Attorney-Approved Deed Template for the State of Ohio

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Ohio Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. |

| Governing Laws | The Ohio Revised Code, specifically Section 5301, governs the execution and recording of deeds. |

| Recording Requirements | To be valid, the deed must be signed, notarized, and recorded with the county recorder's office. |

Dos and Don'ts

When filling out the Ohio Deed form, it is important to follow certain guidelines to ensure accuracy and compliance with state requirements. Below is a list of things to do and avoid during this process.

- Do provide accurate information about the property, including the legal description.

- Do include the names of all parties involved in the transaction.

- Do sign the deed in the presence of a notary public.

- Do check for any required additional documents that may need to accompany the deed.

- Don't leave any fields blank; all sections must be completed.

- Don't use white-out or other correction methods on the form; errors should be crossed out and corrected properly.

Following these guidelines can help ensure that the deed is processed without issues. It is advisable to review the completed form carefully before submission.

Create Popular Deed Forms for Different States

Sample Deed - Deeds can also ensure that inheritance rights are respected after a property owner's death.

The Illinois Articles of Incorporation form is a critical document required for establishing a corporation within the state. It sets the foundation of the corporate entity, outlining essential details such as the corporation's name, purpose, and the information about its initial officers and incorporators. For those ready to formalize their business in Illinois, completing this form is a significant first step, and you can find it online at https://formsillinois.com/.

Deed Transfer Nj - Parties should thoroughly review a deed to ensure all information is accurate before signing.

Common mistakes

-

Incorrect Grantee Information: Many individuals fail to provide accurate details about the grantee. This can include misspellings of names or incorrect addresses. Ensuring that the grantee's name matches their identification is crucial.

-

Missing Signatures: A common oversight is the omission of required signatures. Both the grantor and, in some cases, witnesses must sign the deed. Without these signatures, the deed may not be considered valid.

-

Improper Notarization: Some people neglect to have the deed properly notarized. Notarization is essential for verifying the identities of the parties involved and ensuring the document's authenticity.

-

Failure to Include Legal Description: The legal description of the property must be included. This description should be precise and detailed. Omitting this information can lead to confusion regarding the property being transferred.

-

Incorrect Date: The date of execution is often overlooked or incorrectly filled out. This date is significant, as it marks when the deed is officially executed and can affect the timing of property transfers.

-

Not Following Local Requirements: Each county in Ohio may have specific requirements for deed forms. Failing to adhere to these local regulations can result in delays or rejections of the deed.

Documents used along the form

When transferring property in Ohio, several forms and documents may accompany the Ohio Deed form to ensure a smooth and legally sound transaction. Each of these documents plays a crucial role in the process, providing necessary information and protections for both the buyer and seller. Below is a list of common documents you might encounter.

- Title Search Report: This document outlines the history of ownership for the property. It helps identify any liens, encumbrances, or claims against the title that may affect the sale.

- Purchase Agreement: A legally binding contract between the buyer and seller detailing the terms of the sale, including the purchase price and any contingencies.

- Residential Lease Agreement: The Ohio PDF Forms facilitate the rental process by providing a standard lease agreement that outlines both parties' rights and responsibilities, ensuring clarity and protection in rental transactions.

- Affidavit of Title: This sworn statement confirms that the seller has the legal right to sell the property and that there are no undisclosed claims or liens against it.

- Settlement Statement (HUD-1): A detailed account of all costs associated with the real estate transaction, including closing costs, fees, and adjustments, provided to both parties before closing.

- Power of Attorney: A document that allows one person to act on behalf of another in legal matters, often used if the seller cannot be present at closing.

- Tax Certificates: These documents verify that all property taxes have been paid up to date. They help ensure that the buyer will not inherit any tax liabilities from the seller.

- Disclosure Statements: Sellers are often required to provide disclosures about the property’s condition, including any known issues or defects, to inform the buyer adequately.

- Deed of Trust: This document secures a loan with the property as collateral, outlining the lender's rights in case of default.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide rules, regulations, and financial statements that govern the community.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about potential lead hazards and the seller’s responsibilities regarding lead paint.

Understanding these documents can help streamline the property transfer process and ensure all parties are informed and protected. It’s always advisable to consult with a legal professional to navigate these forms effectively and to address any specific concerns that may arise during the transaction.

Misconceptions

When it comes to the Ohio Deed form, there are several misconceptions that can lead to confusion. Understanding the truth behind these myths is essential for anyone involved in real estate transactions in Ohio.

- All deeds are the same. Many people think that all deed forms are interchangeable. In reality, different types of deeds serve different purposes, such as warranty deeds, quitclaim deeds, and others.

- A deed must be notarized to be valid. While notarization is often required for a deed to be recorded, a deed can still be valid without it if it meets other legal requirements.

- You can use a deed from another state. Each state has its own laws regarding deeds. Using a deed form from another state may not comply with Ohio law and could lead to issues.

- Once a deed is signed, it cannot be changed. While it is true that a deed is a legal document, it can be amended or revoked under certain conditions, depending on the circumstances.

- All deeds need to be filed with the county recorder. Not all deeds must be recorded, but filing is recommended to protect ownership rights and provide public notice.

- Only an attorney can prepare a deed. While having an attorney can be beneficial, individuals can prepare their own deeds as long as they understand the requirements and complete the form correctly.

- A deed transfer is the same as a title transfer. A deed is the document that conveys property, while title refers to the legal ownership of that property. They are related but not the same.

By clarifying these misconceptions, individuals can navigate the process of using the Ohio Deed form more effectively. It is always wise to seek guidance if there are any uncertainties.

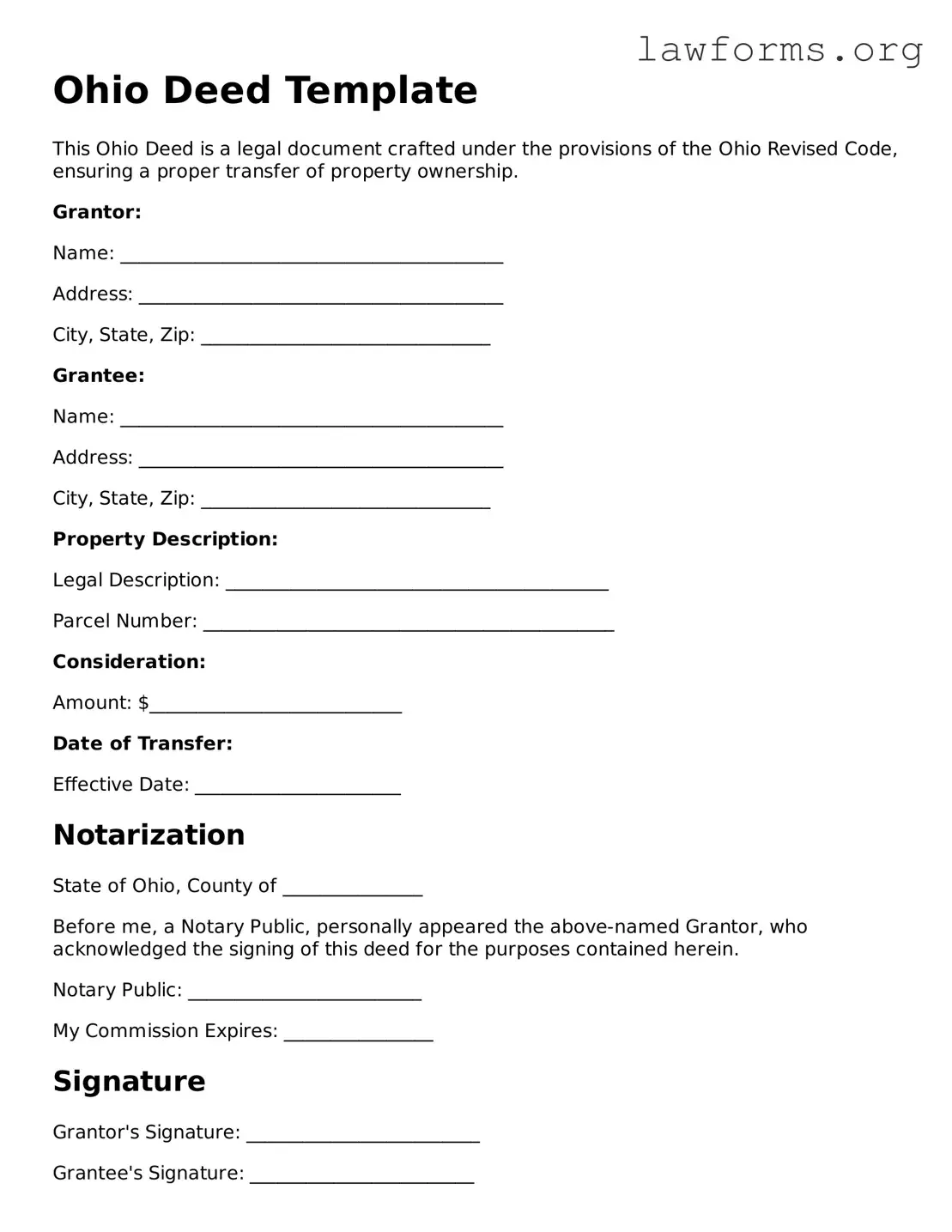

Preview - Ohio Deed Form

Ohio Deed Template

This Ohio Deed is a legal document crafted under the provisions of the Ohio Revised Code, ensuring a proper transfer of property ownership.

Grantor:

Name: _________________________________________

Address: _______________________________________

City, State, Zip: _______________________________

Grantee:

Name: _________________________________________

Address: _______________________________________

City, State, Zip: _______________________________

Property Description:

Legal Description: _________________________________________

Parcel Number: ____________________________________________

Consideration:

Amount: $___________________________

Date of Transfer:

Effective Date: ______________________

Notarization

State of Ohio, County of _______________

Before me, a Notary Public, personally appeared the above-named Grantor, who acknowledged the signing of this deed for the purposes contained herein.

Notary Public: _________________________

My Commission Expires: ________________

Signature

Grantor's Signature: _________________________

Grantee's Signature: ________________________

It is important to ensure that this deed is recorded in the County Recorder's office where the property is located. This helps protect the rights of everyone involved in the transaction.

Key takeaways

When filling out and using the Ohio Deed form, it is essential to understand several key aspects to ensure the process is handled correctly. Below are important takeaways to consider:

- Identify the Parties: Clearly state the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). Accurate identification is crucial.

- Property Description: Provide a detailed description of the property being transferred. This includes the address and legal description, which can typically be found in previous deeds or tax documents.

- Consideration Amount: Indicate the amount of consideration, or payment, exchanged for the property. This is a standard requirement and must be included.

- Signatures Required: Ensure that the grantor's signature is present on the deed. If there are multiple grantors, all must sign to validate the transfer.

- Notarization: The deed must be notarized to be legally binding. A notary public will verify the identities of the signers and witness the signing process.

- Filing the Deed: After completing the deed, it must be filed with the appropriate county recorder’s office. This step is necessary to make the transfer official and public.

- Consult Legal Advice: It is often beneficial to seek legal advice when preparing a deed. An attorney can help ensure compliance with local laws and prevent potential issues.

Similar forms

The Deed form shares similarities with several other legal documents. Each document serves a specific purpose and often contains similar elements. Below is a list of seven documents that are comparable to the Deed form:

- Title Transfer Document: This document facilitates the transfer of ownership of property from one party to another, similar to how a Deed conveys title.

- California Judicial Council form: This standardized document is essential for ensuring organized court filings and can be accessed through https://californiadocsonline.com/california-judicial-council-form.

- Mortgage Agreement: Like a Deed, this agreement outlines the terms of property ownership and the lender's rights in case of default.

- Lease Agreement: A Lease Agreement, while temporary, also defines the rights and responsibilities of both the property owner and the tenant, akin to the stipulations in a Deed.

- Bill of Sale: This document serves to transfer ownership of personal property, much like a Deed does for real property.

- Trust Agreement: A Trust Agreement establishes a fiduciary relationship, similar to how a Deed may designate a trustee for property management.

- Quitclaim Deed: This specific type of Deed allows the transfer of interest in property without guaranteeing clear title, paralleling the general purpose of a Deed.

- Power of Attorney: This document grants authority to another person to act on behalf of the property owner, which can be related to the execution of a Deed.