Attorney-Approved Durable Power of Attorney Template for the State of Ohio

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | An Ohio Durable Power of Attorney form allows a person to appoint someone else to manage their financial and legal affairs if they become incapacitated. |

| Governing Law | This form is governed by Ohio Revised Code Section 1337.24, which outlines the requirements and powers granted through the document. |

| Durability | The term "durable" means that the authority granted remains effective even if the principal becomes mentally incompetent. |

| Agent's Authority | The agent can make decisions regarding financial matters, property transactions, and other legal affairs as specified in the form. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

Dos and Don'ts

When filling out the Ohio Durable Power of Attorney form, it is essential to approach the process with care and attention to detail. Below are some guidelines to consider, including both actions to take and pitfalls to avoid.

- Do clearly identify the principal, the person granting the power of attorney.

- Do choose a trustworthy agent who will act in your best interest.

- Do specify the powers you wish to grant to your agent, making them as detailed as possible.

- Do date and sign the form in the presence of a notary public to ensure its validity.

- Do keep copies of the completed form for your records and provide one to your agent.

- Don't leave any sections blank, as this may lead to confusion or misinterpretation.

- Don't choose an agent who may have conflicting interests or who you do not fully trust.

- Don't overlook the importance of discussing your wishes with your agent beforehand.

- Don't forget to review and update the document periodically, especially if your circumstances change.

Create Popular Durable Power of Attorney Forms for Different States

How to Do Power of Attorney - This document can help prevent confusion during a financial crisis.

When engaging in a vehicle transaction, it is essential to utilize the proper documentation, such as the Washington Motor Vehicle Bill of Sale, to avoid any ambiguities. You can find a reliable template for this important document at Forms Washington, which can assist both buyers and sellers in ensuring a smooth ownership transfer.

How to File for Power of Attorney in Florida - The chosen agent must act in the best interest of the individual, adhering to their wishes outlined in the document.

Durable Power Printable Power of Attorney Form - Choosing the right agent is crucial, as they will have significant authority over your affairs.

Common mistakes

-

Not naming a specific agent: It's crucial to choose a trusted individual to act on your behalf. Leaving this section blank or selecting multiple agents without clear instructions can lead to confusion and potential disputes.

-

Failing to specify powers: The form allows you to outline specific powers you wish to grant. Omitting these details can result in your agent lacking the authority to make important decisions when needed.

-

Not signing in front of a witness: Ohio requires that the Durable Power of Attorney be signed in front of a witness. Neglecting this step can invalidate the document, leaving your wishes unfulfilled.

-

Ignoring the date: Failing to date the document can create uncertainty about when it was executed. This oversight might lead to complications, especially if the document is contested later.

-

Not updating the form: Life circumstances change. If you experience a significant life event, such as marriage or divorce, it’s important to update your Durable Power of Attorney to reflect those changes.

-

Choosing an unqualified agent: Selecting someone who lacks the necessary skills or knowledge to handle your affairs can be detrimental. It’s essential to choose an agent who understands your values and can make decisions accordingly.

-

Not discussing the document with your agent: Open communication is key. Failing to discuss your wishes and the contents of the Durable Power of Attorney with your agent can lead to misunderstandings when they need to act on your behalf.

Documents used along the form

When considering the Ohio Durable Power of Attorney form, it is essential to understand that this document often works in conjunction with several other forms and documents. Each of these plays a crucial role in ensuring that an individual's wishes are respected and that their affairs are managed appropriately, especially in the event of incapacitation. Below are some commonly used documents that complement the Durable Power of Attorney.

- Living Will: This document outlines an individual's preferences regarding medical treatment and end-of-life care. It specifies the types of medical interventions a person wishes to receive or refuse if they become unable to communicate their decisions.

- Healthcare Power of Attorney: Similar to the Durable Power of Attorney, this form specifically grants authority to a designated person to make healthcare decisions on behalf of someone else. It is particularly important for ensuring that medical decisions align with the individual's values and desires.

- Non-compete Agreement: To protect your business interests, consider our important Non-compete Agreement tips that outline the essential elements and clauses needed for effective agreements.

- Will: A will is a legal document that details how an individual's assets and affairs should be handled after their death. It can designate guardians for minor children and outline specific bequests, ensuring that the deceased's wishes are honored.

- Trust: A trust is a legal arrangement where one party holds property for the benefit of another. Trusts can help manage assets during an individual's lifetime and can facilitate the transfer of those assets upon death, often avoiding the probate process.

- Financial Power of Attorney: This document allows a designated individual to manage financial matters on behalf of another person. It can cover a wide range of financial transactions, from paying bills to managing investments, and is particularly useful for those who may become incapacitated.

Understanding these documents and how they interact with the Ohio Durable Power of Attorney form can provide peace of mind. By preparing these essential forms, individuals can ensure their preferences are honored and their affairs are handled according to their wishes, even when they may not be able to communicate them directly.

Misconceptions

Understanding the Ohio Durable Power of Attorney form is essential for anyone considering this important legal document. However, several misconceptions can lead to confusion. Below are eight common misunderstandings about this form, along with clarifications to help clarify the truth.

- Misconception 1: A Durable Power of Attorney is only for financial matters.

- Misconception 2: The agent must be a family member.

- Misconception 3: A Durable Power of Attorney is only effective after the principal becomes incapacitated.

- Misconception 4: Once signed, a Durable Power of Attorney cannot be revoked.

- Misconception 5: The agent has unlimited power over your affairs.

- Misconception 6: A Durable Power of Attorney is the same as a living will.

- Misconception 7: All Durable Power of Attorney forms are the same.

- Misconception 8: You only need a Durable Power of Attorney if you are elderly or ill.

This is not true. While many people use a Durable Power of Attorney primarily for financial decisions, it can also cover health care and other personal matters, depending on how it is drafted.

There is no requirement that the agent be a family member. Anyone you trust, including a friend or a professional, can serve as your agent, provided they are willing to take on the responsibility.

In Ohio, a Durable Power of Attorney can be effective immediately upon signing, unless specified otherwise. This allows the agent to act on your behalf right away, if needed.

This is incorrect. You can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. A written notice of revocation should be provided to the agent.

While the agent does have significant authority, their powers are limited to what is outlined in the document. You can specify exactly what decisions they can make on your behalf.

This is a common confusion. A Durable Power of Attorney allows someone to make decisions on your behalf, while a living will specifically outlines your wishes regarding medical treatment at the end of life.

Forms can vary significantly based on state laws and personal preferences. It is crucial to use the Ohio-specific form and tailor it to your individual needs.

This is a limiting belief. Anyone, regardless of age or health status, can benefit from having a Durable Power of Attorney in place to ensure their wishes are respected in case of unexpected circumstances.

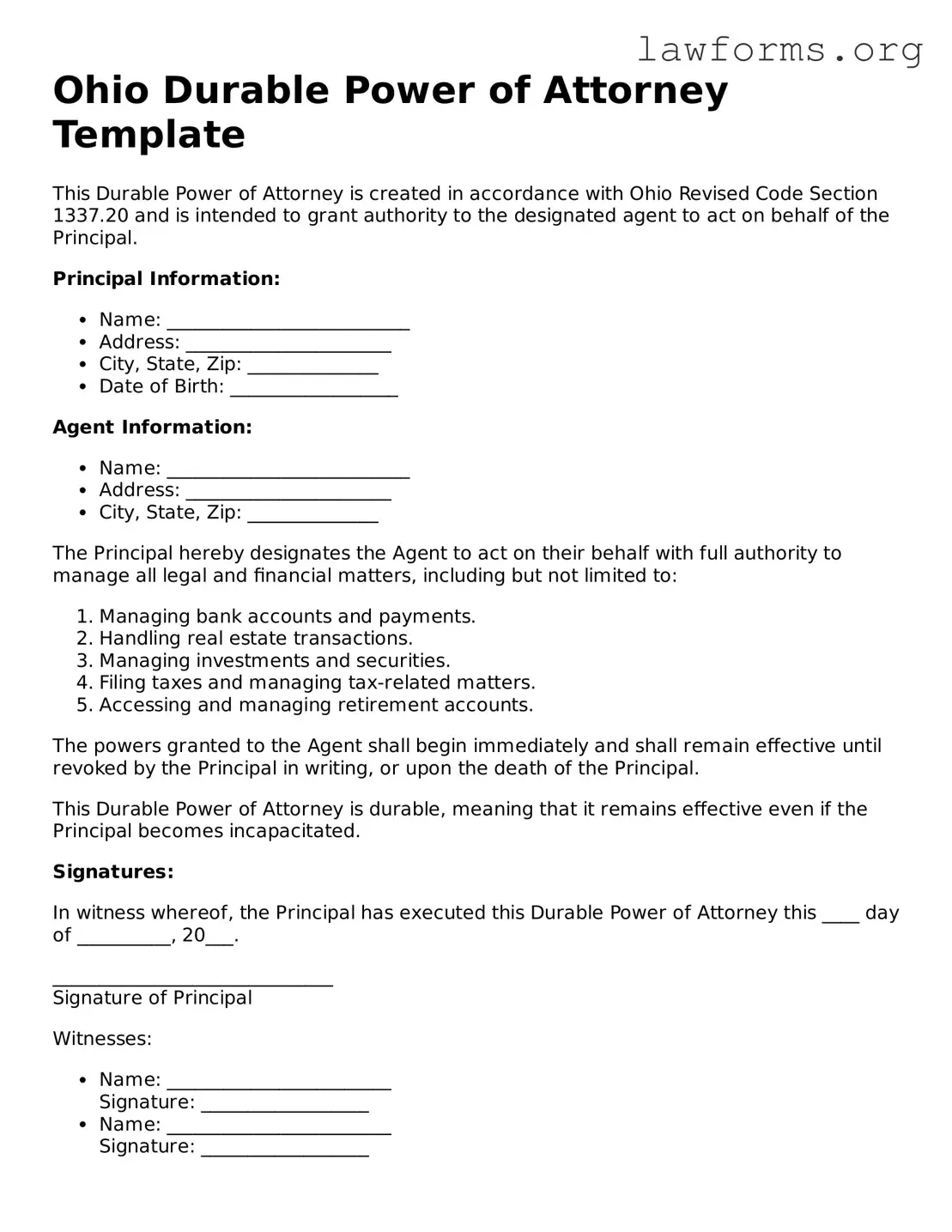

Preview - Ohio Durable Power of Attorney Form

Ohio Durable Power of Attorney Template

This Durable Power of Attorney is created in accordance with Ohio Revised Code Section 1337.20 and is intended to grant authority to the designated agent to act on behalf of the Principal.

Principal Information:

- Name: __________________________

- Address: ______________________

- City, State, Zip: ______________

- Date of Birth: __________________

Agent Information:

- Name: __________________________

- Address: ______________________

- City, State, Zip: ______________

The Principal hereby designates the Agent to act on their behalf with full authority to manage all legal and financial matters, including but not limited to:

- Managing bank accounts and payments.

- Handling real estate transactions.

- Managing investments and securities.

- Filing taxes and managing tax-related matters.

- Accessing and managing retirement accounts.

The powers granted to the Agent shall begin immediately and shall remain effective until revoked by the Principal in writing, or upon the death of the Principal.

This Durable Power of Attorney is durable, meaning that it remains effective even if the Principal becomes incapacitated.

Signatures:

In witness whereof, the Principal has executed this Durable Power of Attorney this ____ day of __________, 20___.

______________________________

Signature of Principal

Witnesses:

- Name: ________________________

Signature: __________________ - Name: ________________________

Signature: __________________

Key takeaways

Understanding the purpose of a Durable Power of Attorney (DPOA) is crucial. This document allows you to designate someone to make financial or legal decisions on your behalf if you become incapacitated.

Choose your agent wisely. The person you appoint should be trustworthy and capable of managing your affairs. This individual will have significant authority over your financial matters.

Be specific about the powers granted. The Ohio DPOA form allows you to outline the specific powers you wish to give your agent. Consider whether you want to include broad powers or limit them to certain areas.

Sign the form in the presence of a notary. In Ohio, a Durable Power of Attorney must be notarized to be legally valid. This step adds an extra layer of protection and authenticity to the document.

Keep copies of the completed form. Once the DPOA is filled out and signed, ensure that both you and your agent have copies. It’s also wise to inform relevant institutions, such as banks, about the arrangement.

Similar forms

The Durable Power of Attorney (DPOA) is a powerful legal document that allows one person to make decisions on behalf of another. However, it shares similarities with several other important documents. Here’s a breakdown of seven documents that are akin to the DPOA, highlighting their key similarities:

- General Power of Attorney: Like the DPOA, this document grants authority to someone to act on your behalf. However, it typically becomes invalid if you become incapacitated, unlike the DPOA, which remains effective.

- Healthcare Power of Attorney: This document allows someone to make medical decisions for you if you are unable to do so. Similar to the DPOA, it designates an agent to act in your best interest.

- Living Will: While a Living Will outlines your wishes regarding medical treatment in end-of-life situations, it complements the Healthcare Power of Attorney by providing guidance for the agent's decisions.

- Revocable Living Trust: This estate planning tool allows you to manage your assets during your lifetime and specifies how they should be distributed after your death. Like a DPOA, it helps avoid court intervention but focuses more on asset management.

- Advance Healthcare Directive: Combining elements of both a Living Will and a Healthcare Power of Attorney, this document outlines your healthcare preferences and appoints an agent to make decisions based on those wishes.

- Employment Verification Form: The California Employment Verification form is vital for confirming an individual's employment status, which is necessary for various applications such as loans and housing requests. For more details, visit https://californiadocsonline.com/employment-verification-form/.

- Financial Power of Attorney: Similar to the DPOA, this document specifically authorizes someone to handle financial matters, such as managing bank accounts and paying bills, but may not cover healthcare decisions.

- Will: While a Will outlines how your assets should be distributed after death, it can be compared to the DPOA in that both documents address important decisions regarding your affairs, though they apply at different times.

Understanding these documents can help you make informed decisions about your legal and healthcare preferences. Each serves a unique purpose, yet they all share the common goal of ensuring your wishes are honored when you cannot express them yourself.