Attorney-Approved Transfer-on-Death Deed Template for the State of North Carolina

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The North Carolina Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive their real estate upon their death, bypassing probate. |

| Governing Law | This deed is governed by North Carolina General Statutes, specifically Chapter 32A, which outlines the rules and requirements for transfer-on-death deeds. |

| Revocation | Property owners can revoke a Transfer-on-Death Deed at any time during their lifetime. This can be done through a subsequent deed or by destroying the original deed. |

| Execution Requirements | The deed must be signed by the owner in the presence of a notary public and recorded in the county where the property is located to be effective. |

Dos and Don'ts

When filling out the North Carolina Transfer-on-Death Deed form, there are several important considerations to keep in mind. Here are six things to do and avoid:

- Do ensure accuracy: Double-check all names, addresses, and property details to avoid any mistakes.

- Do consult with a legal professional: Seek advice to understand the implications of the deed and ensure it meets your needs.

- Do sign in front of a notary: Proper notarization is essential for the deed to be valid.

- Do record the deed: Submit the completed form to the appropriate county office to make it official.

- Don't leave sections blank: Every part of the form should be filled out completely to prevent delays or issues.

- Don't overlook state laws: Familiarize yourself with North Carolina laws regarding Transfer-on-Death Deeds to ensure compliance.

Create Popular Transfer-on-Death Deed Forms for Different States

Tod Deed California - After the owner’s death, beneficiaries may need to file certain documents to claim the property officially.

Problems With Transfer on Death Deeds Ohio - This deed can reinforce intentions to pass real estate directly to the ones the owner cherishes most.

To ensure your child is protected when you're not available, consider the benefits of a reliable parental Power of Attorney for a Child document. This form allows designated individuals to make decisions in your absence, providing peace of mind in times of need.

Where Can I Get a Tod Form - This deed encourages proactive estate planning, which can save loved ones time and stress later.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary information. This includes not listing the full names of both the grantor and the grantee, or omitting the legal description of the property. Each detail is crucial for ensuring the deed is valid and enforceable.

-

Incorrect Signatures: Another frequent error involves signatures. Both the grantor and witnesses must sign the deed in the appropriate places. If any signature is missing or not properly executed, it can lead to complications down the line.

-

Not Notarizing the Document: A Transfer-on-Death Deed must be notarized to be valid. Failing to have the document notarized can render it ineffective, meaning the intended transfer of property may not occur as planned.

-

Filing Errors: After completing the form, it's essential to file it with the appropriate county office. Mistakes can happen here as well, such as submitting the deed to the wrong office or missing the filing deadline. These errors can delay the transfer process or cause the deed to be rejected.

Documents used along the form

The North Carolina Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries upon their death without going through probate. When utilizing this deed, several other forms and documents may be necessary to ensure a smooth transfer of property. Here are some of the most commonly used documents alongside the Transfer-on-Death Deed in North Carolina.

- Last Will and Testament: This legal document outlines how a person's assets should be distributed after their death. It can complement a Transfer-on-Death Deed by detailing other property not covered by the deed.

- Power of Attorney Form: This document allows you to designate an agent to make decisions on your behalf, including those related to property transfers. For a comprehensive template, you can refer to Forms Washington.

- Beneficiary Designation Forms: These forms are used for financial accounts and insurance policies. They allow individuals to specify who will receive these assets upon their death, ensuring a clear transfer of ownership.

- Affidavit of Heirship: This document may be necessary to establish the heirs of a deceased person. It can help clarify the rightful beneficiaries of the property if there are disputes or uncertainties.

- Property Title Search: Conducting a title search ensures that the property is free of liens or other claims. This step is crucial before transferring property to avoid future legal complications.

Using these documents in conjunction with the Transfer-on-Death Deed can simplify the process of transferring property and help avoid potential legal issues. Always consider consulting a legal professional for guidance tailored to your specific situation.

Misconceptions

Understanding the North Carolina Transfer-on-Death (TOD) Deed form is essential for effective estate planning. However, several misconceptions can lead to confusion. Here are ten common misconceptions about the TOD Deed form in North Carolina:

- The TOD Deed is only for wealthy individuals. Many people believe that only those with substantial assets need a TOD Deed. In reality, it can benefit anyone looking to simplify the transfer of property upon death.

- Using a TOD Deed avoids all probate issues. While a TOD Deed does allow property to pass outside of probate, it does not eliminate the entire probate process for other assets that may not have a designated beneficiary.

- All types of property can be transferred using a TOD Deed. This is not true. The TOD Deed can only be used for real estate, not personal property like vehicles or bank accounts.

- The TOD Deed can be revoked at any time. Although a TOD Deed can be revoked, it must be done through a formal process, which includes filing a new deed or a revocation document with the county register of deeds.

- Beneficiaries automatically inherit the property without any responsibilities. Beneficiaries may still have to deal with property taxes and maintenance costs after inheriting the property.

- The TOD Deed is the same as a will. While both documents deal with the distribution of property, a TOD Deed specifically transfers real estate outside of probate, whereas a will covers all assets and requires probate.

- Signing a TOD Deed is enough to ensure it is valid. Simply signing the deed does not make it valid. It must be properly recorded with the local register of deeds to take effect.

- There is no need to inform beneficiaries about the TOD Deed. Communication is important. Beneficiaries should be informed to avoid confusion and potential disputes after the property owner’s death.

- Only one beneficiary can be named on a TOD Deed. Multiple beneficiaries can be designated, allowing for shared ownership of the property after the owner's death.

- The TOD Deed can be used for property that is subject to a mortgage. While a TOD Deed can be created for mortgaged property, the mortgage will still need to be addressed, as the beneficiary may inherit the property with the existing debt.

Clarifying these misconceptions can help individuals make informed decisions about their estate planning needs in North Carolina.

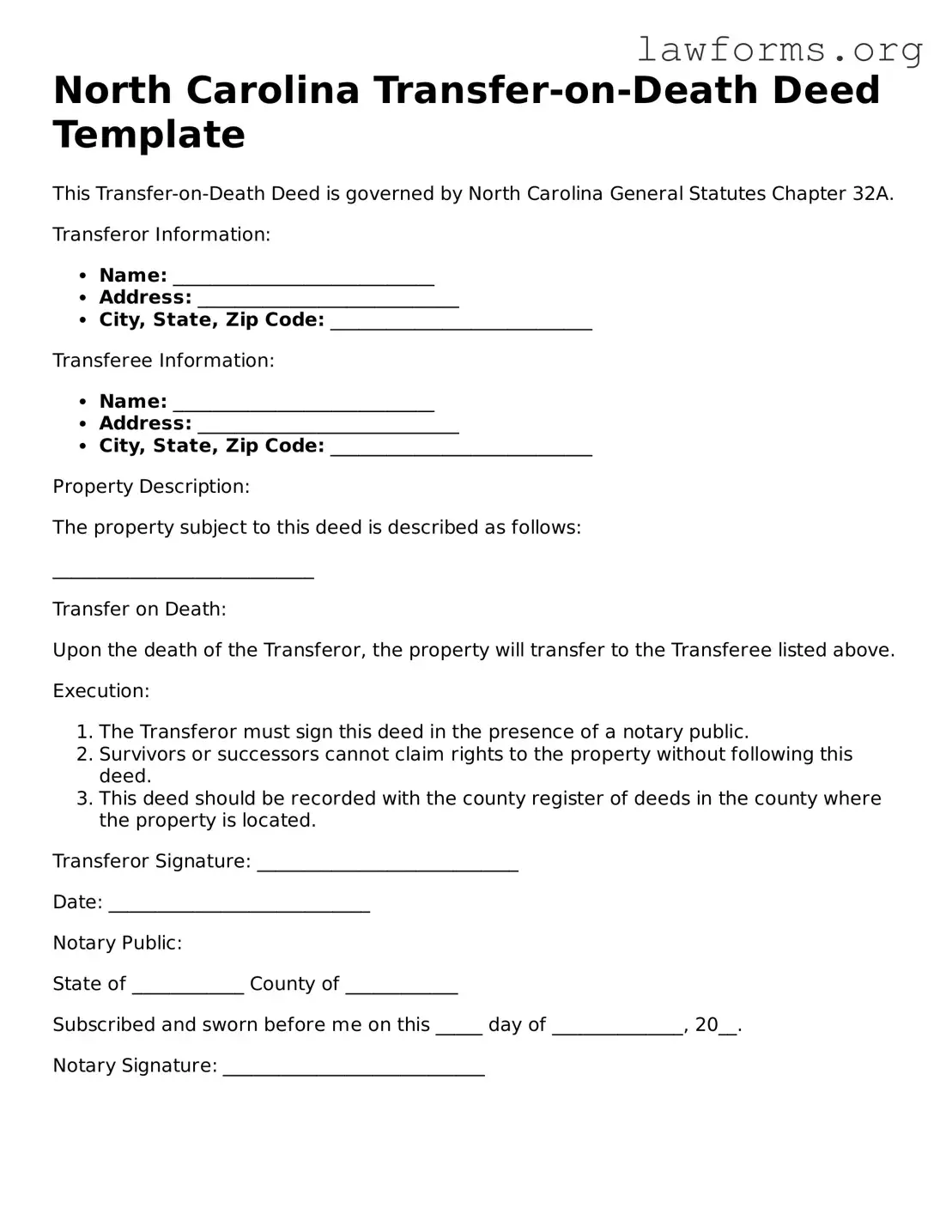

Preview - North Carolina Transfer-on-Death Deed Form

North Carolina Transfer-on-Death Deed Template

This Transfer-on-Death Deed is governed by North Carolina General Statutes Chapter 32A.

Transferor Information:

- Name: ____________________________

- Address: ____________________________

- City, State, Zip Code: ____________________________

Transferee Information:

- Name: ____________________________

- Address: ____________________________

- City, State, Zip Code: ____________________________

Property Description:

The property subject to this deed is described as follows:

____________________________

Transfer on Death:

Upon the death of the Transferor, the property will transfer to the Transferee listed above.

Execution:

- The Transferor must sign this deed in the presence of a notary public.

- Survivors or successors cannot claim rights to the property without following this deed.

- This deed should be recorded with the county register of deeds in the county where the property is located.

Transferor Signature: ____________________________

Date: ____________________________

Notary Public:

State of ____________ County of ____________

Subscribed and sworn before me on this _____ day of ______________, 20__.

Notary Signature: ____________________________

Key takeaways

Filling out and using the North Carolina Transfer-on-Death Deed form can be straightforward if you keep these key takeaways in mind:

- Understand the Purpose: The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries without going through probate.

- Eligibility: This deed can be used for any real property in North Carolina, including residential and commercial properties.

- Complete the Form Accurately: Ensure all required information is filled out correctly, including the legal description of the property and the names of the beneficiaries.

- Signatures Required: The deed must be signed by the property owner(s) in the presence of a notary public.

- Recording the Deed: After signing, the deed must be recorded at the local Register of Deeds office to be effective.

- Revocation: The property owner can revoke the deed at any time before their death by filing a revocation form.

- Beneficiary Rights: Beneficiaries do not have rights to the property until the owner passes away.

- Tax Implications: Consult a tax professional regarding any potential tax consequences for both the owner and the beneficiaries.

- Legal Assistance: Consider seeking legal advice to ensure the deed is executed properly and aligns with your estate planning goals.

- State-Specific Rules: Familiarize yourself with North Carolina laws regarding Transfer-on-Death Deeds, as they may differ from other states.

By keeping these points in mind, you can navigate the process of using the Transfer-on-Death Deed effectively and confidently.

Similar forms

The Transfer-on-Death (TOD) Deed is a unique estate planning tool that allows property owners to designate a beneficiary who will inherit the property upon their death, without going through probate. While the TOD Deed has its distinct features, it shares similarities with several other legal documents. Here are four documents that are comparable to the TOD Deed:

- Will: A will is a legal document that outlines how a person's assets and property should be distributed after their death. Like a TOD Deed, a will allows individuals to specify beneficiaries, but it requires probate, which can be a lengthy and costly process.

- Homeschool Letter of Intent: This important document is necessary for parents wishing to homeschool their children in California, and it ensures compliance with state regulations. For more details, visit https://californiadocsonline.com/homeschool-letter-of-intent-form.

- Living Trust: A living trust is a legal arrangement where a trustee holds and manages assets for the benefit of the beneficiaries. Similar to a TOD Deed, a living trust helps avoid probate, but it is generally more complex and requires ongoing management.

- Beneficiary Designation Forms: These forms are used for financial accounts, such as life insurance policies and retirement accounts, to designate who will receive the assets upon the account holder's death. Like the TOD Deed, these forms allow for a direct transfer of assets without going through probate.

- Joint Tenancy with Right of Survivorship: This arrangement allows two or more people to own property together, with the surviving owner automatically inheriting the deceased owner's share. Similar to a TOD Deed, this method facilitates a seamless transfer of property upon death, bypassing probate.

Understanding these documents can help individuals make informed decisions about their estate planning needs. Each option has its advantages and drawbacks, so it's essential to consider personal circumstances and goals when choosing the right approach.