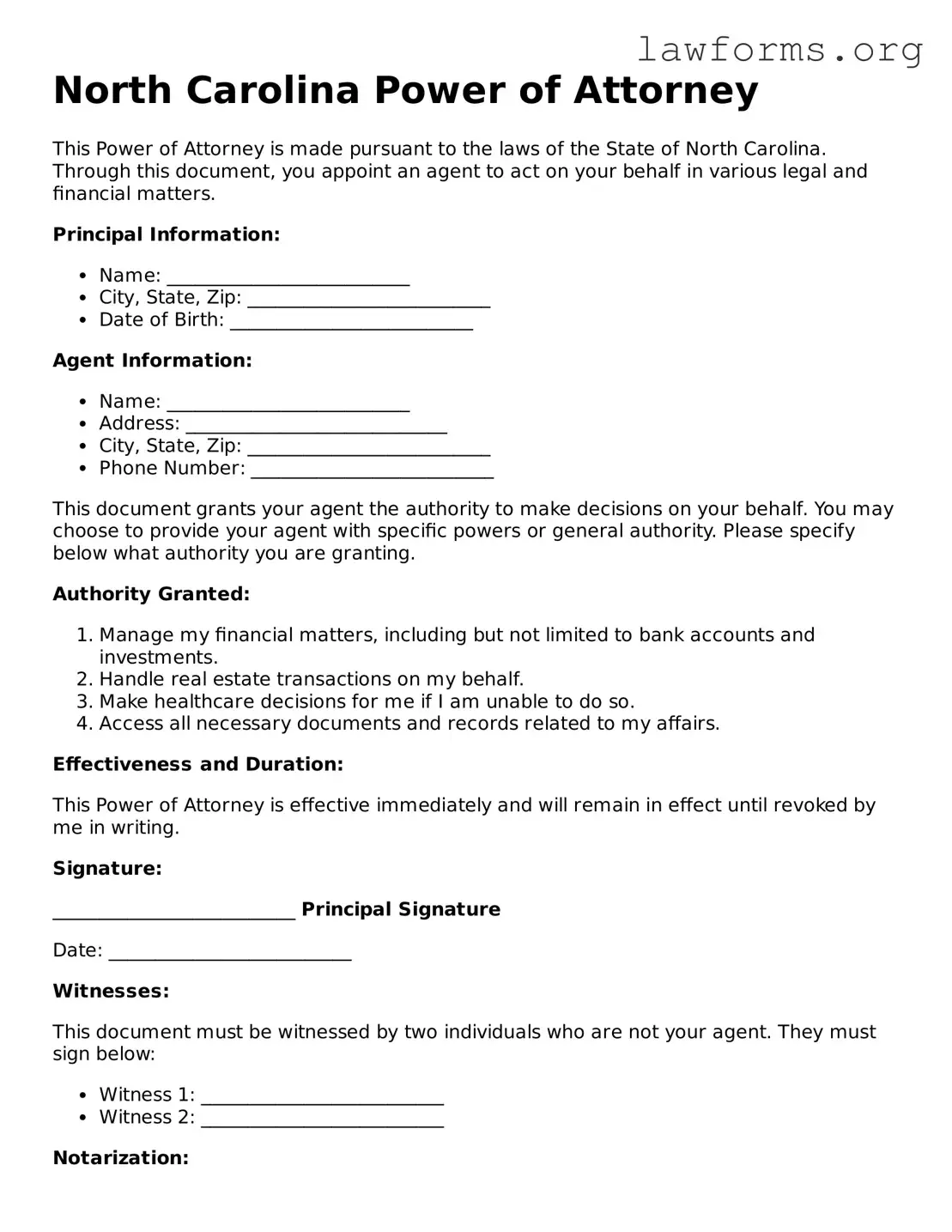

Preview - North Carolina Power of Attorney Form

North Carolina Power of Attorney

This Power of Attorney is made pursuant to the laws of the State of North Carolina. Through this document, you appoint an agent to act on your behalf in various legal and financial matters.

Principal Information:

- Name: __________________________

- City, State, Zip: __________________________

- Date of Birth: __________________________

Agent Information:

- Name: __________________________

- Address: ____________________________

- City, State, Zip: __________________________

- Phone Number: __________________________

This document grants your agent the authority to make decisions on your behalf. You may choose to provide your agent with specific powers or general authority. Please specify below what authority you are granting.

Authority Granted:

- Manage my financial matters, including but not limited to bank accounts and investments.

- Handle real estate transactions on my behalf.

- Make healthcare decisions for me if I am unable to do so.

- Access all necessary documents and records related to my affairs.

Effectiveness and Duration:

This Power of Attorney is effective immediately and will remain in effect until revoked by me in writing.

Signature:

__________________________ Principal Signature

Date: __________________________

Witnesses:

This document must be witnessed by two individuals who are not your agent. They must sign below:

- Witness 1: __________________________

- Witness 2: __________________________

Notarization:

This document should be notarized for added legal standing.

Notary Public: __________________________

Date: __________________________

Key takeaways

- Understand the Purpose: A Power of Attorney (POA) allows you to appoint someone to make decisions on your behalf if you are unable to do so.

- Choose Your Agent Wisely: Select a trustworthy person as your agent, as they will have significant authority over your financial and legal matters.

- Be Specific: Clearly outline the powers you are granting. This can include managing finances, making healthcare decisions, or handling real estate transactions.

- Consider Durability: A durable POA remains effective even if you become incapacitated. Make sure to specify this if it is your intention.

- Sign and Date: You must sign and date the form in front of a notary public. This step is crucial for the document to be legally valid.

- Communicate with Your Agent: Discuss your wishes and expectations with your agent. This ensures they understand your preferences and can act accordingly.

- Review Regularly: Periodically review your POA to ensure it still reflects your wishes, especially after major life changes.

Similar forms

- Living Will: This document outlines your preferences for medical treatment in situations where you cannot communicate your wishes. Like a Power of Attorney, it designates someone to make decisions on your behalf, but specifically for healthcare matters.

- Advance Healthcare Directive: Similar to a living will, this document allows you to specify your healthcare preferences and appoint an agent to make decisions if you are incapacitated. Both empower individuals to control their medical care.

- Healthcare Proxy: This document appoints someone to make healthcare decisions for you when you cannot. While a Power of Attorney can cover a broad range of decisions, a healthcare proxy focuses solely on medical matters.

- Durable Power of Attorney: This is a specific type of Power of Attorney that remains in effect even if you become incapacitated. It is similar in function but emphasizes durability in decision-making authority.

- Durable Power of Attorney: This legal document allows you to appoint someone to make decisions on your behalf if you become unable to do so. To learn more about creating this essential form, visit Forms Washington.

- Financial Power of Attorney: This document specifically allows someone to manage your financial affairs, such as paying bills or handling investments. It shares the same principle of granting authority but is focused solely on financial matters.

- Trust Agreement: A trust allows you to place your assets under the control of a trustee for the benefit of your beneficiaries. Like a Power of Attorney, it involves delegating authority but usually focuses on asset management and distribution.

- Guardianship Document: This legal arrangement appoints someone to care for an individual who cannot care for themselves. While a Power of Attorney grants authority to make decisions, guardianship involves a more comprehensive responsibility for personal care.

- Property Management Agreement: This document allows someone to manage real estate or other property on your behalf. It is similar to a Power of Attorney but is specifically tailored for property-related decisions.