Attorney-Approved Bill of Sale Template for the State of Ohio

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Ohio Bill of Sale form is used to document the transfer of ownership of personal property from one party to another. |

| Governing Law | This form is governed by Ohio Revised Code Section 1302.01, which outlines the laws regarding sales and transfers of goods. |

| Types of Property | The form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Signatures Required | Both the seller and the buyer must sign the Bill of Sale to make the transfer legally binding. |

Dos and Don'ts

When filling out the Ohio Bill of Sale form, it's essential to get it right to ensure a smooth transaction. Here are ten things you should and shouldn't do:

- Do provide accurate information about the buyer and seller.

- Do include a detailed description of the item being sold.

- Do specify the sale price clearly.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the Bill of Sale for your records.

- Don't leave any fields blank; fill in all required information.

- Don't use vague descriptions; be specific about the item.

- Don't forget to check for any local requirements that may apply.

- Don't rush through the process; take your time to ensure accuracy.

- Don't ignore the importance of witnesses if required for your transaction.

Create Popular Bill of Sale Forms for Different States

Boat Bill of Sale - A signed Bill of Sale can expedite processes involving both parties.

North Carolina Title - This document helps avoid misunderstandings regarding the terms of the sale.

Is a Bill of Sale Proof of Ownership - This form serves as proof of a transaction and outlines the details of the sale.

When purchasing a vehicle, it is important to utilize a Motor Vehicle Bill of Sale form that can be obtained from reliable sources like Formaid Org, ensuring that all necessary information is accurately captured and that both parties are protected during the transaction.

How to Transfer Title in Florida - A Bill of Sale is a straightforward way to communicate the terms of the sale.

Common mistakes

-

Not including all necessary information. Buyers and sellers often forget to provide essential details such as the full names and addresses of both parties, the date of the sale, and a complete description of the item being sold.

-

Failing to accurately describe the item. It's crucial to include specific details like the make, model, year, and VIN for vehicles. Vague descriptions can lead to misunderstandings later.

-

Not signing the document. Both parties must sign the Bill of Sale. Omitting signatures can render the document invalid, creating complications during ownership transfer.

-

Ignoring the need for witnesses. Some transactions may require witnesses to the signing. Not having witnesses can affect the document's enforceability.

-

Using incorrect dates. Ensure the date of sale is accurate. An incorrect date can lead to confusion regarding the timeline of the transaction.

-

Not keeping copies. After filling out the Bill of Sale, both parties should retain a copy. Failing to do so can complicate future disputes or questions about the sale.

-

Neglecting to check local regulations. Different counties or cities may have specific requirements for a Bill of Sale. Not being aware of these can lead to issues down the line.

Documents used along the form

When you're completing a transaction that involves the Ohio Bill of Sale, there are several other documents that may be helpful or even necessary. These documents can provide additional protection, clarify the terms of the sale, or ensure that all legal requirements are met. Here’s a list of commonly used forms and documents that often accompany the Bill of Sale in Ohio.

- Title Transfer Document: This document officially transfers ownership of the vehicle or item from the seller to the buyer. It’s crucial for registering the item with the state.

- Odometer Disclosure Statement: Required for vehicle sales, this form records the vehicle's mileage at the time of sale. It helps prevent fraud and ensures transparency.

- Vehicle Registration Application: After purchasing a vehicle, the buyer must complete this application to register the vehicle in their name with the Ohio Bureau of Motor Vehicles.

- Proof of Insurance: Buyers must provide proof of insurance coverage before they can register their new vehicle. This document verifies that the buyer has the necessary insurance in place.

- Power of Attorney Form: Essential for designating an agent to make decisions on behalf of the principal in matters of personal property transactions, this document helps ensure that the principal's wishes are represented. For more information, you can refer to Forms Washington.

- Payment Receipt: This document serves as proof of payment for the item sold. It details the amount paid, the date of the transaction, and the parties involved.

- Affidavit of Ownership: If the seller does not have the original title, this affidavit can help establish ownership and facilitate the sale of the item.

- Sales Tax Form: Depending on the nature of the sale, a sales tax form may need to be completed to report and pay any applicable taxes on the transaction.

- Warranty Document: If the item sold comes with a warranty, this document outlines the terms and conditions, providing the buyer with peace of mind regarding future repairs or issues.

Having these documents ready can streamline the sales process and help ensure that everything is in order. Whether you’re buying or selling, being prepared with the right paperwork can make all the difference in a smooth transaction.

Misconceptions

When it comes to the Ohio Bill of Sale form, several misconceptions can lead to confusion for those looking to complete a transaction. Understanding these misconceptions can help ensure a smoother process. Here are six common misunderstandings:

- It is not necessary for a Bill of Sale in Ohio. Many people believe that a Bill of Sale is optional for all transactions. However, in Ohio, a Bill of Sale is crucial for documenting the sale of certain items, especially vehicles, to provide proof of ownership transfer.

- All Bill of Sale forms are the same. This is a common misconception. While the basic elements may be similar, specific details required can vary based on the type of transaction and the items being sold. It’s important to use the appropriate form for your needs.

- A Bill of Sale does not need to be notarized. Some believe that notarization is unnecessary. In Ohio, while notarization is not always required, having the document notarized can add an extra layer of legitimacy and may be required by certain institutions, like the DMV.

- A Bill of Sale guarantees the item is free of liens. This is a misunderstanding that can lead to complications. A Bill of Sale does not inherently guarantee that the item is free of liens or encumbrances. Buyers should conduct their own due diligence to verify the item's status.

- Once signed, the Bill of Sale cannot be altered. Some people think that after signing, the document is set in stone. In reality, amendments can be made if both parties agree. Any changes should be documented and signed by both parties to avoid disputes.

- The Bill of Sale is only for vehicle transactions. While it is commonly associated with vehicles, a Bill of Sale can be used for a variety of items, including personal property, equipment, and even livestock. Its use is not limited to motor vehicles.

Understanding these misconceptions can help individuals navigate the process of completing a Bill of Sale in Ohio more effectively. Being informed is key to ensuring a successful transaction.

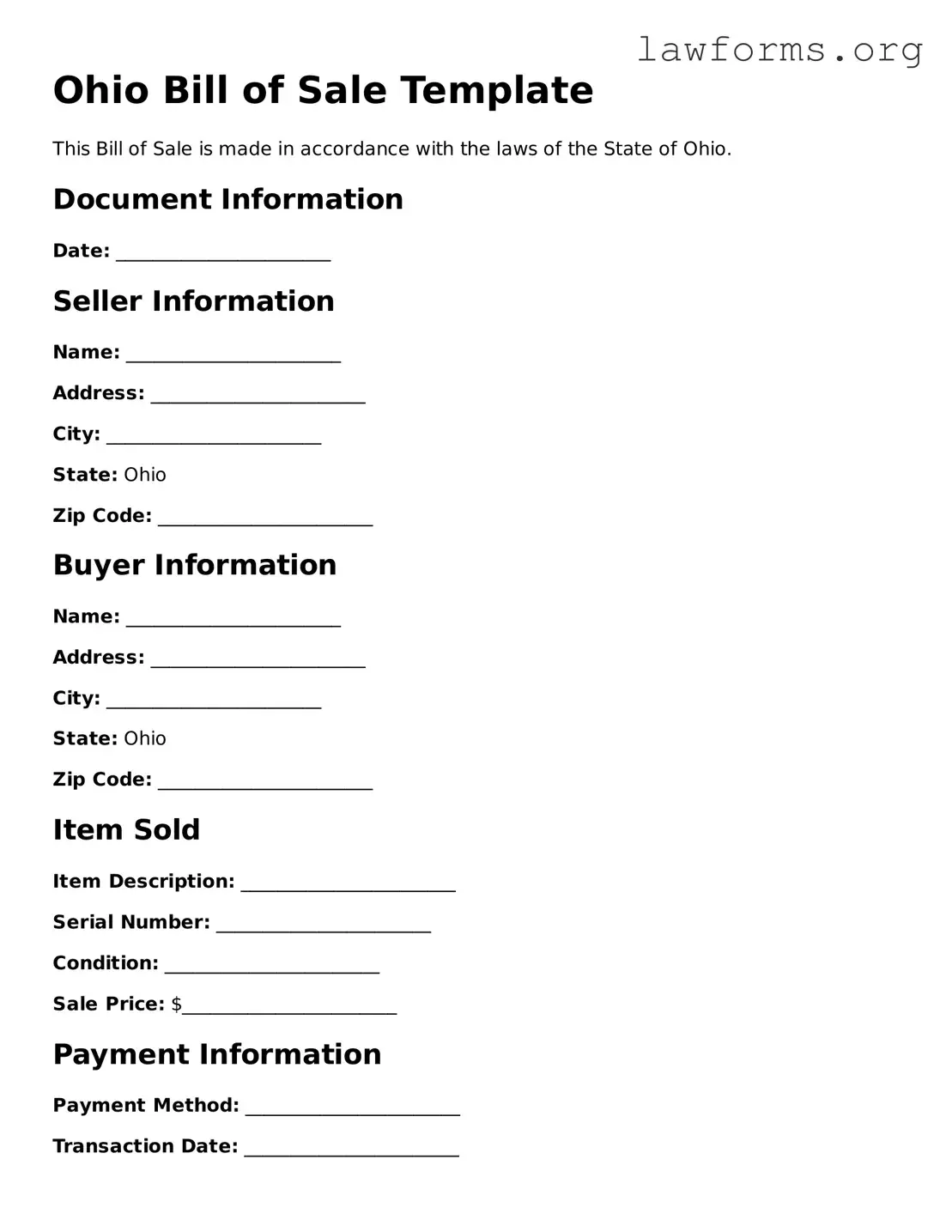

Preview - Ohio Bill of Sale Form

Ohio Bill of Sale Template

This Bill of Sale is made in accordance with the laws of the State of Ohio.

Document Information

Date: _______________________

Seller Information

Name: _______________________

Address: _______________________

City: _______________________

State: Ohio

Zip Code: _______________________

Buyer Information

Name: _______________________

Address: _______________________

City: _______________________

State: Ohio

Zip Code: _______________________

Item Sold

Item Description: _______________________

Serial Number: _______________________

Condition: _______________________

Sale Price: $_______________________

Payment Information

Payment Method: _______________________

Transaction Date: _______________________

Signatures

The undersigned hereby affirm that the above information is accurate and complete.

- Seller Signature: _______________________

- Buyer Signature: _______________________

Witness Information (optional)

Witness Name: _______________________

Witness Signature: _______________________

Notary Public (optional)

State of Ohio

County of _______________________

Subscribed and sworn before me this _____ day of _____________, 20__.

Notary Public Signature: _______________________

My Commission Expires: _______________________

Please retain a copy of this Bill of Sale for your records.

Key takeaways

- Purpose: The Ohio Bill of Sale serves as a legal document that records the transfer of ownership of personal property from one party to another.

- Identification: Both the seller and buyer must provide their full names and addresses to ensure clear identification of the parties involved.

- Description of Property: A detailed description of the item being sold is necessary. This includes the make, model, year, and any identifying numbers, such as VIN for vehicles.

- Purchase Price: The agreed-upon purchase price must be clearly stated in the document to avoid any disputes in the future.

- Signatures: Both parties must sign the Bill of Sale to validate the transaction. It is advisable to have witnesses or notarization for added legal protection.

- Retention: Each party should keep a copy of the Bill of Sale for their records. This document may be required for registration or tax purposes.

- State Compliance: Ensure that the Bill of Sale complies with Ohio state laws, as certain items may have specific requirements or additional forms.

Similar forms

- Purchase Agreement: This document outlines the terms of sale between a buyer and seller. It details the items being sold, price, and conditions, similar to how a Bill of Sale confirms the transfer of ownership.

- Receipt: A receipt serves as proof of payment for goods or services. Like a Bill of Sale, it provides evidence of the transaction and can include details such as the date, amount, and description of the item.

- Lease Agreement: A lease agreement establishes the terms under which one party rents property from another. Both documents formalize the transfer of rights, either for ownership or temporary use.

- Warranty Deed: A warranty deed transfers ownership of real estate and guarantees that the seller holds clear title. Similar to a Bill of Sale, it serves as a legal document confirming the transfer of property rights.

- Title Transfer Document: This document is used to officially transfer ownership of a vehicle. Like a Bill of Sale, it provides legal proof of the change in ownership and may be required for registration.

- General Bill of Sale Form: For secure transfers of personal property, refer to our essential general bill of sale to ensure all ownership changes are properly documented.

- Gift Deed: A gift deed transfers property ownership without payment. Similar to a Bill of Sale, it legally documents the transfer of ownership but does not involve a financial transaction.

- Contract for Sale: This contract outlines the terms of sale for goods or services. It specifies the obligations of both parties, similar to a Bill of Sale, which confirms the agreement and transfer of ownership.