Attorney-Approved Deed in Lieu of Foreclosure Template for the State of Ohio

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | Ohio Revised Code, Section 5301.01 governs the use of deeds in lieu of foreclosure in Ohio. |

| Eligibility | Homeowners facing financial difficulties may qualify for this option if they are unable to continue mortgage payments. |

| Process | The borrower must negotiate with the lender to agree on the terms of the deed in lieu of foreclosure. |

| Benefits | This option can help homeowners avoid the lengthy foreclosure process and potential damage to their credit score. |

| Risks | Homeowners may still be liable for any remaining mortgage balance if the property value is less than the outstanding loan. |

| Documentation | Essential documents include the deed itself, a release of liability, and any agreements made with the lender. |

| Impact on Credit | A deed in lieu of foreclosure typically has a less severe impact on credit scores compared to a foreclosure. |

| Timeframe | The process can often be completed more quickly than a foreclosure, sometimes within a few months. |

| Alternatives | Homeowners might also consider loan modifications or short sales as alternatives to a deed in lieu of foreclosure. |

Dos and Don'ts

When filling out the Ohio Deed in Lieu of Foreclosure form, there are important guidelines to follow. Here’s a list of what you should and shouldn’t do:

- Do ensure that all property information is accurate and complete.

- Do include the names of all parties involved in the transaction.

- Do sign the document in the presence of a notary public.

- Do provide a clear description of the property being transferred.

- Do keep copies of the completed form for your records.

- Don't leave any sections blank; this can cause delays.

- Don't forget to check for any outstanding liens or mortgages on the property.

- Don't rush through the process; take your time to ensure accuracy.

- Don't submit the form without reviewing it thoroughly.

Following these guidelines will help ensure a smoother process when completing the Deed in Lieu of Foreclosure form in Ohio.

Create Popular Deed in Lieu of Foreclosure Forms for Different States

California Pre-foreclosure Property Transfer - A formal approach to address and manage financial challenges linked to home ownership.

Deed in Lieu - It is always advisable to weigh the pros and cons of a Deed in Lieu against other options like short sales.

For those navigating the intricacies of workplace injury claims in Georgia, understanding the importance of the WC-200a form is paramount. This form, which is used for Change of Physician / Additional Treatment by Consent, allows injured employees to effectively communicate their needs for medical care adjustments. Accessing more detailed information about the form can be found at https://georgiaform.com, ensuring that individuals stay informed and compliant with the relevant statutes and procedures.

Deed in Lieu of Foreclosure Form - A deed in lieu can save time and legal fees often associated with foreclosure proceedings.

Sale in Lieu of Foreclosure - A successful Deed in Lieu can provide both parties with a fresh start after financial difficulties.

Common mistakes

-

Failing to accurately identify the property. Ensure that the legal description of the property is complete and correct.

-

Not including all necessary parties. All owners of the property must sign the deed, or the process may be delayed.

-

Overlooking the need for notarization. The deed must be signed in front of a notary public to be valid.

-

Using outdated forms. Always use the most current version of the Deed in Lieu of Foreclosure form to avoid complications.

-

Failing to review the deed for accuracy. Double-check all information for typos or errors before submission.

-

Neglecting to consult with a legal advisor. It’s wise to seek professional guidance to ensure compliance with all legal requirements.

-

Not understanding the implications of the deed. Be aware of how this action may affect your credit and future homeownership.

-

Ignoring local laws and regulations. Different jurisdictions may have specific requirements for deeds in lieu of foreclosure.

-

Failing to provide the lender with required documentation. Lenders often need additional paperwork to process the deed.

-

Not keeping copies of the submitted documents. Always retain copies for your records in case of future disputes.

Documents used along the form

When navigating the complexities of real estate transactions, especially those involving foreclosure, several important documents often accompany the Ohio Deed in Lieu of Foreclosure form. Each of these documents plays a crucial role in ensuring that the process is handled smoothly and legally. Understanding these forms can help homeowners and lenders alike make informed decisions.

- Loan Modification Agreement: This document outlines changes to the original loan terms, such as interest rates or payment schedules. It can provide a viable alternative to foreclosure by making it easier for homeowners to keep their property.

- Notice of Default: This formal notification informs the borrower that they have fallen behind on their mortgage payments. It serves as a critical step in the foreclosure process, prompting the borrower to take action to avoid further legal consequences.

- Trailer Bill of Sale: This crucial document ensures the lawful transfer of ownership for trailers in New York, serving as both a receipt for the transaction and a record of ownership change—access the document for your transaction needs.

- Release of Liability: This document releases the borrower from any further obligations associated with the mortgage once the deed in lieu is executed. It provides peace of mind by ensuring that the borrower is not held accountable for any remaining debt on the property.

- Settlement Statement: Also known as a HUD-1, this document provides a detailed account of all financial transactions involved in the transfer of property. It includes information about fees, payments, and any credits applied, ensuring transparency for both parties.

By familiarizing yourself with these documents, you can better navigate the legal landscape surrounding foreclosure and property transfers. Each form serves its purpose and contributes to a clearer understanding of the rights and responsibilities involved in the process.

Misconceptions

When facing financial difficulties, many homeowners consider a deed in lieu of foreclosure as an option. However, several misconceptions can cloud understanding of this process. Here are four common misconceptions about the Ohio Deed in Lieu of Foreclosure form.

- It eliminates all debt associated with the mortgage. Many believe that signing a deed in lieu of foreclosure automatically cancels all mortgage-related debts. In reality, this process may not absolve homeowners from other financial obligations, such as second mortgages or home equity lines of credit.

- It is a quick and easy solution. Some homeowners think that a deed in lieu of foreclosure is a simple way to resolve their mortgage issues. However, the process can be lengthy and requires negotiation with the lender. Homeowners must also provide documentation and meet specific criteria.

- It has no impact on credit scores. A common belief is that a deed in lieu of foreclosure does not affect credit ratings. Unfortunately, this is not the case. While it may be less damaging than a foreclosure, it can still negatively impact credit scores and remain on credit reports for several years.

- All lenders accept a deed in lieu of foreclosure. Many assume that all mortgage lenders will agree to a deed in lieu of foreclosure. However, this is not universally true. Each lender has its own policies and may not accept this option, depending on the circumstances of the homeowner's situation.

Understanding these misconceptions can help homeowners make informed decisions about their options when facing financial hardship.

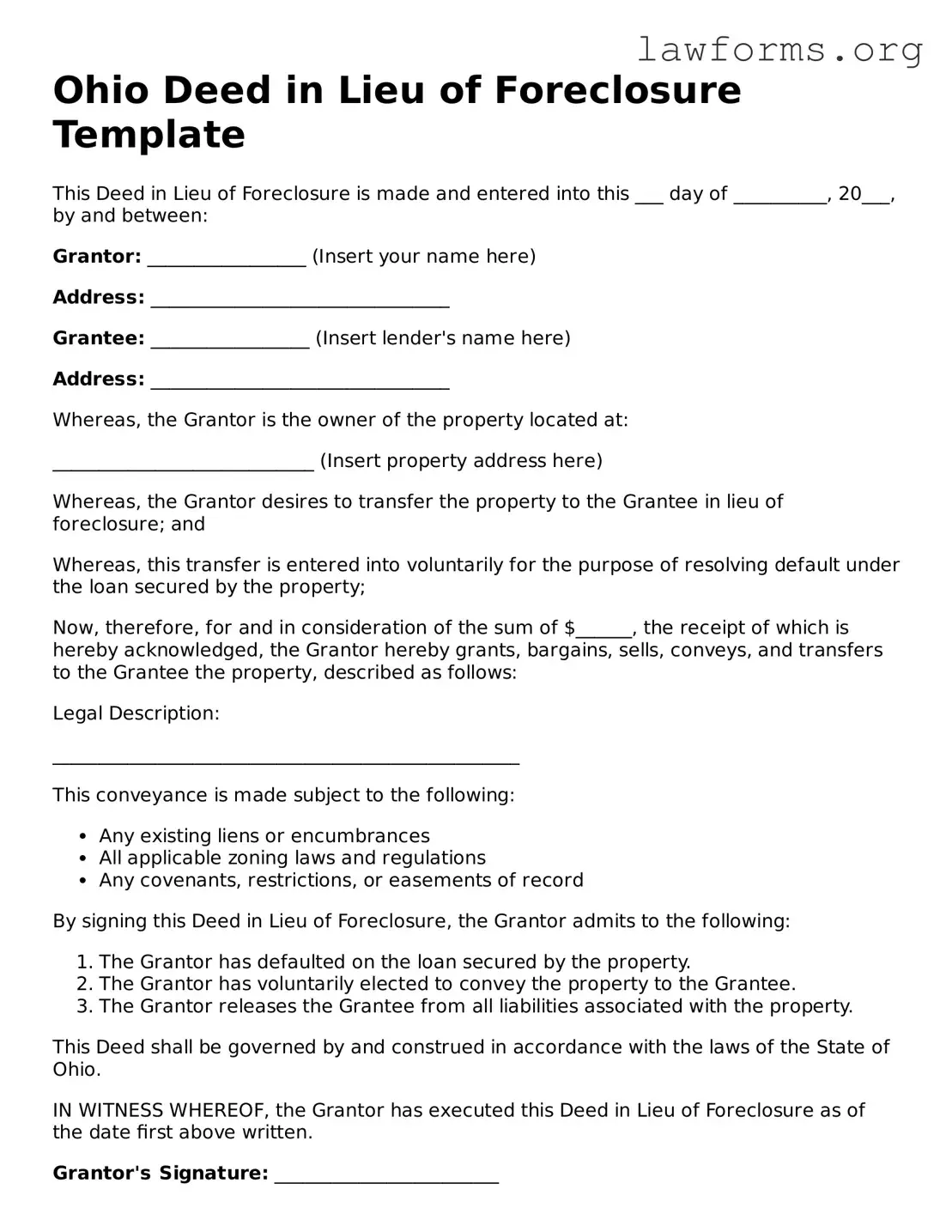

Preview - Ohio Deed in Lieu of Foreclosure Form

Ohio Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made and entered into this ___ day of __________, 20___, by and between:

Grantor: _________________ (Insert your name here)

Address: ________________________________

Grantee: _________________ (Insert lender's name here)

Address: ________________________________

Whereas, the Grantor is the owner of the property located at:

____________________________ (Insert property address here)

Whereas, the Grantor desires to transfer the property to the Grantee in lieu of foreclosure; and

Whereas, this transfer is entered into voluntarily for the purpose of resolving default under the loan secured by the property;

Now, therefore, for and in consideration of the sum of $______, the receipt of which is hereby acknowledged, the Grantor hereby grants, bargains, sells, conveys, and transfers to the Grantee the property, described as follows:

Legal Description:

__________________________________________________

This conveyance is made subject to the following:

- Any existing liens or encumbrances

- All applicable zoning laws and regulations

- Any covenants, restrictions, or easements of record

By signing this Deed in Lieu of Foreclosure, the Grantor admits to the following:

- The Grantor has defaulted on the loan secured by the property.

- The Grantor has voluntarily elected to convey the property to the Grantee.

- The Grantor releases the Grantee from all liabilities associated with the property.

This Deed shall be governed by and construed in accordance with the laws of the State of Ohio.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor's Signature: ________________________

Print Name: ________________________

State of Ohio

County of _______________

On this ___ day of __________, 20___, before me, a Notary Public, personally appeared ________________________ (Grantor’s name) and acknowledged the execution of this instrument.

Witness my hand and official seal.

Notary Public Signature: ________________________

My Commission Expires: ________________________

Key takeaways

Here are some key takeaways regarding the Ohio Deed in Lieu of Foreclosure form:

- The deed allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure.

- Both parties must agree to the terms outlined in the deed.

- It is essential to ensure all outstanding debts related to the property are addressed before signing.

- Consulting with a legal expert can help clarify any potential consequences of using this deed.

- The deed must be properly recorded with the county recorder's office to be legally effective.

- Homeowners should review their mortgage documents to understand any specific requirements for the deed in lieu process.

Similar forms

- Short Sale Agreement: Similar to a deed in lieu of foreclosure, a short sale involves the homeowner selling the property for less than the outstanding mortgage balance. Both options aim to avoid foreclosure and mitigate losses for lenders.

- Loan Modification Agreement: This document alters the terms of the original mortgage to make payments more manageable for the homeowner. Like a deed in lieu, it seeks to prevent foreclosure, but it does so by adjusting the loan rather than transferring ownership.

- Forbearance Agreement: In this arrangement, the lender agrees to temporarily suspend or reduce mortgage payments. This is similar to a deed in lieu in that both provide a way for homeowners to avoid foreclosure, but forbearance allows the homeowner to retain ownership during a specified period.

- Repayment Plan: This document outlines a plan for the homeowner to catch up on missed payments over time. It shares similarities with a deed in lieu of foreclosure, as both are strategies to help homeowners avoid the negative consequences of foreclosure.

- Deed of Trust: While primarily a security instrument, a deed of trust can be similar in that it involves a transfer of interest in property. However, it serves as a collateral agreement for a loan, rather than a means to avoid foreclosure.

- Property Transfer Deed: This document is crucial for conveying ownership of real estate in New York. It details the transaction between the seller and buyer, ensuring that all legal requirements are met and that the transfer is recognized. For more information, see the Property Transfer Deed.

- Release of Mortgage: This document signifies that a mortgage has been paid off or settled. Similar to a deed in lieu, it represents the end of a borrower's obligation to the lender, though it typically comes after a successful payment rather than as a preemptive measure against foreclosure.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a path for debt restructuring. While a deed in lieu offers a more straightforward resolution, both serve as options to help homeowners manage overwhelming debt and avoid the consequences of foreclosure.