Attorney-Approved Articles of Incorporation Template for the State of Ohio

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Ohio Articles of Incorporation form is used to officially create a corporation in Ohio. |

| Governing Law | The form is governed by the Ohio Revised Code, specifically Chapter 1701. |

| Filing Requirement | Filing the Articles of Incorporation is required to legally establish a corporation. |

| Information Needed | Key information includes the corporation's name, purpose, and registered agent. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Fees | There is a filing fee associated with submitting the Articles of Incorporation. |

| Processing Time | Processing times can vary, but typically, it takes several business days. |

| Amendments | Changes to the Articles of Incorporation can be made through an amendment process. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record. |

| Corporate Powers | The Articles outline the powers and limitations of the corporation as defined by Ohio law. |

Dos and Don'ts

When filling out the Ohio Articles of Incorporation form, it is essential to approach the task with care. Below is a list of seven important dos and don'ts to consider during this process.

- Do ensure that the name of your corporation is unique and not already in use by another entity in Ohio.

- Don't use prohibited words in your corporation's name, such as "bank" or "insurance," unless you meet specific regulatory requirements.

- Do provide a clear and accurate description of the business purpose of your corporation.

- Don't leave any required fields blank; incomplete forms can lead to delays or rejections.

- Do include the names and addresses of the initial directors and the registered agent.

- Don't forget to sign and date the form; an unsigned form will not be processed.

- Do double-check all information for accuracy before submitting the form to avoid any issues.

By following these guidelines, individuals can help ensure a smoother incorporation process in Ohio.

Create Popular Articles of Incorporation Forms for Different States

Articles of Incorporation Texas - They provide transparency and accountability for shareholders.

When considering a Power of Attorney, it is crucial to recognize the importance of preparing a comprehensive document that delineates the powers bestowed upon the agent. For those in Washington, a valuable resource for templates and guidance is available at Forms Washington, which can help ensure that all legal requirements are met and that the principal's intentions are clearly articulated.

Document Retrieval Center - Establishes existence in the eyes of the law.

Common mistakes

-

Incorrect Business Name: One common mistake is failing to choose a unique name for the corporation. The name must not be similar to any existing businesses registered in Ohio. Before submitting, it's wise to check the Ohio Secretary of State's website to ensure the name is available.

-

Missing Registered Agent Information: Every corporation needs a registered agent. This person or business must have a physical address in Ohio. Many people forget to include this information or do not provide a valid address, which can lead to delays.

-

Incorrect Purpose Statement: The Articles of Incorporation require a purpose statement for the business. Some individuals either leave this blank or write a vague statement. A clear and specific purpose helps clarify the business's intent and can prevent issues later on.

-

Omitting Signatures: Failing to sign the form is a frequent oversight. All incorporators must sign the Articles of Incorporation. Without these signatures, the document is incomplete and cannot be processed.

Documents used along the form

When forming a corporation in Ohio, several documents and forms may accompany the Articles of Incorporation to ensure compliance with state laws and regulations. Each of these documents serves a specific purpose in the incorporation process.

- Bylaws: This document outlines the internal rules and procedures for the corporation's operation. Bylaws typically cover aspects such as the roles of directors and officers, meeting protocols, and voting procedures.

- Power of Attorney for a Child: For parents ensuring their child's well-being during absences, the essential Power of Attorney for a Child document allows a trusted individual to make necessary decisions on their behalf.

- Initial Director Consent: This form is used to appoint the initial board of directors. It demonstrates that the appointed individuals agree to serve in this capacity, which is essential for establishing governance.

- Organizational Meeting Minutes: These minutes document the first meeting of the board of directors. They record decisions made, such as the adoption of bylaws and the appointment of officers.

- Employer Identification Number (EIN) Application: This form, submitted to the IRS, is necessary for obtaining an EIN. The EIN is crucial for tax purposes and is required for opening a corporate bank account.

- State Business License Application: Depending on the type of business, a specific license may be required to operate legally within Ohio. This application varies based on industry and location.

- Registered Agent Designation: This document identifies the registered agent for the corporation. The registered agent serves as the official point of contact for legal documents and government notifications.

- Statement of Information: Some states require this document to provide updated information about the corporation's address, directors, and officers. It helps maintain transparency and keeps the state informed.

- Shareholder Agreements: While not always required, this document can outline the rights and responsibilities of shareholders. It may address issues such as transfer of shares and dispute resolution.

- Operating Agreement (for LLCs): If forming a limited liability company (LLC) instead of a corporation, an operating agreement is essential. It details the management structure and operational procedures for the LLC.

These forms and documents are integral to the incorporation process in Ohio. They help establish a solid foundation for the corporation and ensure compliance with legal requirements. Understanding the purpose of each document can aid in navigating the complexities of forming a business entity.

Misconceptions

When it comes to forming a corporation in Ohio, many people harbor misconceptions about the Articles of Incorporation form. Understanding these misunderstandings can help streamline the incorporation process and ensure compliance with state laws. Here’s a list of ten common misconceptions:

- All businesses must file Articles of Incorporation. Many believe that every type of business entity, including sole proprietorships and partnerships, must file these articles. However, only corporations are required to submit this form.

- The Articles of Incorporation are the same as a business license. Some confuse these two documents. The Articles of Incorporation establish the corporation's existence, while a business license allows the business to operate legally in a specific area.

- Filing Articles of Incorporation guarantees business success. While this form is essential for legal recognition, it does not ensure that the business will thrive. Success depends on a variety of factors, including market demand and management skills.

- Once filed, Articles of Incorporation cannot be changed. Many think that these documents are set in stone. In reality, amendments can be made to update information like the business name or registered agent.

- Articles of Incorporation can be filed at any time. Some believe there are no time constraints. However, it’s best to file as early as possible, especially if you want to start conducting business right away.

- All states have the same requirements for Articles of Incorporation. This is a common misconception. Each state has its own specific requirements and forms, so it’s crucial to refer to Ohio’s guidelines.

- You don’t need a registered agent if you file Articles of Incorporation. Some people think this is optional. However, every corporation must designate a registered agent to receive legal documents.

- Filing fees are the same for all types of corporations. Many assume that the fees are uniform. In Ohio, the fees can vary based on the type of corporation you are forming, such as a profit or nonprofit corporation.

- Articles of Incorporation are only for large businesses. This misconception leads many small business owners to overlook the importance of filing. In reality, even small businesses benefit from formal incorporation.

- Once incorporated, you never have to file again. Some believe that incorporation is a one-time event. In fact, corporations must comply with ongoing requirements, including annual reports and fees.

By addressing these misconceptions, aspiring business owners can better navigate the incorporation process and set a solid foundation for their ventures in Ohio.

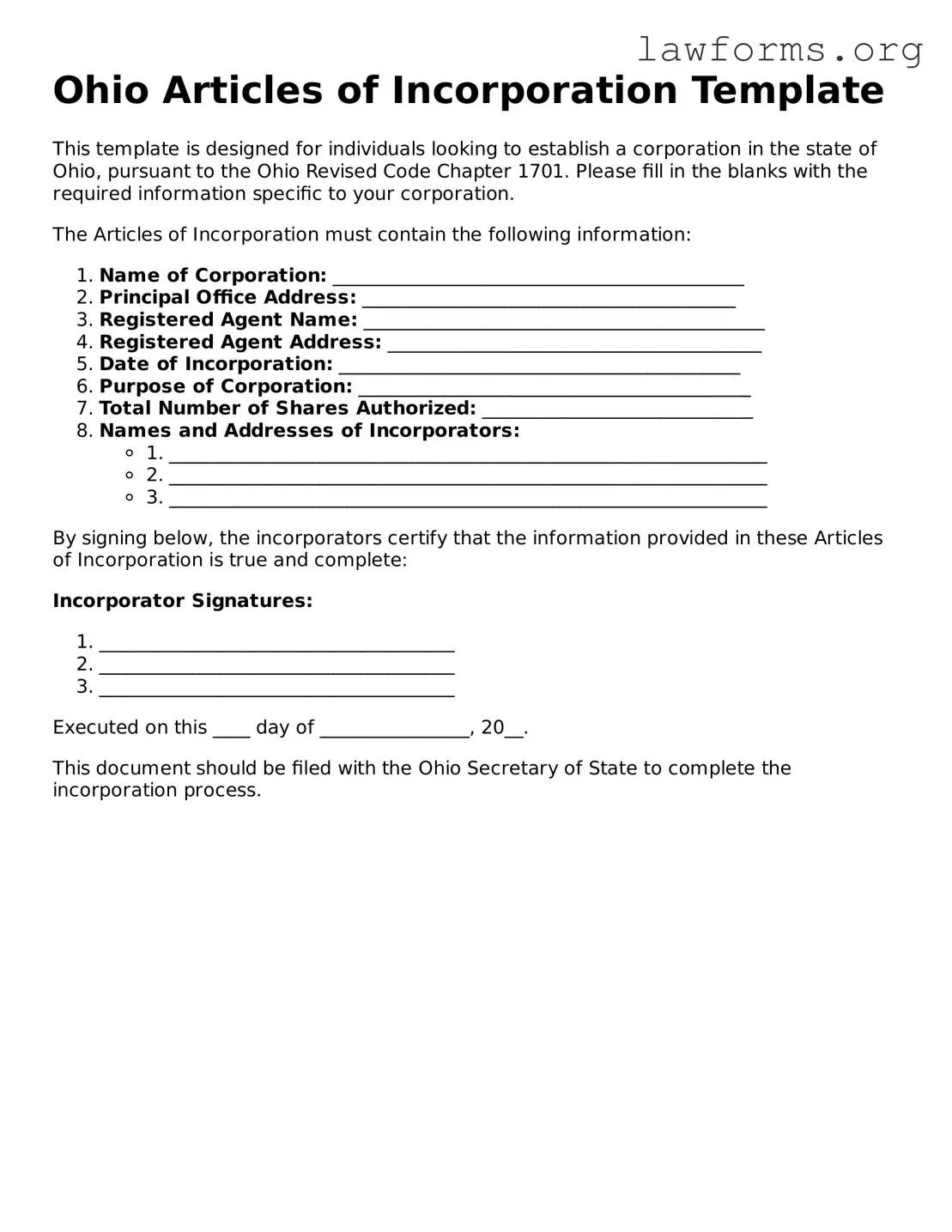

Preview - Ohio Articles of Incorporation Form

Ohio Articles of Incorporation Template

This template is designed for individuals looking to establish a corporation in the state of Ohio, pursuant to the Ohio Revised Code Chapter 1701. Please fill in the blanks with the required information specific to your corporation.

The Articles of Incorporation must contain the following information:

- Name of Corporation: ____________________________________________

- Principal Office Address: ________________________________________

- Registered Agent Name: ___________________________________________

- Registered Agent Address: ________________________________________

- Date of Incorporation: ___________________________________________

- Purpose of Corporation: __________________________________________

- Total Number of Shares Authorized: _____________________________

- Names and Addresses of Incorporators:

- 1. ________________________________________________________________

- 2. ________________________________________________________________

- 3. ________________________________________________________________

By signing below, the incorporators certify that the information provided in these Articles of Incorporation is true and complete:

Incorporator Signatures:

- ______________________________________

- ______________________________________

- ______________________________________

Executed on this ____ day of ________________, 20__.

This document should be filed with the Ohio Secretary of State to complete the incorporation process.

Key takeaways

When filling out and using the Ohio Articles of Incorporation form, there are several important points to keep in mind. These takeaways will help ensure a smooth incorporation process.

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for establishing a corporation in Ohio. This document outlines the corporation's basic information and structure.

- Accurate Information is Crucial: Ensure that all information provided, such as the name of the corporation, the registered agent, and the business address, is accurate. Errors can lead to delays or rejection of the application.

- Filing Fees: Be aware of the filing fees associated with the Articles of Incorporation. As of the latest information, the fee is typically around $125, but it is advisable to check for any updates or changes.

- Choose the Right Business Structure: Consider the type of corporation you want to form, such as a C Corporation or an S Corporation. Each has different tax implications and operational requirements.

- Follow Up: After submitting the Articles of Incorporation, monitor the status of your application. You can contact the Ohio Secretary of State's office to verify that your incorporation has been processed.

Similar forms

The Articles of Incorporation serve as a foundational document for establishing a corporation. Several other documents share similarities with this form, each playing a crucial role in the formation and governance of a business entity. Below are seven documents that are comparable to the Articles of Incorporation:

- Bylaws: These internal rules govern the management of the corporation. While the Articles of Incorporation outline the structure and purpose of the corporation, the bylaws detail how it will operate on a day-to-day basis.

- Certificate of Formation: In some states, this document is synonymous with the Articles of Incorporation. It serves a similar purpose, establishing the existence of the corporation and providing essential information about its structure.

- Homeschool Letter of Intent: This form is essential for parents looking to officially declare their intention to homeschool their children and can be accessed at californiadocsonline.com/homeschool-letter-of-intent-form.

- Operating Agreement: For limited liability companies (LLCs), this document is akin to the bylaws of a corporation. It outlines the management structure and operational guidelines for the LLC, similar to how bylaws function for corporations.

- Partnership Agreement: This document is used by partnerships to define the roles and responsibilities of partners. Like the Articles of Incorporation, it formalizes the structure of the business and governs its operations.

- Business License: While not directly comparable in function, a business license is necessary for legal operation. It signifies that the business has met local regulations, similar to how Articles of Incorporation signify compliance with state requirements.

- Annual Report: This document is filed periodically and provides updates on the corporation's activities and financial status. It is similar to the Articles of Incorporation in that it maintains the corporation's compliance with state requirements.

- Shareholder Agreement: This document governs the relationship between shareholders and outlines their rights and obligations. It complements the Articles of Incorporation by providing more detailed rules about ownership and decision-making processes.