Attorney-Approved Promissory Note Template for the State of North Carolina

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The North Carolina Promissory Note is governed by the North Carolina General Statutes, specifically Chapter 25, which pertains to the Uniform Commercial Code. |

| Parties Involved | The note typically involves two parties: the borrower (maker) who promises to pay and the lender (payee) who receives the payment. |

| Interest Rate | Interest rates can be specified in the note, and they must comply with North Carolina's usury laws to avoid excessive charges. |

| Payment Terms | The payment terms, including the due date and installment amounts, should be clearly outlined to avoid confusion. |

| Signatures | Both parties must sign the promissory note for it to be legally binding, indicating their agreement to the terms. |

| Enforceability | If properly executed, a promissory note is enforceable in a court of law, allowing the lender to seek repayment through legal means if necessary. |

| Default Consequences | In the event of default, the lender may have the right to demand immediate payment or pursue other remedies as outlined in the note. |

| Modification | Any changes to the terms of the promissory note should be made in writing and signed by both parties to ensure validity. |

Dos and Don'ts

When filling out the North Carolina Promissory Note form, it's essential to approach the task with care. Below are five things to keep in mind, including what to do and what to avoid.

- Do ensure that all information is accurate and complete. Double-check names, addresses, and amounts.

- Do read the entire form carefully before signing. Understanding the terms is crucial.

- Do use clear and legible handwriting if filling out a paper form. This helps prevent misunderstandings.

- Don't leave any blank spaces. If a section does not apply, write "N/A" to indicate it was considered.

- Don't rush through the process. Take your time to ensure everything is filled out correctly.

By following these guidelines, you can help ensure that your Promissory Note is properly executed and legally binding.

Create Popular Promissory Note Forms for Different States

Loan Note Template - Some Promissory Notes include clauses regarding the choice of law governing the agreement.

In Illinois, completing the Motor Vehicle Bill of Sale form is crucial for ensuring that both parties are protected during the sale process, as it serves as proof of the transaction. This form not only facilitates a smooth exchange but also includes important information such as the vehicle details and seller and buyer identities. For convenience, you can access the necessary documentation at https://formsillinois.com/ to help you through your vehicle sale or purchase.

Texas Promissory Note - They can vary widely in complexity from simple one-page documents to more intricate formats.

Promissory Note Notarized - This document details the terms of a loan agreement between a borrower and a lender.

Common mistakes

-

Incorrect Borrower Information: Many people forget to include the full legal name of the borrower. Always double-check for accuracy.

-

Missing Lender Details: Some forms lack the lender's complete name and address. This information is crucial for clarity and future communication.

-

Improper Date Entry: Failing to write the date clearly can lead to confusion. Ensure the date is filled out correctly and legibly.

-

Omitting Loan Amount: Forgetting to state the loan amount is a common mistake. Clearly specify the amount in both numbers and words.

-

Ignoring Payment Terms: Some individuals do not detail the payment schedule. It’s essential to outline when payments are due and how much they will be.

-

Neglecting Signatures: A frequent error is not having the necessary signatures. Both the borrower and lender must sign the document for it to be valid.

-

Not Keeping Copies: Failing to make copies of the signed Promissory Note can lead to issues later. Always keep a copy for your records.

Documents used along the form

When entering into a financial agreement in North Carolina, a Promissory Note is often accompanied by other important documents. Each of these forms plays a critical role in outlining the terms of the loan, ensuring clarity and protection for both the lender and the borrower. Below are five common documents that are frequently used alongside a North Carolina Promissory Note.

- Security Agreement: This document outlines the collateral that secures the loan. It provides the lender with rights to the specified assets if the borrower defaults on the Promissory Note.

- Loan Agreement: This comprehensive document details the terms of the loan, including interest rates, repayment schedules, and any fees associated with the loan. It serves as a formal contract between the lender and borrower.

- Personal Guarantee: In cases where the borrower is a business, a personal guarantee may be required from the business owner. This document holds the individual personally responsible for the loan if the business fails to repay it.

- Mobile Home Bill of Sale: Essential for the transfer of ownership, this form should include both parties' information and the mobile home's details to ensure legality and clarity in the transaction. For more information and templates, visit Forms Washington.

- Disclosure Statement: This document provides the borrower with important information about the loan, including the total cost of borrowing, interest rates, and any potential penalties for late payments. It ensures that the borrower is fully informed before signing the Promissory Note.

- Amortization Schedule: This schedule outlines the repayment plan for the loan, breaking down each payment into principal and interest components over the life of the loan. It helps borrowers understand their payment obligations clearly.

These documents collectively create a framework for the loan transaction, helping to protect the interests of both parties involved. Understanding each form is essential for navigating the lending process effectively.

Misconceptions

-

Misconception 1: A promissory note must be notarized to be valid.

This is not true. In North Carolina, a promissory note does not require notarization to be legally binding. As long as the parties involved agree to the terms and sign the document, it holds validity.

-

Misconception 2: A promissory note is the same as a loan agreement.

While both documents relate to borrowing money, they serve different purposes. A promissory note is a simple promise to pay back a specific amount, whereas a loan agreement outlines the terms and conditions of the loan in greater detail.

-

Misconception 3: You can’t modify a promissory note once it’s signed.

This is incorrect. Parties can agree to modify the terms of a promissory note after it has been signed. However, any changes should be documented in writing and signed by all parties to ensure clarity and enforceability.

-

Misconception 4: Promissory notes are only for large loans.

Many people think that promissory notes are only for significant amounts of money. In reality, they can be used for any loan amount, whether it’s a small personal loan between friends or a larger business transaction.

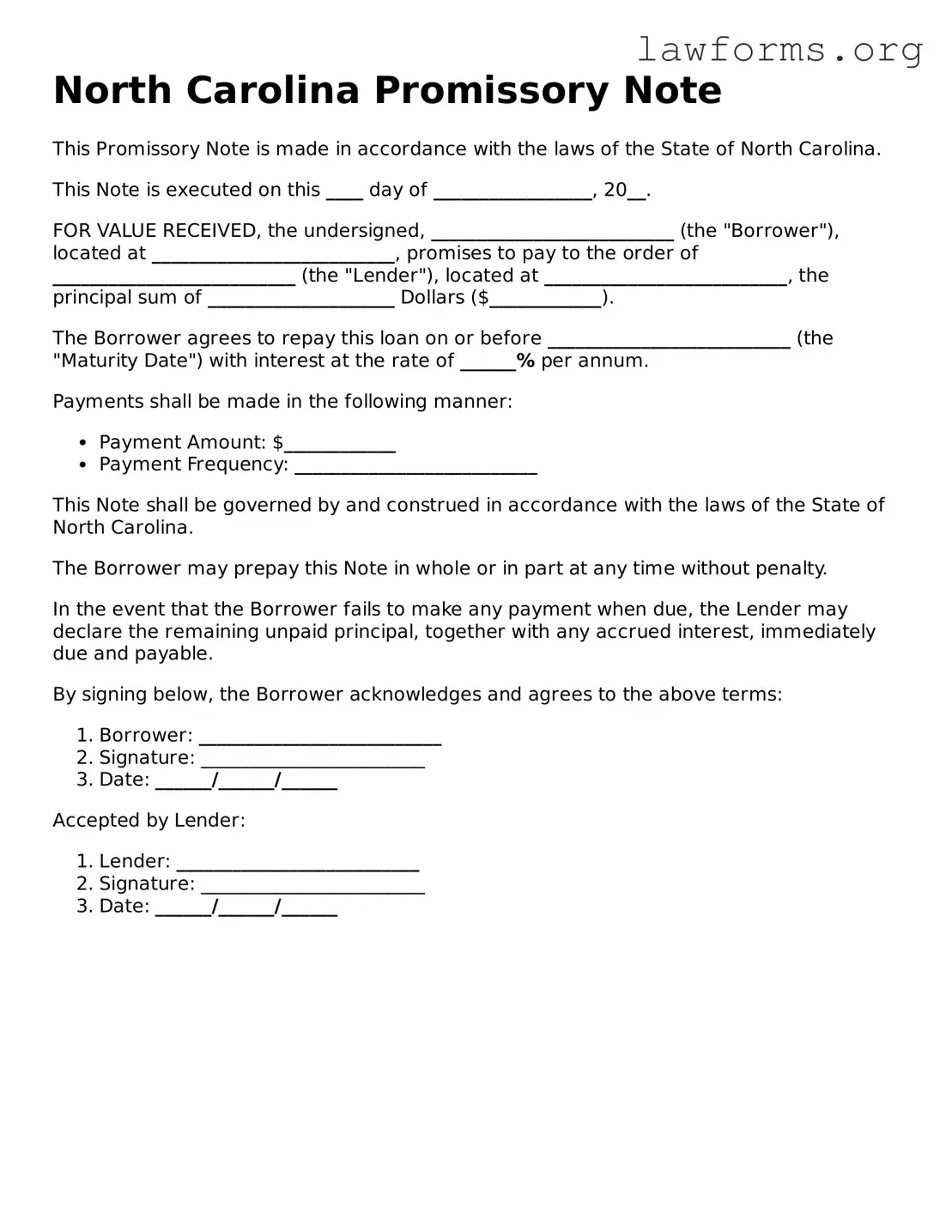

Preview - North Carolina Promissory Note Form

North Carolina Promissory Note

This Promissory Note is made in accordance with the laws of the State of North Carolina.

This Note is executed on this ____ day of _________________, 20__.

FOR VALUE RECEIVED, the undersigned, __________________________ (the "Borrower"), located at __________________________, promises to pay to the order of __________________________ (the "Lender"), located at __________________________, the principal sum of ____________________ Dollars ($____________).

The Borrower agrees to repay this loan on or before __________________________ (the "Maturity Date") with interest at the rate of ______% per annum.

Payments shall be made in the following manner:

- Payment Amount: $____________

- Payment Frequency: __________________________

This Note shall be governed by and construed in accordance with the laws of the State of North Carolina.

The Borrower may prepay this Note in whole or in part at any time without penalty.

In the event that the Borrower fails to make any payment when due, the Lender may declare the remaining unpaid principal, together with any accrued interest, immediately due and payable.

By signing below, the Borrower acknowledges and agrees to the above terms:

- Borrower: __________________________

- Signature: ________________________

- Date: ______/______/______

Accepted by Lender:

- Lender: __________________________

- Signature: ________________________

- Date: ______/______/______

Key takeaways

When dealing with a North Carolina Promissory Note, understanding its structure and requirements is essential for both borrowers and lenders. Here are some key takeaways to consider:

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that both parties are legally recognized in the agreement.

- Specify the Loan Amount: Clearly indicate the principal amount being borrowed. This figure should be accurate and reflect the actual loan.

- Outline the Interest Rate: If applicable, include the interest rate being charged on the loan. This can be fixed or variable, but it must be explicitly stated.

- Define Payment Terms: Clearly outline how and when payments will be made. Include due dates, payment methods, and any grace periods.

- Include Late Fees: If late fees apply, specify the amount or percentage that will be charged for overdue payments. This encourages timely repayment.

- State the Maturity Date: Indicate when the loan must be fully repaid. This is crucial for both parties to understand the timeline of the agreement.

- Consider Collateral: If the loan is secured, detail the collateral being offered. This provides security for the lender in case of default.

- Legal Compliance: Ensure that the Promissory Note complies with North Carolina laws. This may include specific language or disclosures required by state law.

- Signatures: Both parties must sign and date the document. This signifies their agreement to the terms laid out in the note.

By paying attention to these elements, both borrowers and lenders can create a clear and enforceable Promissory Note that protects their interests.

Similar forms

- Loan Agreement: A loan agreement outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. Like a promissory note, it serves as a legal document that binds the borrower to repay the lender.

- Mobile Home Bill of Sale: For those involved in mobile home transactions, the detailed Mobile Home Bill of Sale instructions provide essential guidance to ensure legal compliance and clarity in ownership transfer.

- Mortgage: A mortgage is a specific type of loan used to purchase real estate. It includes a promissory note as part of the agreement, ensuring that the borrower will repay the loan under agreed terms, often secured by the property itself.

- Lease Agreement: A lease agreement is a contract between a landlord and a tenant. It specifies the terms of renting property, including payment obligations. Similar to a promissory note, it creates a commitment to make payments over time.

- IOU (I Owe You): An IOU is a simple document acknowledging a debt. While less formal than a promissory note, it serves a similar purpose by indicating that one party owes money to another, along with the amount and possibly the repayment terms.

- Credit Agreement: A credit agreement details the terms under which a lender provides credit to a borrower. It includes repayment terms and interest rates, akin to a promissory note, which confirms the borrower's obligation to repay borrowed funds.