Attorney-Approved Real Estate Purchase Agreement Template for the State of North Carolina

Form Specifications

| Fact Name | Details |

|---|---|

| Governing Law | The North Carolina Real Estate Purchase Agreement is governed by North Carolina state law. |

| Purpose | This form outlines the terms and conditions for the sale of real estate in North Carolina. |

| Parties Involved | The agreement includes the buyer and seller, both of whom must sign the document. |

| Property Description | A detailed description of the property being sold must be included in the agreement. |

| Purchase Price | The total purchase price of the property must be clearly stated in the agreement. |

| Earnest Money | The agreement typically requires the buyer to submit earnest money as a show of good faith. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, that must be met for the sale to proceed. |

| Closing Date | A specific closing date should be established to finalize the sale of the property. |

| Disclosures | North Carolina law requires sellers to disclose certain information about the property’s condition. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Dos and Don'ts

When filling out the North Carolina Real Estate Purchase Agreement form, it's important to follow best practices to ensure accuracy and legality. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate information about the property and parties involved.

- Do clearly state the purchase price and terms of payment.

- Do include any contingencies that may affect the sale.

- Do sign and date the agreement where required.

- Don’t leave any blank spaces; fill in all required fields.

- Don’t use abbreviations that may cause confusion.

- Don’t forget to initial any changes made to the agreement.

- Don’t overlook the importance of legal advice if unsure about terms.

- Don’t submit the form without reviewing it for errors.

Create Popular Real Estate Purchase Agreement Forms for Different States

How to Make a Purchase Agreement - Details the obligations for utilities and services prior to closing.

Midland Title - Contingencies regarding financing, home inspections, and appraisals are often critical to protect the interests of the buyer.

Understanding the importance of a Living Will is vital for anyone looking to make informed healthcare decisions. Having a clear outline in place helps family members and healthcare providers navigate medical choices during critical moments. For those seeking a reliable resource, consider utilizing a detailed Living Will preparation guide to assist in crafting your document effectively.

Real Estate Purchase and Sale Agreement - Usually requires both parties' signatures to become effective.

Common mistakes

-

Incomplete Information: One common mistake is failing to fill out all required fields. Buyers and sellers often overlook sections, such as the legal description of the property or the names of all parties involved. This can lead to confusion and delays in the transaction.

-

Incorrect Dates: Entering the wrong dates can complicate the agreement. It's crucial to ensure that the contract dates, including the closing date and the expiration of the offer, are accurate and clearly stated.

-

Failure to Specify Contingencies: Many people forget to include important contingencies, such as financing or inspection conditions. Without these, buyers may find themselves in a difficult position if issues arise after the agreement is signed.

-

Ignoring Earnest Money Details: Some individuals do not specify the amount of earnest money or the terms related to its return. This oversight can lead to disputes if the deal falls through.

-

Neglecting to Review the Entire Agreement: Rushing through the form without carefully reviewing all terms can result in misunderstandings. It is essential to read the entire document to understand obligations and rights fully.

-

Not Consulting Professionals: Many individuals attempt to fill out the form without seeking advice from real estate agents or attorneys. This can lead to mistakes that might have been easily avoided with professional guidance.

Documents used along the form

When engaging in real estate transactions in North Carolina, several documents accompany the Real Estate Purchase Agreement. These forms serve various purposes, ensuring that all parties involved are protected and informed throughout the process. Below is a list of commonly used forms that complement the Real Estate Purchase Agreement.

- Property Disclosure Statement: This document requires the seller to disclose known issues with the property, such as structural problems or pest infestations. It aims to inform the buyer about the property's condition before the sale is finalized.

- Due Diligence Agreement: This form outlines the buyer's right to conduct inspections and assessments on the property. It specifies the time frame for these activities and often includes a non-refundable fee paid to the seller for the right to withdraw from the purchase during this period.

- Offer to Purchase and Contract: This document combines the offer and the acceptance of terms between the buyer and seller. It details the purchase price, closing date, and any contingencies that must be met before the sale can proceed.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document itemizes all costs associated with the transaction. It provides a clear breakdown of fees, including closing costs, commissions, and any adjustments for taxes or utilities.

- Employment Verification Form: This important document confirms the employment status of workers, ensuring that accurate information is provided when necessary. These forms can be sourced from Forms Washington.

- Title Insurance Policy: This policy protects the buyer against any legal claims or disputes regarding the property's title. It ensures that the buyer has clear ownership and can defend against any challenges to that ownership.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be valid, and it typically includes a description of the property and the names of both parties.

These documents work together to create a comprehensive framework for real estate transactions in North Carolina. Understanding each form's purpose can help buyers and sellers navigate the complexities of the real estate market more effectively.

Misconceptions

When it comes to real estate transactions in North Carolina, the Real Estate Purchase Agreement (REPA) is a crucial document. However, several misconceptions often arise regarding its purpose and function. Here are five common misunderstandings about the North Carolina Real Estate Purchase Agreement:

- It is a binding contract from the moment it is signed. Many believe that once both parties sign the agreement, it is immediately enforceable. In reality, the contract may be contingent upon certain conditions, such as financing or inspections, which must be met before it becomes binding.

- All terms are negotiable. While many aspects of the agreement can be negotiated, some terms are standard and may not be easily altered. Understanding which elements are flexible and which are not is essential for both buyers and sellers.

- It protects the buyer exclusively. A common misconception is that the REPA is designed solely to protect the buyer's interests. In truth, the agreement serves to balance the interests of both parties, outlining obligations and rights for each side.

- It is the same as a lease agreement. Some people confuse the purchase agreement with a lease. While both documents involve property, the REPA is intended for the sale of real estate, whereas a lease pertains to renting a property.

- Once submitted, changes cannot be made. Many believe that after the purchase agreement is submitted, no further changes can occur. However, amendments can be made with the consent of both parties, allowing for adjustments as needed throughout the transaction process.

Understanding these misconceptions can help individuals navigate the complexities of real estate transactions more effectively. Knowledge empowers buyers and sellers alike, fostering a smoother process in what can often be a stressful experience.

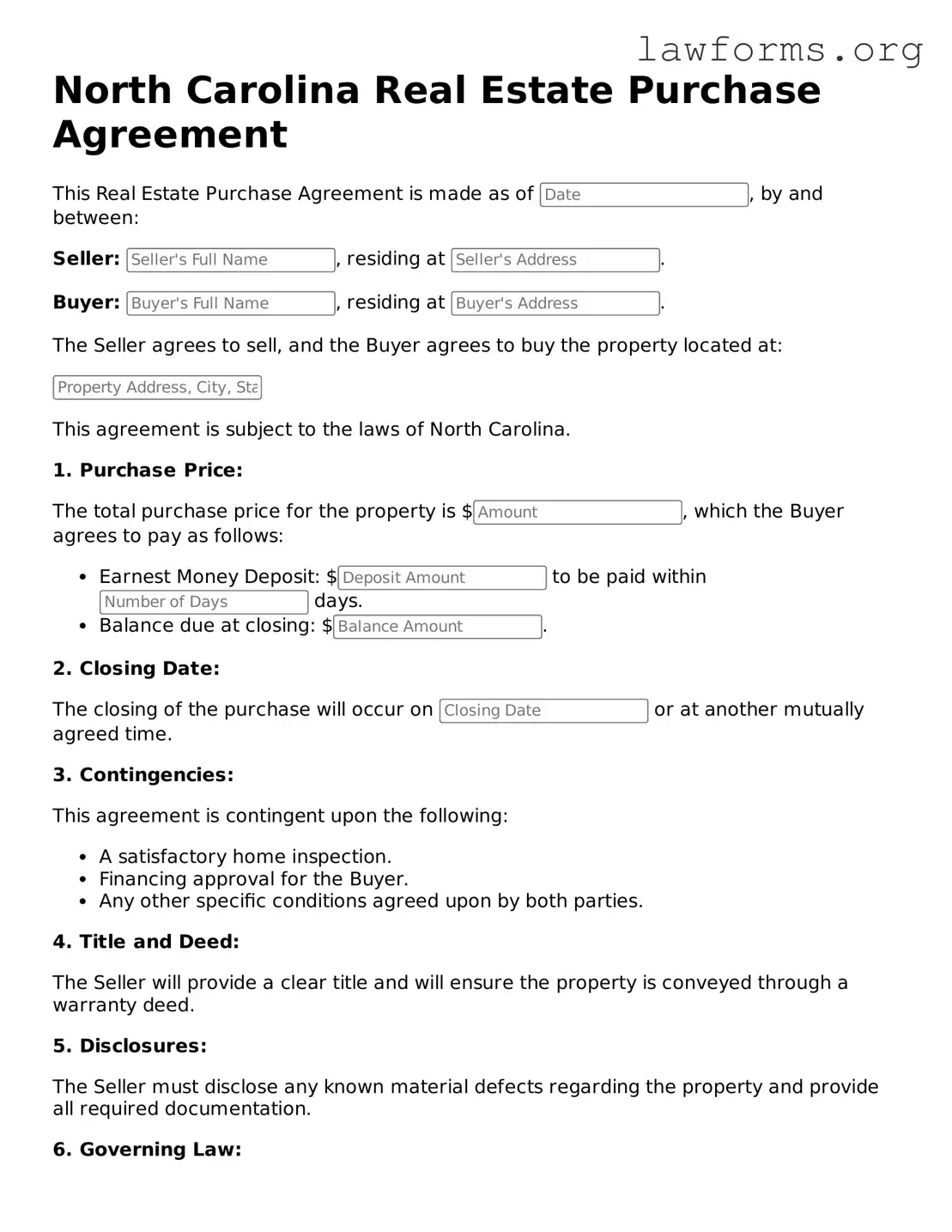

Preview - North Carolina Real Estate Purchase Agreement Form

North Carolina Real Estate Purchase Agreement

This Real Estate Purchase Agreement is made as of , by and between:

Seller: , residing at .

Buyer: , residing at .

The Seller agrees to sell, and the Buyer agrees to buy the property located at:

This agreement is subject to the laws of North Carolina.

1. Purchase Price:

The total purchase price for the property is $, which the Buyer agrees to pay as follows:

- Earnest Money Deposit: $ to be paid within days.

- Balance due at closing: $.

2. Closing Date:

The closing of the purchase will occur on or at another mutually agreed time.

3. Contingencies:

This agreement is contingent upon the following:

- A satisfactory home inspection.

- Financing approval for the Buyer.

- Any other specific conditions agreed upon by both parties.

4. Title and Deed:

The Seller will provide a clear title and will ensure the property is conveyed through a warranty deed.

5. Disclosures:

The Seller must disclose any known material defects regarding the property and provide all required documentation.

6. Governing Law:

This agreement is governed by the laws of North Carolina.

7. Signatures:

By signing below, both parties agree to the terms laid out in this agreement:

Seller's Signature: ______________________ Date: ______________

Buyer's Signature: ______________________ Date: ______________

Witnessed by:

______________________ Date: ______________

Key takeaways

When filling out and using the North Carolina Real Estate Purchase Agreement form, consider the following key takeaways:

- Accuracy is crucial: Ensure all information, including names, addresses, and property details, is correct to avoid complications later.

- Understand the terms: Familiarize yourself with the specific terms and conditions outlined in the agreement to ensure clarity for both parties.

- Contingencies matter: Include any necessary contingencies, such as financing or inspection, to protect your interests during the transaction.

- Consult professionals: Seek advice from real estate agents or legal professionals to navigate the complexities of the agreement effectively.

Similar forms

The Real Estate Purchase Agreement is a crucial document in the home buying process, but it shares similarities with several other important documents. Here are ten documents that have comparable features or purposes:

- Lease Agreement: Like a purchase agreement, a lease outlines the terms under which one party can use another party's property. Both documents specify conditions, responsibilities, and rights of the involved parties.

- Option to Purchase Agreement: This document gives a tenant the right to purchase the property at a later date. It includes terms similar to those found in a purchase agreement, such as price and duration.

- Real Estate Listing Agreement: This agreement is between a property owner and a real estate agent. It details the terms of the agent's representation, much like a purchase agreement outlines the terms of a sale.

- Sales Contract: Often used in various sales transactions, this contract outlines the terms of sale, including price and payment details, similar to a real estate purchase agreement.

- Closing Disclosure: This document provides a detailed account of all costs associated with the purchase of a home. It complements the purchase agreement by ensuring transparency in financial obligations.

- Title Deed: The title deed transfers ownership of the property. While it serves a different purpose, it ultimately relates to the finalization of a real estate transaction, much like the purchase agreement.

-

Dog Bill of Sale: To facilitate the transfer of dog ownership, it is essential to use a Dog Bill of Sale. This legal document not only outlines the details of the dog, such as its breed and health information, but also protects both the seller and buyer throughout the transaction. For more information, visit https://californiadocsonline.com/dog-bill-of-sale-form.

- Purchase and Sale Agreement: This document is often used interchangeably with a real estate purchase agreement. It contains similar terms and conditions regarding the sale of property.

- Escrow Agreement: This agreement outlines the conditions under which funds or documents are held by a third party until the transaction is complete, mirroring the conditional nature of a purchase agreement.

- Home Inspection Agreement: This document details the terms under which a home inspection will be conducted. It often accompanies a purchase agreement to ensure the buyer is aware of the property's condition.

- Financing Agreement: This document outlines the terms of a loan for purchasing property. It includes payment terms and conditions, akin to the financial obligations outlined in a purchase agreement.

Each of these documents plays a vital role in real estate transactions, ensuring that all parties understand their rights and responsibilities. By familiarizing yourself with these agreements, you can navigate the real estate process with greater confidence.